What does a foreign exchange trader do?

The foreign exchange market is volatile and influenced by numerous factors. A foreign exchange trader considers these factors and utilizes them in their favor. They typically take care to predict misvaluations of currencies accurately. They act on the conclusions reached from their analysis and either buy or sell assets in different markets. This position requires diligence and patience.

Foreign exchange trader responsibilities

Here are examples of responsibilities from real foreign exchange trader resumes:

- Manage overall risk for FX online dealer during Asia shift.

- Communicate with brokers to ensure accurate allocations for futures, foreign exchange, and equities between separately manage accounts.

- Experience using Bloomberg, Reuters, and FX trading platforms.

- Display subject matter expertise in Reuters, Bloomberg, EBS, and various foreign exchange platforms.

- Use of Reuters, CQG and Knight-Ridder computer services.

- Validate transaction and trading details with international banks and multiple ECN trading platforms.

- Analyze the currency market by using different indicators: MACD, Bollinger bonds, moving average.

- Plan and implement trades and hedges utilizing cash instruments, forwards, futures, options and swaps.

- Implement transactions through computerize networks such as Reuters and EBS and by telephone with spot foreign exchange brokers.

- Trade spot and derivative positions for corporate customers.

- Verify that end-of-month derivative positions are accurately reflect in the system.

- Generate price discovery and execute desired positions across various products including volatility views through straddles and variance swaps.

- Automate the trade allocation and reconciliation procedures using VBA programming which is leveraged to systematically detect any trade breaks or discrepancies.

- Provide negotiated swap points, NDF's, options, and EFP pricing for clients.

- Switch shifts as needed, from NY trading to Asia to London time zones.

Foreign exchange trader skills and personality traits

We calculated that 35% of Foreign Exchange Traders are proficient in Manage Risk, Equities, and Foreign Exchange Products. They’re also known for soft skills such as Customer-service skills, Initiative, and Analytical skills.

We break down the percentage of Foreign Exchange Traders that have these skills listed on their resume here:

- Manage Risk, 35%

Employed complex scenario analysis and forecasting models to predict the future results and to manage risk.

- Equities, 17%

Communicated with brokers to ensure accurate allocations for futures, foreign exchange, and equities between separately managed accounts.

- Foreign Exchange Products, 12%

Marketed the bank's foreign exchange products to generate new business and enhance existing customer relationships.

- Foreign Currency Transactions, 8%

Provided ongoing training to the Asia Pacific region and manufacturing operations regarding the financial effects of foreign currency transactions.

- Technical Analysis, 3%

Managed market risk in European currencies using technical analysis and sophisticated charting software.

- Fundamental Analysis, 2%

Performed fundamental analysis of global capital markets to forecast exchange rates and advise corporate clients on hedging strategies.

"manage risk," "equities," and "foreign exchange products" are among the most common skills that foreign exchange traders use at work. You can find even more foreign exchange trader responsibilities below, including:

Customer-service skills. To carry out their duties, the most important skill for a foreign exchange trader to have is customer-service skills. Their role and responsibilities require that "securities, commodities, and financial services sales agents must be persuasive and make clients feel comfortable with the agent’s recommendations." Foreign exchange traders often use customer-service skills in their day-to-day job, as shown by this real resume: "structured fx forwards and swaps with counterparties (banks and customers) which accounted for 40% of treasury income. "

Initiative. Another soft skill that's essential for fulfilling foreign exchange trader duties is initiative. The role rewards competence in this skill because "securities, commodities, and financial services sales agents must create their own client base by making “cold” sales calls to people to whom they have not been referred and to people not expecting the call." According to a foreign exchange trader resume, here's how foreign exchange traders can utilize initiative in their job responsibilities: "structured products liaison in cross-selling initiative with the ms derivatives department. "

Analytical skills. Another skill that relates to the job responsibilities of foreign exchange traders is analytical skills. This skill is critical to many everyday foreign exchange trader duties, as "to judge the profitability of potential deals, securities, commodities, and financial services sales agents must have strong analytical skills." This example from a resume shows how this skill is used: "complete spot transactions through an on-line trading platform using fundamental and technical analysis. "

Detail oriented. For certain foreign exchange trader responsibilities to be completed, the job requires competence in "detail oriented." The day-to-day duties of a foreign exchange trader rely on this skill, as "investment bankers must pay close attention to the details of initial public offerings and mergers and acquisitions because small changes can have large consequences." For example, this snippet was taken directly from a resume about how this skill applies to what foreign exchange traders do: "authored a daily morning update provided to institutional clients only that detailed the overnight's trading activity. "

Math skills. A commonly-found skill in foreign exchange trader job descriptions, "math skills" is essential to what foreign exchange traders do. Foreign exchange trader responsibilities rely on this skill because "securities, commodities, and financial services sales agents need to be familiar with mathematical tools, including investment formulas." You can also see how foreign exchange trader duties rely on math skills in this resume example: "completed analysis of financial trends and international markets for forex trading (qualitative and quantitative). "

