- Industry Statistics

- Wedding Industry Statistics

- Yoga Industry Statistics

- Music Industry Statistics

- Landscaping Industry Statistics

- Bicycle Industry Statistics

- Coffee Industry Statistics

- Car Rental Industry Statistics

- Home Improvement Industry Statistics

- Insurance Industry Statistics

- Supplements Industry Statistics

- Golf Industry Statistics

- Fitness Industry Statistics

- US Media And Entertainment Industry Statistics

- Firearm Industry Statistics

- Financial Services Industry Statistics

- Health And Wellness Industry Statistics

- Trucking Industry Statistics

- Wine Industry Statistics

- Pet Industry Statistics

- Mobile App Industry Statistics

- Digital Marketing Industry Statistics

- Hotel Industry Statistics

- Retail Statistics

- Robotics Industry Statistics

- Jewelry Industry Statistics

- Appointment Scheduling statistics

- Restaurant Industry Statistics

- Food Delivery Statistics

- Food Truck Industry

- Fashion Industry

- Real Estate Industry

- US Film Industry

- US Beverage Industry

- USu202fFast Food Restaurants

- US Construction Industry

- US Book Industry

- Cosmetics Industry

- US Food Retail Industry

- US Pharmaceutical Industry

- US Healthcare Industry

- Airline Industry

- Automobile Industry

- Transportation Industry Statistics

- Event Industry Statistics

- Project Management Statistics

- Oil And Gas Industry Statistics

- Nursing Home Statistics

- Nursing Shortage Statistics

- Nursing Statistics

Fitness industry research summary. The fitness industry has continued to thrive in recent years, fueled by a growing consumer dedication to health and wellness. Below are the essential fitness industry and gym statistics globally and within the U.S.:

-

The global fitness industry market value exceeds $96.7 billion

-

The U.S. fitness industry revenue in 2023 reached $35.03 billion

-

In the United States, 40% of Americans currently hold gym memberships

-

From now until 2028, the fitness industry is projected to grow 171.75% to $434.74 billion

-

The online fitness sector is anticipated to grow at a rate of 33.10% annually until 2028

For further insights, we’ve categorized the data as follows:

Gym Members and Fitness Consumers | Gym Member Demographics | Health and Fitness Clubs | Post-Pandemic Developments

Fitness industry trends and projections

The fitness industry has evolved with shifting consumer preferences. From the rise of Yoga to an increasing number of gym memberships, fitness remains a top priority. Here are the latest trends and projections for the industry:

-

The fitness industry has been expanding at an average rate of 8.7% per year.

While prices for gym memberships and fitness programs have remained stable, more individuals are prioritizing their physical health. The benefits of fitness extend beyond weight loss and energy boosts; they positively impact mental well-being as well.

-

Between 2011-2023, revenue for gyms and health centers in the U.S. has shown consistent annual growth.

The shift towards online fitness options accelerated during the pandemic; revenue for gym memberships has since rebounded and continues to rise.

-

The fitness industry revenue saw a decline of 32.45% in 2020 but has rebounded to pre-pandemic levels by 2021.

The health sector most affected during 2020-2021 were gyms and health centers, but by the end of 2021, they were only down 22.5% from 2019 levels.

Meanwhile, the online fitness market surged by 66.32% compared to pre-pandemic levels.

-

By 2028, U.S. fitness industry revenue is expected to reach $434.74 billion.

This growth reflects an annual increase of 33.10% from 2021 to 2028, with the online/digital fitness segment projected to grow an astounding 640.1% during this period.

-

Predictions indicate that by 2030, the fitness industry will boast 230 million members.

The U.S. currently leads the world in gym industry revenue. To maintain this status, an increase of 15.6 million members or approximately 1.33 million new gym members per year is required.

-

The online fitness sector is projected to grow at a compound annual growth rate (CAGR) of 33.5% from 2020 to 2027.

This robust growth is largely attributed to the convenience of virtual workouts, allowing individuals to exercise from home.

