What does an accounts payable manager do?

An accounts payable manager is in charge of supervising a company's financial activities, particularly in all payable matters. Their primary responsibilities revolve around managing and assessing staff performances and overseeing check and payroll disbursements. They also take care of maintaining and securing records of employees, clients, and company finances, and implement company objectives while ensuring accuracy in all operations. Furthermore, as a manager, it is essential to uphold all company policies and regulations, all while leading and encouraging staff in a joint effort to accomplish goals and tasks.

Accounts payable manager responsibilities

Here are examples of responsibilities from real accounts payable manager resumes:

- Manage bi-weekly payroll, bonuses, pay cards, PTO.

- Collect, enter & manage the quality of information require to produce accurate information report to IRS.

- Authorize all AP payment invoices, manage deposits and cash management functions, while providing overall complete payroll oversight.

- Refine the 'pro forma invoice' system process to manage prepayments of client invoices enhancing efficiency and adding value.

- Assist in computer software upgrade to integrate all accounting functions including pricing, AP, AR, GL and inventory.

- Ensure timely and efficient processing of authorize AP invoices and cash disbursements, as well as AR invoices and cash receipts.

- Develop spreadsheets to utilize Hyperion in the analysis of gross margin by publication.

- Practice GAAP ensuring all expenses, assets and liabilities are properly code and track.

- Enter invoices, printing checks and paying all vendors, organize Kronos for payroll.

- Generate payment runs including checks, wires, ACH and manual checks twice weekly or on at need basis.

- Develop and roll-out consolidation and standardization of accounts payable system conversions in an environment with corporate wide ERP system.

- Compute, classify, and record numerical data to keep financial records complete and accurate in accordance with GAAP.

- Review and analyze periodic payrolls weekly in Kronos (timekeeping system) prior to payroll transmittal for both company codes.

- Include trade payable accounts, banking accounts (wire, ACH, and check payments), outstanding and refund checks.

- Prepare highly complex calculation of internally develop capitalized software.

Accounts payable manager skills and personality traits

We calculated that 7% of Accounts Payable Managers are proficient in Customer Service, Reconciliations, and Purchase Orders. They’re also known for soft skills such as Analytical skills, Communication skills, and Organizational skills.

We break down the percentage of Accounts Payable Managers that have these skills listed on their resume here:

- Customer Service, 7%

Developed and maintained professional relationships with key vendors with approachable and dedicated attitude to guarantee a high level of customer service.

- Reconciliations, 6%

Prepared and reviewed balance sheet reconciliations for various accounts including researching reconciling items, analyzing results and communicating to management.

- Purchase Orders, 5%

Perform monthly reconciliation of international vendor statements by matching invoices with purchase orders and receiving documentation and entering invoices into the system

- Vendor Invoices, 5%

Analyzed vendor invoices for accuracy and available payment options that maximized the company's cash position while eliminating additional late charges.

- Financial Statements, 4%

Compiled, analyzed and provided financial information for the preparation of financial statements and closing journal entries to controller.

- Payroll, 4%

Converted numerous manual payroll systems to on-line database programs and prepared specialized reports required by senior management.

"customer service," "reconciliations," and "purchase orders" are among the most common skills that accounts payable managers use at work. You can find even more accounts payable manager responsibilities below, including:

Analytical skills. To carry out their duties, the most important skill for an accounts payable manager to have is analytical skills. Their role and responsibilities require that "to assist executives in making decisions, financial managers need to evaluate data and information that affects their organization." Accounts payable managers often use analytical skills in their day-to-day job, as shown by this real resume: "setup/revised proper data to maintain w-9's and 1099's for tax reporting. "

Communication skills. Another soft skill that's essential for fulfilling accounts payable manager duties is communication skills. The role rewards competence in this skill because "financial managers must be able to explain and justify complex financial transactions." According to an accounts payable manager resume, here's how accounts payable managers can utilize communication skills in their job responsibilities: "facilitated cooperative efforts and communication among 400+ locations to ensure timely payment processing. "

Organizational skills. This is an important skill for accounts payable managers to perform their duties. For an example of how accounts payable manager responsibilities depend on this skill, consider that "because financial managers deal with a range of information and documents, they must have structures in place to be effective in their work." This excerpt from a resume also shows how vital it is to everyday roles and responsibilities of an accounts payable manager: "worked with appropriate staff, established internal controls and quality checks ensuring controls are in compliance with organizational requirements. ".

