What does a field agent do?

Field agents are the ones who work and do their job not inside the four corners of the office; instead, they do the assigned task outside. They often are expected to have good communication skills so that they can get a response from the most unwilling person in the area. Besides, they must also possess good character traits and professionalism to effectively address higher-up's concerns. As the man on the field, they provide customer support more effectively.

Field agent responsibilities

Here are examples of responsibilities from real field agent resumes:

- Sell life insurance, long term care insurance and retirement annuities to assign members.

- Assist senior base clients with understanding and purchasing Medicare supplements, annuities, health and life insurance products.

- Operate remote telecommunications using applications and secure computer communications to troubleshoot and resolve issues on customer Samsung devices.

- Help maintain Primerica as the number one source for insurance needs by directly switching accounts over to the company.

Field agent skills and personality traits

We calculated that 28% of Field Agents are proficient in GPS, Long-Term Care, and Health Insurance. They’re also known for soft skills such as Analytical skills, Communication skills, and Initiative.

We break down the percentage of Field Agents that have these skills listed on their resume here:

- GPS, 28%

Documented roads and buildings to assist in GPS tracking program designed by the US government.

- Long-Term Care, 17%

Provided world-class customer service while driving sales of life insurance, long-term care, and annuities products.

- Health Insurance, 10%

Conducted telephone interviews on various topics (health insurance, politics, current events, education, etc.)

- Annuities, 9%

Specialized in fraternal benefits, such as Life Insurance, Disability Income Protection, Long Term Care Insurance, and Annuities.

- Subpoenas, 6%

Processed request for Release of Information of all subpoenas and authorization from both, attorneys and photocopy legal services.

- Life Insurance Products, 6%

Field agent responsible for sale of American Income Life insurance products.

Common skills that a field agent uses to do their job include "gps," "long-term care," and "health insurance." You can find details on the most important field agent responsibilities below.

Analytical skills. The most essential soft skill for a field agent to carry out their responsibilities is analytical skills. This skill is important for the role because "insurance sales agents must evaluate the needs of each client to determine the appropriate insurance policy." Additionally, a field agent resume shows how their duties depend on analytical skills: "collected potential consumer data to generate warm leads that allowed for consistent marketing after initial consumer engagement to encourage product purchase. "

Communication skills. Another soft skill that's essential for fulfilling field agent duties is communication skills. The role rewards competence in this skill because "insurance sales agents must listen to clients and be able to clearly explain suitable policies." According to a field agent resume, here's how field agents can utilize communication skills in their job responsibilities: "developed sales and communication skills by practicing phone scripts, probing questions, and needs-based sales presentations daily. "

Initiative. field agents are also known for initiative, which are critical to their duties. You can see how this skill relates to field agent responsibilities, because "insurance sales agents need to actively seek out new clients in order to increase business." A field agent resume example shows how initiative is used in the workplace: "closed new business via self generated means of prospecting (including cold calls) as well as from corporate initiatives. "

Self-confidence. A big part of what field agents do relies on "self-confidence." You can see how essential it is to field agent responsibilities because "insurance sales agents should be confident when contacting prospective clients." Here's an example of how this skill is used from a resume that represents typical field agent tasks: "received 50+ daily inbound calls in a fast-paced environment and entered confidential customer information into company databases. "

The three companies that hire the most field agents are:

- Terraboost Media5 field agents jobs

- Smith Seckman Reid4 field agents jobs

- Nordstrom2 field agents jobs

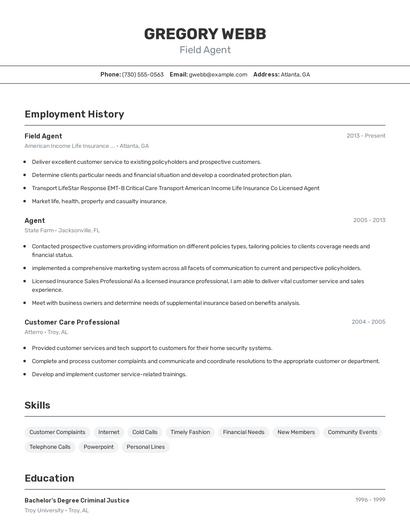

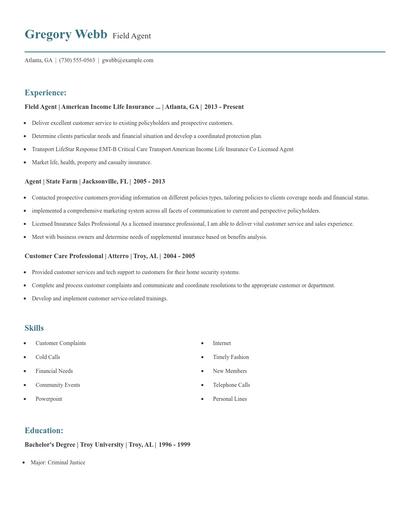

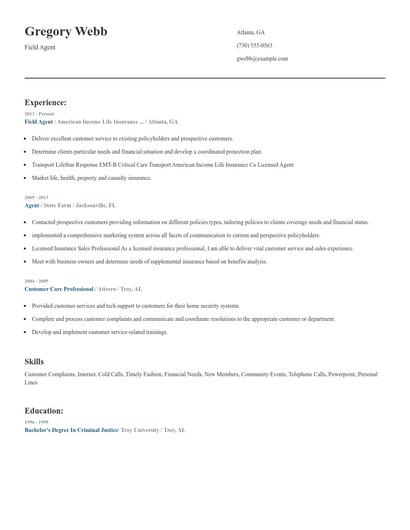

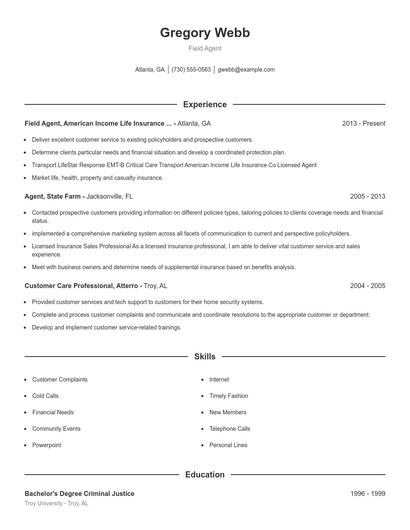

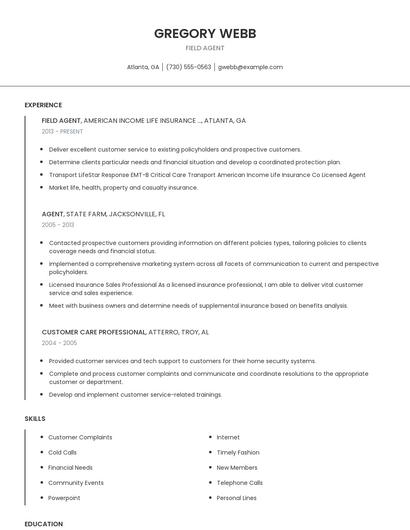

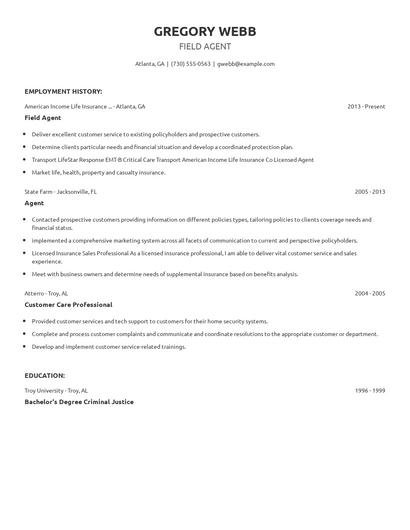

Choose from 10+ customizable field agent resume templates

Build a professional field agent resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your field agent resume.Compare different field agents

Field agent vs. Insurance verification specialist

An insurance verification specialist is responsible for confirming a patient's insurance details and eligibility to receive medical care services. Insurance verification specialists review the insurance documents of the patients, including its coverage and limitations, and escalate concerns to the supervisor for immediate resolution. They process paperwork accordingly upon coordinating with the patients and attending health professionals. An insurance verification specialist must have excellent communication and organizational skills, finishing administrative tasks efficiently under minimal supervision.

