What does a senior energy trader do?

A senior energy trader's main goal is to build financial models so that their company can buy and sell energy shares. They must be extremely experienced in the trading of shares in the NYSE and/or NASDAQ securities. They establish their company in the market and square off deals to ensure profit.

They deal with equities, stocks, and mutual funds.

Senior energy trader responsibilities

Here are examples of responsibilities from real senior energy trader resumes:

- Hire and manage an experience team of NERC energy traders.

- Execute and manage spreads, cracks, and volatility portfolio futures and OTC.

- Project manage new commercial paper program conversion on Bloomberg trading system which streamline processing under tight time deadlines.

- Trade Asian equities & manage the global currency book for the firm's various mutual funds out of the

- Analyze and manage book liquidity and risk exposure including the Greeks, basis, FX, dividend, and expiry risks.

- Reconcile trades with strict adherence to FINRA guidelines regarding customer order handling which help to achieve a consistently clean compliance record.

- Utilize Bloomberg trading platform to monitor/analyze real-time financial market data.

- Tag flows using the OATI system.

- Trade both residential and commercial MBS for broker/dealer.

- Trade ADR's over dividend record dates for dividend enhancement.

- Produce industry marketing material and PowerPoint presentations for ETF road shows.

- Ensure trades settle with the NSCC and confirm accurate cash movement.

- Monitor high volume of NSCC trading, resolving reject and problematic trades.

- Establish markets and maintain positions in fix and floating rate MBS and CMO.

- Increase positive P/L positions or minimizing negative P/L positions until risk are diminished.

Senior energy trader skills and personality traits

We calculated that 12% of Senior Energy Traders are proficient in Risk Management, Portfolio Management, and Derivative. They’re also known for soft skills such as Analytical skills, Customer-service skills, and Detail oriented.

We break down the percentage of Senior Energy Traders that have these skills listed on their resume here:

- Risk Management, 12%

Direct accountability for analyzing, executing and overseeing all trading strategies, including developing risk management and trading models.

- Portfolio Management, 8%

Assisted portfolio management in developing policies for construction and guidelines for portfolio implementation.

- Derivative, 6%

Developed pricing and transaction cost minimizing systems for inflation-linked bond, emerging market bond and credit derivative trading utilizing statistical modeling.

- Fixed Income, 6%

Analyzed and processed both mandatory and voluntary equity and fixed income corporate actions.

- Financial Products, 5%

Worked with accountants to inform, and educated on new business, terminology, and market rules for all financial products.

- Trade Execution, 5%

Ensured accurate trade execution in fast moving global futures, commodities, and currency markets.

Most senior energy traders use their skills in "risk management," "portfolio management," and "derivative" to do their jobs. You can find more detail on essential senior energy trader responsibilities here:

Analytical skills. One of the key soft skills for a senior energy trader to have is analytical skills. You can see how this relates to what senior energy traders do because "to judge the profitability of potential deals, securities, commodities, and financial services sales agents must have strong analytical skills." Additionally, a senior energy trader resume shows how senior energy traders use analytical skills: "innovated and executed proprietary trading strategies derived through fundamental and technical analysis. "

Customer-service skills. Another essential skill to perform senior energy trader duties is customer-service skills. Senior energy traders responsibilities require that "securities, commodities, and financial services sales agents must be persuasive and make clients feel comfortable with the agent’s recommendations." Senior energy traders also use customer-service skills in their role according to a real resume snippet: "deployed vast amounts of firm capital to facilitate customer order flow and provide liquidity in order to trade sizable block transactions. "

Detail oriented. Another skill that relates to the job responsibilities of senior energy traders is detail oriented. This skill is critical to many everyday senior energy trader duties, as "investment bankers must pay close attention to the details of initial public offerings and mergers and acquisitions because small changes can have large consequences." This example from a resume shows how this skill is used: "provided detailed quantitative analysis for a trading portfolio. "

Initiative. A big part of what senior energy traders do relies on "initiative." You can see how essential it is to senior energy trader responsibilities because "securities, commodities, and financial services sales agents must create their own client base by making “cold” sales calls to people to whom they have not been referred and to people not expecting the call." Here's an example of how this skill is used from a resume that represents typical senior energy trader tasks: "lead trader in both executing arbitrage opportunities and compliance review cleanup initiatives. "

Math skills. Another common skill required for senior energy trader responsibilities is "math skills." This skill comes up in the duties of senior energy traders all the time, as "securities, commodities, and financial services sales agents need to be familiar with mathematical tools, including investment formulas." An excerpt from a real senior energy trader resume shows how this skill is central to what a senior energy trader does: "monitored physical markets, supply and demand statistics, refinery outages, and technical analysis. "

The three companies that hire the most senior energy traders are:

- Shell Trading3 senior energy traders jobs

- Bank of America2 senior energy traders jobs

- Citi2 senior energy traders jobs

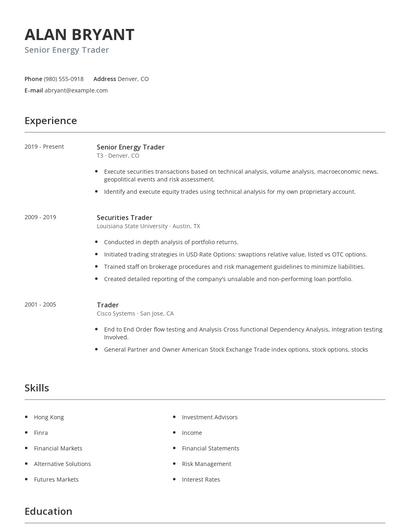

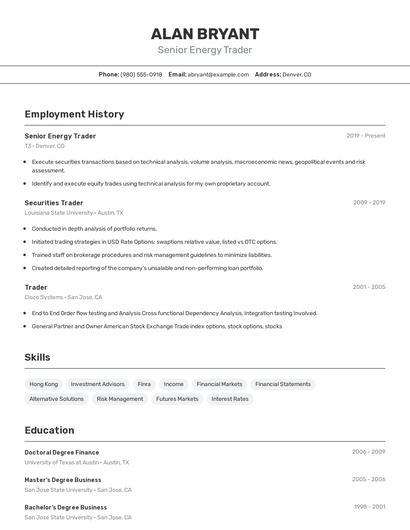

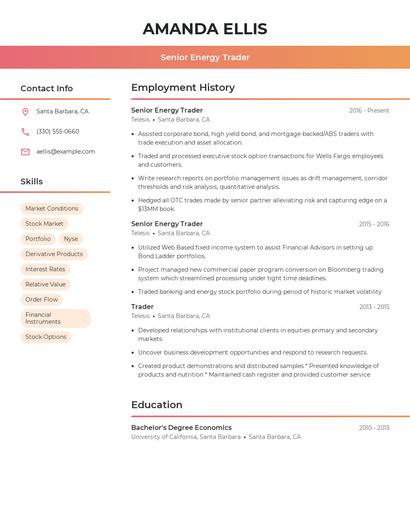

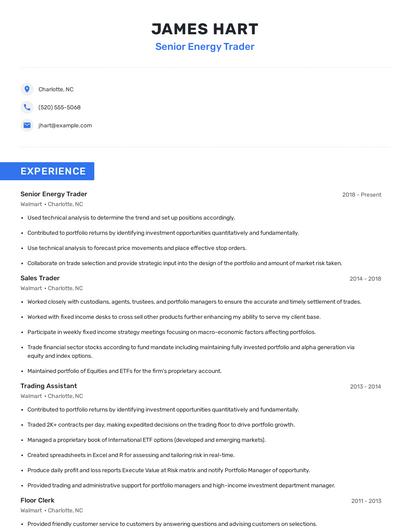

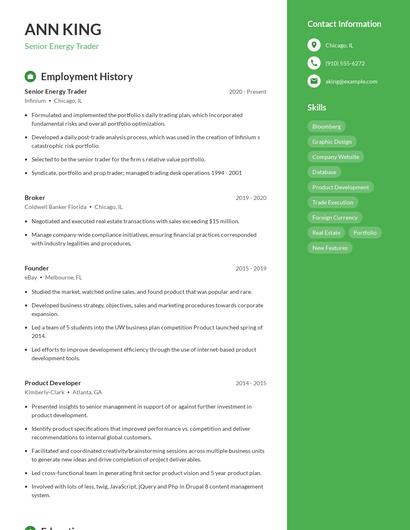

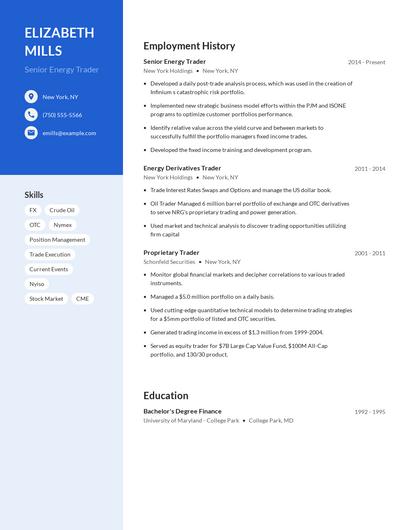

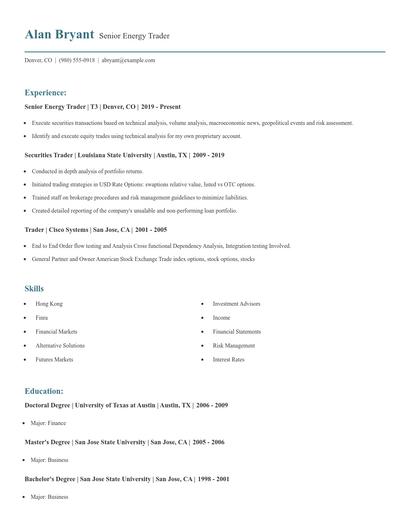

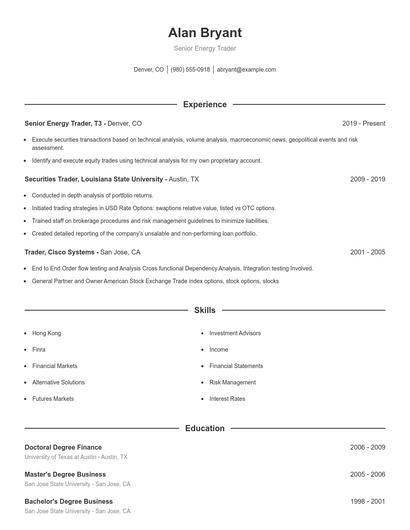

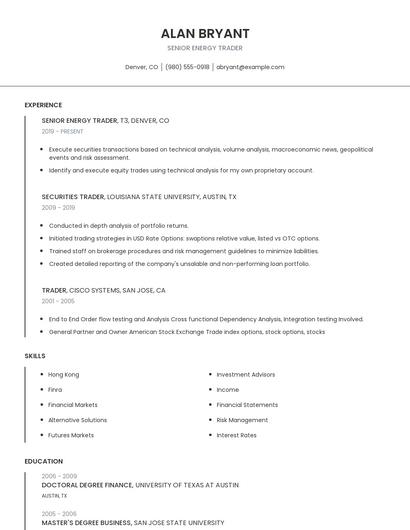

Choose from 10+ customizable senior energy trader resume templates

Build a professional senior energy trader resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your senior energy trader resume.Compare different senior energy traders

Senior energy trader vs. Commodity broker

A trader is responsible for buying and selling financial instruments for a firm or an individual, monitoring stock movements, and analyzing price fluctuations. Traders focus on short-term and long-term trades, depending on their customers' demands and best interests. In some cases, traders also act as financial advisors to their clients, providing financial management support, and handling their account investments. A trader must have excellent knowledge of the financial industry and must be highly-analytical, dealing with consistent changes in the stock market and maintain smart decisions to achieve their clients' financial goals.

While similarities exist, there are also some differences between senior energy traders and commodity broker. For instance, senior energy trader responsibilities require skills such as "portfolio management," "fixed income," "financial products," and "trade execution." Whereas a commodity broker is skilled in "commodities," "client accounts," "nfa," and "cold calls." This is part of what separates the two careers.

Commodity brokers tend to make the most money working in the finance industry, where they earn an average salary of $89,520. In contrast, senior energy traders make the biggest average salary, $118,871, in the finance industry.The education levels that commodity brokers earn slightly differ from senior energy traders. In particular, commodity brokers are 7.6% less likely to graduate with a Master's Degree than a senior energy trader. Additionally, they're 0.2% less likely to earn a Doctoral Degree.Senior energy trader vs. Trader

