What does a securities trader do?

Securities trader responsibilities

Here are examples of responsibilities from real securities trader resumes:

- Research, analyze, and invest in equities in order to achieve short term capital gains.

- Manage business, sales, marketing, international negotiation and communication for a commodities business.

- Collaborate with partners in trading domestic equities, international equities, corporate bonds, and sovereign debt instruments.

- Carry out NYSE and NASDAQ equity trading on behalf of institutional clientele and register investment advisors.

- Execute institutional equity orders on both an agency and proprietary basis in strict accordance to FINRA regulations and establish company guidelines.

- Trade multiple products on SGX, CBOT, CME, HKFE, TSE, EUREX and LIFFE exchanges.

- Execute curve base spread strategies of CME & CBOT interest rate products.

- Develop extensive knowledge of NASDAQ trading systems.

- Execute institutional equity orders on both an agency and proprietary basis in strict accordance to FINRA regulations and establish company guidelines.

Securities trader skills and personality traits

We calculated that 18% of Securities Traders are proficient in Securities, Risk Management, and Fixed Income. They’re also known for soft skills such as Analytical skills, Customer-service skills, and Detail oriented.

We break down the percentage of Securities Traders that have these skills listed on their resume here:

- Securities, 18%

Illustrated technical trends to Portfolio Managers, and incorporated into fundamental analysis of relevant securities to anticipate volatility and price direction.

- Risk Management, 11%

Implemented a risk management strategy that resulted in minimized risk and minimizing losses.

- Fixed Income, 8%

Traded stocks, options, and fixed income products during a time of extreme market volatility and heavy volumes.

- Equities, 8%

Collaborated with partners in trading domestic equities, international equities, corporate bonds, and sovereign debt instruments.

- Financial Statements, 6%

Updated broker/dealer lists with contact information and maintained financial statements per SEC rules.

- Bonds, 5%

Maintained complete knowledge of investment products including stocks, options, municipal bonds, treasuries, mutual funds and annuities.

"securities," "risk management," and "fixed income" are among the most common skills that securities traders use at work. You can find even more securities trader responsibilities below, including:

Analytical skills. The most essential soft skill for a securities trader to carry out their responsibilities is analytical skills. This skill is important for the role because "to judge the profitability of potential deals, securities, commodities, and financial services sales agents must have strong analytical skills." Additionally, a securities trader resume shows how their duties depend on analytical skills: "perform fundamental and technical analysis on many publicly traded companies to determine investment potential. "

Customer-service skills. Another soft skill that's essential for fulfilling securities trader duties is customer-service skills. The role rewards competence in this skill because "securities, commodities, and financial services sales agents must be persuasive and make clients feel comfortable with the agent’s recommendations." According to a securities trader resume, here's how securities traders can utilize customer-service skills in their job responsibilities: "analyzed and managed risk in unusual trade activity in exploited accounts and reduced customer fraud and company financial risk. "

Detail oriented. This is an important skill for securities traders to perform their duties. For an example of how securities trader responsibilities depend on this skill, consider that "investment bankers must pay close attention to the details of initial public offerings and mergers and acquisitions because small changes can have large consequences." This excerpt from a resume also shows how vital it is to everyday roles and responsibilities of a securities trader: "provided detailed arbitrage and market information to 6 traders while ensuring proper trade execution, clearing activities and position accuracy. ".

Initiative. securities trader responsibilities often require "initiative." The duties that rely on this skill are shown by the fact that "securities, commodities, and financial services sales agents must create their own client base by making “cold” sales calls to people to whom they have not been referred and to people not expecting the call." This resume example shows what securities traders do with initiative on a typical day: "lead trader in both executing arbitrage opportunities and compliance review cleanup initiatives. "

Math skills. Another crucial skill for a securities trader to carry out their responsibilities is "math skills." A big part of what securities traders relies on this skill, since "securities, commodities, and financial services sales agents need to be familiar with mathematical tools, including investment formulas." How this skill relates to securities trader duties can be seen in an example from a securities trader resume snippet: "conducted quantitative and fundamental research to keep bond portfolios in line with benchmarks. "

The three companies that hire the most securities traders are:

