What does a senior examiner do?

A senior examiner networks with team members from different departments to achieve the common goals of the company. They take recommendations from external clients and the members of the company and convey those recommendations to their team members. They must possess excellent oral and verbal communication skills.

Senior examiner responsibilities

Here are examples of responsibilities from real senior examiner resumes:

- Manage country wide litigate and non-litigate claims for TPA construction program.

- Check vitals, blood draws, EKG's, urine collects, and processing all the paper work.

- Conduct EKG and mount for submission.

- Provide scheduling, training, review and coordinate contact between bank and FDIC personnel.

- Perform BSA/AML compliance examinations in assign institutions.

- Make written recommendations to FDIC's senior executive management on least-cost litigation resolution strategies.

- Provide comprehensive written and verbal reports of regulatory concerns note during the examinations to member firm executives and FINRA's management.

- Supervise examiners while acting as examiner-in-charge.

- Perform such examinations as the examiner-in-charge.

- Collect blood, urine, and ECG.

- Mount ECG strips for interpretation.

- Monitor drug court veterans using computer databases and making contact with multiple government agencies.

Senior examiner skills and personality traits

We calculated that 12% of Senior Examiners are proficient in Risk Management, Digital Forensics, and Encase. They’re also known for soft skills such as Writing skills, Analytical skills, and Detail oriented.

We break down the percentage of Senior Examiners that have these skills listed on their resume here:

- Risk Management, 12%

Evaluated risk management, capital protection, liquidity, earnings and asset quality at complex financial institutions.

- Digital Forensics, 9%

Developed digital forensics training programs to support the implementation of device forensics into intelligence support requirements.

- Encase, 7%

Perform Forensic collections and investigations using Forensic software and hardware including EnCase, FTK, NUIX, Tableau and Aid4Mail.

- Financial Institutions, 6%

Collaborated with financial institutions, government agencies, foundations and community-based groups to broker partnerships among not-for-profits and sources of financing.

- Regulatory Agencies, 5%

Prepared final examination reports of findings and communicated recommendations for corrective action to management, member firms and other regulatory agencies.

- Extraction, 5%

Determine fraud and misappropriations through utilization of data extraction and analysis software and forensic audit techniques.

"risk management," "digital forensics," and "encase" are among the most common skills that senior examiners use at work. You can find even more senior examiner responsibilities below, including:

Writing skills. The most essential soft skill for a senior examiner to carry out their responsibilities is writing skills. This skill is important for the role because "financial examiners regularly write reports on the safety and soundness of financial institutions." Additionally, a senior examiner resume shows how their duties depend on writing skills: "presented findings and recommendations, orally and in writing, to senior management and finra s enforcement attorneys. "

Analytical skills. Another essential skill to perform senior examiner duties is analytical skills. Senior examiners responsibilities require that "financial examiners need to evaluate how well the managers of financial institutions are handling risk and whether the individual loans the institution makes are safe." Senior examiners also use analytical skills in their role according to a real resume snippet: "analyzed financial reports and other relevant data to ensure compliance with all regulations. "

Detail oriented. Another skill that relates to the job responsibilities of senior examiners is detail oriented. This skill is critical to many everyday senior examiner duties, as "financial examiners must pay close attention to minutiae when reviewing balance sheets in order to identify risky assets." This example from a resume shows how this skill is used: "prepared detailed audit reports, which are distributed to audit manager, portfolio managers and account executives. "

Math skills. senior examiner responsibilities often require "math skills." The duties that rely on this skill are shown by the fact that "financial examiners must do calculations and monitor balance sheets to ensure that a financial institution has available cash." This resume example shows what senior examiners do with math skills on a typical day: "performed qualitative, quantitative and compliance analysis of credit unions operations. "

The three companies that hire the most senior examiners are:

- Federal Reserve Bank6 senior examiners jobs

- Raphael & Associates6 senior examiners jobs

- Novetta

5 senior examiners jobs

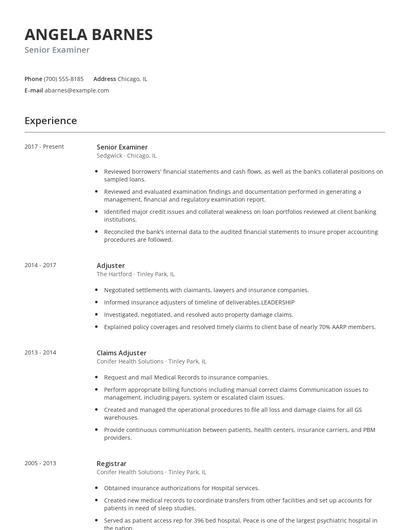

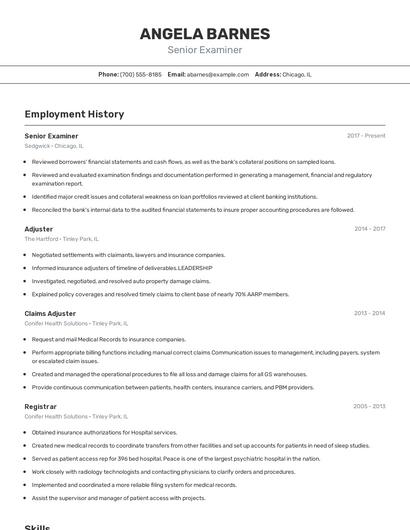

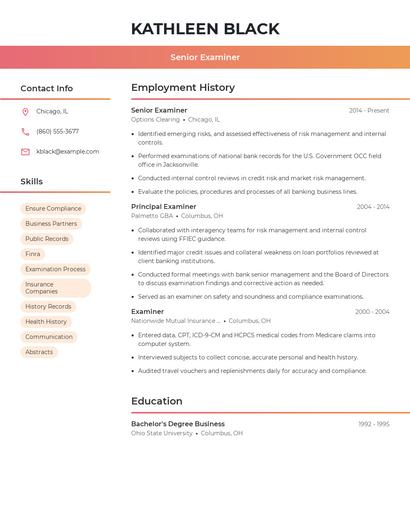

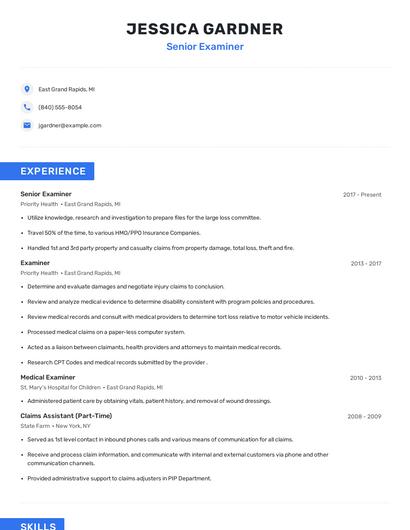

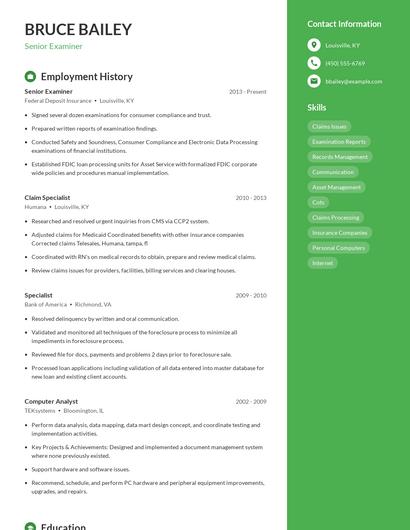

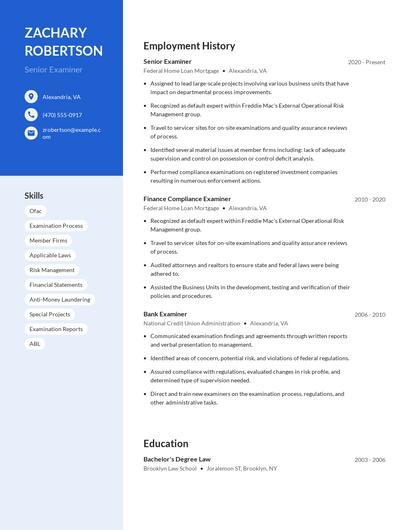

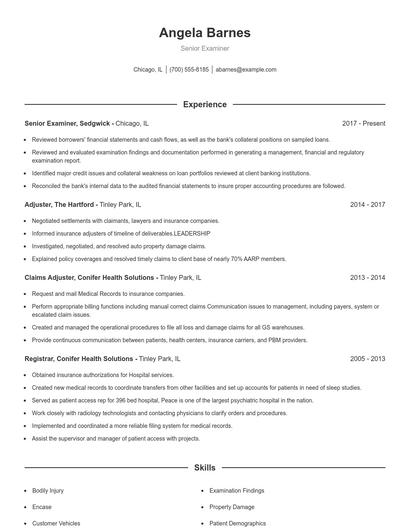

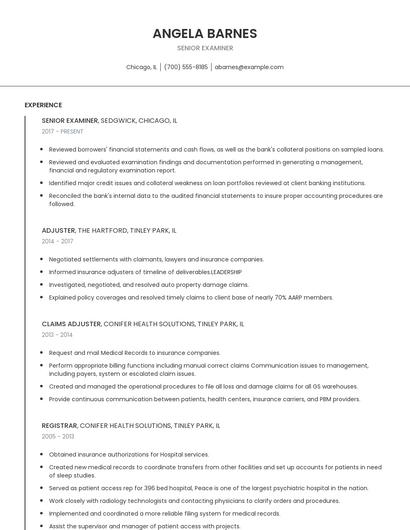

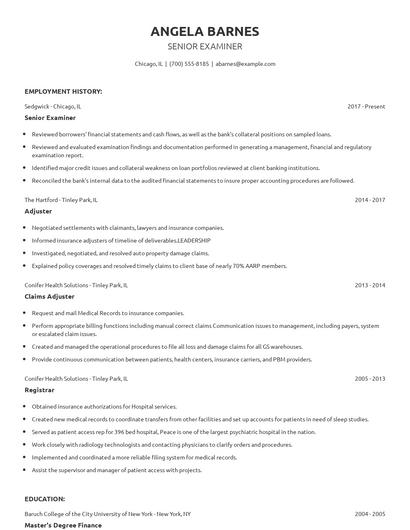

Choose from 10+ customizable senior examiner resume templates

Build a professional senior examiner resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your senior examiner resume.Compare different senior examiners

Senior examiner vs. Community reinvestment act officer

These skill sets are where the common ground ends though. The responsibilities of a senior examiner are more likely to require skills like "risk management," "digital forensics," "encase," and "financial institutions." On the other hand, a job as a community reinvestment act officer requires skills like "affordable housing," "payment assistance," "occ," and "bank management." As you can see, what employees do in each career varies considerably.

The education levels that community reinvestment act officers earn slightly differ from senior examiners. In particular, community reinvestment act officers are 14.1% less likely to graduate with a Master's Degree than a senior examiner. Additionally, they're 2.4% less likely to earn a Doctoral Degree.Senior examiner vs. Examination proctor

While some skills are similar in these professions, other skills aren't so similar. For example, resumes show us that senior examiner responsibilities requires skills like "risk management," "digital forensics," "encase," and "financial institutions." But an examination proctor might use other skills in their typical duties, such as, "test materials," "examination procedures," "test administration," and "test room."

Average education levels between the two professions vary. Examination proctors tend to reach similar levels of education than senior examiners. In fact, they're 3.6% less likely to graduate with a Master's Degree and 2.4% less likely to earn a Doctoral Degree.Senior examiner vs. Senior capital markets specialist

Some important key differences between the two careers include a few of the skills necessary to fulfill the responsibilities of each. Some examples from senior examiner resumes include skills like "risk management," "digital forensics," "encase," and "financial institutions," whereas a senior capital markets specialist is more likely to list skills in "derivative," "treasury," "fixed income," and "advisory services. "

Most senior capital markets specialists achieve a higher degree level compared to senior examiners. For example, they're 13.9% more likely to graduate with a Master's Degree, and 2.4% more likely to earn a Doctoral Degree.Senior examiner vs. Examining officer

Types of senior examiner

Updated January 8, 2025