A Hedge Fund Trader specializes in developing investment strategies through market research and analysis. Although the extent of their duties depends on their company of employment, it typically includes managing and monitoring market portfolios, trading according to policies and regulations, reaching out to potential business partners through calls and correspondence, discussing terms, and keeping an eye on stock prices. A Hedge Fund Trader must maintain an active communication line with staff for an efficient and fruitful workflow.

Each career also uses different skills, according to real senior energy trader resumes. While senior energy trader responsibilities can utilize skills like "risk management," "portfolio management," "financial products," and "treasury," traders use skills like "portfolio," "p/l," "commodities," and "vba."

Traders earn a lower average salary than senior energy traders. But traders earn the highest pay in the finance industry, with an average salary of $108,107. Additionally, senior energy traders earn the highest salaries in the finance with average pay of $118,871 annually.Average education levels between the two professions vary. Traders tend to reach similar levels of education than senior energy traders. In fact, they're 4.1% less likely to graduate with a Master's Degree and 0.2% less likely to earn a Doctoral Degree.Senior energy trader vs. Futures trader

There are many key differences between these two careers, including some of the skills required to perform responsibilities within each role. For example, a senior energy trader is likely to be skilled in "portfolio management," "fixed income," "financial products," and "securities," while a typical futures trader is skilled in "futures contracts," "commodities," "financial data," and "equity futures."

Futures traders earn the best pay in the finance industry, where they command an average salary of $116,582. Senior energy traders earn the highest pay from the finance industry, with an average salary of $118,871.Most futures traders achieve a similar degree level compared to senior energy traders. For example, they're 3.7% less likely to graduate with a Master's Degree, and 0.3% less likely to earn a Doctoral Degree.Senior energy trader vs. Hedge fund trader

Types of senior energy trader

Updated January 8, 2025