What does a vice president, fixed income do?

Vice president, fixed income responsibilities

Here are examples of responsibilities from real vice president, fixed income resumes:

- Manage company's relationship with SIFMA and coordinate with them on MBS trading and settlement-relate issues.

- Help manage agency MBS portfolio with goals to outperform index and mandates, complacent with book yield requirements and income needs.

- Design and manage multiple evidence-base healthcare solutions for population health and analytics in alignment with the organizational mission.

- Develop marketing strategies for high yield/distress, mortgage-backed securities, corporate, commercial mortgage-backed securities and municipal bonds sales.

- Code a few key JAVA middle tier components.

- Automate download of historic and/or bulk data from Bloomberg base on date range and list of tickers provide.

- Code all the middle tier components in JAVA and implement mathematical and statistical components used for the ranking calculations.

- Develop financial models to optimize debt structures using traditional and derivative products.

- Source, structure and market credit derivative products globally for managers and investors.

- Leverage Bloomberg, proprietary applications, and Internet sources for information and inventory.

- Specialize in European bonds during highly volatile market conditions, and outperform performance benchmarks.

- Research potential portfolio additions, trade securities at market time opportunities and adjust investment programs for optimal portfolio performance.

- Research and evaluate sovereign risk exposure embed in clients' portfolios directly through government bonds and indirectly through corporate credit.

- Develop and oversee management of major investment in food brokerage businesses that result in numerous regional acquisitions and industry consolidation.

- Monitor preparation of asset/liability management report.

Vice president, fixed income skills and personality traits

We calculated that 16% of Vice Presidents, Fixed Income are proficient in Fixed Income, Portfolio Management, and Securities. They’re also known for soft skills such as Detail oriented, Math skills, and Organizational skills.

We break down the percentage of Vice Presidents, Fixed Income that have these skills listed on their resume here:

- Fixed Income, 16%

Led taxable and tax-exempt sector and security selection, credit evaluations of new fixed income investment offerings/opportunities for the subsidiary portfolios.

- Portfolio Management, 7%

Directed all phases of portfolio management from strategy development and implementation of the initial investment to reviewing results with clients.

- Securities, 6%

Introduced and implemented securities lending to the Evergreen funds and separately managed accounts resulting in increased revenues and enhanced portfolio returns.

- Risk Management, 5%

Developed internal credit-rating models and served as liaison between credit-risk management and business analysts for trading- and credit-systems development projects.

- Income Products, 5%

Focused on full spectrum of fixed-income products, invested in a variety of fund vehicles and separate accounts.

- Asset Classes, 4%

Identify and adjust sector weightings across asset classes, including U.S. Treasuries, TIPS, Agencies, MBS, and CMBS.

Common skills that a vice president, fixed income uses to do their job include "fixed income," "portfolio management," and "securities." You can find details on the most important vice president, fixed income responsibilities below.

Detail oriented. One of the key soft skills for a vice president, fixed income to have is detail oriented. You can see how this relates to what vice presidents, fixed income do because "in preparing and analyzing reports, such as balance sheets and income statements, financial managers must be precise and attentive to their work in order to avoid errors." Additionally, a vice president, fixed income resume shows how vice presidents, fixed income use detail oriented: "enhanced client relationships through responsiveness, special attention to detail, and forming strong business alliances. "

Math skills. Many vice president, fixed income duties rely on math skills. "financial managers need strong skills in certain branches of mathematics, including algebra," so a vice president, fixed income will need this skill often in their role. This resume example is just one of many ways vice president, fixed income responsibilities rely on math skills: "validated monthly ticketing statistics for derivative billing to hedge fund clients. "

Organizational skills. vice presidents, fixed income are also known for organizational skills, which are critical to their duties. You can see how this skill relates to vice president, fixed income responsibilities, because "because financial managers deal with a range of information and documents, they must have structures in place to be effective in their work." A vice president, fixed income resume example shows how organizational skills is used in the workplace: "manage finance, operations, new business development and key client account relationships to achieve organizational objectives. "

Analytical skills. A big part of what vice presidents, fixed income do relies on "analytical skills." You can see how essential it is to vice president, fixed income responsibilities because "to assist executives in making decisions, financial managers need to evaluate data and information that affects their organization." Here's an example of how this skill is used from a resume that represents typical vice president, fixed income tasks: "analyzed and implemented trade ideas for synthetic cdo's. "

Communication skills. Another common skill required for vice president, fixed income responsibilities is "communication skills." This skill comes up in the duties of vice presidents, fixed income all the time, as "financial managers must be able to explain and justify complex financial transactions." An excerpt from a real vice president, fixed income resume shows how this skill is central to what a vice president, fixed income does: "maintain ongoing communication of market data to portfolio managers and analysts. "