- MassMutual2 securities traders jobs

- JPMorgan Chase & Co.1 securities traders jobs

- Northern Trust1 securities traders jobs

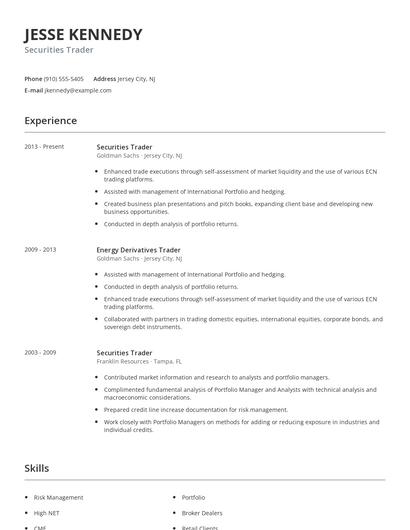

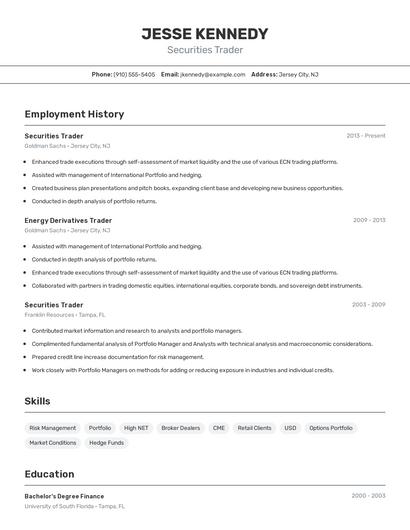

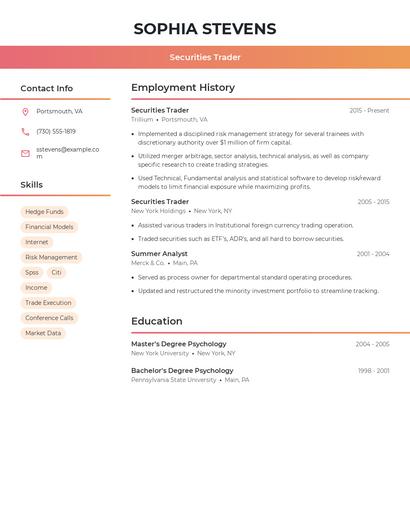

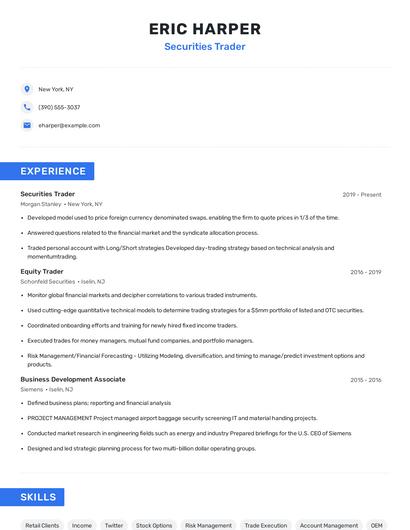

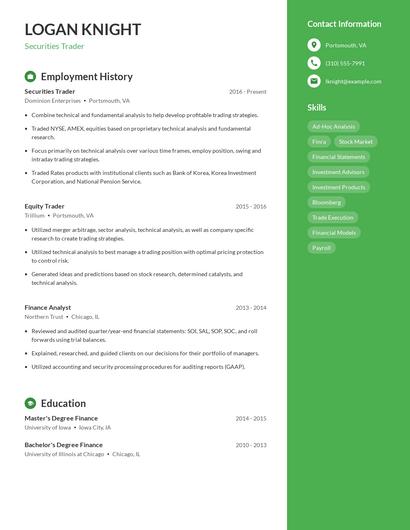

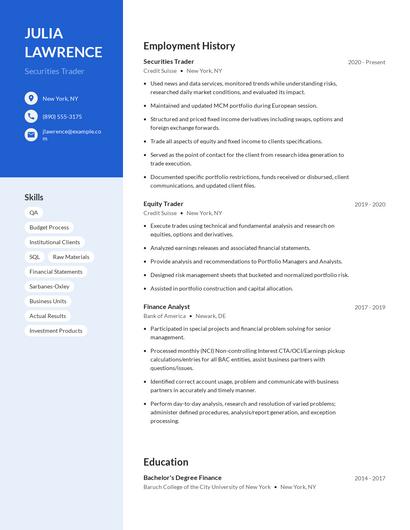

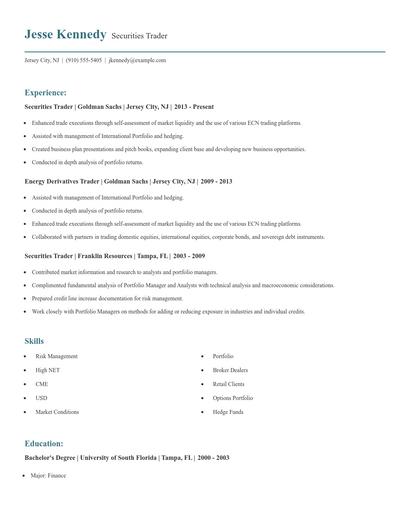

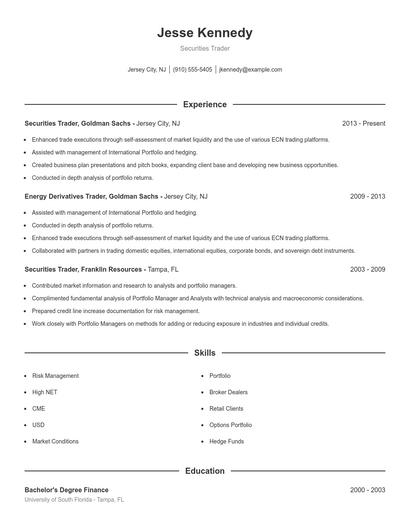

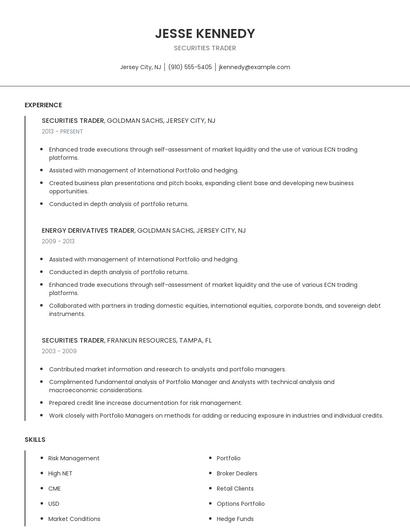

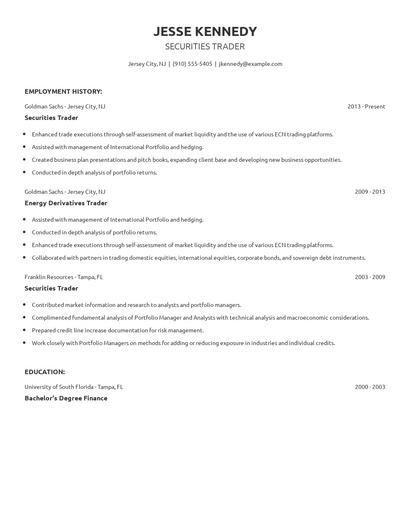

Choose from 10+ customizable securities trader resume templates

Build a professional securities trader resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your securities trader resume.Compare different securities traders

Securities trader vs. Commodity broker

The foreign exchange market is volatile and influenced by numerous factors. A foreign exchange trader considers these factors and utilizes them in their favor. They typically take care to predict misvaluations of currencies accurately. They act on the conclusions reached from their analysis and either buy or sell assets in different markets. This position requires diligence and patience.

These skill sets are where the common ground ends though. The responsibilities of a securities trader are more likely to require skills like "securities," "fixed income," "financial statements," and "fixed income trading." On the other hand, a job as a commodity broker requires skills like "commodities," "nfa," "cold calls," and "market research." As you can see, what employees do in each career varies considerably.