Detail oriented. For certain accounts payable manager responsibilities to be completed, the job requires competence in "detail oriented." The day-to-day duties of an accounts payable manager rely on this skill, as "in preparing and analyzing reports, such as balance sheets and income statements, financial managers must be precise and attentive to their work in order to avoid errors." For example, this snippet was taken directly from a resume about how this skill applies to what accounts payable managers do: "maintain vendor records including acquiring w-9 documentation and direct deposit detail. "

Math skills. A commonly-found skill in accounts payable manager job descriptions, "math skills" is essential to what accounts payable managers do. Accounts payable manager responsibilities rely on this skill because "financial managers need strong skills in certain branches of mathematics, including algebra." You can also see how accounts payable manager duties rely on math skills in this resume example: "designed executive level accounts payable processing statistics reports and ensured their timely distribution to management on a monthly basis. "

The three companies that hire the most accounts payable managers are:

- Robert Half21 accounts payable managers jobs

- Los Angeles LGBT Center9 accounts payable managers jobs

- State Bar of Texas8 accounts payable managers jobs

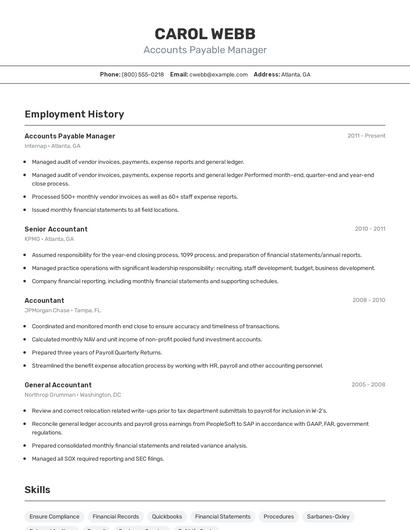

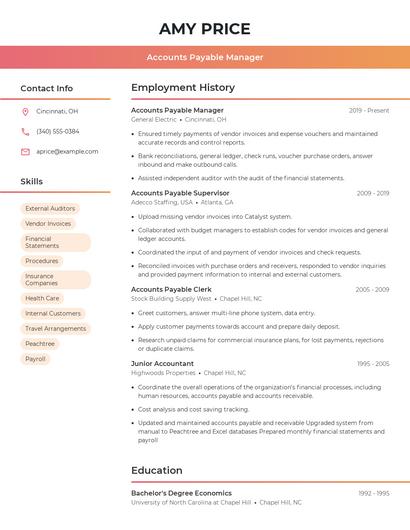

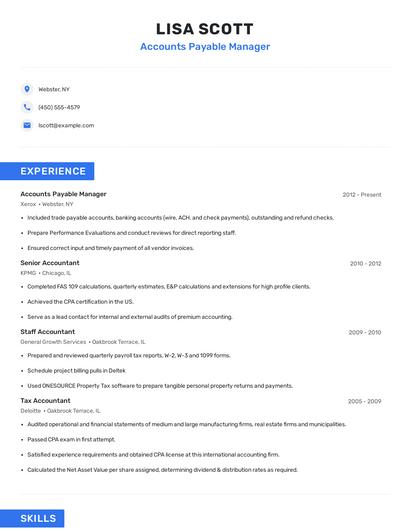

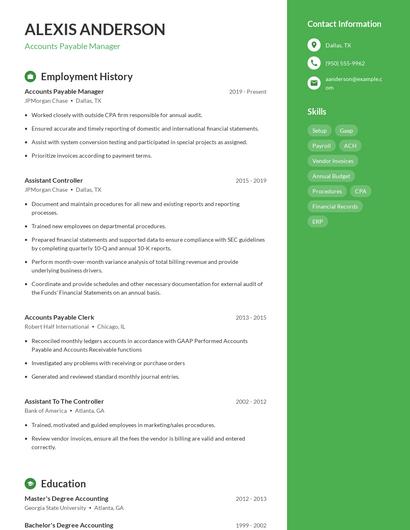

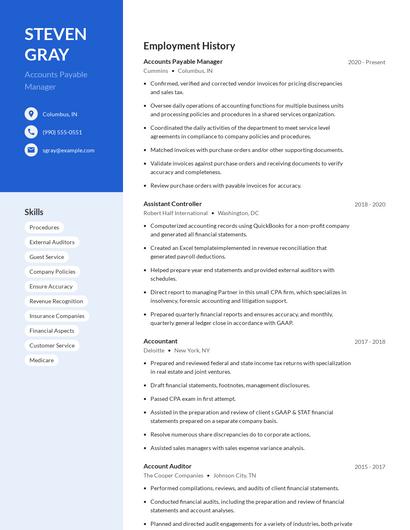

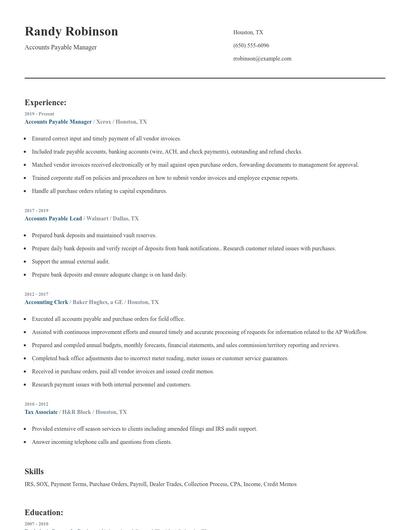

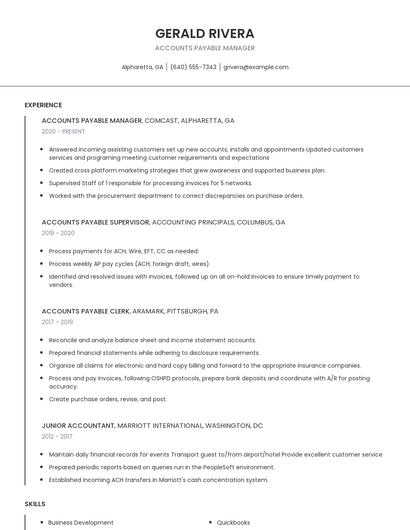

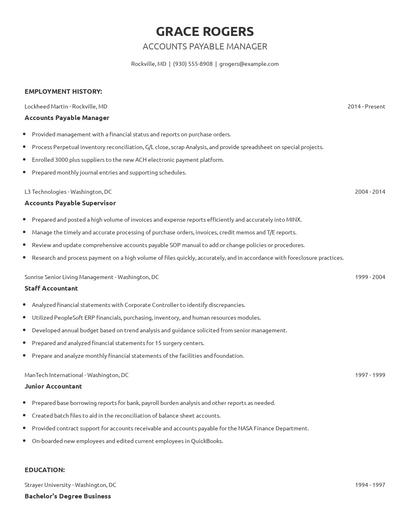

Choose from 10+ customizable accounts payable manager resume templates

Build a professional accounts payable manager resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your accounts payable manager resume.Compare different accounts payable managers

Accounts payable manager vs. Manager/finance accounting

A manager of finance accounting's role is to oversee the financial activities in a company or organization. Their responsibilities revolve around coordinating with other departments to gather financial data, analyze the revenues and expenditures, and develop written reports and presentations. A manager of finance accounting must also maintain accurate financial records, identify any errors or inconsistencies, and perform support tasks for staff when necessary. Furthermore, as a manager, it is essential to lead and encourage the team, all while implementing the company's policies and regulations.

These skill sets are where the common ground ends though. The responsibilities of an accounts payable manager are more likely to require skills like "purchase orders," "vendor invoices," "payroll," and "credit card." On the other hand, a job as a manager/finance accounting requires skills like "cpa," "due diligence," "treasury," and "hyperion." As you can see, what employees do in each career varies considerably.

Managers/finance accounting earn the highest salaries when working in the government industry, with an average yearly salary of $92,198. On the other hand, accounts payable managers are paid more in the finance industry with an average salary of $70,221.managers/finance accounting tend to reach higher levels of education than accounts payable managers. In fact, managers/finance accounting are 10.9% more likely to graduate with a Master's Degree and 0.0% more likely to have a Doctoral Degree.Accounts payable manager vs. Branch manager

