What does a payroll manager do?

A payroll manager is responsible for monitoring the payment process of all employees. Payroll managers oversee payroll records, reviewing calculable taxes and other deductions, creating a comprehensive summary of payroll details, managing payroll discrepancies, and releasing payroll checks through the organization's payment method. They must also follow strict procedures on legal requirements and tax obligations. A payroll manager must have excellent analytical and communication skills, especially on responding to the employees' inquiries and concerns, as well as managing the performance of the payroll staff.

Payroll manager responsibilities

Here are examples of responsibilities from real payroll manager resumes:

- Manage accounting and finance operations including A/R, A/P and general accounting, etc.

- Manage annual W2 reconciliation and distribution.

- Manage expatriates compensation packages and taxation.

- Coordinate department conversion of manual payroll system to KRONOS automate time and attendance system.

- Save the company $5,500 by learning ADP and creating payroll accruals and profiles to accurately record employee PTO time profiles.

- Process payroll utilizing ADP payroll system

- Administer electronic timekeeping system using KRONOS.

- Oversee optimal utilization of ADP HRIS integrate HR/payroll/time/attendance system; establish and maintain feeds to synchronize payroll data with accounting software.

- Maintain and keep track of EEO log, I9's and post hire paperwork.

- Govern all year-end w-2 activities.

- Maintain all files for EEO compliance.

- Provide information to the CPA who creates the company's financial statements.

- Use of Lawson to review correct FTE and pay rule application for employee schedule.

- Prepare year-end financial information for CPA to use in completion of corporate tax return.

- Record, track, and review vacation, PTO taken/accruals, make necessary adjustments to final paycheck for terminate employees.

Payroll manager skills and personality traits

We calculated that 8% of Payroll Managers are proficient in Customer Service, Human Resources, and Payroll System. They’re also known for soft skills such as Communication skills, Math skills, and Organizational skills.

We break down the percentage of Payroll Managers that have these skills listed on their resume here:

- Customer Service, 8%

Managed inbound Customer Service inquiries in high-volume call center, answering questions and maintaining accurate records regarding Garnishment and Employment Verification.

- Human Resources, 5%

Provided oversight and management for all aspects of payroll processing while interfacing closely with Human Resources and assisting the Corporate Controller.

- Payroll System, 5%

Processed in-house weekly and bi-weekly payroll utilizing Optimum Solutions automated payroll system for time and attendance and payroll processing.

- Payroll Tax, 5%

Maintained all financial aspects of the business from Payroll and Accounts Payable/Receivable to payroll tax preparation/reporting and General Ledger maintenance.

- HRIS, 4%

Oversee optimal utilization of ADP HRIS integrated HR/payroll/time/attendance system; establish and maintain feeds to synchronize payroll data with accounting software.

- Reconciliations, 4%

Prepared General Ledger interface for Lawson Financial system and all General Ledger reconciliations in respects to payroll related accounts.

"customer service," "human resources," and "payroll system" are among the most common skills that payroll managers use at work. You can find even more payroll manager responsibilities below, including:

Communication skills. To carry out their duties, the most important skill for a payroll manager to have is communication skills. Their role and responsibilities require that "financial clerks should be able to explain policies and procedures to colleagues and customers." Payroll managers often use communication skills in their day-to-day job, as shown by this real resume: "managed staff of 5 associates via adp enterprise payroll system by remote communication. "

Math skills. Another soft skill that's essential for fulfilling payroll manager duties is math skills. The role rewards competence in this skill because "the job duties of financial clerks includes calculating charges and updating financial records." According to a payroll manager resume, here's how payroll managers can utilize math skills in their job responsibilities: "manage job costing, bank reconciliations, labor statistics reporting and credit/fuel cards management. "

Organizational skills. This is an important skill for payroll managers to perform their duties. For an example of how payroll manager responsibilities depend on this skill, consider that "financial clerks must be able to arrange files so they can find them quickly and efficiently." This excerpt from a resume also shows how vital it is to everyday roles and responsibilities of a payroll manager: "provided detailed training in the organizational payroll procedures and systems of the team/group to ensure orderly and timely processing of workflow. ".