The three companies that hire the most vice president, fixed incomes are:

- BlackRock7 vice presidents, fixed income jobs

- Deutsche Bank3 vice presidents, fixed income jobs

- First Republic Bank

2 vice presidents, fixed income jobs

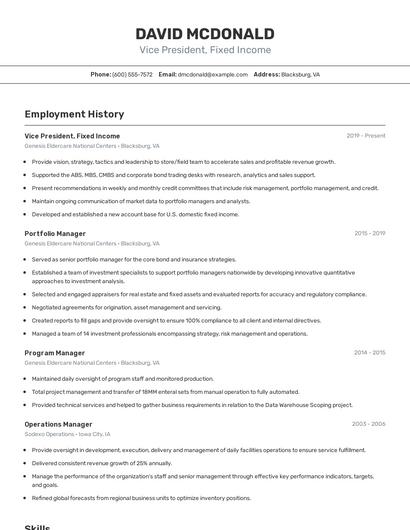

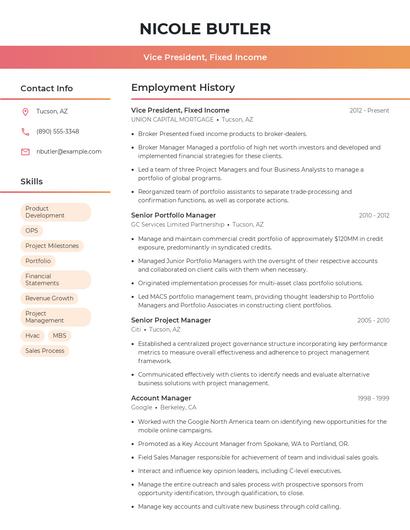

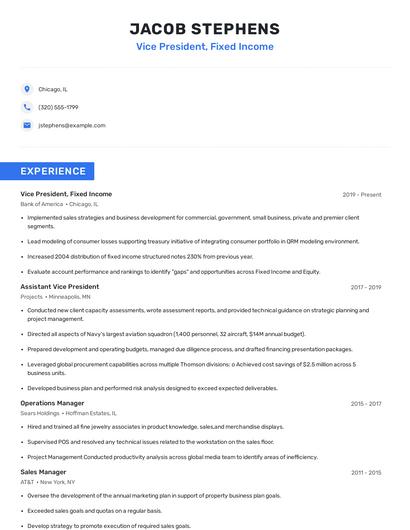

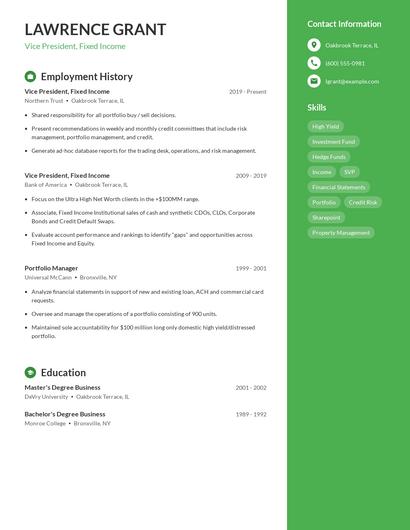

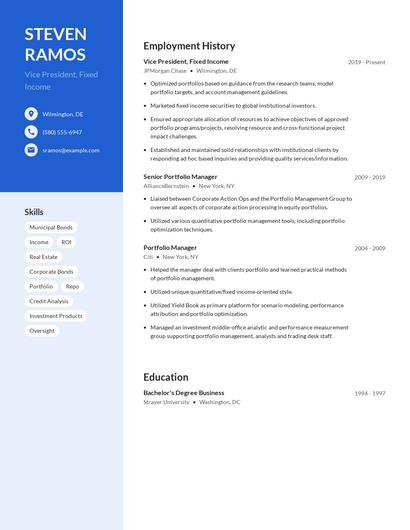

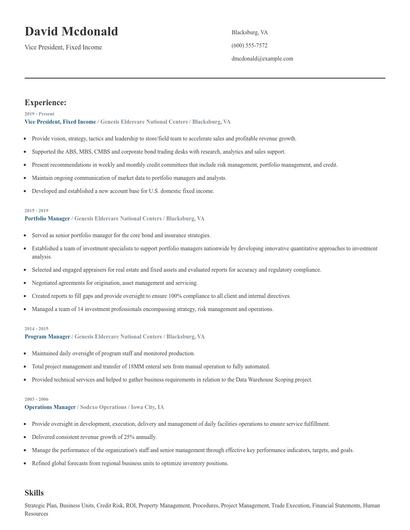

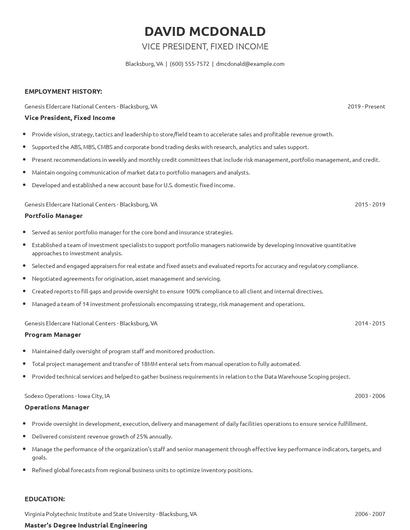

Choose from 10+ customizable vice president, fixed income resume templates

Build a professional vice president, fixed income resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your vice president, fixed income resume.Compare different vice presidents, fixed income

Vice president, fixed income vs. Tax manager

A Tax Manager is responsible for managing tax reporting and compliance within an organization. They provide innovative tax planning and prepare state and federal tax returns for companies.

These skill sets are where the common ground ends though. The responsibilities of a vice president, fixed income are more likely to require skills like "fixed income," "portfolio management," "risk management," and "income products." On the other hand, a job as a tax manager requires skills like "cpa," "tax planning," "tax compliance," and "taxation." As you can see, what employees do in each career varies considerably.

Tax managers really shine in the finance industry with an average salary of $96,231. Comparatively, vice presidents, fixed income tend to make the most money in the finance industry with an average salary of $169,862.On average, tax managers reach similar levels of education than vice presidents, fixed income. Tax managers are 3.2% more likely to earn a Master's Degree and 1.0% more likely to graduate with a Doctoral Degree.Vice president, fixed income vs. Collections manager

A collections manager is an individual who manages a staff of collectors whose job is to contact companies and individuals for the late payments on the products and services they have received. Collections managers oversee a company's process of retrieving money owed to them by assigning collectors to collect the money. They are required to handle customer complaints and must negotiate with customers about payment arrangements to ensure they are being paid. They also provide reports on the collection department's progress, statistics, and data analysis.

Each career also uses different skills, according to real vice president, fixed income resumes. While vice president, fixed income responsibilities can utilize skills like "fixed income," "portfolio management," "securities," and "risk management," collections managers use skills like "customer service," "collection management," "portfolio," and "fdcpa."

