What does a finance reporting accountant do?

A finance reporting accountant is responsible for monitoring the efficiency and accuracy of the company's financial reporting procedures. Finance reporting accountants analyze the financial statements of the company, including its expenses, balance sheets, revenues, cash flow, and other related financial information and discuss it to the management. They also provide strategic recommendations to minimize loss through cost-reduction operational processes and identifying business opportunities to increase profits. A finance reporting accountant should have excellent knowledge of the accounting principles and disciplines, evaluating financial forecasts and resolving account discrepancies.

Finance reporting accountant responsibilities

Here are examples of responsibilities from real finance reporting accountant resumes:

- Manage derivative accounting at global level and ensure accounting and economic hedging objectives are align.

- Conduct trend analysis and other research to determine accuracy of various payroll accruals.

- Prepare and submit budgets and latest estimates into Hyperion Essbase.

- Maintain financial reporting system (HFM account mapping/data loads).

- Maintain supporting files/binders for all external/ internal reporting (Hyperion- HFM).

- Act as primary contact for external financial auditor during financial audit and SOX audit.

- Provide consultation to clients on XBRL process, technology and use of the systems.

- Assist with compliance and maintenance of XBRL requirements, including block tagging and detail footnote tagging.

- Generate and maintain monthly SOX reporting requirements.

- Review monthly payroll journals and reconcile payroll accounts

- Prepare and review accruals and corresponding expense accounts.

- Prepare semi-monthly payroll and maintain relationship with outside payroll service.

- Prepare and review monthly headcounts for various locations through Hyperion financial system.

- Prepare audit work papers and documentation for auditors to maintain compliance of Sarbanes-Oxley.

- Research new accounting standards and regulations to ensure disclosures comply with GAAP reporting requirements.

Finance reporting accountant skills and personality traits

We calculated that 15% of Finance Reporting Accountants are proficient in GAAP, Reconciliations, and External Auditors. They’re also known for soft skills such as Organizational skills, Analytical skills, and Communication skills.

We break down the percentage of Finance Reporting Accountants that have these skills listed on their resume here:

- GAAP, 15%

Prepared quarterly and annual subsidiary financial reports and state commission reports, in accordance with US GAAP and state-specific utility regulations.

- Reconciliations, 14%

Ensured staff follows standard operating procedures to maintain complete and accurate schedules and reconciliations to support financial statement reporting.

- External Auditors, 6%

Prepared annual report package for operating entities and worked to coordinate audit processes with external auditors.

- Account Reconciliations, 4%

Managed A/R team, Account reconciliations/Month end & Year end close

- Financial Data, 4%

Prepared / reviewed key financial data analysis related to U.S. operations at the request of various departments within organization.

- Internal Controls, 3%

Monitored and tested internal controls for Southern Company Parent.

Common skills that a finance reporting accountant uses to do their job include "gaap," "reconciliations," and "external auditors." You can find details on the most important finance reporting accountant responsibilities below.

Organizational skills. The most essential soft skill for a finance reporting accountant to carry out their responsibilities is organizational skills. This skill is important for the role because "strong organizational skills are important for accountants and auditors, who often work with a range of financial documents for a variety of clients." Additionally, a finance reporting accountant resume shows how their duties depend on organizational skills: "ensured organizational and gaap compliance using excel and peachtree presented to senior staff and board members for 21 locations. "

Communication skills. Another skill that relates to the job responsibilities of finance reporting accountants is communication skills. This skill is critical to many everyday finance reporting accountant duties, as "accountants and auditors must be able to listen to and discuss facts and concerns from clients, managers, and other stakeholders." This example from a resume shows how this skill is used: "compiled consolidated financial statements for sec filings and supporting documentation for earnings communications. "

Detail oriented. finance reporting accountant responsibilities often require "detail oriented." The duties that rely on this skill are shown by the fact that "accountants and auditors must pay attention to detail when compiling and examining documents." This resume example shows what finance reporting accountants do with detail oriented on a typical day: "prepared consolidated financial statements for approximately 85 corporations including maintenance of general ledgers and preparation of detailed financial analysis. "

Math skills. A commonly-found skill in finance reporting accountant job descriptions, "math skills" is essential to what finance reporting accountants do. Finance reporting accountant responsibilities rely on this skill because "accountants and auditors must be able to analyze, compare, and interpret facts and figures." You can also see how finance reporting accountant duties rely on math skills in this resume example: "honed data analysis and reporting techniques by analyzing quality performance statistics. "

The three companies that hire the most finance reporting accountants are:

- iHeartMedia11 finance reporting accountants jobs

- Robert Half10 finance reporting accountants jobs

- Gannett5 finance reporting accountants jobs

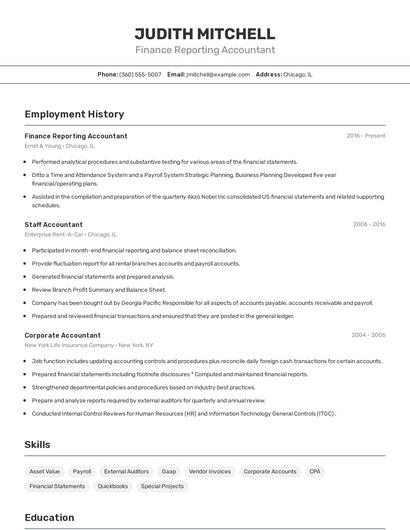

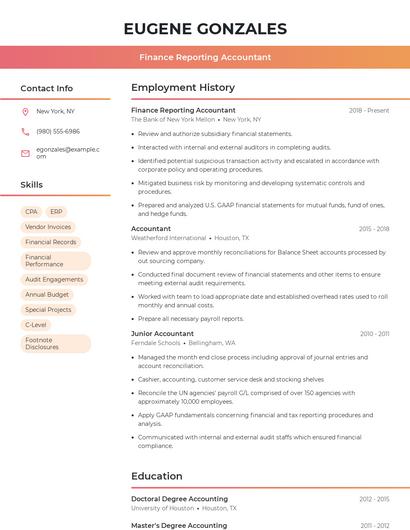

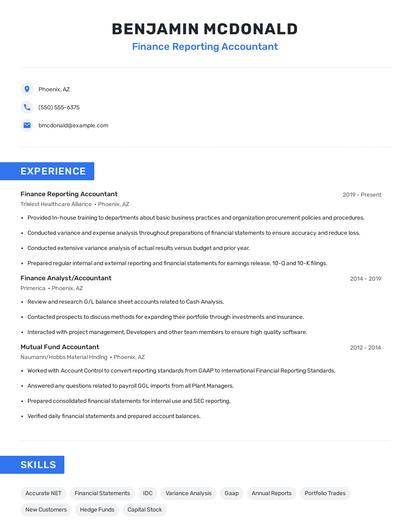

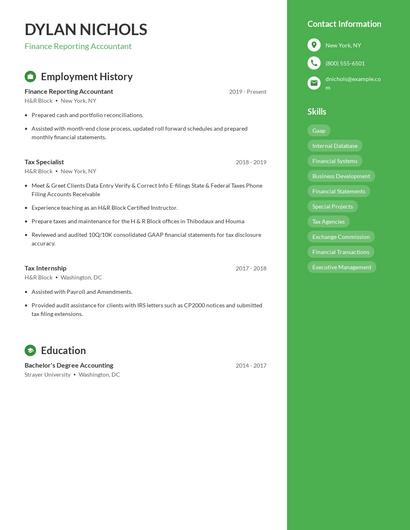

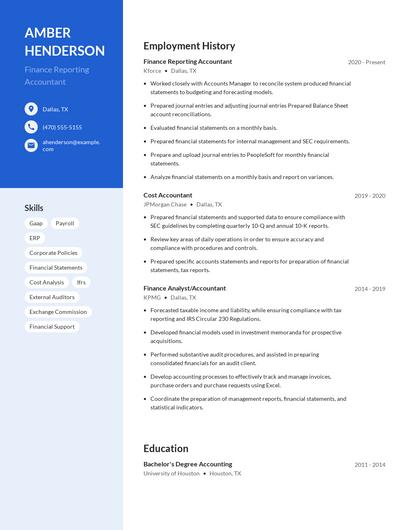

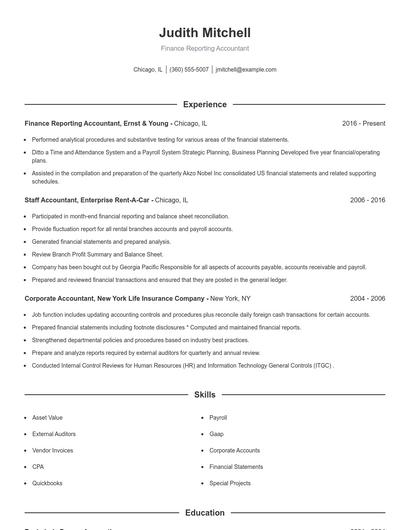

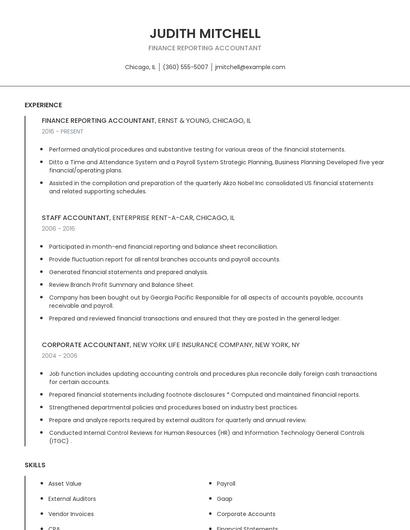

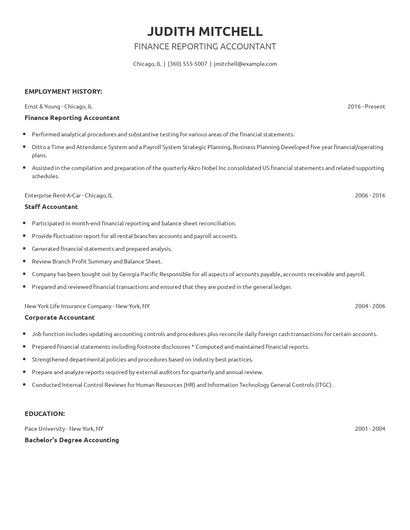

Choose from 10+ customizable finance reporting accountant resume templates

Build a professional finance reporting accountant resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your finance reporting accountant resume.Compare different finance reporting accountants