While similarities exist, there are also some differences between field agents and insurance verification specialist. For instance, field agent responsibilities require skills such as "gps," "long-term care," "annuities," and "subpoenas." Whereas a insurance verification specialist is skilled in "patients," "insurance verification," "customer service," and "insurance eligibility." This is part of what separates the two careers.

Insurance verification specialists earn the highest salaries when working in the pharmaceutical industry, with an average yearly salary of $35,651. On the other hand, field agents are paid more in the finance industry with an average salary of $53,420.On average, insurance verification specialists reach similar levels of education than field agents. Insurance verification specialists are 3.5% less likely to earn a Master's Degree and 0.2% less likely to graduate with a Doctoral Degree.Field agent vs. Insurance producer

An insurance producer is responsible for selling and buying financial services and products for an insurance company. They negotiate issues regarding health, life insurance, and other properties. Also, an insurance producer maintains a good relationship between clients and prospective clients by offering the best insurance service and ensuring that all the policies and guidelines are fully followed.

While some skills are similar in these professions, other skills aren't so similar. For example, resumes show us that field agent responsibilities requires skills like "gps," "long-term care," "subpoenas," and "law enforcement agencies." But an insurance producer might use other skills in their typical duties, such as, "casualty insurance," "customer service," "develop leads," and "team-oriented environment."

Insurance producers may earn a higher salary than field agents, but insurance producers earn the most pay in the real estate industry with an average salary of $62,146. On the other hand, field agents receive higher pay in the finance industry, where they earn an average salary of $53,420.In general, insurance producers achieve similar levels of education than field agents. They're 1.0% more likely to obtain a Master's Degree while being 0.2% more likely to earn a Doctoral Degree.Field agent vs. Insurance broker

Insurance brokers are responsible for assisting clients to determine their liability risks and in selecting the appropriate policies for their family, home, business, or automobile to ensure their protection. They direct clients in creating a sound decision and supply them with a variety of quotes that best suit their needs. Their duties include demonstrating the benefits, terms, conditions, and suspension for a number of participating insurance policies. Also, they may negotiate lesser rates for their clients and continue in guiding these clients in technical issues like filing a claim or changing their insurance coverage.

Some important key differences between the two careers include a few of the skills necessary to fulfill the responsibilities of each. Some examples from field agent resumes include skills like "gps," "long-term care," "health insurance," and "subpoenas," whereas an insurance broker is more likely to list skills in "customer service," "lead generation," "financial resources," and "insurance carriers. "

Insurance brokers make a very good living in the insurance industry with an average annual salary of $72,365. On the other hand, field agents are paid the highest salary in the finance industry, with average annual pay of $53,420.Most insurance brokers achieve a similar degree level compared to field agents. For example, they're 1.3% more likely to graduate with a Master's Degree, and 0.5% more likely to earn a Doctoral Degree.Field agent vs. Insurance representative

An insurance representative serves as a client's point of contact in insurance companies. Their responsibilities include researching client opportunities, reaching out to potential clients to offer products and services, discussing terms and policies, providing detailed advice, and assisting in every procedure, ensuring convenience and client satisfaction. Aside from securing sales, an insurance representative may also process applications and claims while adhering to the company's policies and regulations. Furthermore, they may also perform clerical tasks such as handling calls and correspondence, arranging appointments, and maintaining records of all transactions.

Types of field agent

Updated January 8, 2025