Collections managers may earn a lower salary than vice presidents, fixed income, but collections managers earn the most pay in the health care industry with an average salary of $60,577. On the other hand, vice presidents, fixed income receive higher pay in the finance industry, where they earn an average salary of $169,862.Average education levels between the two professions vary. Collections managers tend to reach lower levels of education than vice presidents, fixed income. In fact, they're 12.3% less likely to graduate with a Master's Degree and 1.0% less likely to earn a Doctoral Degree.Vice president, fixed income vs. Portfolio manager

A portfolio manager is responsible for managing the clients' investment portfolios to advise them of the best investment plans to achieve their financial goals and objectives. Portfolio managers determine the most suitable options by evaluating the clients' credit score and risk potential and the client's financial background. A portfolio manager should be highly knowledgeable and updated with the recent financial industry changes to decide on investment plans with maximum returns.

The required skills of the two careers differ considerably. For example, vice presidents, fixed income are more likely to have skills like "income products," "asset classes," "capital markets," and "bonds." But a portfolio manager is more likely to have skills like "customer service," "project management," "financial statements," and "real estate."

Portfolio managers earn the best pay in the finance industry, where they command an average salary of $135,937. Vice presidents, fixed income earn the highest pay from the finance industry, with an average salary of $169,862.When it comes to education, portfolio managers tend to earn similar degree levels compared to vice presidents, fixed income. In fact, they're 0.4% less likely to earn a Master's Degree, and 0.7% less likely to graduate with a Doctoral Degree.Vice president, fixed income vs. Accounts receivable manager

An accounts receivable manager is responsible for overseeing the financial matters in a business or company, focusing on the generated sales and income. Moreover, they are also responsible for maintaining an accurate and efficient collection of payments, conducting research and analysis, and supervising the workforce, striving to meet all the goals within the allotted time. As a manager in the department, it is also vital to lead fellow skilled professionals and implement the policies and regulations of the company or organization.

Types of vice president, fixed income

Updated January 8, 2025