What does an asset analyst do?

Asset analysts are accounting professionals who specialize in the management of the company's assets. They maintain the company's record of assets. They ensure that their database is updated. They also ensure that all physical assets are properly maintained. Asset analysts prepare reports related to these assets and draft recommendations as needed. They also keep themselves updated on the current trends in both the industry and in the economic market. They should always be on the lookout for possible asset acquisitions to improve the company's economic standing.

Asset analyst responsibilities

Here are examples of responsibilities from real asset analyst resumes:

- Develop, maintain financial models/applications (VBA Excel/Access) to automate and streamline business processes and perform financial analysis.

- Compare large data sets using SQL queries.

- Streamline procedure of data scrubbing restrict securities and accounts, decreasing processing time.

- Supervise payroll and benefits calculation, taxes submission, equipment inventory and other relate activities.

- Resolve technical coding issue in GSEC entity where securities are being inaccurately release, decreasing deficit numbers and analysis time.

- Perform in a multifacete role providing full-scale accounting and financial services, payroll management, database administration, and recording/reporting.

- Research and apply generally accept accounting practices (GAAP) and regulatory accounting guidance and resolve accounting discrepancies & irregularities.

- Develop corporate accounting policy for the capitalization of internally develop software and implement a reporting structure to comply with GAAP standards.

- Record payments and deposits in QuickBooks.

- Process billing through QuickBooks to customers while monitoring the income derive from clients.

- Provide an analysis of software complexity metrics and object-orient metrics running on Linux servers.

- Create automated spreadsheets incorporating macros and vlookup commands that allow leadership to independently perform routine financial research with minimal effort.

Asset analyst skills and personality traits

We calculated that 18% of Asset Analysts are proficient in Asset Management, Fixed Assets, and Real Estate. They’re also known for soft skills such as Computer skills, Math skills, and Analytical skills.

We break down the percentage of Asset Analysts that have these skills listed on their resume here:

- Asset Management, 18%

Tracked and managed software assets from time asset is received to retirement Resolved complex asset management problems and critical account situations.

- Fixed Assets, 5%

Calculate depreciation for all fixed assets using declining balance method.

- Real Estate, 5%

Communicate discrepancies to management regarding financial summaries created for commercial real estate properties.

- Financial Statements, 4%

Produced required analyses of balance sheets, and other relevant financial statements for commercial income-producing properties and sponsors.

- Securities, 4%

Analyzed monthly Commercial Mortgage Backed Securities statements.

- Process Improvement, 4%

Work closely with all Operations functions to identify process improvement opportunities and implement best practice.

Most asset analysts use their skills in "asset management," "fixed assets," and "real estate" to do their jobs. You can find more detail on essential asset analyst responsibilities here:

Computer skills. The most essential soft skill for an asset analyst to carry out their responsibilities is computer skills. This skill is important for the role because "financial analysts must be adept at using software to analyze financial data and trends, create portfolios, and make forecasts." Additionally, an asset analyst resume shows how their duties depend on computer skills: "designed an asset management system that would discover all computer hardware and software. "

Math skills. Many asset analyst duties rely on math skills. "financial analysts use mathematics to estimate the value of financial securities.," so an asset analyst will need this skill often in their role. This resume example is just one of many ways asset analyst responsibilities rely on math skills: "analyzed real estate developments and performed asset management statistics. "

Analytical skills. asset analysts are also known for analytical skills, which are critical to their duties. You can see how this skill relates to asset analyst responsibilities, because "financial analysts must evaluate a range of information in finding profitable investments." An asset analyst resume example shows how analytical skills is used in the workplace: "analyzed and reconciled asset management data to ensure all information is complete and accurate. "

Communication skills. For certain asset analyst responsibilities to be completed, the job requires competence in "communication skills." The day-to-day duties of an asset analyst rely on this skill, as "financial analysts must be able to clearly explain their recommendations to clients." For example, this snippet was taken directly from a resume about how this skill applies to what asset analysts do: "manage all capex reporting and communication. "

Detail oriented. Another crucial skill for an asset analyst to carry out their responsibilities is "detail oriented." A big part of what asset analysts relies on this skill, since "financial analysts must pay attention when reviewing a possible investment, as even small issues may have large implications for its health." How this skill relates to asset analyst duties can be seen in an example from an asset analyst resume snippet: "produced accurate monthly, quarterly, and annual financial statements in a deadline-oriented environment. "

The three companies that hire the most asset analysts are:

- CB Richard Ellis Memphis LLC5 asset analysts jobs

- Citi4 asset analysts jobs

- Fifth Third Bank4 asset analysts jobs

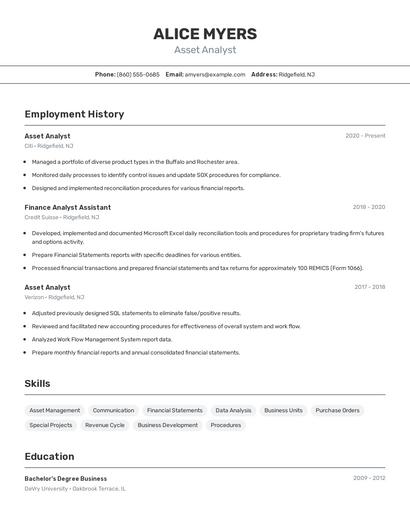

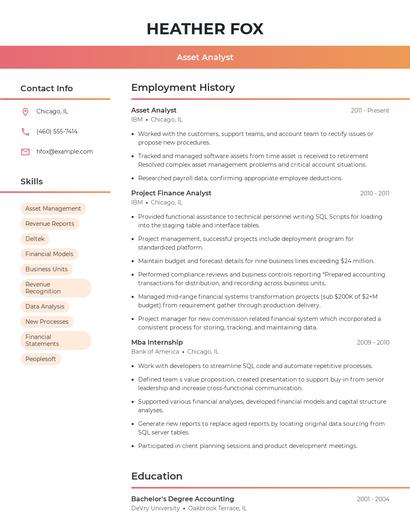

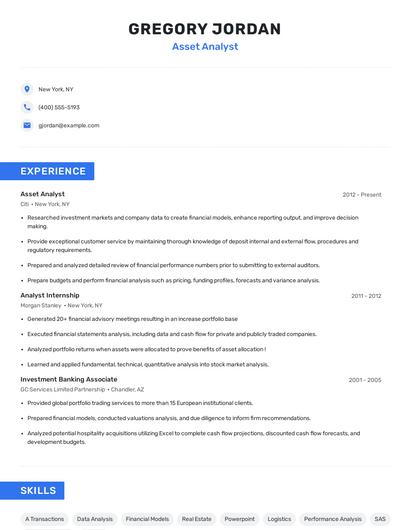

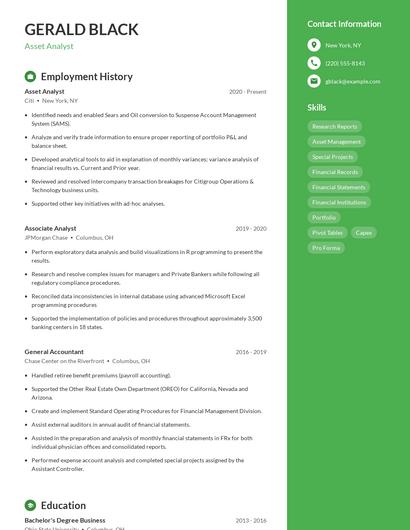

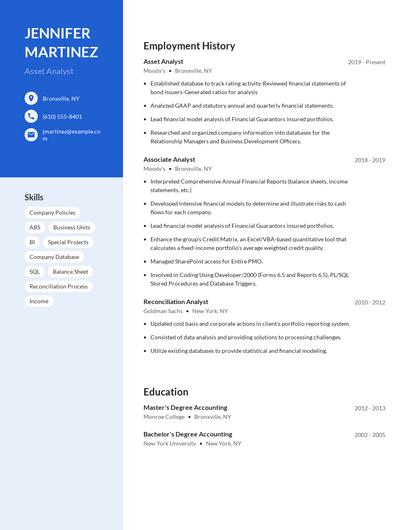

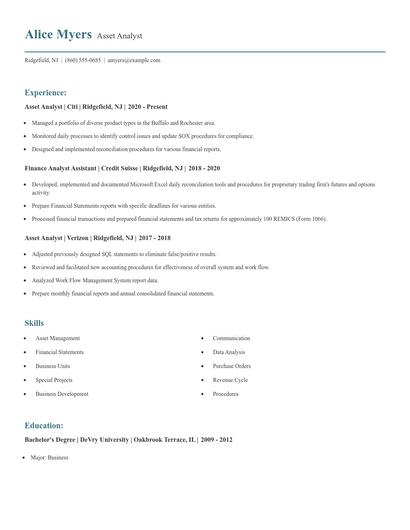

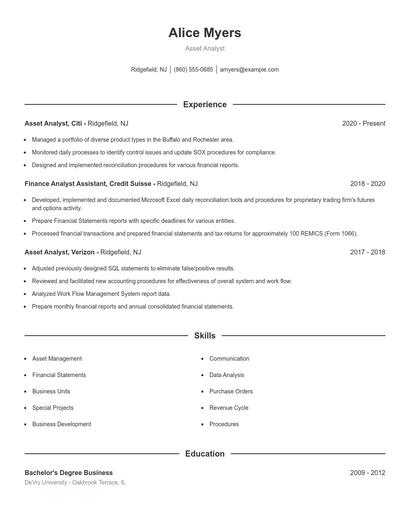

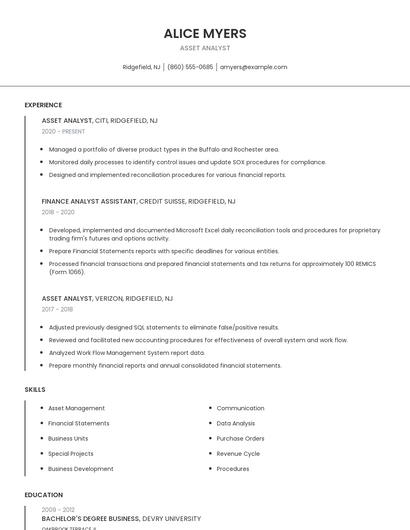

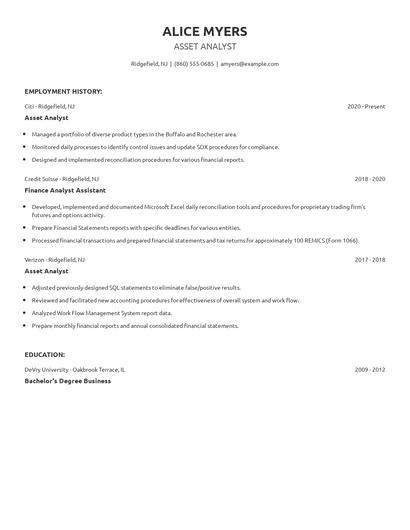

Choose from 10+ customizable asset analyst resume templates

Build a professional asset analyst resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your asset analyst resume.Compare different asset analysts

Asset analyst vs. Financial analyst internship

A financial analyst intern is responsible for supporting an organization with financial activities and tasks. Typical duties and responsibilities may include creating and analyzing financial reports, preparing financial statements, and helping with audits. You may be asked to perform some administrative tasks while observing the various aspects of portfolio management, accounting, and financial reporting. As a financial analyst intern, you are expected to conduct competitive analysis and market research and help prepare reports and recommendations on due diligence. You are also expected to join in on meetings and calls with company prospects.

While similarities exist, there are also some differences between asset analysts and financial analyst internship. For instance, asset analyst responsibilities require skills such as "asset management," "financial statements," "securities," and "process improvement." Whereas a financial analyst internship is skilled in "data analysis," "market research," "r," and "financial statement analysis." This is part of what separates the two careers.

The education levels that financial analyst interns earn slightly differ from asset analysts. In particular, financial analyst interns are 5.6% more likely to graduate with a Master's Degree than an asset analyst. Additionally, they're 0.3% less likely to earn a Doctoral Degree.Asset analyst vs. Analyst internship

An analyst internship is a student program where an intern is assigned to assist analyst professionals by analyzing business goals, objectives, and needs. Analyst interns assist in the planning and designing of business processes and suggest recommendations for improvement. They conduct research and analysis to support business operations and resolve issues using systems and data. They also help estimate the costs and benefits of multiple business actions and help the business organization launch new initiatives.

In addition to the difference in salary, there are some other key differences worth noting. For example, asset analyst responsibilities are more likely to require skills like "asset management," "securities," "process improvement," and "reconciliations." Meanwhile, an analyst internship has duties that require skills in areas such as "data analysis," "python," "data entry," and "strong analytical." These differences highlight just how different the day-to-day in each role looks.

