What does a public accountant do?

A public accountant handles duties relating to financial planning, bookkeeping, and preparing government taxes and audits. Besides overseeing financial management and budget management, a public accountant also maintains and audits an organization's financial records. Other duties performed by public accountants include creating and analyzing budgets and recommending fiscally practical techniques to save the company's money. A public accountant reports financial information to the organization management and audits its accounts for overspending, fraud, errors, and misinformation.

Public accountant responsibilities

Here are examples of responsibilities from real public accountant resumes:

- Manage and monitor accounting procedures for compliance with Sarbanes-Oxley and coordinate and facilitate external audit requirements.

- Perform write-ups, analysis of general ledger, adjusting journal entries and reconciliations.

- Ensure accuracy and completeness of write-ups and monthly bank reconciliations.

- Handle tax matters with the IRS for clients and business owners.

- Assist clients with IRS correspondence, accounting and recording business transactions.

- Collaborate in the resolution of taxation disputes with federal, state and local tax agencies.

- Reduce time and costs and increase efficiency by introducing new accounting procedures and implementing the use of QuickBooks software.

- Reclassify various financial statements accounts on QuickBooks.

- Prepare daily SOX audit documentation, ensuring that bank account activity have been reconcile and to identify any outstanding variances.

- Research, design and present PowerPoint presentations for in-house CPE training to all levels of personnel.

- Work on bond offerings for residential subdivisions.

- Reconcile payroll accounts, sales taxes, loan accounts, A/R, A/P and other assets accounts with trial balance.

- Support clients by updating and keeping timely financial records (A/R, A/P, payroll, sales) for their business.

- Monitor bond and covenant requirements, providing tax return and audit information to external contacts.

- Respond to questions from business units regarding general accounting and/or PeopleSoft system matters and investigate and resolve GL accounting inconsistencies.

Public accountant skills and personality traits

We calculated that 17% of Public Accountants are proficient in CPA, Real Estate, and Audit Procedures. They’re also known for soft skills such as Analytical skills, Communication skills, and Detail oriented.

We break down the percentage of Public Accountants that have these skills listed on their resume here:

- CPA, 17%

Control A/P, month end bank reconciliation, worked with CPA to check daily bank transactions and other accounting functions.

- Real Estate, 9%

Managed monthly/annual closings, billing and collection of manufacturing coupon receivables, trade marketing contract reporting and real estate subsidiary accounting.

- Audit Procedures, 9%

Prepared audit working papers and audit reports documenting the audit procedures and all adjustments made.

- Financial Statement Preparation, 7%

Provided public accounting services to small and mid-sized companies, including financial statement preparation, tax planning and preparation and management consulting

- Payroll Tax, 6%

Prepared income tax, estate tax, sales tax, payroll tax, bookkeeping, auditing, and research.

- Partnerships, 5%

Prepared tax returns for corporations, partnerships, non-profit organizations and individuals.

"cpa," "real estate," and "audit procedures" are among the most common skills that public accountants use at work. You can find even more public accountant responsibilities below, including:

Communication skills. Another soft skill that's essential for fulfilling public accountant duties is communication skills. The role rewards competence in this skill because "accountants and auditors must be able to listen to and discuss facts and concerns from clients, managers, and other stakeholders." According to a public accountant resume, here's how public accountants can utilize communication skills in their job responsibilities: "maintain timely and accurate records, customer communications, account reconciliations; report of key metrics, tracking collection attempts/progress. "

Detail oriented. This is an important skill for public accountants to perform their duties. For an example of how public accountant responsibilities depend on this skill, consider that "accountants and auditors must pay attention to detail when compiling and examining documents." This excerpt from a resume also shows how vital it is to everyday roles and responsibilities of a public accountant: "created spreadsheet oriented tools for reconciliations and analysis".

