Automatically apply for jobs with Zippia

Upload your resume to get started.

Remittance clerk skills for your resume and career

15 remittance clerk skills for your resume and career

1. Data Entry

Data entry means entering data into a company's system with the help of a keyboard. A person responsible for entering data may also be asked to verify the authenticity of the data being entered. A person doing data entry must pay great attention to tiny details.

- Performed data entry functions and utilized a low speed document processing device for capturing and encoding transactions.

- Managed all rejected items from the data entry system and sorted correspondence for all Wireless and CBSS documents.

2. Process Payments

- Process payments received from Frontier customers that are invoiced in DPI and Arbor.

- Process payments and reports for bank deposits.

3. Bank Deposits

Any money that a customer chooses to leave with their bank account is a deposit. Deposits can vary in amounts and different banks have limits on the deposits their customers can have as a minimum. Banks charge customers for deposits especially when a teller is used by the customer to deposit money into their account.

- Prepared daily bank deposits and reconciled bank corrections.

- Complete bank deposits by scanning all checks and verify that each batch balances before submitting to the bank depository.

4. OpEx

- Opened envelopes, by hand or by using the OPEX incoming and scanning machine.

- Opened mail manually and mechanically using Opex 51and Eagle 150 high speed extractor machines.

5. Check Payments

- Processed check payments for national banks, companies and personal credit card accounts.

- Job duties were to verify and post check payments and all cash payments.

6. IRS

IRS stands for internal revenue services. It helps many compliant taxpayers become conversant with the law regarding taxes; it ensures the minority who refuse to comply with paying taxes pay the required amount.

- Reviewed all returns to validate the accuracy of IRS tax forms; ensured forms were sorted by current or prior year.

- Processed end of day reports and forwarded this information to the IRS and State taxing authorities.

Choose from 10+ customizable remittance clerk resume templates

Build a professional remittance clerk resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your remittance clerk resume.7. Customer Accounts

- Utilize bad check application (BCA) to process insufficient funds check to customer accounts.

- Promoted calling features and added them to customer accounts as requested.

8. Credit Card

A type of card issued by banks and other financial institutions, that enable users to manage and borrow their finances is called a credit card. The funds borrowed from a financial institution through a credit card are meant to be paid back along with certain amounts of interest imposed by the bank.

- Assisted with implementation of Credit Union first automated equipment (NCR 7770) for mail remittance and credit card payments processing.

- Managed and handled all aspects of customer payment by credit card, checks and cash.

9. Customer Service

Customer service is the process of offering assistance to all the current and potential customers -- answering questions, fixing problems, and providing excellent service. The main goal of customer service is to build a strong relationship with the customers so that they keep coming back for more business.

- Processed customer transactions as well as provided them with general customer service.

- Receive payments Process non-payment notices Customer service

10. Customer Payments

- Prepare customer payments for processing, set-up and maintenance activities for the remittance processor and related equipment.

- Contributed to meeting department goals in processing high volumes of customer payments and remittances.

11. Tax Forms

- Completed and submitted tax forms and returns, workers' compensation forms, pension contribution forms, and other government documents.

- Scanned tax forms and sent them to the correct departments for proper credit for clients.

12. Tax Returns

- Review and examine tax returns and file materials to identify primary subject matter and assign proper classification.

- Prepared tax payment and tax returns for company subsidiaries corporations, domestic and international.

13. Account Numbers

- Verified and input account numbers.

- Provided superior client services, highlighting account issues for customers by entering account numbers for new insufficient funds accounts.

14. Bill Payments

- Updated customer account for bill payments and late and insufficient funds charges.

15. Office Equipment

- Use of office equipment, 10 key, and computer on daily basis.

- Operate standard office equipment, specialize equipment, microcomputer using office software.

5 Remittance Clerk resume examples

Build a professional remittance clerk resume in minutes. Browse through our resume examples to identify the best way to word your resume. Then choose from 5+ resume templates to create your remittance clerk resume.

What skills help Remittance Clerks find jobs?

Tell us what job you are looking for, we’ll show you what skills employers want.

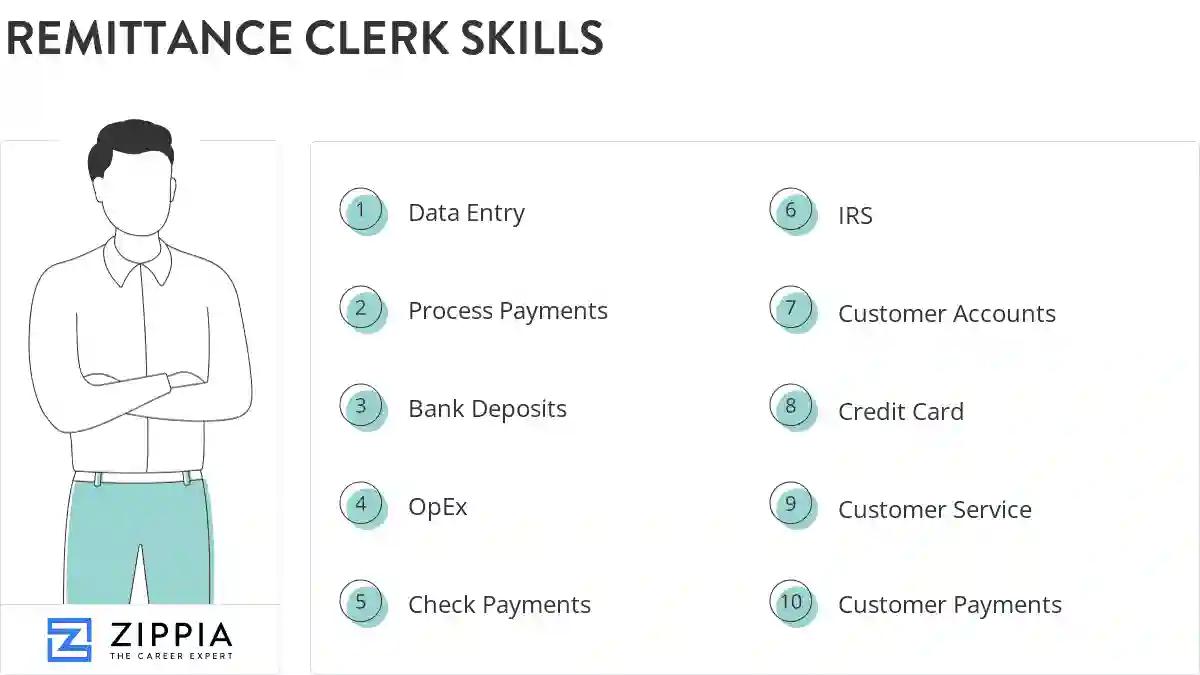

List of remittance clerk skills to add to your resume

The most important skills for a remittance clerk resume and required skills for a remittance clerk to have include:

- Data Entry

- Process Payments

- Bank Deposits

- OpEx

- Check Payments

- IRS

- Customer Accounts

- Credit Card

- Customer Service

- Customer Payments

- Tax Forms

- Tax Returns

- Account Numbers

- Bill Payments

- Office Equipment

- Financial Data

- Patient Accounts

- RP

- Numerical Data

- Business Transactions

- TMS

Updated January 8, 2025