Automatically apply for jobs with Zippia

Upload your resume to get started.

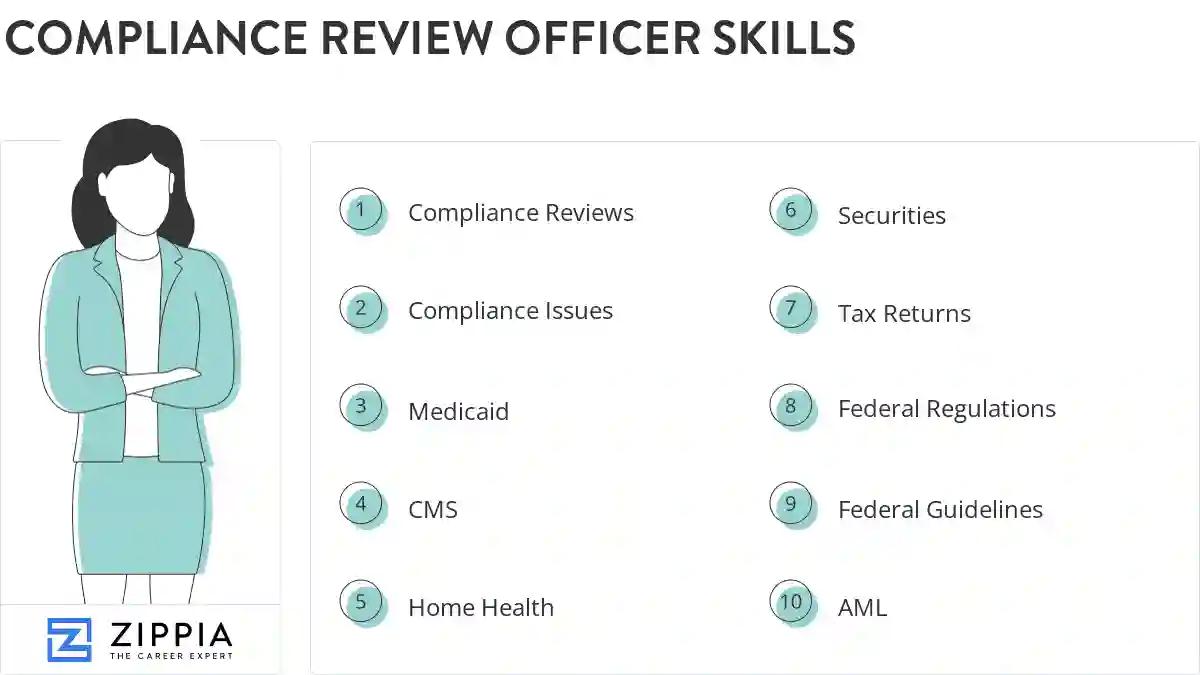

Compliance review officer skills for your resume and career

15 compliance review officer skills for your resume and career

1. Compliance Reviews

- Performed compliance reviews of numerous Immigration and Customs Enforcement (ICE) detention facilities throughout the United States.

- Assist with the development, maintenance and management of the compliance review program.

2. Compliance Issues

Compliance issues are where people or businesses breach their legal obligations in a country or region where they operate or live. Some of the compliance issues that businesses face may be in regard to wage and overtime regulations and IRS audits. They may result in legal recourse by stakeholders like employees.

- Provided regular ongoing feedback regarding pertinent contractual and compliance issues within the area of responsibility.

- Conduct gap analysis on policy and compliance issues and assist management with developing strategies to mitigate risk.

3. Medicaid

- Performed prospective Medicare and Medicaid audits on every claim submitted by the Orthopedic Department as mandated by Corporate Integrity Agreement.

- Interacted closely with the surveillance utilization and review team to audit medical record documentation in accordance with Medicaid regulations and guidelines.

4. CMS

A Content Management System or CMS is computer software that works as a framework where content can be assembled and managed by using a database. CMS is an important asset in web development. This platform enables users to create, edit, collaborate on, publish and store digital content. It helps users to manage their content and modify it from a single system.

- Review deficiencies/violations citations and ensure violations/citations cited reflect non-compliance with CMS Federal and State regulations.

