What does an options trader do?

Options traders are financial experts who work for large investment banks or private hedge fund companies to buy and sell stock options as well as manage complex capital investments for clients. These traders are required to create options contracts and develop forecasting models so that they can determine the optimal price to buy an option to maximize profit and minimize risk. They must assist head traders with client services to allow more trading revenue production. Options traders must also employ risk management strategies to minimize portfolio risk and increase their volume in trading.

Options trader responsibilities

Here are examples of responsibilities from real options trader resumes:

- Enact, and manage equity block desk operation and set up floor broker network on NYSE.

- Create VBA applications to automate basic trading functions and administration functions such as reorganization tenders and trade pricing issues.

- Manage business, sales, marketing, international negotiation and communication for a commodities business.

- Trade options profitably on screen markets and trade complex option spreads via telephone brokers at the CBOE and CME.

- Experience in communicating and executing derivative arbitrage opportunities, as well as communicating and executing trades fitting against an option position.

- Research the SPX, DOW, and NASDAQ.

- Promote to trade U.S. treasury futures and grain spreads.

- Trade coffee, cocoa and Euro FX futures and options for own account.

- Trade hundreds of NYSE list stocks, learned tape reading and analyze each stock's movement.

- Collaborate with technology team to improve software used to send orders and markets to ISE exchange.

- Import historical data from Bloomberg into proprietary database, forecast price levels, present recommendation to team.

- Make markets for all brokers in the pit, and on the screen using Bloomberg and squawk boxes.

- Prepare pricing models and analyze the risk of the ETF business on a daily basis and for each individual trade.

- Implement trading strategies that are used to execute trades base on commodity futures, FOREX, equities, options and bonds.

- Execute domestic/global equities securities for multiple product lines with minimal market impact.

Options trader skills and personality traits

We calculated that 32% of Options Traders are proficient in FX, Stock Options, and Equities. They’re also known for soft skills such as Analytical skills, Customer-service skills, and Detail oriented.

We break down the percentage of Options Traders that have these skills listed on their resume here:

- FX, 32%

Established Consolidated in FX Pit with a team of two; Highest grossing FX Options trading team at Consolidated.

- Stock Options, 17%

Executed stock option equity trades for international executives.

- Equities, 11%

Executed domestic/global equities securities for multiple product lines with minimal market impact.

- Stock Market, 5%

Analyzed the stock market with a focus on implementing stock option positions for profit based on projected market changes.

- Risk Management Strategies, 3%

Advised upstream and downstream clients on hedging and risk management strategies in soft commodity space.

- Equity Options, 3%

Traded equity options for this proprietary derivatives trading firm.

"fx," "stock options," and "equities" are among the most common skills that options traders use at work. You can find even more options trader responsibilities below, including:

Analytical skills. To carry out their duties, the most important skill for an options trader to have is analytical skills. Their role and responsibilities require that "to judge the profitability of potential deals, securities, commodities, and financial services sales agents must have strong analytical skills." Options traders often use analytical skills in their day-to-day job, as shown by this real resume: "implemented knowledge of options trading and options strategies while using analytical, problem solving, and mathematical skills to execute. "

Customer-service skills. Another essential skill to perform options trader duties is customer-service skills. Options traders responsibilities require that "securities, commodities, and financial services sales agents must be persuasive and make clients feel comfortable with the agent’s recommendations." Options traders also use customer-service skills in their role according to a real resume snippet: "devised long/short etf trade strategies for customers and helped portfolio managers implement these ideas. "

Detail oriented. Another skill that relates to the job responsibilities of options traders is detail oriented. This skill is critical to many everyday options trader duties, as "investment bankers must pay close attention to the details of initial public offerings and mergers and acquisitions because small changes can have large consequences." This example from a resume shows how this skill is used: "performed detailed analysis, market/economic indicator research and evaluation on technical numbers and historical data. "

Initiative. A big part of what options traders do relies on "initiative." You can see how essential it is to options trader responsibilities because "securities, commodities, and financial services sales agents must create their own client base by making “cold” sales calls to people to whom they have not been referred and to people not expecting the call." Here's an example of how this skill is used from a resume that represents typical options trader tasks: "lead trader in both executing arbitrage opportunities and compliance review cleanup initiatives. "

Math skills. Another crucial skill for an options trader to carry out their responsibilities is "math skills." A big part of what options traders relies on this skill, since "securities, commodities, and financial services sales agents need to be familiar with mathematical tools, including investment formulas." How this skill relates to options trader duties can be seen in an example from an options trader resume snippet: "work with another trader on developing quantitative volatility arbitrage strategies. "

The three companies that hire the most options traders are:

- DTE Energy2 options traders jobs

- Belvedere Trading2 options traders jobs

- Intercontinental Exchange1 options traders jobs

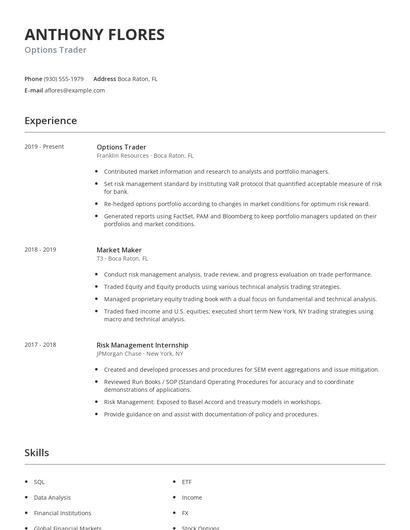

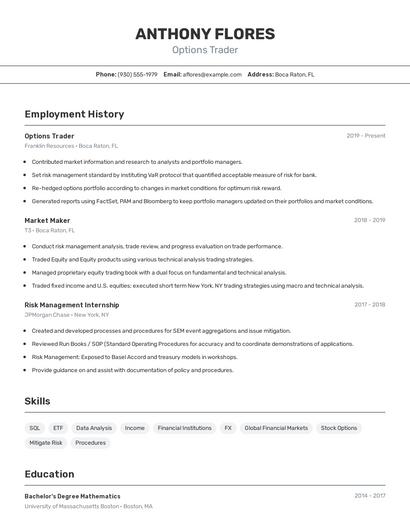

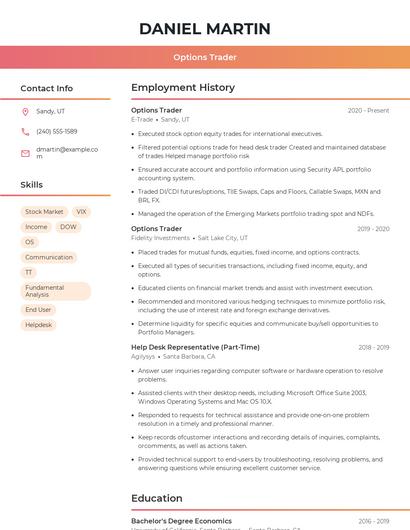

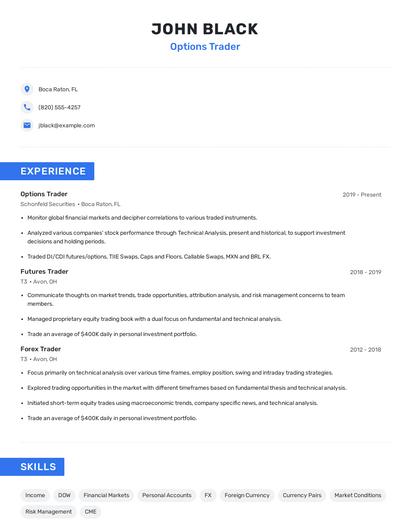

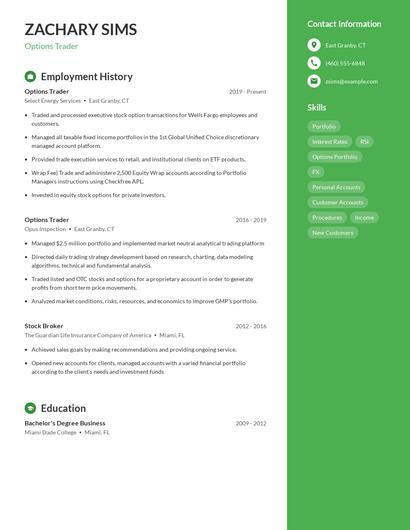

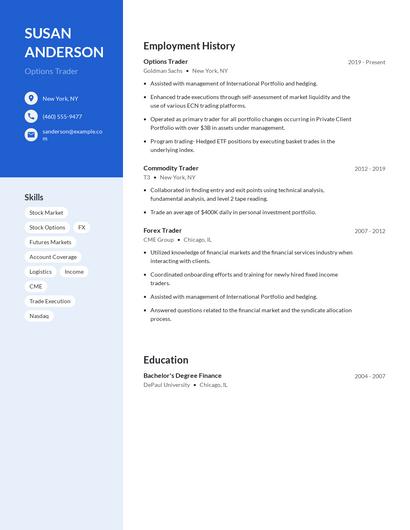

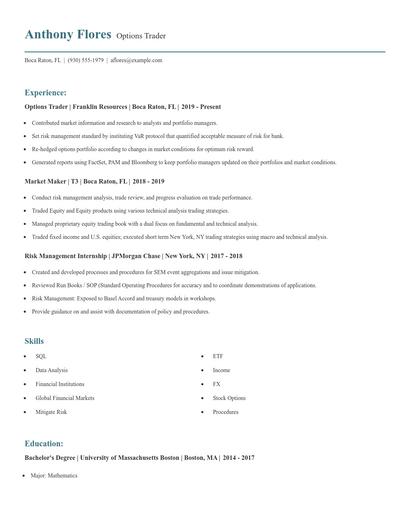

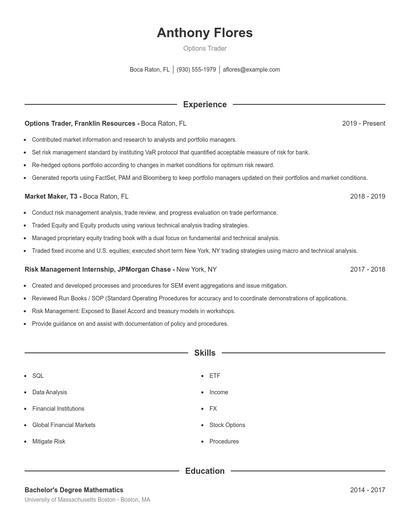

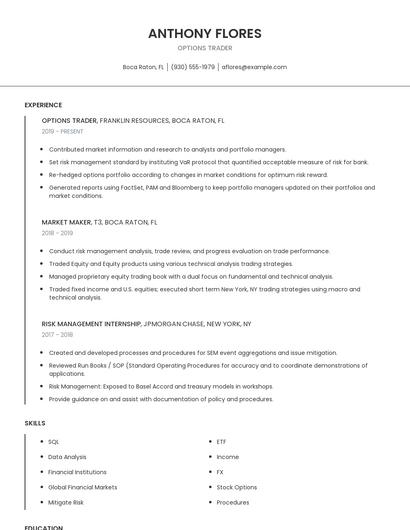

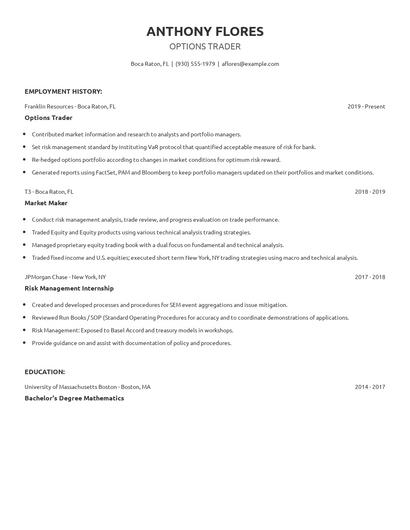

Choose from 10+ customizable options trader resume templates

Build a professional options trader resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your options trader resume.Compare different options traders

Options trader vs. Commodity broker

The foreign exchange market is volatile and influenced by numerous factors. A foreign exchange trader considers these factors and utilizes them in their favor. They typically take care to predict misvaluations of currencies accurately. They act on the conclusions reached from their analysis and either buy or sell assets in different markets. This position requires diligence and patience.

These skill sets are where the common ground ends though. The responsibilities of an options trader are more likely to require skills like "fx," "training programs," "stock options," and "stock market." On the other hand, a job as a commodity broker requires skills like "commodities," "market analysis," "risk management," and "client accounts." As you can see, what employees do in each career varies considerably.

Commodity brokers really shine in the finance industry with an average salary of $89,520. Comparatively, options traders tend to make the most money in the finance industry with an average salary of $118,188.commodity brokers tend to reach similar levels of education than options traders. In fact, commodity brokers are 3.0% less likely to graduate with a Master's Degree and 0.1% more likely to have a Doctoral Degree.Options trader vs. Foreign exchange trader

