What does a payment processor do?

A payment processor is responsible for managing and informing the clients of their payment obligations for the services offered by a financial institution or other related organizations. Payment processors record transactions and ensure the timely completion of account statements. They discuss the terms and conditions of the service contract with the clients and respond to their inquiries and concerns. A payment processor must have excellent communication and organizational skills, especially in coming up with repayment plans and solutions for clients who are not able to pay services in time.

Payment processor responsibilities

Here are examples of responsibilities from real payment processor resumes:

- Manage and review all incoming discounts and electronic contractual adjustments for accuracy per the negotiated Medicaid and Medicare contracts ;.

- Maintain daily transactions for customer payments and various bank accounts using Quickbooks to track transactions.

- Prepare and print all reports for EDI processing.

- Maintain client customer confidentiality and HIPAA regulations with all data handling and transfers.

- Uphold and reinforce compliance with hospital policies and federal regulations such as HIPAA.

- Investigate and take corrective action regarding invoices reject by system or through EDI.

- Edit the employee's handbook as well as created PowerPoint's for incoming managers.

- Perform billing and coding duties, utilizing knowledge of medical terminology, ICD-9, CPT coding.

- Research return checks, creditor refund checks, returned/reject EFT transactions to ensure funds credit properly.

- Prepare process documents and work instructions with extensive use of PowerPoint resulting in successful ISO audit.

- Interpret EOB's and insurance claims, include preparation processing, posting and reconciling to source documents.

- Investigate current Medicare, Medicaid, and state guidelines to determine coordination of benefits and provider billing errors.

- Cross train as back up processing ACH's, stop payments, debit card holds and customer address changes.

- Determine whether a deductible refund are due the insured and issue payments via live check or EFT deposit accordingly.

- Process credit card and ACH payments; email/fax credit card payment to clients; compile and mail checks to clients.

Payment processor skills and personality traits

We calculated that 15% of Payment Processors are proficient in Customer Service, Patients, and Data Entry. They’re also known for soft skills such as Computer skills, Detail oriented, and Integrity.

We break down the percentage of Payment Processors that have these skills listed on their resume here:

- Customer Service, 15%

Worked jointly with customer service representatives and account managers to ensure proper and expedient processing of invoices for international carriers.

- Patients, 10%

Reviewed Explanation of Benefits from insurance companies to determine patients' payment responsibility or to understand denial reasons.

- Data Entry, 10%

Processed mortgage payments* Balanced transactions daily* Endorsed and encoded customer checks* Data entry, very fast and accurate

- ACH, 8%

Managed Electronic banking services to include personal and business internet banking, electronic statement, ACH, and Visa Check card.

- Phone Calls, 5%

Sent/Received e-mails and forwarded/answered phone calls to ensure customer satisfaction.

- Credit Card Payments, 4%

Assisted with the A/P department on daily reconciliation of deposits, EFT's and credit card payments within different provider locations.

"customer service," "patients," and "data entry" are among the most common skills that payment processors use at work. You can find even more payment processor responsibilities below, including:

Computer skills. The most essential soft skill for a payment processor to carry out their responsibilities is computer skills. This skill is important for the role because "bookkeeping, accounting, and auditing clerks need to be comfortable using computer spreadsheets and bookkeeping software." Additionally, a payment processor resume shows how their duties depend on computer skills: "review eob's for payments and adjustments; enter them by utilizing the company computer system. "

Detail oriented. Another essential skill to perform payment processor duties is detail oriented. Payment processors responsibilities require that "bookkeeping, accounting, and auditing clerks are responsible for producing accurate financial records." Payment processors also use detail oriented in their role according to a real resume snippet: "utilized data entry skills to maintain detailed account information and notes. "

Integrity. payment processors are also known for integrity, which are critical to their duties. You can see how this skill relates to payment processor responsibilities, because "bookkeeping, accounting, and auditing clerks have control of an organization’s financial documentation, which they must use properly and keep confidential." A payment processor resume example shows how integrity is used in the workplace: "ranked second in department, demonstrating the ability to process payments quickly while maintaining integrity and providing superior customer service. "

Math skills. payment processor responsibilities often require "math skills." The duties that rely on this skill are shown by the fact that "bookkeeping, accounting, and auditing clerks deal with numbers daily and should be comfortable with basic arithmetic." This resume example shows what payment processors do with math skills on a typical day: "generate cash application spreadsheets, reports, and statistics that significantly improved the ability to apply funding to the correct customer accounts"

The three companies that hire the most payment processors are:

- Navient14 payment processors jobs

- Fifth Third Bank8 payment processors jobs

- Lincoln Financial Group7 payment processors jobs

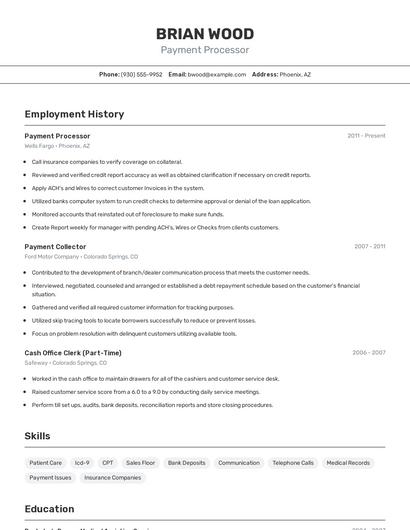

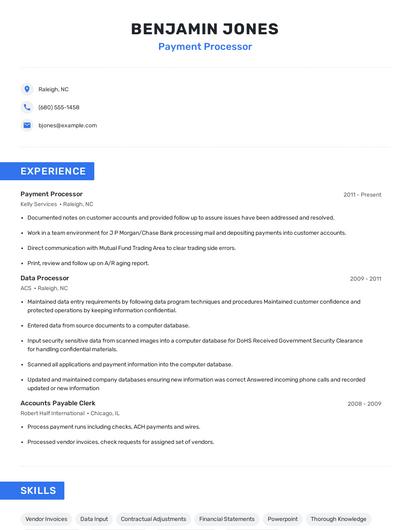

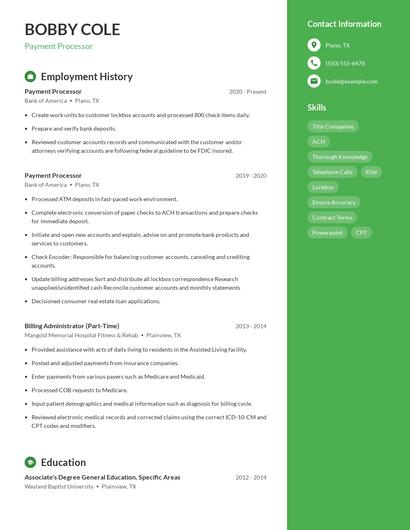

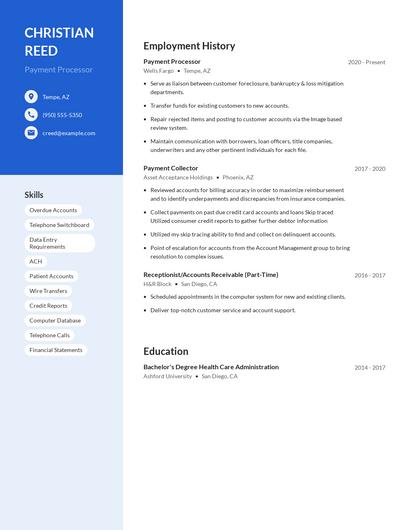

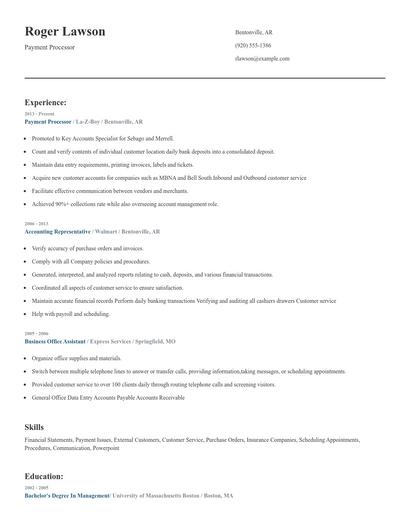

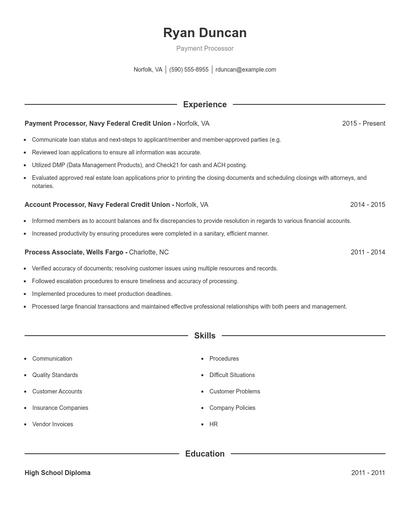

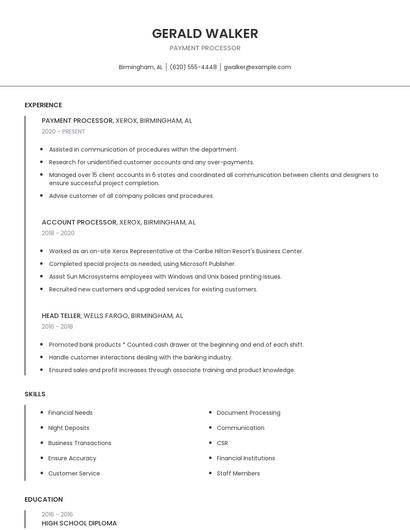

Choose from 10+ customizable payment processor resume templates

Build a professional payment processor resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your payment processor resume.Compare different payment processors

Payment processor vs. Billing specialist

Billing specialists are accounting or finance employees who are responsible for sending out billing invoices to clients. They calculate charges that their clients have incurred. They then write bills, ensure that all details are correct, and send these out to clients. They also manage payment due dates and ensure that clients are duly reminded of such deadlines. Billing specialists also manage client accounts and ensure that they are paying on time. They help identify clients who have outstanding payables and send out collection notices to them. At times, billing specialists also manage the receipt of payments to manage account records better.

