Explore jobs

Find specific jobs

Explore careers

Explore professions

Best companies

Explore companies

What is a senior corporate accountant and how to become one

Senior corporate accountants are responsible for analyzing financial statements and forecasting industry trends, and determining risks. They ensure compliance with all financial requirements and advise management when necessary. They improve and record all accounting control procedures periodically. Likewise, they identify issues and suggest improvements. Additionally, they prepare budgets and monitor expenditures. Furthermore, they handle monthly, quarterly and annual closings and manage periodic reporting. Also, they oversee internal and external audits.

To become a senior corporate accountant, you need at least a bachelor's degree in accounting, finance, or a related field. Some employers prefer an MBA or CPA. Applicants must have three to five years of relevant work experience. You must have extensive knowledge of accounting regulations and practices. Essential skills include analytical, attention to detail, problem-solving, organization, leadership, and communication skills. You must be proficient in Microsoft Office and finance software. These accountants make about $85,440 in a year. This varies between $63,000 and $116,000.

What general advice would you give to a senior corporate accountant?

Most of the above remains true so the only open question is job availability. It would be unrealistic to say things are great. However, it seems that job prospects for accounting majors will be better than for those of virtually every other entry-level profession during difficult times. I have been speaking with firm leaders across the spectrum of firms and most do intend to be on campus in the fall recruiting season. Of course, they have a lot of time to learn more about the economy over the next few months, but we are cautiously optimistic. Again, I am confident that whatever the state of job availability for young CPAs-to-be, prospects will be better for accounting graduates than virtually any other profession.

They will be entering the profession at a fascinating moment in time. Of course, the technological advances assure this regardless of economic conditions. However, there are business disruption-related issues that will provide rich opportunities for making a difference. For example, audit staff will be working with clients to see them through these troubling times. Lamentably, I fear that these young professionals will learn more about the going concern determination than they desire to know. Tax staff will help clients to optimally use the tax loss carrybacks and carryforwards that are arising by the day. Entry level professionals in corporate accounting will get a day-to-day front row seat in business management through crisis. While lamentable times, these are times when young professionals can make a difference that saves jobs.

Avg. Salary $73,008

Avg. Salary $59,228

Growth rate 6%

Growth rate 0.3%

American Indian and Alaska Native 0.46%

Asian 14.11%

Black or African American 8.78%

Hispanic or Latino 11.13%

Unknown 3.97%

White 61.55%

Genderfemale 53.80%

male 46.20%

Age - 43American Indian and Alaska Native 3.00%

Asian 7.00%

Black or African American 14.00%

Hispanic or Latino 19.00%

White 57.00%

Genderfemale 47.00%

male 53.00%

Age - 43Stress level is manageable

7.1 - high

Complexity level is advanced

7 - challenging

Work life balance is good

6.4 - fair

Senior corporate accountant career paths

Key steps to become a senior corporate accountant

Explore senior corporate accountant education requirements

Start to develop specific senior corporate accountant skills

Skills Percentages Reconciliations 13.35% GAAP 9.39% SOX 4.56% External Auditors 4.44% Internal Controls 4.43% Complete relevant senior corporate accountant training and internships

Accountants spend an average of 1-3 months on post-employment, on-the-job training. New senior corporate accountants learn the skills and techniques required for their job and employer during this time. The chart below shows how long it takes to gain competency as a senior corporate accountant based on U.S. Bureau of Labor Statistics data and data from real senior corporate accountant resumes.Research senior corporate accountant duties and responsibilities

- Manage CAPEX and Hyperion reporting.

- Manage Sarbanes-Oxley documentation and perform the related testing in accordance with policy.

- Manage all treasury activity for corporate entities including daily cash management, monthly earn fee calculations, and property relate reimbursements.

- Prepare documentation in support of financial statements for SOX regulations, internal and external auditors.