A Hedge Fund Trader specializes in developing investment strategies through market research and analysis. Although the extent of their duties depends on their company of employment, it typically includes managing and monitoring market portfolios, trading according to policies and regulations, reaching out to potential business partners through calls and correspondence, discussing terms, and keeping an eye on stock prices. A Hedge Fund Trader must maintain an active communication line with staff for an efficient and fruitful workflow.

In addition to the difference in salary, there are some other key differences worth noting. For example, options trader responsibilities are more likely to require skills like "fx," "training programs," "stock options," and "stock market." Meanwhile, a foreign exchange trader has duties that require skills in areas such as "manage risk," "foreign exchange products," "foreign currency transactions," and "swaps." These differences highlight just how different the day-to-day in each role looks.

Foreign exchange traders may earn a higher salary than options traders, but foreign exchange traders earn the most pay in the finance industry with an average salary of $118,788. On the other hand, options traders receive higher pay in the finance industry, where they earn an average salary of $118,188.In general, foreign exchange traders achieve similar levels of education than options traders. They're 3.3% more likely to obtain a Master's Degree while being 0.1% less likely to earn a Doctoral Degree.Options trader vs. Energy derivatives trader

Some important key differences between the two careers include a few of the skills necessary to fulfill the responsibilities of each. Some examples from options trader resumes include skills like "fx," "training programs," "stock options," and "stock market," whereas an energy derivatives trader is more likely to list skills in "futures contracts," "interest rates," "fixed income," and "foreign exchange. "

Energy derivatives traders make a very good living in the agriculture industry with an average annual salary of $116,251. On the other hand, options traders are paid the highest salary in the finance industry, with average annual pay of $118,188.When it comes to education, energy derivatives traders tend to earn higher degree levels compared to options traders. In fact, they're 7.6% more likely to earn a Master's Degree, and 0.4% more likely to graduate with a Doctoral Degree.Options trader vs. Hedge fund trader

Types of options trader

Updated January 8, 2025