The three companies that hire the most foreign exchange traders are:

- Commerce Bank1 foreign exchange traders jobs

- Wellington Group1 foreign exchange traders jobs

- Wellington Management1 foreign exchange traders jobs

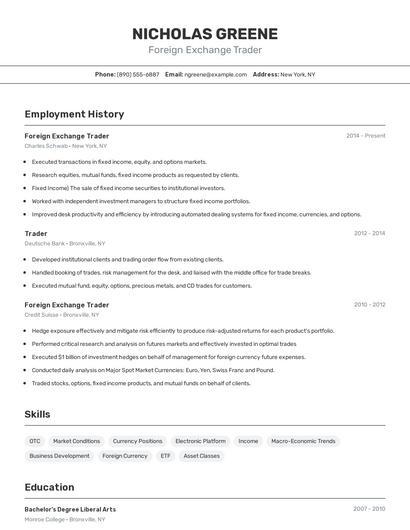

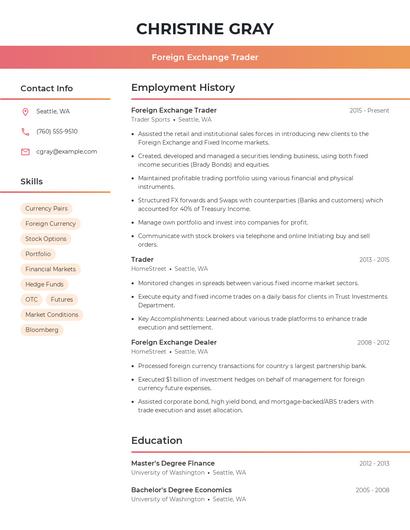

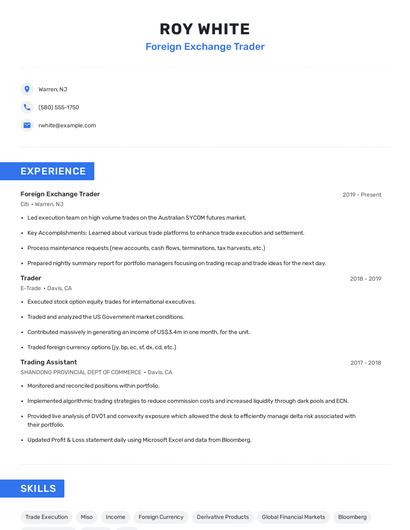

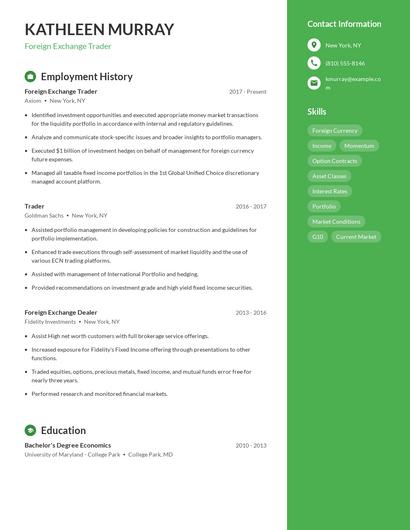

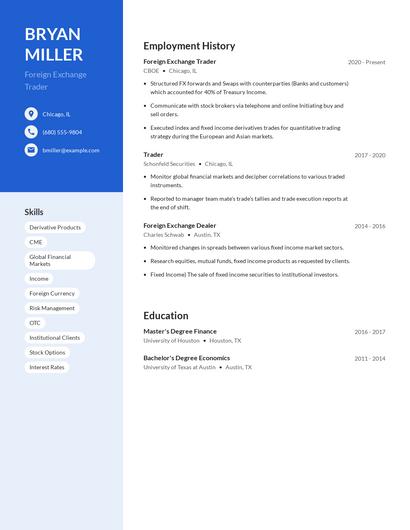

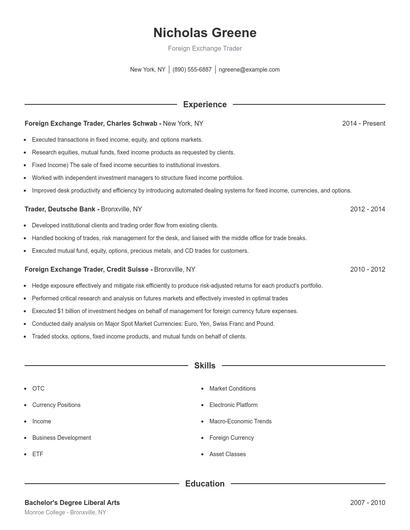

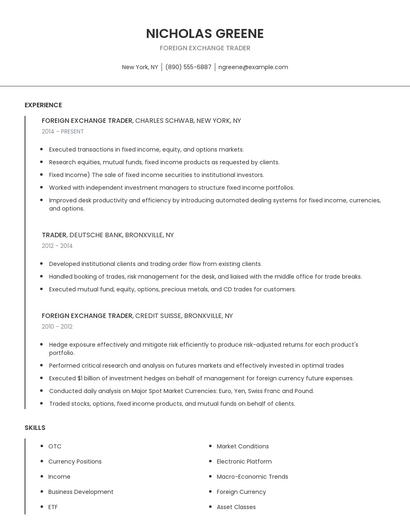

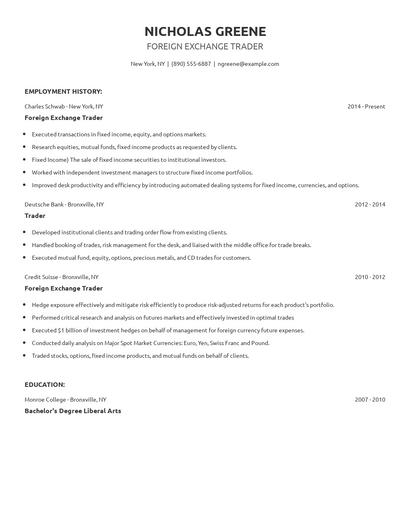

Choose from 10+ customizable foreign exchange trader resume templates

Build a professional foreign exchange trader resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your foreign exchange trader resume.Compare different foreign exchange traders

Foreign exchange trader vs. Commodity broker

A trader is responsible for buying and selling financial instruments for a firm or an individual, monitoring stock movements, and analyzing price fluctuations. Traders focus on short-term and long-term trades, depending on their customers' demands and best interests. In some cases, traders also act as financial advisors to their clients, providing financial management support, and handling their account investments. A trader must have excellent knowledge of the financial industry and must be highly-analytical, dealing with consistent changes in the stock market and maintain smart decisions to achieve their clients' financial goals.

While similarities exist, there are also some differences between foreign exchange traders and commodity broker. For instance, foreign exchange trader responsibilities require skills such as "manage risk," "foreign exchange products," "foreign currency transactions," and "swaps." Whereas a commodity broker is skilled in "commodities," "risk management," "client accounts," and "nfa." This is part of what separates the two careers.

Commodity brokers tend to make the most money working in the finance industry, where they earn an average salary of $89,520. In contrast, foreign exchange traders make the biggest average salary, $118,788, in the finance industry.commodity brokers tend to reach lower levels of education than foreign exchange traders. In fact, commodity brokers are 6.3% less likely to graduate with a Master's Degree and 0.3% more likely to have a Doctoral Degree.Foreign exchange trader vs. Municipal bond trader

An equity trader is responsible for conducting research and data analysis and monitoring the stock movement to identify the best time to buy and sell financial equities and other financial instruments. Equity traders evaluate the market conditions of equity owners by looking at charts and financial statements to ensure that they are meeting the clients' long-term goals and objectives. They recommend investment decisions by analyzing clients' requirements, as well as their risk limits and options for their best interests.