Get senior corporate accountant experience

Generally, it takes 2-4 years to become a senior corporate accountant. The most common roles before becoming a senior corporate accountant include staff accountant, senior accountant team lead and accountant.Prepare your senior corporate accountant resume

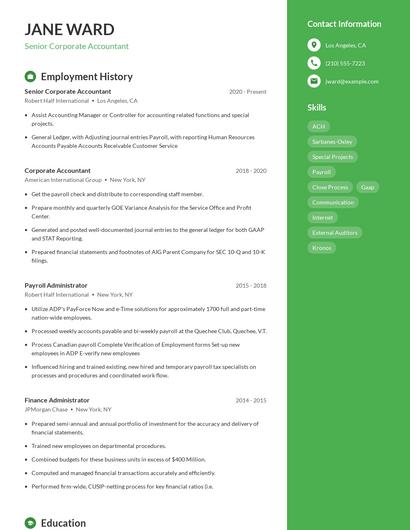

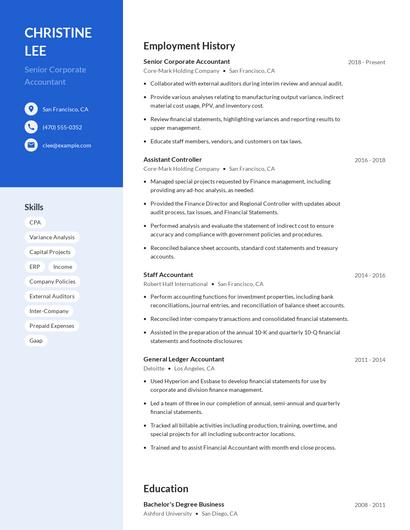

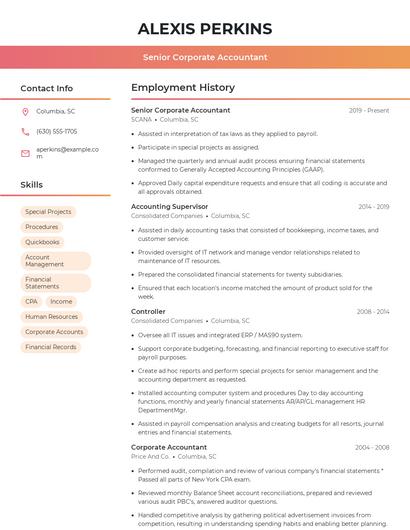

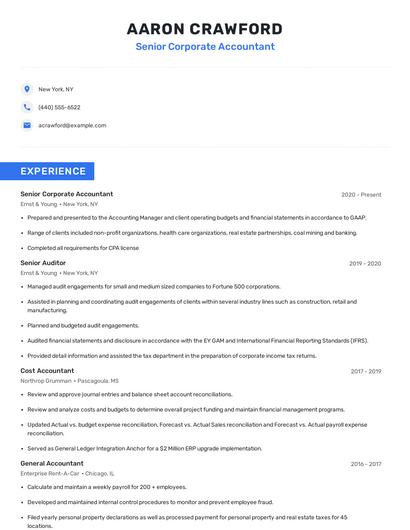

When your background is strong enough, you can start writing your senior corporate accountant resume.

You can use Zippia's AI resume builder to make the resume writing process easier while also making sure that you include key information that hiring managers expect to see on a senior corporate accountant resume. You'll find resume tips and examples of skills, responsibilities, and summaries, all provided by Zippi, your career sidekick.

Choose from 10+ customizable senior corporate accountant resume templates

Build a professional senior corporate accountant resume in minutes. Browse through our resume examples to identify the best way to word your resume. Then choose from 10+ resume templates to create your senior corporate accountant resume.Apply for senior corporate accountant jobs

Now it's time to start searching for a senior corporate accountant job. Consider the tips below for a successful job search:

- Browse job boards for relevant postings

- Consult your professional network

- Reach out to companies you're interested in working for directly

- Watch out for job scams

How did you land your first senior corporate accountant job

Are you a senior corporate accountant?

Share your story for a free salary report.

Average senior corporate accountant salary

The average senior corporate accountant salary in the United States is $73,008 per year or $35 per hour. Senior corporate accountant salaries range between $57,000 and $92,000 per year.

What am I worth?

How do senior corporate accountants rate their job?

Senior corporate accountant reviews

all finance transactions preparing finance reporting and presenting the yearly report to the managers

Reporting to a CPA Controller or CFO, always learning and not micromanaged. Treated as a professional always.

Business owners that do not know or understand compliance and GAAP, or the patience to follow the rules... generally common in small companies.

It's an office job.

Everything else. Too much anxiety, debts, low sallary (€700/month).