Branch managers oversee the company's field office. This position is usually present in industries such as banking and food service. Branch managers are responsible for all aspects of the branch operations, including, but not limited to, finances, marketing, quality control, and human resources. They ensure that the goals of the branch are met in the most efficient way possible. They balance the needs of both the organization and the employees in the department. Branch managers are also expected to have a hand in training the employees to be useful members of the organization.

While some skills are similar in these professions, other skills aren't so similar. For example, resumes show us that accounts payable manager responsibilities requires skills like "customer service," "purchase orders," "vendor invoices," and "internal controls." But a branch manager might use other skills in their typical duties, such as, "customer satisfaction," "business development," "branch management," and "human resources."

Branch managers may earn a lower salary than accounts payable managers, but branch managers earn the most pay in the professional industry with an average salary of $55,380. On the other hand, accounts payable managers receive higher pay in the finance industry, where they earn an average salary of $70,221.Average education levels between the two professions vary. Branch managers tend to reach similar levels of education than accounts payable managers. In fact, they're 0.6% less likely to graduate with a Master's Degree and 0.0% more likely to earn a Doctoral Degree.Accounts payable manager vs. Credit manager

A credit manager is an individual who supervises the credit granting process for a company by evaluating the creditworthiness of potential customers. Credit managers must maintain corporate credit policy to optimize company sales and reduce bad debt losses. They must manage the proper relationship with agencies such as the collection agency, credit insurance providers, and the sales department. Credit managers may work in different industries such as banks, accounting firms, or auto dealerships. They must also possess a bachelor's degree in financial management or related field.

Some important key differences between the two careers include a few of the skills necessary to fulfill the responsibilities of each. Some examples from accounts payable manager resumes include skills like "reconciliations," "purchase orders," "vendor invoices," and "internal controls," whereas a credit manager is more likely to list skills in "credit risk," "credit policy," "customer accounts," and "credit limits. "

Credit managers make a very good living in the finance industry with an average annual salary of $86,294. On the other hand, accounts payable managers are paid the highest salary in the finance industry, with average annual pay of $70,221.When it comes to education, credit managers tend to earn similar degree levels compared to accounts payable managers. In fact, they're 0.9% more likely to earn a Master's Degree, and 0.2% more likely to graduate with a Doctoral Degree.Accounts payable manager vs. Cash manager

A cash manager is responsible for monitoring cash flow, analyzing financial transactions, and allocating adequate budget and resources for every department's operations. Cash managers conduct data and statistical analysis to determine the company's expenses and financial loss and strategize techniques in minimizing those risks. They also help senior management in identifying business opportunities that would generate more revenue resources and increase profits for the business. A cash manager handles billing disputes, resolves account discrepancies, and submits accurate financial reports.

Types of accounts payable manager

Updated January 8, 2025