The three companies that hire the most payroll managers are:

- Deloitte200 payroll managers jobs

- Pwc78 payroll managers jobs

- Accenture45 payroll managers jobs

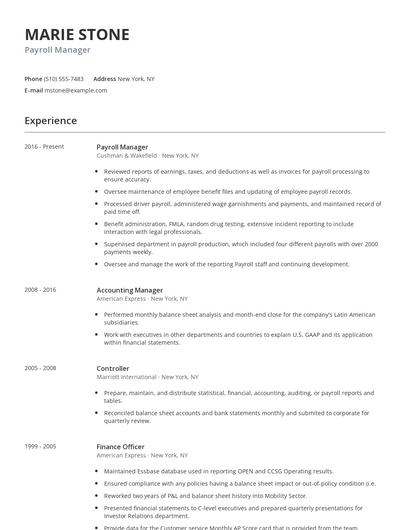

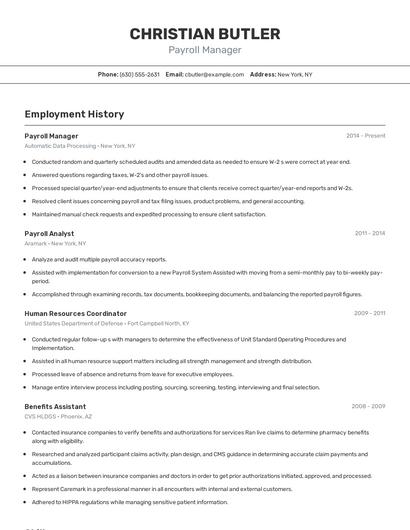

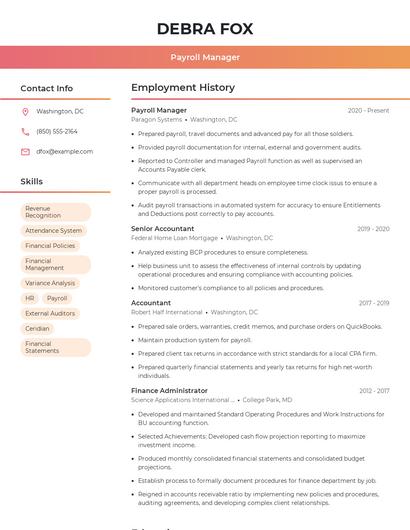

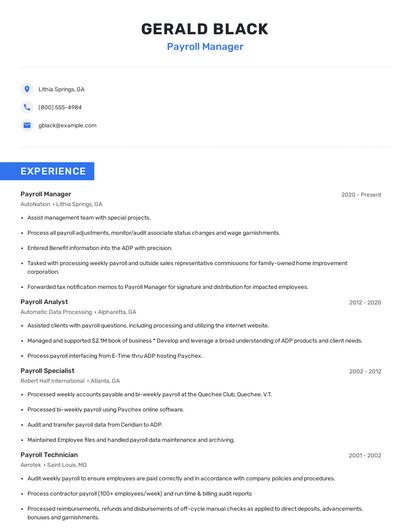

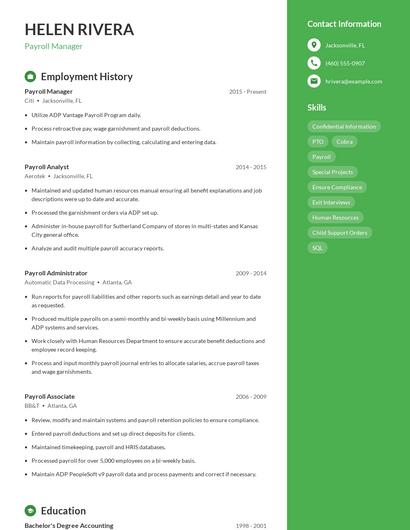

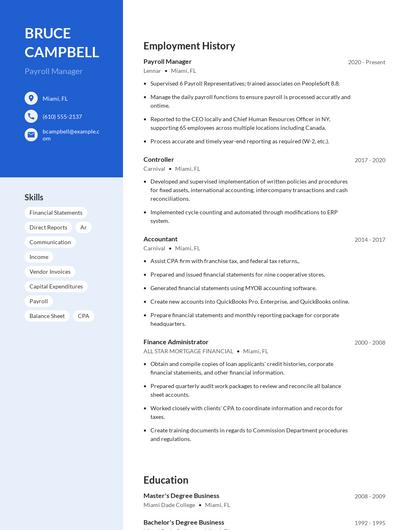

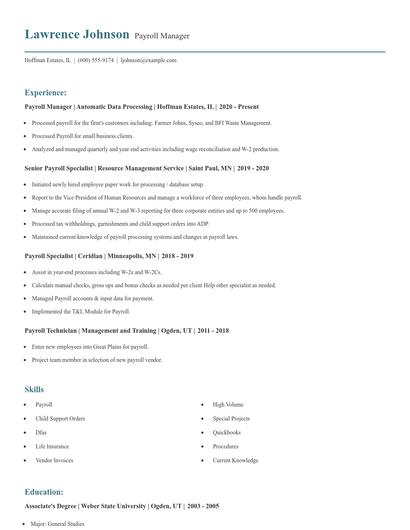

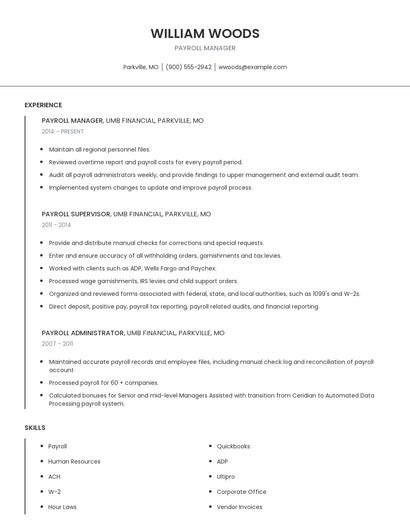

Choose from 10+ customizable payroll manager resume templates

Build a professional payroll manager resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your payroll manager resume.Compare different payroll managers

Payroll manager vs. Timekeeper

A Timekeeper works in various industries and organizations and is typically hired as the acting liaison between payroll coordinators and employees. This is to make sure the pay distribution process runs smoothly. As a timekeeper, you will be required to maintain an accurate track of the total number of hours worked for payroll purposes. This involves compiling payroll data from timesheets, computing wages, including the removal of taxes and social security withholding, and putting it into the computer system.

While similarities exist, there are also some differences between payroll managers and timekeeper. For instance, payroll manager responsibilities require skills such as "customer service," "payroll tax," "hris," and "reconciliations." Whereas a timekeeper is skilled in "data entry," "per diem," "turnaround," and "purchase orders." This is part of what separates the two careers.

Timekeepers tend to reach similar levels of education than payroll managers. In fact, timekeepers are 4.5% less likely to graduate with a Master's Degree and 0.3% less likely to have a Doctoral Degree.Payroll manager vs. Benefits clerk

The main duty of a Payroll & Human Resources Assistant is to provide payroll information through collecting time and attendance records. They also answer questions regarding examinations, eligibility, salaries, benefits, and other important information.

In addition to the difference in salary, there are some other key differences worth noting. For example, payroll manager responsibilities are more likely to require skills like "customer service," "payroll tax," "reconciliations," and "payroll operations." Meanwhile, a benefits clerk has duties that require skills in areas such as "data entry," "open enrollment," "life insurance," and "health insurance." These differences highlight just how different the day-to-day in each role looks.