Commodity brokers earn the highest salaries when working in the finance industry, with an average yearly salary of $89,520. On the other hand, securities traders are paid more in the finance industry with an average salary of $126,287.On average, commodity brokers reach similar levels of education than securities traders. Commodity brokers are 1.6% less likely to earn a Master's Degree and 0.5% less likely to graduate with a Doctoral Degree.Securities trader vs. Municipal bond trader

While some skills are similar in these professions, other skills aren't so similar. For example, resumes show us that securities trader responsibilities requires skills like "equities," "financial statements," "fixed income trading," and "client accounts." But a municipal bond trader might use other skills in their typical duties, such as, "institutional sales," "income securities," "municipal bond market," and "capital markets."

In general, municipal bond traders achieve similar levels of education than securities traders. They're 2.1% less likely to obtain a Master's Degree while being 0.5% less likely to earn a Doctoral Degree.Securities trader vs. Foreign exchange trader

The required skills of the two careers differ considerably. For example, securities traders are more likely to have skills like "securities," "risk management," "fixed income," and "fixed income trading." But a foreign exchange trader is more likely to have skills like "manage risk," "foreign exchange products," "foreign currency transactions," and "swaps."

Foreign exchange traders earn the best pay in the finance industry, where they command an average salary of $118,788. Securities traders earn the highest pay from the finance industry, with an average salary of $126,287.foreign exchange traders typically earn similar educational levels compared to securities traders. Specifically, they're 4.6% more likely to graduate with a Master's Degree, and 0.8% more likely to earn a Doctoral Degree.Securities trader vs. Bond trader

Types of securities trader

Updated January 8, 2025