Analyst interns earn a lower average salary than asset analysts. But analyst interns earn the highest pay in the professional industry, with an average salary of $41,723. Additionally, asset analysts earn the highest salaries in the finance with average pay of $89,994 annually.Average education levels between the two professions vary. Analyst interns tend to reach higher levels of education than asset analysts. In fact, they're 5.9% more likely to graduate with a Master's Degree and 0.3% more likely to earn a Doctoral Degree.Asset analyst vs. Finance analyst/accountant

In a company setting, a finance analyst/accountant is in charge of handling and monitoring financial activities, ensuring efficiency and accuracy. Their responsibilities revolve around preparing financial reports, performing audits and risk assessments, and identifying any errors and inconsistencies, resolving them promptly and efficiently. They also conduct research and analysis to identify new business opportunities, evaluate the existing procedures to determine its strengths and weaknesses, and recommend solutions to optimize operations for financial growth. Furthermore, as a finance analyst/accountant, it is essential to uphold the company's policies and regulations, including its vision and mission.

Some important key differences between the two careers include a few of the skills necessary to fulfill the responsibilities of each. Some examples from asset analyst resumes include skills like "asset management," "real estate," "financial statements," and "securities," whereas a finance analyst/accountant is more likely to list skills in "general ledger accounts," "payroll," "external auditors," and "account reconciliations. "

Finance analyst/accountants earn the highest salary when working in the finance industry, where they receive an average salary of $78,897. Comparatively, asset analysts have the highest earning potential in the finance industry, with an average salary of $89,994.When it comes to education, finance analyst/accountants tend to earn similar degree levels compared to asset analysts. In fact, they're 3.4% more likely to earn a Master's Degree, and 0.6% more likely to graduate with a Doctoral Degree.Asset analyst vs. Corporate finance analyst

Corporate finance analysts make significant business decisions based on the data they gather. Typically, corporate finance analysts work within an organization and support management decisions through actionable financial information. They monitor the taxes, expenses, financial statements, and other financial details of where the company sources its income. This position requires a formal qualification in accounting. It also necessitates the analyst to develop interpersonal skills, knowledge in information technology software, financial reporting skills, and experience in management.

Types of asset analyst

Updated January 8, 2025