What does a business banking officer do?

A business banking officer is primarily in charge of liaising with clients, ensuring they get to receive prompt and efficient service. Among their responsibilities include identifying the clients' needs, answering inquiries, recommending other services, and addressing issues and concerns, resolving them in a timely manner. Moreover, a business banking officer may also devise networking strategies to identify new business or client opportunities. Above all, it is essential to build positive relationships with clients and adhere to the company's policies and regulations.

Business banking officer responsibilities

Here are examples of responsibilities from real business banking officer resumes:

- Manage a combination of commercial and personal banking relationships, and promote cross-selling across multiple product lines.

- Manage a portfolio in various stages of workout including liquidation, refinancing, restructure, rehabilitation, bankruptcy and litigation.

- Create new lending opportunities, deposit account acquisition, treasury management options and financial counseling.

- Develop client relationship through financial transaction such as commercial real-estate financing, working capital, construction financing and SBA lending.

- Compile data and prepare reports including loan covenant violation, collateral tracking, risk rating exception, and SBA liquidation reports.

- Provide implementation and training on merchant services and treasury products

- Create collaborative relationships with numerous internal departments to facilitate referrals for cross-selling opportunities.

- Provide development and implementation of go-to market strategy, which evangelize adoption and triple-digit growth of emerging products portfolio.

- Perform market analysis and research to identify target markets and partners.

Business banking officer skills and personality traits

We calculated that 11% of Business Banking Officers are proficient in Business Development, Customer Relationships, and Customer Service. They’re also known for soft skills such as Customer-service skills, Initiative, and Detail oriented.

We break down the percentage of Business Banking Officers that have these skills listed on their resume here:

- Business Development, 11%

Participate in civic and community activities to generate visibility and serve as business development officer for the bank.

- Customer Relationships, 10%

Solicit and develop new business banking customer relationships.

- Customer Service, 8%

Supervised 4 customer service/sales personnel in cross selling a variety of bank services including merchant processing and investment management.

- Relationship Management, 6%

Provided client/vendor relationship management, strategy and planning, project delivery, production services and support as well as financial management.

- Financial Statements, 4%

Reconciled financial statements & conducted cash flow analysis for service and product based businesses.

- Cash Management, 4%

Developed business banking relationships, providing cash management and credit services.

Most business banking officers use their skills in "business development," "customer relationships," and "customer service" to do their jobs. You can find more detail on essential business banking officer responsibilities here:

Initiative. Many business banking officer duties rely on initiative. "loan officers may act as salespeople in promoting their lending institution, so they must contact people and businesses to determine their need for a loan.," so a business banking officer will need this skill often in their role. This resume example is just one of many ways business banking officer responsibilities rely on initiative: "led morning sales huddles and established daily sales focuses and customer service strategies and initiatives. "

Detail oriented. business banking officers are also known for detail oriented, which are critical to their duties. You can see how this skill relates to business banking officer responsibilities, because "information on an application affects the potential profitability of a loan, so loan officers must pay attention to details." A business banking officer resume example shows how detail oriented is used in the workplace: "prepared detailed credit analyses and structured sba commercial/real estate lending packages for borrowers from a wide range of industries. "

Interpersonal skills. Another crucial skill for a business banking officer to carry out their responsibilities is "interpersonal skills." A big part of what business banking officers relies on this skill, since "loan officers must be able to guide customers through the application process and answer their questions." How this skill relates to business banking officer duties can be seen in an example from a business banking officer resume snippet: "developed customer portfolios and maintained interpersonal business relationships to support their financial needs and provide expert product and service recommendations. "

The three companies that hire the most business banking officers are:

- Bank of the West

26 business banking officers jobs

- The PNC Financial Services Group18 business banking officers jobs

- Westamerica Ban14 business banking officers jobs

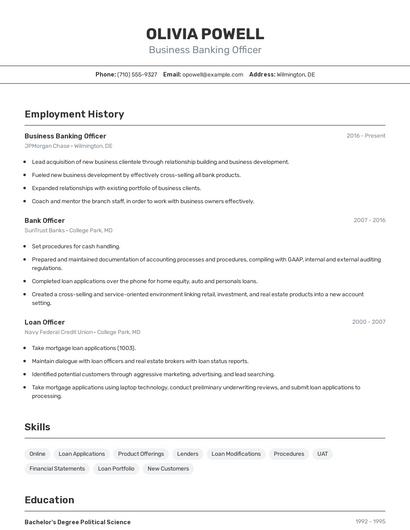

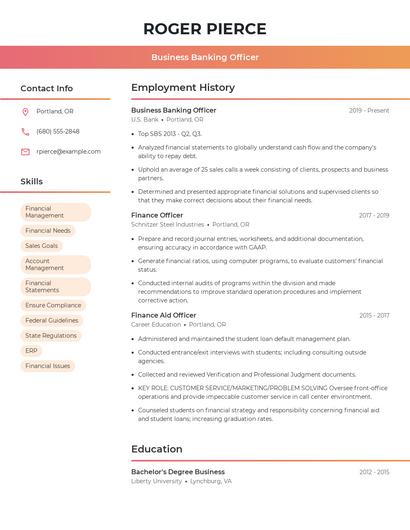

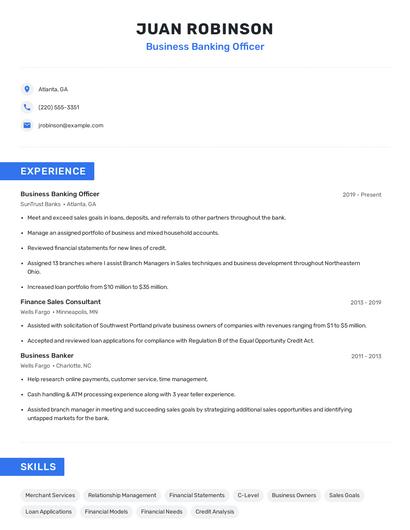

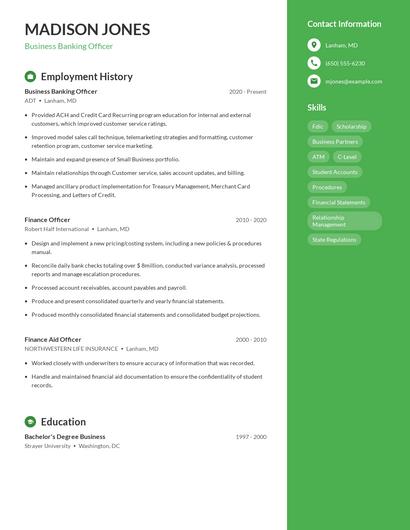

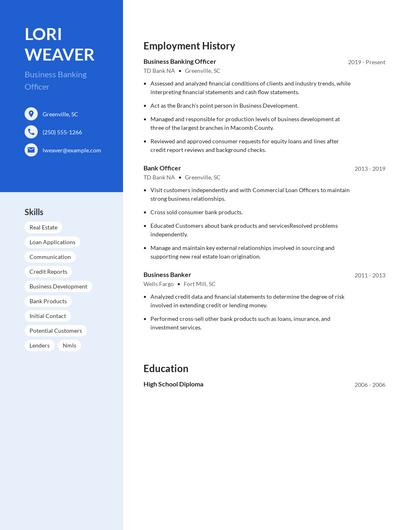

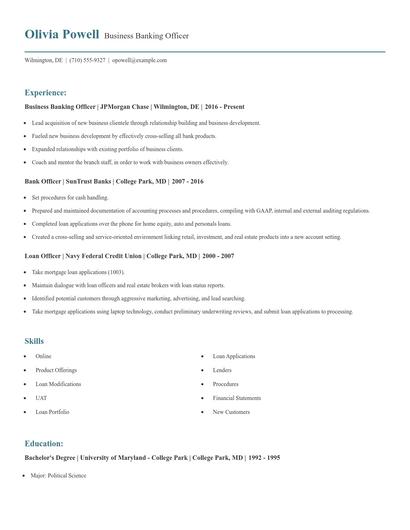

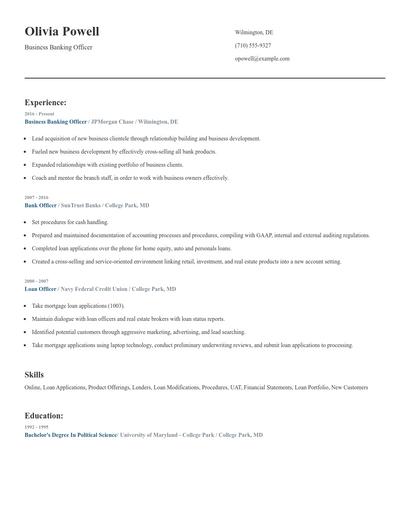

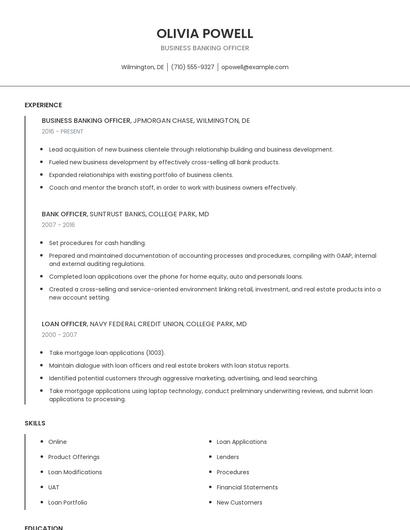

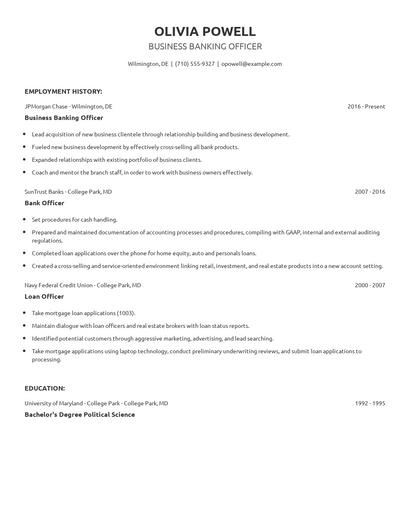

Choose from 10+ customizable business banking officer resume templates

Build a professional business banking officer resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your business banking officer resume.Compare different business banking officers

