Automatically apply for jobs with Zippia

Upload your resume to get started.

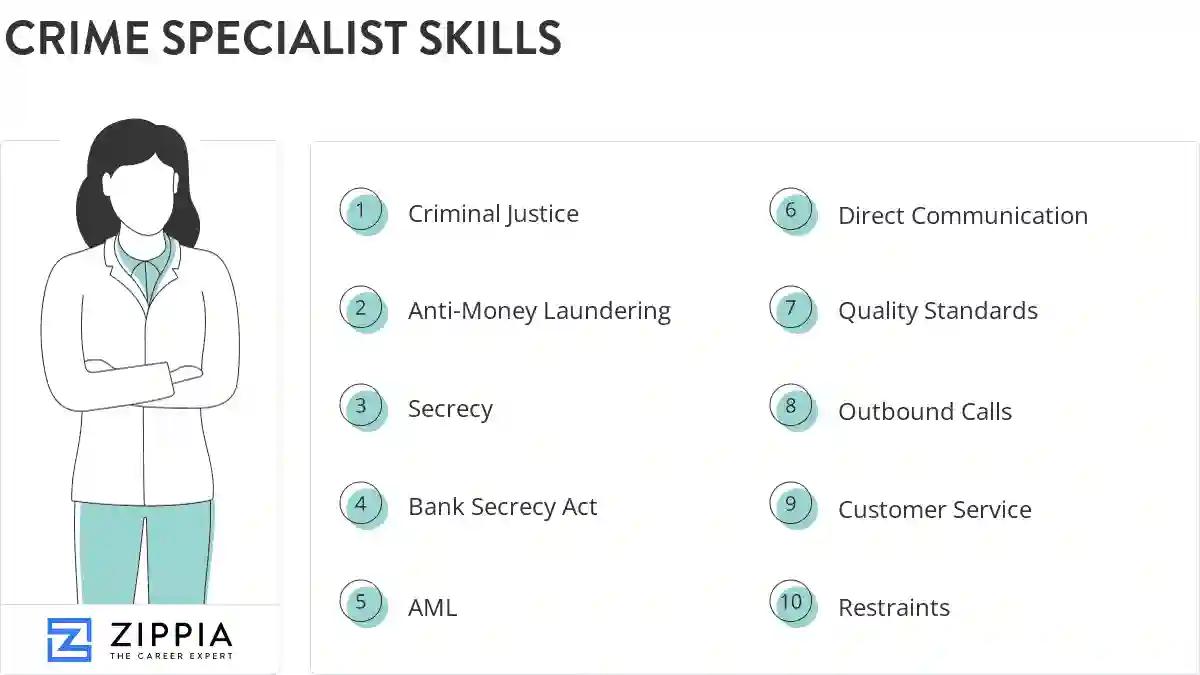

Crime specialist skills for your resume and career

15 crime specialist skills for your resume and career

1. Criminal Justice

- Provided victims of crime with direct support, advocacy, and accompaniment throughout the criminal justice system.

- Obtained NCIC Certification for criminal justice professionals to apprehend fugitives, locate missing persons and recover stolen property.

2. Anti-Money Laundering

Anti-Money Laundering or, as it is often shortened to, AML is the name of a set of laws, regulations, and similar rules and rulings which are crafted and applied with the goal of preventing people from engaging in and successfully doing money laundering.

- Apply banking knowledge in order to conduct anti-money laundering investigations.

- Adhere to Federal Regulation E and Z, anti-money laundering, and the Bank Secrecy Act.

3. Secrecy

Secrecy is the method of hiding data from individuals or groups while disclosing it with other individuals especially if they do not qualify the "need to know".

- Reviewed large currency transaction activity to ensure all store-filed items have been properly processed, within Bank Secrecy Act regulatory requirements.

- Conduct all duties in accordance with company policy and US law to include the Bank Secrecy and Patriot Act.

4. Bank Secrecy Act

- Keep informed of laws, regulations, and current practices pertaining to the Bank Secrecy Act and Anti-Money Laundering regulations.

- Maintained firm compliance posture in accordance with Bank Secrecy Act, U.S. Patriot Act and Anti-Money Laundering standards.

5. AML

AML refers to the rules and systems set up by governments, financial institutions, or organizations to prevent fraudulent economic activities.

