What does a reporting manager do?

The duties of a reporting manager depend on one's line of work or industry of employment. Typically, they perform clerical tasks such as producing progress reports and presentations, maintaining accurate records and documentation, updating databases, managing schedules, and performing regular inspections and site visits. There are also instances where one must respond to inquiries and concerns, report to supervisors, and coordinate with other department personnel. Furthermore, as a manager, it is essential to lead and encourage the team, all while implementing the company's policies and regulations.

Reporting manager responsibilities

Here are examples of responsibilities from real reporting manager resumes:

- Perform, then manage, profit and loss for volatile, derivative mortgage back securities.

- Used Microsoft SharePoint to manage projects, establish work flow, and document reports and report field definitions.

- Manage the administrator of a Hyperion database.

- Manage and mentore junior analysts in report optimization and SAS proficiency.

- Prepare monthly IFRS financial statements including balance sheet and income statement using HFM.

- Establish and maintain SOX documentation for initial compliance including management of testing with internal audit consultants.

- Ensure completion and review of all balance sheet reconciliations, identify risk and opportunities and communicate findings.

- Research, evaluation and recommendation for complex accounting matters, including acquisition accounting and treasury / derivative accounting.

- Perform monthly close activities including revenue recognition, debt and equity accounting and review of team member account reconciliations.

- Maintain budget, estimate and monthly IFRS reporting.

- Participate in adoption of ASC 605-25 multiple element arrangement.

- Assist in preparation of proxy statement and annual report with legal department and investor relations.

- Assist in derivative accounting, pension accounting, purchase price allocation, and impairment analysis.

- Collect all tax data and work with outside tax CPA to create and file all annual tax returns.

- Assist outside CPA with monthly investment statements to provide investment detail to banks that hold loans associate with investments.

Reporting manager skills and personality traits

We calculated that 9% of Reporting Managers are proficient in GAAP, Internal Controls, and External Auditors. They’re also known for soft skills such as Organizational skills, Analytical skills, and Communication skills.

We break down the percentage of Reporting Managers that have these skills listed on their resume here:

- GAAP, 9%

Monitored and ensured identification and compliance with evolving accounting guidance, provide US GAAP interpretation and prepare technical memorandums.

- Internal Controls, 7%

Drafted, documented, communicated and maintained corporate accounting policies and procedures, improved internal controls and process management.

- External Auditors, 4%

Coordinated with external auditors, regulators and banks/lenders to ensure VisionFund adheres to its covenants and obligations for year-end audit process.

- ASC, 4%

Created company s first Credit Valuation Risk Model for derivatives: Interest/Currency Hedges (ASC 820 Fair- Value Measurements).

- Data Analysis, 4%

Interacted with senior leaders to provide data analysis in support of strategic planning, accounting and financial initiatives regarding loan-servicing portfolio.

- Visualization, 4%

Involved in complete design and development of Visualization module in SecureVue application.

"gaap," "internal controls," and "external auditors" are among the most common skills that reporting managers use at work. You can find even more reporting manager responsibilities below, including:

Organizational skills. The most essential soft skill for a reporting manager to carry out their responsibilities is organizational skills. This skill is important for the role because "because financial managers deal with a range of information and documents, they must have structures in place to be effective in their work." Additionally, a reporting manager resume shows how their duties depend on organizational skills: "developed plant 'footprint' documentation for sox for entire chemical division developed organizational structural for standardization of plant accounting departments"

Analytical skills. Another soft skill that's essential for fulfilling reporting manager duties is analytical skills. The role rewards competence in this skill because "to assist executives in making decisions, financial managers need to evaluate data and information that affects their organization." According to a reporting manager resume, here's how reporting managers can utilize analytical skills in their job responsibilities: "reduced from 3 months to 2 weeks the computer conversion/upgrade cycle for erp system and peripheral databases. "

Communication skills. Another skill that relates to the job responsibilities of reporting managers is communication skills. This skill is critical to many everyday reporting manager duties, as "financial managers must be able to explain and justify complex financial transactions." This example from a resume shows how this skill is used: "worked closely with tax, treasury, communications, risk management and investor relations departments as well as business unit finance personnel"

Detail oriented. reporting manager responsibilities often require "detail oriented." The duties that rely on this skill are shown by the fact that "in preparing and analyzing reports, such as balance sheets and income statements, financial managers must be precise and attentive to their work in order to avoid errors." This resume example shows what reporting managers do with detail oriented on a typical day: "analyzed financial reports and provided detailed analysis to the general managers. "

Math skills. Another common skill required for reporting manager responsibilities is "math skills." This skill comes up in the duties of reporting managers all the time, as "financial managers need strong skills in certain branches of mathematics, including algebra." An excerpt from a real reporting manager resume shows how this skill is central to what a reporting manager does: "managed the reporting infrastructure for reporting on contact center production statistics and financial data. "

The three companies that hire the most reporting managers are:

- Deloitte506 reporting managers jobs

- Ryder System45 reporting managers jobs

- BJ's Wholesale Club45 reporting managers jobs

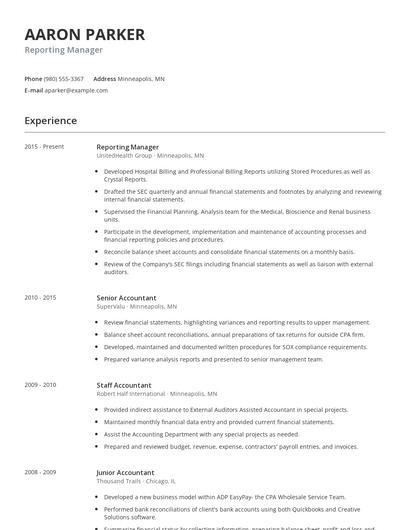

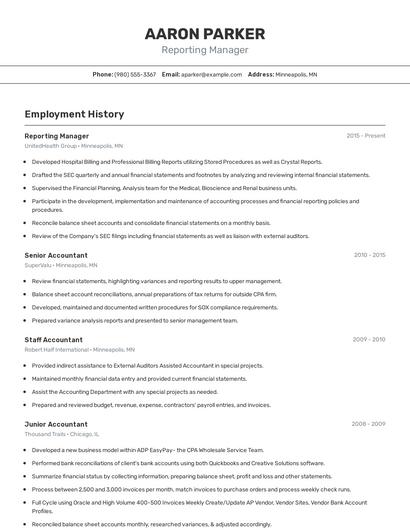

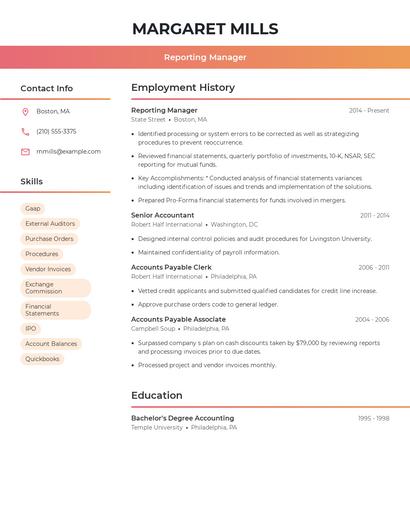

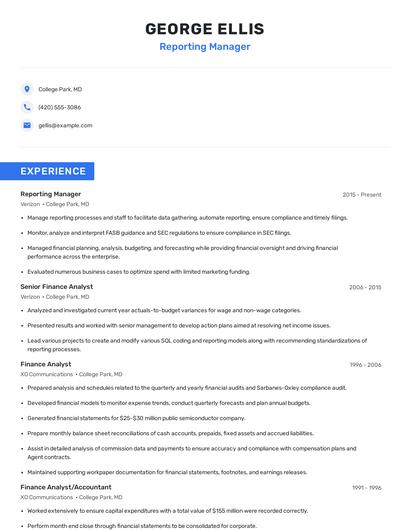

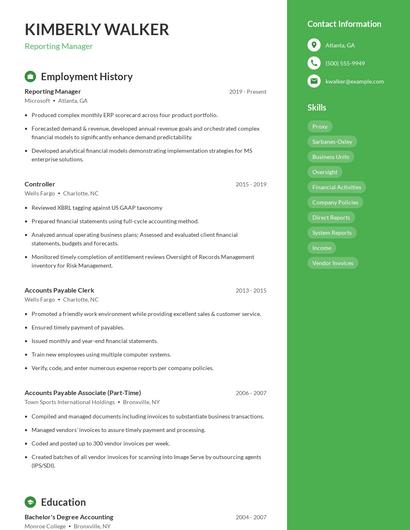

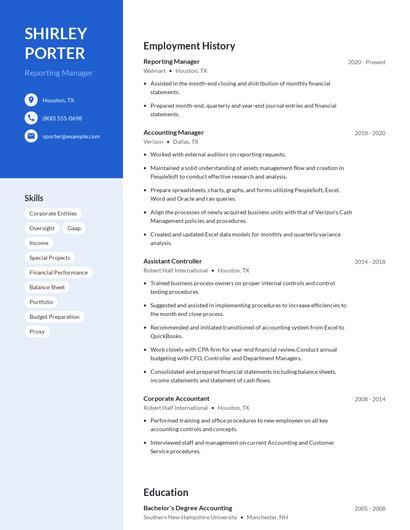

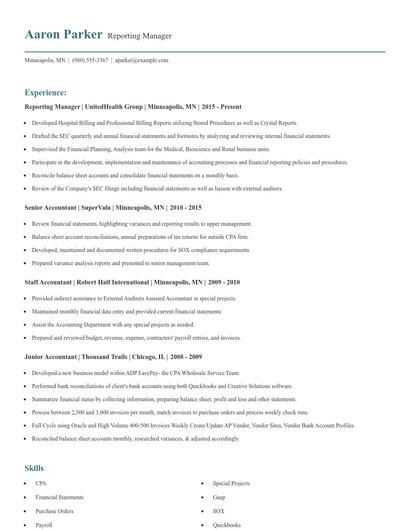

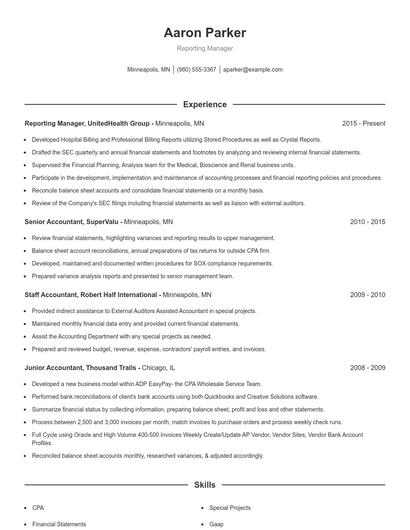

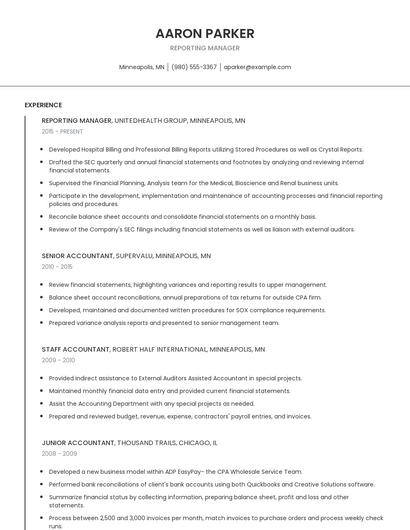

Choose from 10+ customizable reporting manager resume templates

Build a professional reporting manager resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your reporting manager resume.Compare different reporting managers

Reporting manager vs. Finance center manager

The duties of a finance center manager depend on one's place or industry of employment. Typically, they are responsible for overseeing the operations of a financial center, ensuring everything is running smoothly. They are also responsible for performing clerical tasks such as producing progress reports and presentations, managing schedules, setting goals and deadlines, processing documents, and maintaining data and records of all financial activities. Furthermore, as a manager, it is essential to lead and encourage the team, all while implementing the company's policies and regulations.

These skill sets are where the common ground ends though. The responsibilities of a reporting manager are more likely to require skills like "gaap," "internal controls," "external auditors," and "asc." On the other hand, a job as a finance center manager requires skills like "customer service," "exceptional client," "financial services," and "regulatory policies." As you can see, what employees do in each career varies considerably.

Finance center managers tend to reach lower levels of education than reporting managers. In fact, finance center managers are 9.2% less likely to graduate with a Master's Degree and 0.0% more likely to have a Doctoral Degree.Reporting manager vs. Cash manager

A cash manager is responsible for monitoring cash flow, analyzing financial transactions, and allocating adequate budget and resources for every department's operations. Cash managers conduct data and statistical analysis to determine the company's expenses and financial loss and strategize techniques in minimizing those risks. They also help senior management in identifying business opportunities that would generate more revenue resources and increase profits for the business. A cash manager handles billing disputes, resolves account discrepancies, and submits accurate financial reports.