Fitness industry statistics by gym members and fitness consumers

The fitness industry thrives on gym memberships, with millions of Americans participating regularly. Here are some compelling statistics regarding gym members and fitness consumers:

-

Approximately 64.19 million Americans are members of a gym or health club.

This translates to roughly 19% of the U.S. population holding a gym membership, with about 49.9% of Americans visiting the gym at least twice a week.

Total number of gym memberships each year

Year Total Number of Gym Memberships 2023 64.19M 2019 64.2M 2018 62.5M 2017 60.9M 2016 57.3M 2015 55.3M 2014 54.1M 2013 52.9M 2012 50.2M -

The average American spends less than $30 per month on a gym membership in the United States.

Pricing varies based on location, equipment, classes, and facilities. Budget gyms can charge as low as $10 per month, whereas premium fitness clubs may cost up to $100 monthly. Additional costs may include initiation and annual fees.

-

Boutique fitness studios account for 42% of all gym memberships.

These smaller facilities focus on group classes and specialize in specific fitness areas, typically charging two to four times more than traditional health clubs. This segment is expected to continue its upward trajectory, with projections indicating nearly 17% growth by 2025.

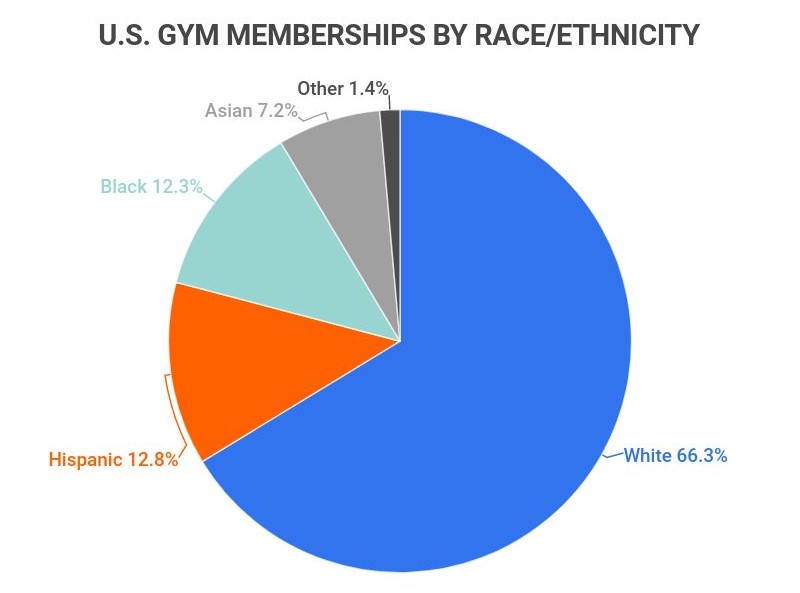

Fitness industry statistics by gym member demographics

Gym memberships in the fitness industry show varied popularity among different demographics. Our analysis reveals the following breakdown:

-

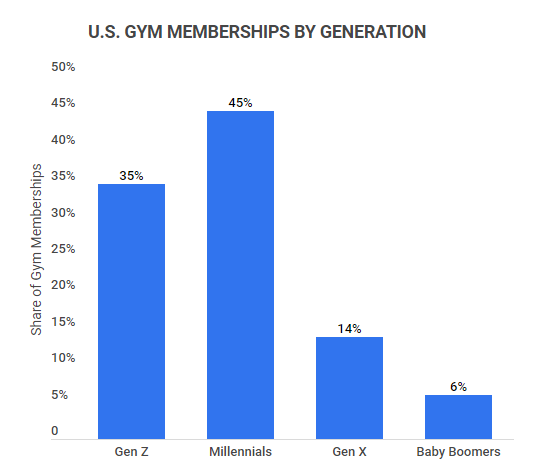

The generational distribution of gym memberships is as follows:

-

Gen Z (born 1994-2012): 35%

-

Millennials (born 1979-1993): 45%

-

Gen X (born 1964-1978): 14%

-

Baby Boomers (born 1949-1963): 6%

-

Fitness industry statistics by health and fitness clubs

The fitness industry encompasses numerous clubs offering services to members. Despite challenges faced during the COVID-19 pandemic, many have shown resilience and recovery by 2023.

