Automatically apply for jobs with Zippia

Upload your resume to get started.

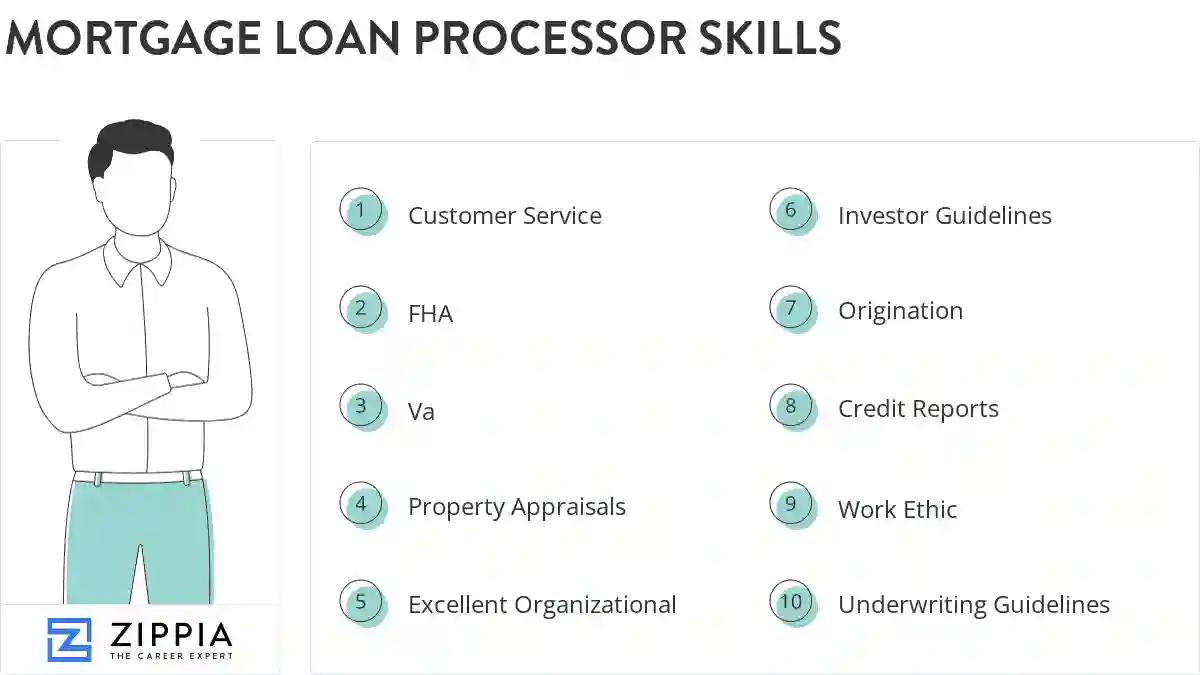

Mortgage loan processor skills for your resume and career

15 mortgage loan processor skills for your resume and career

1. Customer Service

Customer service is the process of offering assistance to all the current and potential customers -- answering questions, fixing problems, and providing excellent service. The main goal of customer service is to build a strong relationship with the customers so that they keep coming back for more business.

- Provided superb customer service with integrity, serving as liaison between borrowers and underwriters; consistently received top-scored customer feedback surveys.

- Provided regular and consistent communication with both the customers and sales team to ensure seamless processing while delivering excellent customer service.

2. FHA

The Federal Housing Administration (FHA) stands for a government agency in the United States that offers housing insurance to FHA-approved lenders who follow certain conditions.

- Coached and developed loan originators daily on specific Federal Housing Authority programs, per FHA guaranteed guidelines.

- Advanced knowledge and experience processing FHA, VA, Construction, USDA, Conventional, Refinance, Employee and Purchase loans.

3. Va

Virtual assistants are the professionals who provide assistance for businesses virtually from remote areas. These individuals are hired by online businesses to perform management and administrative tasks of the company such as marketing, bookkeeping, and many other services. with virtual assistants, businesses can exist and work virtually without any need for a physical office.

- Processed routine to moderately complex conventional or VA mortgage loans according to product guidelines through validation of credit and collateral documentation.

- Worked closely with Underwriters of FNMA, Port, Private, FHA, and the VA to process residential loan applications.

4. Property Appraisals

- Review residential real estate property appraisals according to standard guidelines and ensure integrity of source data being communicated to underwriting system.

- Ordered and analyzed credit reports and property appraisals and reviewed income and asset documentation for loan qualification purposes.

5. Excellent Organizational

- Offered excellent organizational and communication skills, working diligently to ensure document accuracy and completion.