In addition to the difference in salary, there are some other key differences worth noting. For example, reporting manager responsibilities are more likely to require skills like "asc," "data analysis," "visualization," and "strong analytical." Meanwhile, a cash manager has duties that require skills in areas such as "customer service," "cash management," "ach," and "petty cash." These differences highlight just how different the day-to-day in each role looks.

Cash managers may earn a lower salary than reporting managers, but cash managers earn the most pay in the manufacturing industry with an average salary of $101,436. On the other hand, reporting managers receive higher pay in the manufacturing industry, where they earn an average salary of $106,307.Average education levels between the two professions vary. Cash managers tend to reach lower levels of education than reporting managers. In fact, they're 7.0% less likely to graduate with a Master's Degree and 0.0% less likely to earn a Doctoral Degree.What technology do you think will become more important and prevalent for reporting managers in the next 3-5 years?

Thomas King

Department Chair, Director, Master of Accountancy Program, Professor, Accountancy, Case Western Reserve University

Reporting manager vs. Tax manager

A Tax Manager is responsible for managing tax reporting and compliance within an organization. They provide innovative tax planning and prepare state and federal tax returns for companies.

There are many key differences between these two careers, including some of the skills required to perform responsibilities within each role. For example, a reporting manager is likely to be skilled in "data analysis," "visualization," "process improvement," and "xbrl," while a typical tax manager is skilled in "cpa," "client relationships," "tax planning," and "tax compliance."

Tax managers earn the best pay in the finance industry, where they command an average salary of $96,231. Reporting managers earn the highest pay from the manufacturing industry, with an average salary of $106,307.Most tax managers achieve a similar degree level compared to reporting managers. For example, they're 4.1% more likely to graduate with a Master's Degree, and 2.8% more likely to earn a Doctoral Degree.Reporting manager vs. Manager

Managers are responsible for a specific department, function, or employee group. They oversee their assigned departments and all the employees under the department. Managers are responsible that the department they are handling is functioning well. They set the department goals and the steps they must take to achieve the goals. They are also in charge of assessing the performance of their departments and their employees. Additionally, managers are responsible for interviewing prospective candidates for department vacancies and assessing their fit to the needs of the department. Managers also set the general working environment in the department, and they are expected to ensure that their employees remain motivated.

Types of reporting manager

Updated January 8, 2025