-

Currently, there are 32,270 health and fitness clubs in the United States.

The pandemic led to a decline in the number of health and fitness clubs, resulting in a revenue loss of $29.2 billion between March 2020 and June 2021.

-

Globally, there are over 200,000 health and fitness clubs.

The United States, Germany, and the United Kingdom account for the highest number of fitness club memberships.

-

The United States leads globally in gym members, number of gyms, and revenue generation.

The U.S. has 64.19 million gym members, while Germany follows with 11.66 million. The U.S. is home to 41,190 gyms, with Brazil in second place at 29,525 gyms. The U.S. generated $35.03 billion in revenue, with Germany trailing at $6.17 billion.

Number of health clubs by country

Country Total Number of Health Clubs United States 41,190 Brazil 29,525 Mexico 12,871 Germany 9,669 Argentina 7,910 Italy 7,760 United Kingdom 7,239 South Korea 6,590 Canada 6,587 Japan 4,950

Fitness industry statistics and post-pandemic developments

The fitness industry was significantly impacted by the COVID-19 pandemic. Many gyms and clubs faced closures, resulting in revenue losses exceeding 30%. Here’s how the pandemic shaped the fitness landscape:

-

The fitness industry saw a revenue decline of 32.45% between 2019 and 2020.

Gyms, health clubs, and boutique fitness studios were among the hardest hit during the pandemic.

-

In 2020, 75% of active adults utilized live streaming workouts, while 70% engaged with on-demand workouts.

The demand for on-demand workout videos surged by 311%, and the popularity of live streaming workouts skyrocketed by 971%. From March to August 2020, time spent streaming health and fitness content increased by 1,300%.

-

Globally, the home fitness equipment market grew by 40.4% from 2019 to 2020.

This market expanded from $6.76 billion in 2019 to $9.49 billion in 2020. However, it is projected to decline by 3.16% by 2023 as gyms and fitness centers reopen.

-

By the end of 2021, the global fitness industry revenue had returned to pre-pandemic levels.

Following a significant drop in 2020, the revenue rebounded to approximately $107.48 billion.

-

The online fitness industry was valued at $6.04 billion in 2019.

The pandemic propelled its growth by 77.33%, making it the fastest-growing segment in the fitness industry, offering a wide range of niche classes and on-demand videos that traditional gyms struggle to compete with.

Fitness industry statistics FAQ

-

How much is the U.S. fitness industry worth?

The U.S. fitness industry is valued at $35.03 billion. Despite experiencing a notable decline due to the pandemic, the market has demonstrated remarkable adaptability, particularly with the rise of online and virtual fitness opportunities.

The United States remains the largest fitness market globally, leading in both revenue and membership, with 64.19 million gym members.

-

Is the fitness industry growing?

Yes, the fitness industry is experiencing growth. Over the past decade, the industry has grown at a rate of 3-4% annually, with similar growth projected in the future. Job outlook data indicates a 13% growth for trainers and fitness instructors by 2028.

-

Is the fitness industry profitable?

Yes, the fitness industry is highly profitable. It is valued at over $96.7 billion globally, with consistent growth expected at a rate of 3-4% annually. Reasons for this profitability include:

-

A surge in new gyms and health clubs

-

An increasing number of people prioritizing health and fitness

-

Virtual fitness options accommodating those with limited time to visit gyms

-

Affordable gyms making fitness accessible to a broader audience

-

-

Is the fitness industry competitive?

The fitness industry is highly competitive. Large, all-inclusive clubs face competition from smaller boutique studios, which currently account for 42% of all gym memberships. However, the most significant competition arises from online and digital fitness platforms.