Business banking officer vs. Commercial underwriter

A commercial underwriter is responsible for processing commercial loan applications, evaluating payment agreements and terms of service, validating customers' information, and requesting additional documents as needed. Commercial underwriters analyze the credit qualifications of an applicant, including financial history, account statements, and outstanding loan applications, if any. They identify potential credit risks for the loan request and advice the applicants for alternative loan options according to their needs and qualifications. A commercial underwriter responds to the applicants' inquiries and concerns regarding their loan applications and provides timely decisions for their requests.

While similarities exist, there are also some differences between business banking officers and commercial underwriter. For instance, business banking officer responsibilities require skills such as "business development," "customer relationships," "relationship management," and "cash management." Whereas a commercial underwriter is skilled in "risk management," "credit risk," "credit worthiness," and "underwriting guidelines." This is part of what separates the two careers.

Commercial underwriters really shine in the finance industry with an average salary of $68,368. Comparatively, business banking officers tend to make the most money in the finance industry with an average salary of $72,711.The education levels that commercial underwriters earn slightly differ from business banking officers. In particular, commercial underwriters are 5.3% less likely to graduate with a Master's Degree than a business banking officer. Additionally, they're 0.4% more likely to earn a Doctoral Degree.Business banking officer vs. Foreclosure specialist

A foreclosure specialist is a real estate professional that manages foreclosure processes. Serving in this role means that you will have responsibilities such as ensuring that aspects related to foreclosure meet all government regulations from the federal level to the state level and that deadlines are met and duly communicated to all parties involved. You may have to work with mortgage holders that run the risk of default, in which case you will be tasked with renegotiating loan agreement changes.

While some skills are similar in these professions, other skills aren't so similar. For example, resumes show us that business banking officer responsibilities requires skills like "business development," "customer relationships," "customer service," and "relationship management." But a foreclosure specialist might use other skills in their typical duties, such as, "foreclosure process," "insurer," "loss mitigation," and "litigation."

Foreclosure specialists earn lower levels of education than business banking officers in general. They're 9.7% less likely to graduate with a Master's Degree and 0.4% more likely to earn a Doctoral Degree.Business banking officer vs. Loan analyst

A loan analyst is responsible for determining the eligibility of loan applicants in purchasing loan services by analyzing their application documents, account statements, and financial and credit status. Loan analysts evaluate loan agreements and payment plans and explain feasibility to the customers and loan officers before granting the loan. They also provide loan options and alternatives to the clients according to their needs and risk limitations. A loan analyst must have excellent knowledge of the loan and financial industry, especially in handling credit policies and loan processes and ensuring timely submission of reports.

The required skills of the two careers differ considerably. For example, business banking officers are more likely to have skills like "business development," "customer relationships," "relationship management," and "product knowledge." But a loan analyst is more likely to have skills like "loan documentation," "excellent interpersonal," "data entry," and "due diligence."

Loan analysts earn the best pay in the finance industry, where they command an average salary of $37,567. Business banking officers earn the highest pay from the finance industry, with an average salary of $72,711.Most loan analysts achieve a lower degree level compared to business banking officers. For example, they're 6.5% less likely to graduate with a Master's Degree, and 0.3% less likely to earn a Doctoral Degree.Business banking officer vs. Underwriter

An underwriter's duties depend on the line of work or industry involved, such as mortgage companies, insurance, or lending firms. However, an Underwriter's responsibility will mainly revolve around using their extensive expertise on how a company will achieve financial gains, and assessing the possible financial risks of a client by reviewing various aspects to determine their capacity to uphold monetary obligations. Most of the time, the Underwriter's tasks will also involve evaluating a client's credit history, health, assets, overall financial history.

Even though a few skill sets overlap between business banking officers and underwriters, there are some differences that are important to note. For one, a business banking officer might have more use for skills like "business development," "customer relationships," "relationship management," and "cash management." Meanwhile, some responsibilities of underwriters require skills like "investor guidelines," "mortgage loans," "underwriting guidelines," and "fha. "

In general, underwriters earn the most working in the manufacturing industry, with an average salary of $78,233. The highest-paying industry for a business banking officer is the finance industry.In general, underwriters hold lower degree levels compared to business banking officers. Underwriters are 7.4% less likely to earn their Master's Degree and 0.3% more likely to graduate with a Doctoral Degree.Types of business banking officer

Updated January 8, 2025