- Researched HIPAA information from CMS website in order to determine correct revisions for policies and procedures and develop company-wide communications.

5. Home Health

- Audit all home health and hospice diagnosis codes according to ICD-9-CM coding and documentation guidelines.

- Evaluated the results of statewide home health quality improvement efforts.

6. Securities

- Administered the Securities Finance Compliance Training Program including the development of presentation material, scheduling and presenting training and monitoring attendance.

- Identified all transactions in OTC equity securities and ascertained that every recommendation to customers met suitability standards via exclusion or exemption.

7. Tax Returns

- Analyzed business financial statements and tax returns for department practices.

- Audited and reviewed tax returns for proper application of tax law.

8. Federal Regulations

Federal regulations refer to the set of rules, both general and permanent that are published in the Federal Register by the agencies of the federal government and the executive departments. Federal regulations are the large body of rules that govern federal practice. Examples of these laws include taxes and financial regulation, discrimination law, wages law, and so on.

- Reviewed applicable state/federal regulations and accreditation standards to ensure company policies and procedures are in compliance with regulations/standards.

- Developed procedures to assist schools in maintaining compliance with all accrediting standards and state and federal regulations.

9. Federal Guidelines

- Reviewed advertising for 300+ branches to ensure adherence to State and Federal guidelines.

10. AML

AML refers to the rules and systems set up by governments, financial institutions, or organizations to prevent fraudulent economic activities.

- Conducted daily reviews of MoneyGram's wire transfer and money order agent's AML Compliance Programs.

- Provided initial and ongoing AML and anti-fraud training to agents in both English and Spanish.

11. Loan Documentation

- Verified loan documentation including appraisal and title work for submittal to underwriting.

- Examine residential loan documentation for accuracy, completeness, and compliance with appropriate company and secondary market investor standards.

12. Real Estate

Real estate is land that has buildings on it. This kind of property consists of permanent improvements either natural or man-made, which include, houses, fences, bridges, water trees, and minerals. There are 4 types of real estate namely; residential real estate, commercial real estate, industrial real estate, and vacant land.

- Resolve appraisal discrepancies with Appraisers and approve satisfactory commercial and residential real estate appraisals.

- Risk rated credits from the Real Estate, Commercial and Industrial, and Agricultural portfolios.

13. Bank Policy

- Review all areas of both banks for compliance with Government Regulations and Bank Policy and Procedures.

- Review of loan files for adherence to bank policy and procedures in accordance to regulations requirements.

14. Anti-Money Laundering

Anti-Money Laundering or, as it is often shortened to, AML is the name of a set of laws, regulations, and similar rules and rulings which are crafted and applied with the goal of preventing people from engaging in and successfully doing money laundering.

- Followed corporate policies and procedures to provide guidance and advice to the business lines on mitigating Anti-Money Laundering/reputation risk.

- Complete daily audit of anti-money laundering documentation; review and file Currency Transaction Reports and Suspicious Activity Reports.

15. Audit Process

- Interacted and communicated effectively with Departmental Managers during the audit process.

- Directed the audit process which included the examination of all resident certifications, re-certifications, interim and move-out procedures.

What skills help Compliance Review Officers find jobs?

Tell us what job you are looking for, we’ll show you what skills employers want.

List of compliance review officer skills to add to your resume

The most important skills for a compliance review officer resume and required skills for a compliance review officer to have include:

- Compliance Reviews

- Compliance Issues

- Medicaid

- CMS

- Home Health

- Securities

- Tax Returns

- Federal Regulations

- Federal Guidelines

- AML

- Loan Documentation

- Real Estate

- Bank Policy

- Anti-Money Laundering

- Audit Process

- Business Lines

- Peer Review

- Compliance Procedures

- Financial Statements

- Compliance Regulations

- Scientific Review

- Internal Controls

- Background Investigations

- Appraisal Reports

- USPAP

- Internal Review

- Bank Secrecy Act

- Loan Review

- FDIC

- RESPA

- Mortgage Loans

- Federal Laws

- FHA

- TIL

- HMDA

- NIH

- Credit Risk

- Veterans

- PowerPoint

Updated January 8, 2025