What does a finance controller do?

A financial controller is primarily in charge of the daily finance activities and accounting functions of a company. Their responsibilities typically revolve around preparing and organizing financial reports, analyzing data and looking out for any discrepancies or inconsistencies, and overseeing the company's overall revenues and expenditures. A financial controller must also maintain documentation, participate in risk assessment and budgeting activities, and develop strategies for profit growth. Furthermore, one must coordinate with other department staff to ensure accuracy, all while implementing the company's policies and regulations.

Finance controller responsibilities

Here are examples of responsibilities from real finance controller resumes:

- Lead the implementation of a fully integrate ERP system resulting in increase financial integrity.

- Supervise a staff of seven in the areas of A/P, A/R, G/L, financial reporting and payroll.

- Coordinate annual financial audit with external CPA firm and implement internal controls to satisfy recommendations from auditors.

- Develop and implement procedures with internal controls for all financial and operational processes to ensure GAAP compliance.

- Prepare all accounts for the month-end closing process and additionally gather information for daily/monthly reconciliations and journal entries.

- Work with outside CPA on year-end tax planning; ensure the timely filing and payment of corporate taxes.

- Develop and deliver global training to all finance users prior to a major upgrade of DEK's ERP system.

- Serve as point of escalation for A/R and A/P issues for a company of $100M+ in annual sales.

- Design a new set of month-end close reports to timely and fully record expense accruals for the various business units.

- General accounting using QuickBooks for financial statements.

- Introduce QuickBooks and start an organize accounting system.

- Reconcile accruals, prepay accounts and monthly revenue reporting after reconciliation.

- Facilitate operational and financial compliance audits utilizing GAAP and internal control standards.

- Supervise the daily treasury management, monthly financial reporting and quarterly earnings release.

- Conduct periodic audits, implement SOX compliance procedures and coordinate controllable working capital improvement activities.

Finance controller skills and personality traits

We calculated that 7% of Finance Controllers are proficient in CPA, Payroll, and Financial Controller. They’re also known for soft skills such as Analytical skills, Communication skills, and Detail oriented.

We break down the percentage of Finance Controllers that have these skills listed on their resume here:

- CPA, 7%

Facilitated annual year end close with external CPA firm; which included a mix of Review, Compilation and Tax Reporting.

- Payroll, 7%

Streamlined payroll processing by migrating to Heartland Payroll Systems that supports all Landmark Hospitality companies within the organization.

- Financial Controller, 7%

Project financial controller focused on quality and accuracy of financial project review data in respect with economic targets.

- GAAP, 5%

Prepared monthly GAAP financial statements used for management decision making, including consolidated statements of income for all five locations.

- General Ledger, 5%

Managed all accounting functions including: General ledger accounts reconciliation, Monthly Balance sheet account reconciliation, and Fixed Asset reconciliation.

- Internal Controls, 5%

Traveled to operations to ensure that policies and procedures were consistent to ensure compliance with all internal controls and regulatory requirements.

Most finance controllers use their skills in "cpa," "payroll," and "financial controller" to do their jobs. You can find more detail on essential finance controller responsibilities here:

Analytical skills. To carry out their duties, the most important skill for a finance controller to have is analytical skills. Their role and responsibilities require that "to assist executives in making decisions, financial managers need to evaluate data and information that affects their organization." Finance controllers often use analytical skills in their day-to-day job, as shown by this real resume: "coordinated and executed numerous audits and internal assessments to ensure compliance along with erp mapping / analysis. "

Communication skills. Many finance controller duties rely on communication skills. "financial managers must be able to explain and justify complex financial transactions.," so a finance controller will need this skill often in their role. This resume example is just one of many ways finance controller responsibilities rely on communication skills: "managed group of 5 staff members including director of hr, payroll, and communications. "

Detail oriented. Another skill that relates to the job responsibilities of finance controllers is detail oriented. This skill is critical to many everyday finance controller duties, as "in preparing and analyzing reports, such as balance sheets and income statements, financial managers must be precise and attentive to their work in order to avoid errors." This example from a resume shows how this skill is used: "perform detailed variance analysis and account analysis reconciliations. "