This sector is growing at a rate of 33.10% annually, while traditional gym growth is forecasted at only 7.21% per year.

-

Is the online fitness industry saturated?

Yes, the online fitness industry is notably saturated. Social media has simplified the process for individuals to become trainers or health coaches, leading to a surge in competition. Despite this saturation, the online fitness market is expected to continue expanding.

-

Who are the main competitors in the health and fitness market in the U.S.?

The primary competitors in the U.S. health and fitness market include Anytime Fitness, L.A. Fitness, and Planet Fitness. Anytime Fitness is the largest for-profit chain with 2,175 clubs across North America. L.A. Fitness ranks as the most profitable fitness company for six consecutive years, while Planet Fitness is recognized as the top budget-friendly gym option.

-

How has the pandemic changed the fitness industry?

The pandemic has forever altered the fitness landscape. It has prompted many individuals to prioritize their health, while social distancing measures accelerated the growth of virtual fitness solutions. There are now more fitness options than ever, making it easier for people to incorporate fitness into their lives, regardless of their budget or circumstances.

Conclusion

The fitness industry has undergone profound transformations in recent years. Globally, individuals are placing a higher emphasis on health and fitness than ever before. The market size of the fitness industry has surged, and the number of gyms, health clubs, and online fitness options continues to expand.

The most significant shift has been in the realm of virtual and online fitness. Users are gravitating towards the convenience of on-demand workouts from home, with offerings tailored to specific demographics and interests. Wearable technology continues to be a leading trend, with approximately one in five Americans using smartwatches or fitness trackers.

References

-

ClubIntel. “230 by 2030 Implications for the U.S. Market.” Accessed on November 17, 2022.

-

BlobeNewswire. “Compete: Global Virtual Fitness Market to Hit $59,650.3 Million By 2027.” Accessed on November 17, 2022.

-

IHRSA Media Center. “Sharing the benefits of physical activity.” Accessed on November 17, 2022.

-

Forbes. “The Six Reasons the Fitness Industry is Booming.” Accessed on November 17, 2022

-

FinancesOnline. “87 Gym Membership Statistics You Must Learn: 2023 Cost, Demographics, and Market Share.” Accessed on March 12, 2023.

-

LiveStrong.Com. “113 Gym Membership Statistics You Need to Know.” Accessed on March 12, 2023.

- Industry Statistics

- Wedding Industry Statistics

- Yoga Industry Statistics

- Music Industry Statistics

- Landscaping Industry Statistics

- Bicycle Industry Statistics

- Coffee Industry Statistics

- Car Rental Industry Statistics

- Home Improvement Industry Statistics

- Insurance Industry Statistics

- Supplements Industry Statistics

- Golf Industry Statistics

- Fitness Industry Statistics

- US Media And Entertainment Industry Statistics

- Firearm Industry Statistics

- Financial Services Industry Statistics

- Health And Wellness Industry Statistics

- Trucking Industry Statistics

- Wine Industry Statistics

- Pet Industry Statistics

- Mobile App Industry Statistics

- Digital Marketing Industry Statistics

- Hotel Industry Statistics

- Retail Statistics

- Robotics Industry Statistics

- Jewelry Industry Statistics

- Appointment Scheduling statistics

- Restaurant Industry Statistics

- Food Delivery Statistics

- Food Truck Industry

- Fashion Industry

- Real Estate Industry

- US Film Industry

- US Beverage Industry

- USu202fFast Food Restaurants

- US Construction Industry

- US Book Industry

- Cosmetics Industry

- US Food Retail Industry

- US Pharmaceutical Industry

- US Healthcare Industry

- Airline Industry

- Automobile Industry

- Transportation Industry Statistics

- Event Industry Statistics

- Project Management Statistics

- Oil And Gas Industry Statistics

- Nursing Home Statistics

- Nursing Shortage Statistics

- Nursing Statistics