While similarities exist, there are also some differences between payment processors and billing specialist. For instance, payment processor responsibilities require skills such as "ach," "phone calls," "credit card payments," and "lockbox." Whereas a billing specialist is skilled in "medical billing," "submit claims," "medical terminology," and "medical claims." This is part of what separates the two careers.

Billing specialists tend to make the most money working in the manufacturing industry, where they earn an average salary of $37,417. In contrast, payment processors make the biggest average salary, $38,534, in the insurance industry.On average, billing specialists reach similar levels of education than payment processors. Billing specialists are 0.6% less likely to earn a Master's Degree and 0.1% more likely to graduate with a Doctoral Degree.Payment processor vs. Cash application specialist

Cash Application Specialists handle a variety of tasks related to company finances. They manage the organization of the company's financial records and oversee the overall cash inflow. They may also be assigned to handle payment collection, preparation of invoices, and receipts' issuance. They manage their relationship with their counterparts in client organizations to ensure a harmonious work relationship. This will help them follow up payments, communicate better, and resolve any concerns. Cash application specialists are also in charge of updating client records and ensuring that clients' payments are accurate. They also process refunds and facilitate other financial transactions.

In addition to the difference in salary, there are some other key differences worth noting. For example, payment processor responsibilities are more likely to require skills like "phone calls," "lockbox," "securities," and "powerpoint." Meanwhile, a cash application specialist has duties that require skills in areas such as "reconciliations," "cash receipts," "cash handling," and "medicare." These differences highlight just how different the day-to-day in each role looks.

Cash application specialists may earn a higher salary than payment processors, but cash application specialists earn the most pay in the transportation industry with an average salary of $39,650. On the other hand, payment processors receive higher pay in the insurance industry, where they earn an average salary of $38,534.Average education levels between the two professions vary. Cash application specialists tend to reach similar levels of education than payment processors. In fact, they're 0.3% more likely to graduate with a Master's Degree and 0.1% more likely to earn a Doctoral Degree.Payment processor vs. Billing assistant

A billing assistant is primarily in charge of performing support tasks to maintain smooth billing operations in an establishment. Their responsibilities typically include preparing and processing invoices for clients, sending billing adjustments, printing and reviewing invoices and billings, receiving payments, and monitoring delinquent invoices, sending reminders as necessary. They may also close and balance payments, calculate discounts, and maintain records of all transactions. Moreover, a billing assistant must be alert and proactive for any errors and inconsistencies, dealing with them accordingly.

There are many key differences between these two careers, including some of the skills required to perform responsibilities within each role. For example, a payment processor is likely to be skilled in "customer service," "ach," "phone calls," and "credit card payments," while a typical billing assistant is skilled in "front desk," "insurance verification," "scheduling appointments," and "insurance billing."

Billing assistants make a very good living in the technology industry with an average annual salary of $36,753. On the other hand, payment processors are paid the highest salary in the insurance industry, with average annual pay of $38,534.billing assistants typically earn similar educational levels compared to payment processors. Specifically, they're 0.1% more likely to graduate with a Master's Degree, and 0.4% more likely to earn a Doctoral Degree.Payment processor vs. Accountable clerk

The duties of an accountable clerk vary in one's industry of employment. Typically, their responsibilities revolve around overseeing the financial aspects of a company, including revenue and budget. They mostly process payments and income, ensuring accuracy in every detail and transaction. An accountable clerk may also have clerical tasks such as producing progress reports, answering calls and correspondence, coordinating with various department personnel, and maintaining a database of information. Should there be any issues, it is essential to report to a manager right away.

Even though a few skill sets overlap between payment processors and accountable clerks, there are some differences that are important to note. For one, a payment processor might have more use for skills like "patients," "phone calls," "credit card payments," and "patient payments." Meanwhile, some responsibilities of accountable clerks require skills like "purchase orders," "process payroll," "office equipment," and "payment vouchers. "

Accountable clerks enjoy the best pay in the government industry, with an average salary of $40,489. For comparison, payment processors earn the highest salary in the insurance industry.In general, accountable clerks hold similar degree levels compared to payment processors. Accountable clerks are 0.5% more likely to earn their Master's Degree and 0.2% more likely to graduate with a Doctoral Degree.Types of payment processor

Updated January 8, 2025