Math skills. For certain finance controller responsibilities to be completed, the job requires competence in "math skills." The day-to-day duties of a finance controller rely on this skill, as "financial managers need strong skills in certain branches of mathematics, including algebra." For example, this snippet was taken directly from a resume about how this skill applies to what finance controllers do: "prepared internal / external financial statements supervised accounts payable, accounts receivable, payroll, and statistics departments. "

Organizational skills. Another crucial skill for a finance controller to carry out their responsibilities is "organizational skills." A big part of what finance controllers relies on this skill, since "because financial managers deal with a range of information and documents, they must have structures in place to be effective in their work." How this skill relates to finance controller duties can be seen in an example from a finance controller resume snippet: "committed to organizational processed payroll and performed bank reconciliations monthly. "

The three companies that hire the most finance controllers are:

- JPMorgan Chase & Co.31 finance controllers jobs

- Guidehouse9 finance controllers jobs

- Robert Half7 finance controllers jobs

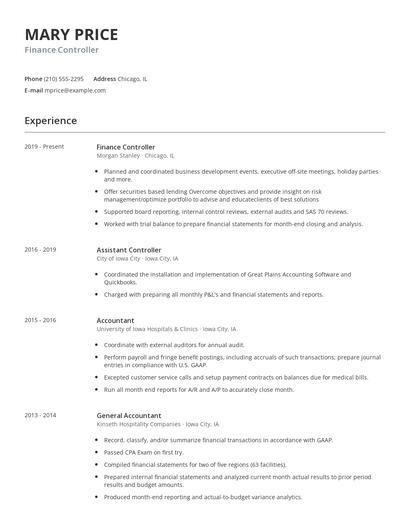

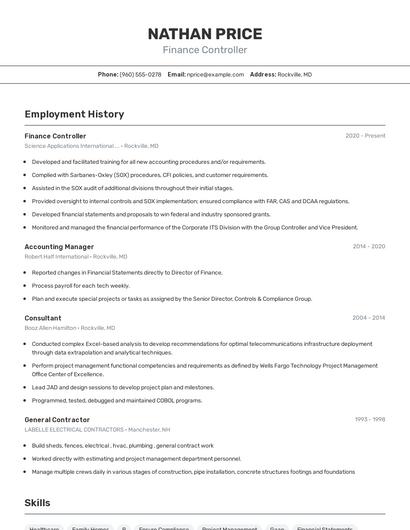

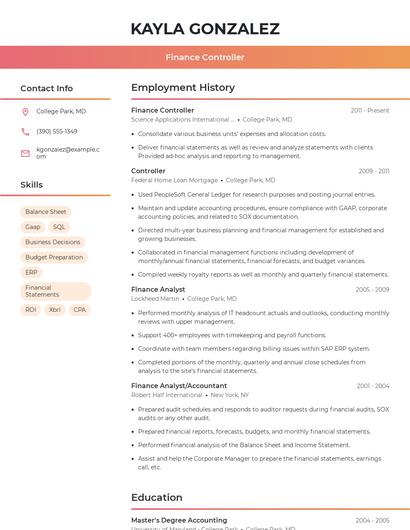

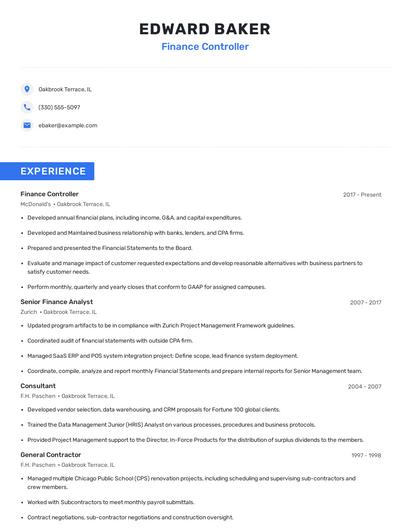

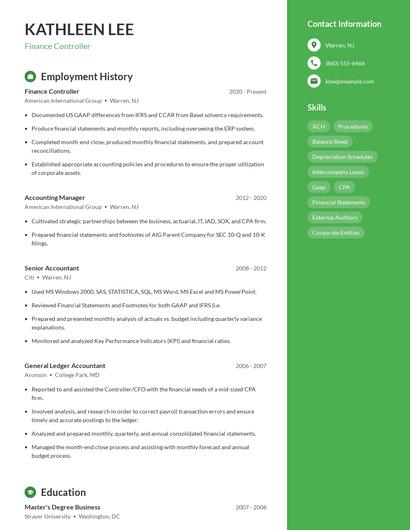

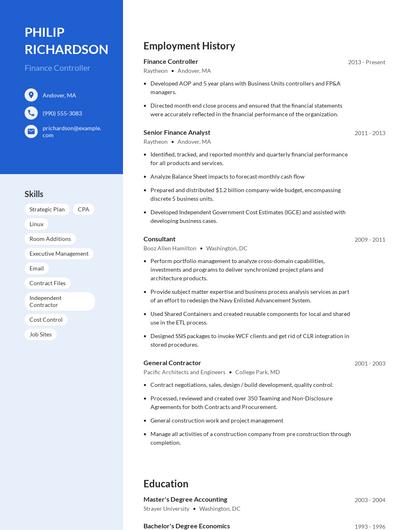

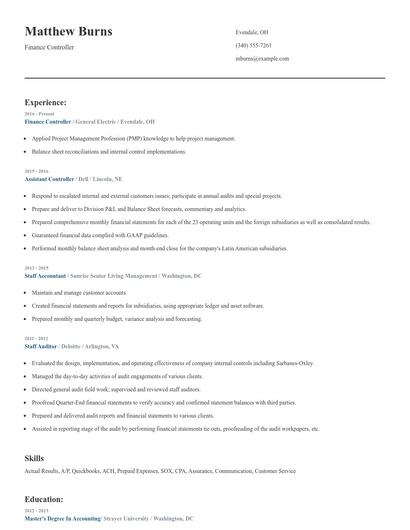

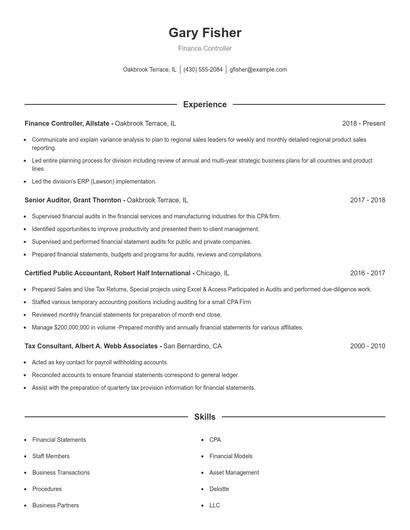

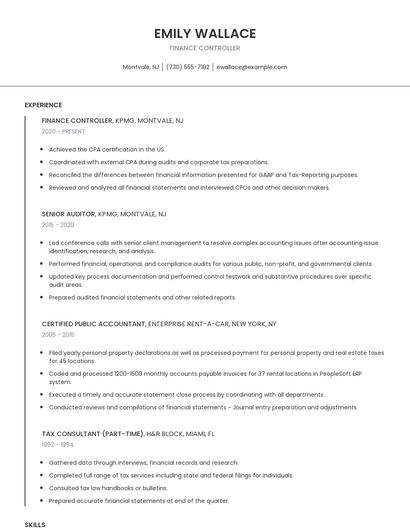

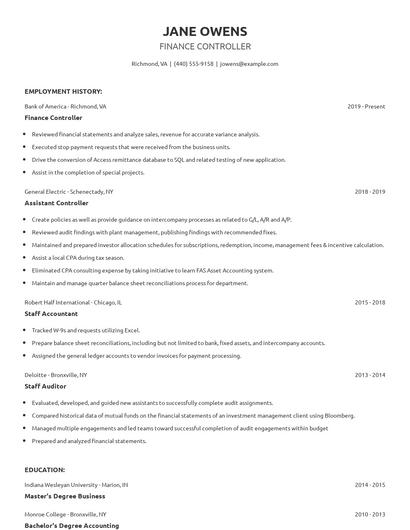

Choose from 10+ customizable finance controller resume templates

Build a professional finance controller resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your finance controller resume.Compare different finance controllers

Finance controller vs. Accounting director

An Accounting Director supervises the general accounting and financial reporting functions, as well as financial services within a company or organization. They also ensure that all transactions and financial policies for their organization meet federal regulations and standards.