Math skills. public accountant responsibilities often require "math skills." The duties that rely on this skill are shown by the fact that "accountants and auditors must be able to analyze, compare, and interpret facts and figures." This resume example shows what public accountants do with math skills on a typical day: "prepare monthly closing financial statements of multiple properties, including income statements, balance sheets, and related quantitative analyses. "

Organizational skills. Another common skill required for public accountant responsibilities is "organizational skills." This skill comes up in the duties of public accountants all the time, as "strong organizational skills are important for accountants and auditors, who often work with a range of financial documents for a variety of clients." An excerpt from a real public accountant resume shows how this skill is central to what a public accountant does: "prepared corporate, organizational and personal tax returns. "

The three companies that hire the most public accountants are:

- Paro16 public accountants jobs

- The Bodine Co.4 public accountants jobs

- Landa2 public accountants jobs

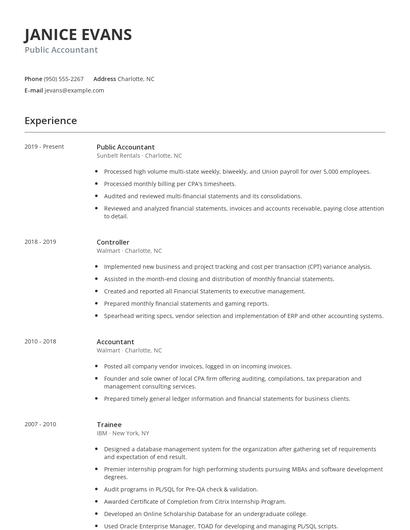

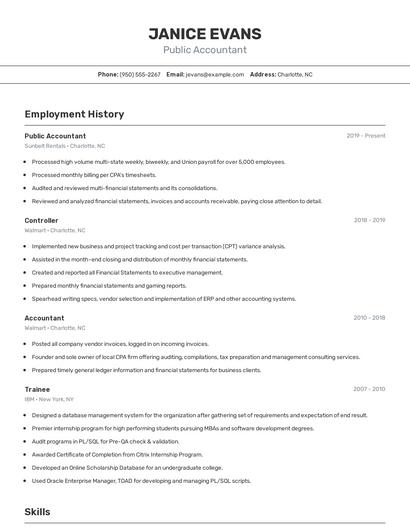

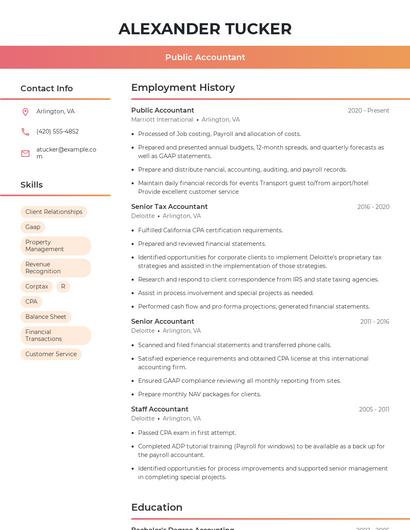

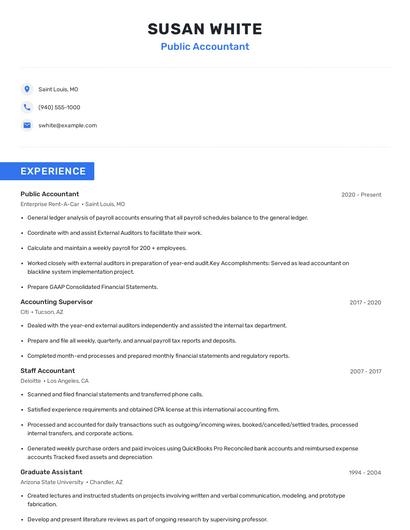

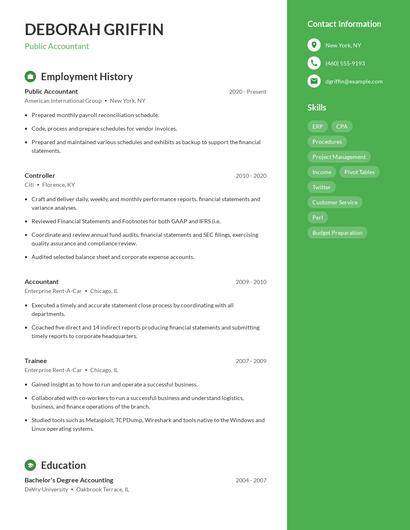

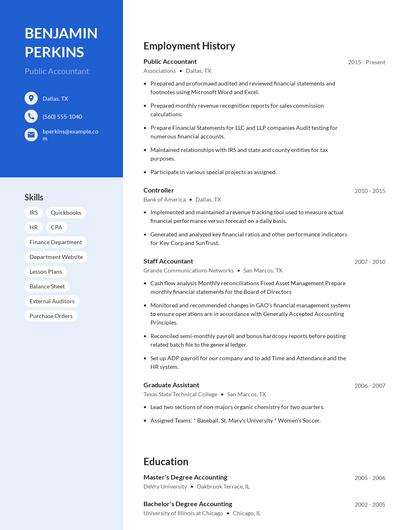

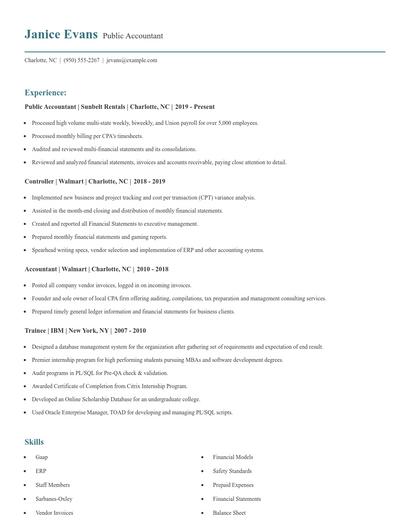

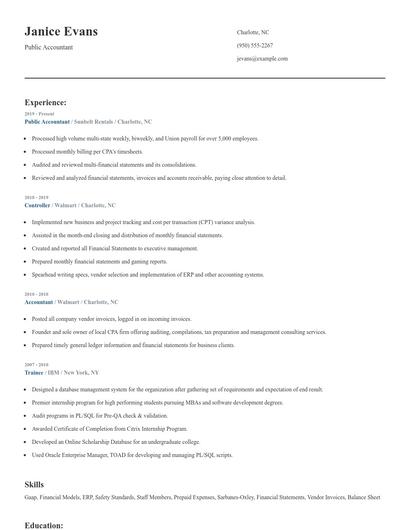

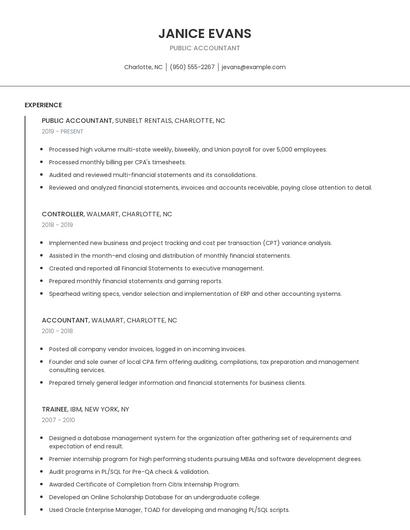

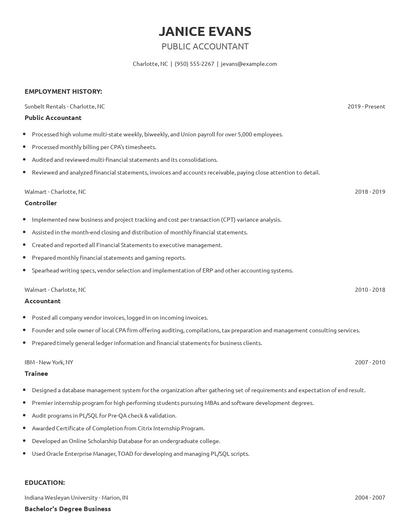

Choose from 10+ customizable public accountant resume templates

Build a professional public accountant resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your public accountant resume.Compare different public accountants

Public accountant vs. Account auditor

The account auditor is the person tasked to conduct audits in sales accounts handled by the company. As with an auditor, this person checks all financial statements, investigates each entry, making sure everything is accounted for correctly. The auditor checks all receivables, attachments, and liquidation to ensure the financial report is accurate, which is vital for strategies that affect company expenses, calculate revenue, gains, and losses, and use those information to file taxes.