Benefits clerks earn a lower average salary than payroll managers. But benefits clerks earn the highest pay in the government industry, with an average salary of $40,253. Additionally, payroll managers earn the highest salaries in the finance with average pay of $85,783 annually.benefits clerks earn similar levels of education than payroll managers in general. They're 1.2% less likely to graduate with a Master's Degree and 0.3% more likely to earn a Doctoral Degree.Payroll manager vs. Commission clerk

There are many key differences between these two careers, including some of the skills required to perform responsibilities within each role. For example, a payroll manager is likely to be skilled in "customer service," "human resources," "payroll system," and "payroll tax," while a typical commission clerk is skilled in "data entry," "journal entries," "planning commission," and "legal notices."

When it comes to education, commission clerks tend to earn similar degree levels compared to payroll managers. In fact, they're 3.6% less likely to earn a Master's Degree, and 2.1% less likely to graduate with a Doctoral Degree.Payroll manager vs. Payroll & human resources assistant

Even though a few skill sets overlap between payroll managers and payroll & human resources assistants, there are some differences that are important to note. For one, a payroll manager might have more use for skills like "customer service," "human resources," "payroll tax," and "reconciliations." Meanwhile, some responsibilities of payroll & human resources assistants require skills like "data entry," "assist human resources," "background checks," and "adp payroll. "

Payroll & human resources assistants enjoy the best pay in the manufacturing industry, with an average salary of $45,905. For comparison, payroll managers earn the highest salary in the finance industry.The average resume of payroll & human resources assistants showed that they earn similar levels of education compared to payroll managers. So much so that theyacirc;euro;trade;re 2.6% less likely to earn a Master's Degree and less likely to earn a Doctoral Degree by 0.3%.Types of payroll manager

Updated January 8, 2025