- Managed multiple loans simultaneously, requiring excellent organizational and multitasking skills.

6. Investor Guidelines

An investor guideline refers to general standards, strategies, and parameters relating to investments; the set guidelines get altered from time-to-time.

- Verified loan packages to be complete with checklist and accompanying disclosures, documented needs list for anticipated or confirmed program/investor guidelines.

- Maintained accountability for reviewing all documentation prior to submitting loan to Underwriting for review to ensure adherence to investor guidelines.

Choose from 10+ customizable mortgage loan processor resume templates

Build a professional mortgage loan processor resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your mortgage loan processor resume.7. Origination

- Evaluate and process data in automated origination system and other tracking databases to ensure consistency with documentation provided in loan files.

- Worked closely with mortgage loan officers and loan origination sources to gather and prepare all documents needed to satisfy underwriting requirements.

8. Credit Reports

Credit reports are statements that carry information about your credit affairs and current credit situation like loan payment history and credit accounts status. A credit report acts as history because it contains the record from the day you opened the account till your account balance. Potential lenders and creditors make use of credit reports and decide whether to offer you credit or not and under what conditions.

- Retrieved and reviewed credit reports of pending applications for distribution and prepared file for assembly of current and future information.

- Verified and compiled application information including credit reports, missing documents, employment histories, and property information.

9. Work Ethic

- Displayed dedication and work ethic by offering to work extra shifts during busy periods.

- Received recognition from President for dedicated work ethic and commitment to the company.

10. Underwriting Guidelines

Underwriting guidelines are a set of rules and requirements an insurer provides to its agents and underwriters. The underwriter then uses these instructions to judge the prospective insured, whether to accept, modify or reject it. These guidelines help the insurers set the criteria for the customer and let them know the amount of money that should be offered to the client, or whether not to offer an insurance policy in the first place.

- Review, analyze and make final determination on loan submissions using manual underwriting guidelines as well as validating Automate Underwriting recommendations.

- Executed quality control and detailed document analysis on every file to ensure government and lender underwriting guidelines were met.

11. Automated Underwriting

- Validate documentation requirements based on automated underwriting recommendation.

- Reviewed received CR applications for accuracy and submitted for decision via Automated Underwriting or Manual Underwriting depending on selected loan product.

12. USDA

- Underwrite and approve, deny or counter offer on all Conventional, Bond, USDA, VA and FHA Loans.

- Processed conventional, FHA, USDA, and several bond programs such as my community, NHF, and !

13. Loan Approval

- Processed mortgage loan applications and ensured the accuracy of all consumer loan documentation necessary for loan approval and closing.

- Collected and analyzed applicants income, asset & credit documentation and information to determine credit worthiness and loan approvals.

14. Underwriting Approval

- Worked closely with borrowers in an effort to obtain necessary documentation to satisfy underwriting conditions in preparation for underwriting approval/closing.

- Reviewed client information for accuracy and completeness prior to submission to underwriting to reduce delays in underwriting approvals.

15. Tax Returns

- Experienced in reviewing complex financial documents such as personal and/or business tax returns and financial statements.

- Reviewed file accuracy and performed financial analysis utilizing tax returns and financial statements.

5 Mortgage Loan Processor resume examples

Build a professional mortgage loan processor resume in minutes. Browse through our resume examples to identify the best way to word your resume. Then choose from 5+ resume templates to create your mortgage loan processor resume.

What skills help Mortgage Loan Processors find jobs?

Tell us what job you are looking for, we’ll show you what skills employers want.

List of mortgage loan processor skills to add to your resume

The most important skills for a mortgage loan processor resume and required skills for a mortgage loan processor to have include:

- Customer Service

- FHA

- Va

- Property Appraisals

- Excellent Organizational

- Investor Guidelines

- Origination

- Credit Reports

- Work Ethic

- Underwriting Guidelines

- Automated Underwriting

- USDA

- Loan Approval

- Underwriting Approval

- Tax Returns

- FNMA

- Process Loans

- Title Commitments

- RESPA

- Bank Secrecy Act

- Loan Programs

- Federal Regulations

- Fannie MAE

- Loan Packages

- Loan Closings

- Party Vendors

- FHLMC

- Mortgage Loan Applications

- Application Data

- Loan Products

- Flood Certifications

- Bank Statements

- Tax Transcripts

- Financial Statements

- AUS

- DU

- Freddie Mac

- Conventional Loans

- HMDA

- HUD-1

- Anti-Money Laundering

- Title Reports

- Borrower Assets

- Performance Standards

- VOE

- Calyx

- Calyx Point

- Jumbo

- Loan Originators

Updated January 8, 2025