While similarities exist, there are also some differences between public accountants and account auditor. For instance, public accountant responsibilities require skills such as "financial statement preparation," "payroll tax," "partnerships," and "income tax returns." Whereas a account auditor is skilled in "audit reports," "payroll," "general ledger accounts," and "audit findings." This is part of what separates the two careers.

Account auditors earn the highest salaries when working in the professional industry, with an average yearly salary of $84,961. On the other hand, public accountants are paid more in the professional industry with an average salary of $75,941.The education levels that account auditors earn slightly differ from public accountants. In particular, account auditors are 0.0% more likely to graduate with a Master's Degree than a public accountant. Additionally, they're 0.6% less likely to earn a Doctoral Degree.Public accountant vs. Finance analyst/accountant

In a company setting, a finance analyst/accountant is in charge of handling and monitoring financial activities, ensuring efficiency and accuracy. Their responsibilities revolve around preparing financial reports, performing audits and risk assessments, and identifying any errors and inconsistencies, resolving them promptly and efficiently. They also conduct research and analysis to identify new business opportunities, evaluate the existing procedures to determine its strengths and weaknesses, and recommend solutions to optimize operations for financial growth. Furthermore, as a finance analyst/accountant, it is essential to uphold the company's policies and regulations, including its vision and mission.

In addition to the difference in salary, there are some other key differences worth noting. For example, public accountant responsibilities are more likely to require skills like "real estate," "audit procedures," "financial statement preparation," and "payroll tax." Meanwhile, a finance analyst/accountant has duties that require skills in areas such as "general ledger accounts," "payroll," "external auditors," and "account reconciliations." These differences highlight just how different the day-to-day in each role looks.

Finance analyst/accountants may earn a higher salary than public accountants, but finance analyst/accountants earn the most pay in the finance industry with an average salary of $78,897. On the other hand, public accountants receive higher pay in the professional industry, where they earn an average salary of $75,941.Average education levels between the two professions vary. Finance analyst/accountants tend to reach similar levels of education than public accountants. In fact, they're 4.4% more likely to graduate with a Master's Degree and 0.6% less likely to earn a Doctoral Degree.What technology do you think will become more important and prevalent for public accountants in the next 3-5 years?

Public accountant vs. Accountant internship

An accounting intern is responsible for assisting an organization's accounting department, observing practical applications and processes, and performing accounting duties under the supervision of tenured accounting staff. Accounting interns support the accounting operations by preparing and organizing financial reports, helping with accounts reconciliation, researching financial and stock market trends, utilizing various accounting software, and managing feedback from their mentors. An accounting intern must be detail-oriented and a fast-learner, immediately adjusting to the company's culture and actively cooperating with the team to ensure a smooth flow of operations.

There are many key differences between these two careers, including some of the skills required to perform responsibilities within each role. For example, a public accountant is likely to be skilled in "real estate," "audit procedures," "financial statement preparation," and "payroll tax," while a typical accountant internship is skilled in "r," "account management," "powerpoint," and "renewable energy."

Accountant interns make a very good living in the media industry with an average annual salary of $36,253. On the other hand, public accountants are paid the highest salary in the professional industry, with average annual pay of $75,941.Most accountant interns achieve a similar degree level compared to public accountants. For example, they're 1.4% less likely to graduate with a Master's Degree, and 0.7% less likely to earn a Doctoral Degree.Public accountant vs. Accountant/consultant

Accountants/consultants perform accounting tasks for organizations or companies. The accountants improve accounting practices and prepare financial statements at the end of every year. They analyze financial data and offer advice on regulatory compliance issues to the finance department. It is their job to make sure that the online system is secure. Most of the day, they organize invoices, prepare statements, and supervising systems. They should be equipped with analytical skills, industry knowledge, critical thinking, and interpersonal communication.

Types of public accountant

Updated January 8, 2025