- Monitored customer account due to incoming and outgoing of funds into account due to Anti Money Laundering (AML).

- Updated the organization about the current AML related industry standards, procedures, and practices

6. Direct Communication

- Handled complex claims in which direct communication with merchants was often required to resolve customer disputes.

- Function as senior lead to assist with team direct communication with customers and merchants.

Choose from 10+ customizable crime specialist resume templates

Build a professional crime specialist resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your crime specialist resume.7. Quality Standards

Quality standards are a specific level of standards of products that are set by the companies for the customers that have to be met and maintained throughout the process until the time of delivery. Quality standards are information that includes the customer's requirements, guidelines, and characteristics for the needed final product or service.

- Responded to inbound customer inquiries while exceeding quality standards in a fast paced communications center environment to ensure customer satisfaction.

- Direct customer contact related to bank accounts activities including complex investigations to achieve department set quality standards.

8. Outbound Calls

An outbound call is made by the call center representative to the customers on behalf of the company. Such calls help increase sales and generate revenue for the organization.

- Deliver great customer service through means of inbound and outbound calls to customers, internal representatives and merchants.

- Receive inbound and make outbound calls all day to cardholders to discuss fraud/potential fraud on their cards.

9. Customer Service

Customer service is the process of offering assistance to all the current and potential customers -- answering questions, fixing problems, and providing excellent service. The main goal of customer service is to build a strong relationship with the customers so that they keep coming back for more business.

- Revised and implemented procedures and training materials to maximize efficiency and customer service; and to assure compliance with governmental regulations.

- Provide exceptional customer service by handling incoming calls from internal and external customers who need assistance due to suspicious online activity.

10. Restraints

- Navigated multiple systems for information to perform general account handling functions, such as closing accounts, holds, and restraints.

- Performed general account handling functions such as close account determination, holds, restraints, among other job responsibilities.

11. Regulatory Compliance

- Implement regulatory compliance requirements surrounding Regulation E, CC and DD.

12. Treasury

- Work with clients to resolve operational cash management issues in relation to selected treasury management products.

- Interact with Treasury Department personnel to identify and resolve non-compliant banks.

13. General Account

- Analyze and review cases for possible fraudulent activity as well as performing general account handling functions.

- Performed general account handling functions opening, closing, restraining, etc.

14. Inbound Calls

- Handled inbound calls related to online banking fraudulent/suspicious activity after thoroughly verifying customers per Wells Fargo's required guideline and procedures.

- Answer inbound calls from customers regarding fraudulent activity that resulted from their debit card being used without their consent or knowledge.

15. Fraud Losses

- Create and maintain fraudulent activity logs/records/databases, reconcile and summarize fraud losses, interpret data, identify trends

- Maintained fraudulent activity files/records/databases, reconcile and summarize fraud losses and produced routine management reports.

5 Crime Specialist resume examples

Build a professional crime specialist resume in minutes. Browse through our resume examples to identify the best way to word your resume. Then choose from 5+ resume templates to create your crime specialist resume.

What skills help Crime Specialists find jobs?

Tell us what job you are looking for, we’ll show you what skills employers want.

What crime specialist skills would you recommend for someone trying to advance their career?

Stephen Schneider Ph.D.

Professor, Website

List of crime specialist skills to add to your resume

The most important skills for a crime specialist resume and required skills for a crime specialist to have include:

- Criminal Justice

- Anti-Money Laundering

- Secrecy

- Bank Secrecy Act

- AML

- Direct Communication

- Quality Standards

- Outbound Calls

- Customer Service

- Restraints

- Regulatory Compliance

- Treasury

- General Account

- Inbound Calls

- Fraud Losses

- Customer Disputes

- Debit Card Fraud

- Technical Proficiency

- Multiple Windows

- Excellent Time Management

- Fraud Trends

- ACH

- Mitigate Losses

- Fraudulent Transactions

- Inbound Customer Inquiries

- Strong Analytical

- ATM

- Financial Abuse

- Securities

- Validate Transactions

- Financial Institutions

- Hogan

- Control Failures

- Loss Accountability

- Account Determination

- Customer Issues

- DAT

- Customer Accounts

- Fraud Cases

- Process Claims

- Credit Card

- Financial Losses

- CIV

- Arbitration

- Suspicious Situations

- FDR

- Takeovers

Updated January 8, 2025