Automatically apply for jobs with Zippia

Upload your resume to get started.

Mortgage originator skills for your resume and career

15 mortgage originator skills for your resume and career

1. Customer Service

Customer service is the process of offering assistance to all the current and potential customers -- answering questions, fixing problems, and providing excellent service. The main goal of customer service is to build a strong relationship with the customers so that they keep coming back for more business.

- Developed and expanded a Client and Business Partner database independently by utilizing strategic marketing and top level customer service.

- Developed clients through community involvement and maintained high level of customer service to ensure referrals and repeat business.

2. Origination

- Promoted sales and origination of family residential properties within predetermined guidelines and rates.

- Check alternative documentation for accuracy before registering loans on origination system.

3. Bank Products

Those products which a bank offers to its customers are called bank products. There a variety of services that a bank offers to attract customers. Some of the banking products/ services are: giving loans, overdrafts, check payments, exchange of foreign currency, consultancy services credit, debit and ATM cards, home and online banking.

- Market and cultivate new mortgage business and cross sell bank products.

- Cross sold all bank products to new and existing customers.

4. Loan Applications

A loan application is a form of request presented by a person to a financial institution for the approval of a loan. This application form carries detailed information regarding the petitioner's identification information, financial competence, and sources of income that indicate whether he can return the loan back or not.

- Reviewed and analyzed consumer financial information, verified information, did risk assessment and determined consumers' creditworthiness for loan application.

- Developed relationships with key real estate developers, bank officers and branch representatives substantially impacting loan application volume.

5. Loan Programs

- Evaluated alternative loan programs and financing options while educating and advising clients on financing solutions.

- Assessed credit worthiness of challenged applications and placed into appropriate loan programs.

6. FHA

The Federal Housing Administration (FHA) stands for a government agency in the United States that offers housing insurance to FHA-approved lenders who follow certain conditions.

- Licensed to originate FHA, VA, USDA, MASS Housing, Rural Housing, Commercial and Conventional Mortgages.

- Originate and process documentation for refinance of California and Texas HARP, Full Doc, and FHA loans.

Choose from 10+ customizable mortgage originator resume templates

Build a professional mortgage originator resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your mortgage originator resume.7. Mortgage Products

- Marketed mortgage products by establishing relationships with brokers, real estate agencies, builders and the business community.

- Count with strong knowledge of lending market conditions, mortgage products/programs, Real Estate laws and underwriting guidelines.

8. Business Development

Business development is the ideas or initiatives that work to make business work better. Selling, advertising, product development, supply chain management, and vendor management are only a few of the divisions involved with it. There is still a lot of networking, negotiating, forming alliances, and trying to save money. The goals set for business development guide and coordinate with all of these various operations and sectors.

- Focus on marketing activities and promotional strategies to attract new purchase business and participate in business development.

- Performed and created additional business development activities to successfully increase sales and leads.

9. Mortgage Programs

- Tailor mortgage programs and loan options to fit each customer's specific goals and needs when buying or refinancing a home.

- Interviewed first mortgage applicants to determine member needs; confidently articulated appropriate Credit Union ONE mortgage programs.

10. NMLS

- Obtained unique identifier with the NMLS.

- Originated purchases and refinances throughout United States Licensed Nationally through NMLS

11. Underwriting Guidelines

Underwriting guidelines are a set of rules and requirements an insurer provides to its agents and underwriters. The underwriter then uses these instructions to judge the prospective insured, whether to accept, modify or reject it. These guidelines help the insurers set the criteria for the customer and let them know the amount of money that should be offered to the client, or whether not to offer an insurance policy in the first place.

- Originated residential mortgages for home purchase or refinance based on the bank's underwriting guidelines and pricing.

- Originated mortgage loans to meet Freddie Mac underwriting guidelines.

12. Cross-Selling

- Employed cross-selling methods to ensure clients were maximizing the use of various Chase products.

- Increased revenues and product awareness by cross-selling service lines and packages.

13. Mortgage Business

- Acquired construction mortgage business utilizing unique knowledge in Renovation and Construction Lending.

- Managed the mortgage business of a real estate office which generated over 100 million in dollar volume annually.

14. Credit Data

- Originated loans, conducted interviews with prospective borrowers, analyzed financial and credit data to determine feasibility of granting loans.

- Conduct telephone interviews with current Countrywide Home Loan customers to analyze financial and credit data and determine customer financing objectives.