In addition to the difference in salary, there are some other key differences worth noting. For example, foreign exchange trader responsibilities are more likely to require skills like "manage risk," "equities," "foreign exchange products," and "foreign currency transactions." Meanwhile, a municipal bond trader has duties that require skills in areas such as "fixed income," "bonds," "institutional sales," and "securities." These differences highlight just how different the day-to-day in each role looks.

Average education levels between the two professions vary. Municipal bond traders tend to reach lower levels of education than foreign exchange traders. In fact, they're 6.7% less likely to graduate with a Master's Degree and 0.3% more likely to earn a Doctoral Degree.Foreign exchange trader vs. Trader

Some important key differences between the two careers include a few of the skills necessary to fulfill the responsibilities of each. Some examples from foreign exchange trader resumes include skills like "foreign exchange products," "foreign currency transactions," "swaps," and "foreign exchange market," whereas a trader is more likely to list skills in "portfolio," "financial markets," "fixed income," and "securities. "

Traders earn the best pay in the finance industry, where they command an average salary of $108,107. Foreign exchange traders earn the highest pay from the finance industry, with an average salary of $118,788.traders typically earn similar educational levels compared to foreign exchange traders. Specifically, they're 2.7% less likely to graduate with a Master's Degree, and 0.2% less likely to earn a Doctoral Degree.Foreign exchange trader vs. Equity trader

Even though a few skill sets overlap between foreign exchange traders and equity traders, there are some differences that are important to note. For one, a foreign exchange trader might have more use for skills like "manage risk," "foreign exchange products," "foreign currency transactions," and "swaps." Meanwhile, some responsibilities of equity traders require skills like "portfolio," "financial markets," "risk management," and "securities. "

In general, equity traders earn the most working in the finance industry, with an average salary of $111,329. The highest-paying industry for a foreign exchange trader is the finance industry.In general, equity traders hold similar degree levels compared to foreign exchange traders. Equity traders are 4.2% less likely to earn their Master's Degree and 0.0% less likely to graduate with a Doctoral Degree.Types of foreign exchange trader

Updated January 8, 2025