Finance reporting accountant vs. Corporate finance analyst

Corporate finance analysts make significant business decisions based on the data they gather. Typically, corporate finance analysts work within an organization and support management decisions through actionable financial information. They monitor the taxes, expenses, financial statements, and other financial details of where the company sources its income. This position requires a formal qualification in accounting. It also necessitates the analyst to develop interpersonal skills, knowledge in information technology software, financial reporting skills, and experience in management.

There are some key differences in the responsibilities of each position. For example, finance reporting accountant responsibilities require skills like "xbrl," "accruals," "ifrs," and "general ledger accounts." Meanwhile a typical corporate finance analyst has skills in areas such as "strong analytical," "financial models," "balance sheet," and "due diligence." This difference in skills reveals the differences in what each career does.

Corporate finance analysts really shine in the finance industry with an average salary of $96,991. Comparatively, finance reporting accountants tend to make the most money in the retail industry with an average salary of $77,788.corporate finance analysts tend to reach similar levels of education than finance reporting accountants. In fact, corporate finance analysts are 2.0% more likely to graduate with a Master's Degree and 0.3% more likely to have a Doctoral Degree.Finance reporting accountant vs. Accounting analyst

An accounting analyst is responsible for supporting the accounting operations of an organization, analyzing financial transactions and financial statements, and resolving account discrepancies. Accounting analysts interpret financial data by consolidating account transactions, performing account reconciliation, and managing account receivables. They also assist in preparing and releasing invoices, issuing billing statements, and creating comprehensive financial reports on the company's budget and expenses. An accounting analyst must have excellent knowledge of the accounting principles and disciplines, as well as extensive analytical and communication skills to perform duties and meet deadlines under minimal supervision.

In addition to the difference in salary, there are some other key differences worth noting. For example, finance reporting accountant responsibilities are more likely to require skills like "xbrl," "income statement," "ifrs," and "earnings releases." Meanwhile, an accounting analyst has duties that require skills in areas such as "customer service," "strong analytical," "hr," and "work ethic." These differences highlight just how different the day-to-day in each role looks.

On average, accounting analysts earn a lower salary than finance reporting accountants. Some industries support higher salaries in each profession. Interestingly enough, accounting analysts earn the most pay in the finance industry with an average salary of $66,550. Whereas finance reporting accountants have higher pay in the retail industry, with an average salary of $77,788.Average education levels between the two professions vary. Accounting analysts tend to reach similar levels of education than finance reporting accountants. In fact, they're 4.0% less likely to graduate with a Master's Degree and 0.3% less likely to earn a Doctoral Degree.What technology do you think will become more important and prevalent for finance reporting accountants in the next 3-5 years?

Nate Peach Ph.D.

Associate Professor of Economics, George Fox University

Finance reporting accountant vs. Finance officer

A finance officer is responsible for monitoring the financial department and the transactions of an organization. Finance officers analyze financial reports, update account statements, and oversee the budget allocation for business operations. They also resolve billing discrepancies and banking issues, assist in cash statement release, and manage payroll disputes. A finance officer conducts data and statistical analysis to evaluate the company's financial performance and stability and identifying opportunities to increase revenues and grow more profits.

There are many key differences between these two careers, including some of the skills required to perform responsibilities within each role. For example, a finance reporting accountant is likely to be skilled in "reconciliations," "account reconciliations," "sox," and "process improvement," while a typical finance officer is skilled in "origination," "financial procedures," "financial management," and "cpa."

Finance officers typically earn similar educational levels compared to finance reporting accountants. Specifically, they're 0.9% more likely to graduate with a Master's Degree, and 0.3% more likely to earn a Doctoral Degree.Finance reporting accountant vs. Accountant

An accountant is an individual whose primary task is to prepare, keep, examine, and interpret financial records. Most accountants are in charge of a wide scope of finance-related tasks, either for private individuals or for large-scale businesses and organizations they are employed with. They make sure that financial statements and records are accurate and comply with laws and regulations. They also compute for taxes, prepare tax returns, and ensure being paid properly and on time. As they keep track and record the flow of money, they can offer guidance on how to reduce costs, enhance revenue, and help in profit maximization.

Types of finance reporting accountant

Updated January 8, 2025