While similarities exist, there are also some differences between finance controllers and accounting director. For instance, finance controller responsibilities require skills such as "financial controller," "general ledger," "excellent interpersonal," and "journal entries." Whereas a accounting director is skilled in "oversight," "customer service," "general ledger accounts," and "shared services." This is part of what separates the two careers.

Accounting directors earn the highest salaries when working in the technology industry, with an average yearly salary of $128,951. On the other hand, finance controllers are paid more in the technology industry with an average salary of $119,209.The education levels that accounting directors earn slightly differ from finance controllers. In particular, accounting directors are 5.4% less likely to graduate with a Master's Degree than a finance controller. Additionally, they're 0.0% more likely to earn a Doctoral Degree.Finance controller vs. Accounting manager

An accounting manager is responsible for supervising and monitoring the overall accounting department operations. Duties of an accounting manager include reviewing account information and account statements, processing invoices, analyzing financial data, performing account reconciliations, assisting with tax processing and audit reports, and generating financial reports for presentation with the board. An accounting manager must have excellent knowledge of the accounting principles and legislation to assist the team with the company's financial goals. Accounting managers must have the outstanding analytical, critical thinking, and decision-making skills to develop the best competitive financial strategies.

While some skills are similar in these professions, other skills aren't so similar. For example, resumes show us that finance controller responsibilities requires skills like "payroll," "financial controller," "excellent interpersonal," and "journal entries." But an accounting manager might use other skills in their typical duties, such as, "customer service," "payroll processing," "general ledger accounts," and "sales tax."

Accounting managers may earn a lower salary than finance controllers, but accounting managers earn the most pay in the finance industry with an average salary of $99,773. On the other hand, finance controllers receive higher pay in the technology industry, where they earn an average salary of $119,209.accounting managers earn lower levels of education than finance controllers in general. They're 8.1% less likely to graduate with a Master's Degree and 0.0% less likely to earn a Doctoral Degree.What technology do you think will become more important and prevalent for finance controllers in the next 3-5 years?

Nate Peach Ph.D.

Associate Professor of Economics, George Fox University

Finance controller vs. Controller, vice president

A Controller, Vice President is focused on controlling and directing financial planning and budget management. They supervise the daily operations of the finance department, such as financial reporting, accounts payable, and payroll.

There are many key differences between these two careers, including some of the skills required to perform responsibilities within each role. For example, a finance controller is likely to be skilled in "financial controller," "strong analytical," "excellent interpersonal," and "balance sheet accounts," while a typical controller, vice president is skilled in "risk management," "oversight," "nyse," and "balance sheet."

Controllers, vice president earn the best pay in the manufacturing industry, where they command an average salary of $162,621. Finance controllers earn the highest pay from the technology industry, with an average salary of $119,209.Most controllers, vice president achieve a similar degree level compared to finance controllers. For example, they're 1.8% less likely to graduate with a Master's Degree, and 0.3% less likely to earn a Doctoral Degree.Finance controller vs. Manager/finance accounting

A manager of finance accounting's role is to oversee the financial activities in a company or organization. Their responsibilities revolve around coordinating with other departments to gather financial data, analyze the revenues and expenditures, and develop written reports and presentations. A manager of finance accounting must also maintain accurate financial records, identify any errors or inconsistencies, and perform support tasks for staff when necessary. Furthermore, as a manager, it is essential to lead and encourage the team, all while implementing the company's policies and regulations.

Even though a few skill sets overlap between finance controllers and managers/finance accounting, there are some differences that are important to note. For one, a finance controller might have more use for skills like "payroll," "financial controller," "excellent interpersonal," and "journal entries." Meanwhile, some responsibilities of managers/finance accounting require skills like "customer service," "hr," "shared services," and "payroll processing. "

Managers/finance accounting enjoy the best pay in the government industry, with an average salary of $92,198. For comparison, finance controllers earn the highest salary in the technology industry.In general, managers/finance accounting hold similar degree levels compared to finance controllers. Managers/finance accounting are 1.5% less likely to earn their Master's Degree and 0.0% more likely to graduate with a Doctoral Degree.Types of finance controller

Updated January 8, 2025