15. Loan Origination

- Worked closely with Bank leadership to increase profitability on loan originations.

- Produced on average over $350,000 in loan originations on a monthly basis

5 Mortgage Originator resume examples

Build a professional mortgage originator resume in minutes. Browse through our resume examples to identify the best way to word your resume. Then choose from 5+ resume templates to create your mortgage originator resume.

What skills help Mortgage Originators find jobs?

Tell us what job you are looking for, we’ll show you what skills employers want.

List of mortgage originator skills to add to your resume

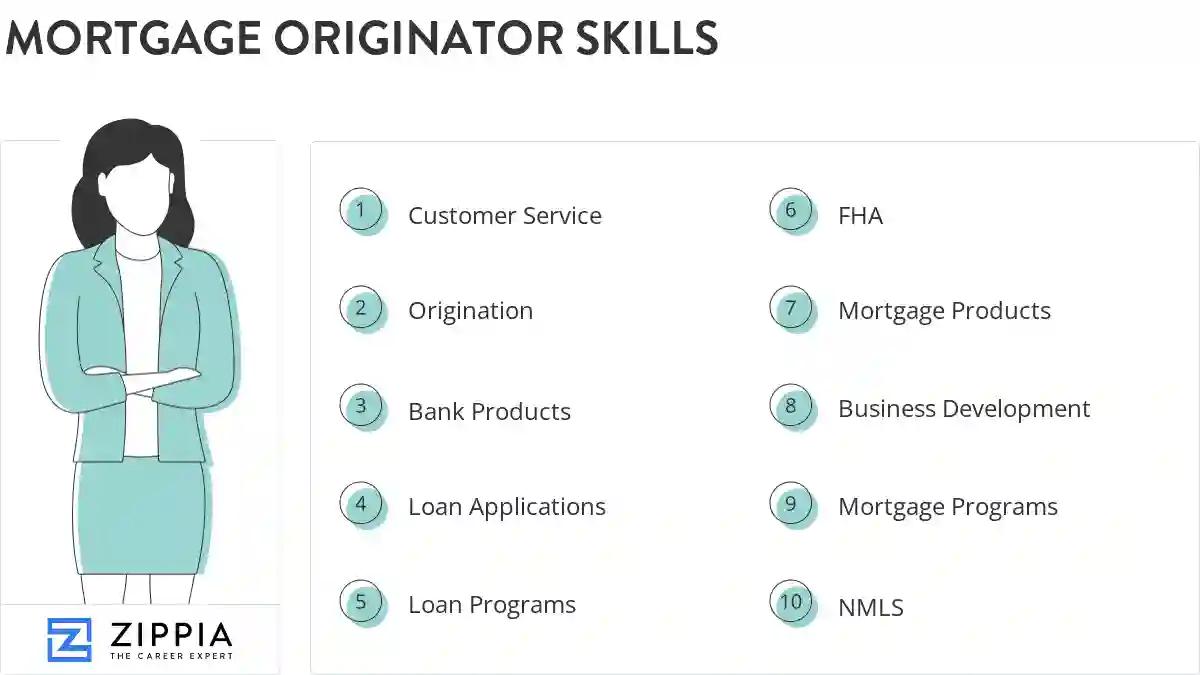

The most important skills for a mortgage originator resume and required skills for a mortgage originator to have include:

- Customer Service

- Origination

- Bank Products

- Loan Applications

- Loan Programs

- FHA

- Mortgage Products

- Business Development

- Mortgage Programs

- NMLS

- Underwriting Guidelines

- Cross-Selling

- Mortgage Business

- Credit Data

- Loan Origination

- Flyers

- Loan Process

- Credit Reports

- Mortgage Origination

- Strong Customer Service

- Loan Products

- Real Estate Professionals

- Mortgage Applications

- Residential Mortgage Loans

- USDA

- Mortgage Process

- FNMA

- Financial Services

- Business Relationships

- Fannie MAE

- Credit Analysis

- Loan Closings

- Reverse Mortgages

- Freddie Mac

- Referral Relationships

- Cold Calls

- Tax Returns

- Loan Packages

- Property Evaluations

- HUD

- Loan Volume

- Construction Loans

- Corporate Financial Statements

- Sales Presentations

- Automated Underwriting

- Commercial Loans

- Conventional Loans

- Bank Branches

- Bank Statements

Updated January 8, 2025