- Business Statistics

- Startup Statistics

- Cloud Adoption Statistics

- Customer Loyalty Statistics

- Nonprofit Statistics

- Affiliate Marketing Statistics

- Cart Abandonment Rate Statistics

- Ridesharing Statistics

- Call Center Statistics

- eLearning statistics

- Customer Service Statistics

- Customer Experience statistics

- Entrepreneur Statistics

- Outsourcing Statistics

- Gross Revenue for Marketing and Advertising

- Sales Statistics

- MBA Statistics

- Average Small Business Revenue + Profit Margin

- How Much Do Employee Benefits Cost?

Research summary: As of 2026, the average cost of employee benefits for private industry workers is $12.50 per hour, which represents 30% of total employee compensation. Over the last few years, the costs of employee benefits have risen, influenced by economic factors such as inflation and changes in labor market dynamics.

The cost of employee benefits is continually evolving. Here’s a comprehensive overview of the costs in 2026 based on our latest research.

-

Employee benefits cost an average of $12.50 per hour (30% of the average cost per employee).

-

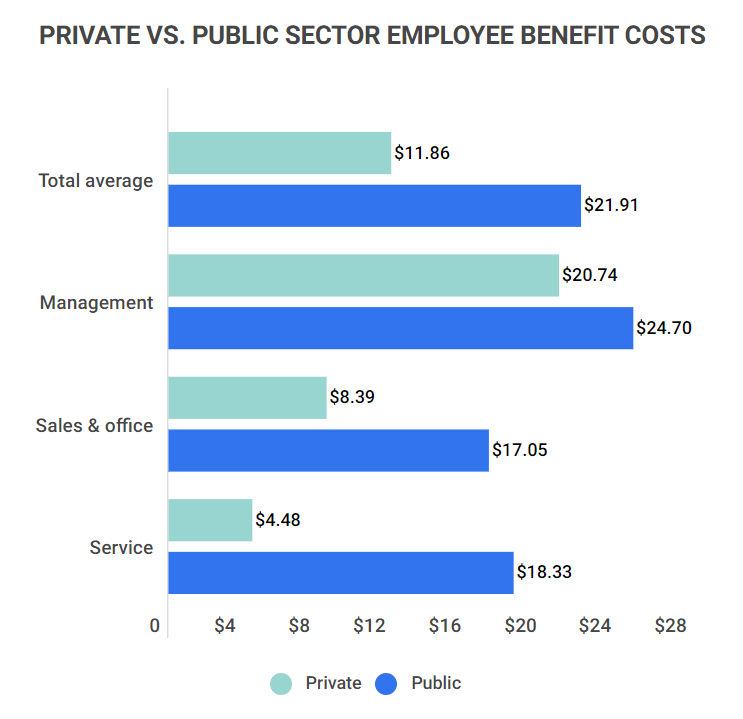

Public sector employee benefits (government workers) cost an average of $23.50, which amounts to 40% of total compensation costs.

-

Management occupations continue to have the highest average cost of benefits for private sector employees, at an average of $22.00.

-

Service occupations have the lowest average cost of benefits for private sector employees, averaging $4.75.

-

From 2021 to 2022, the average cost of employee benefits increased by $1.10 (from $11.86 to $12.50).

-

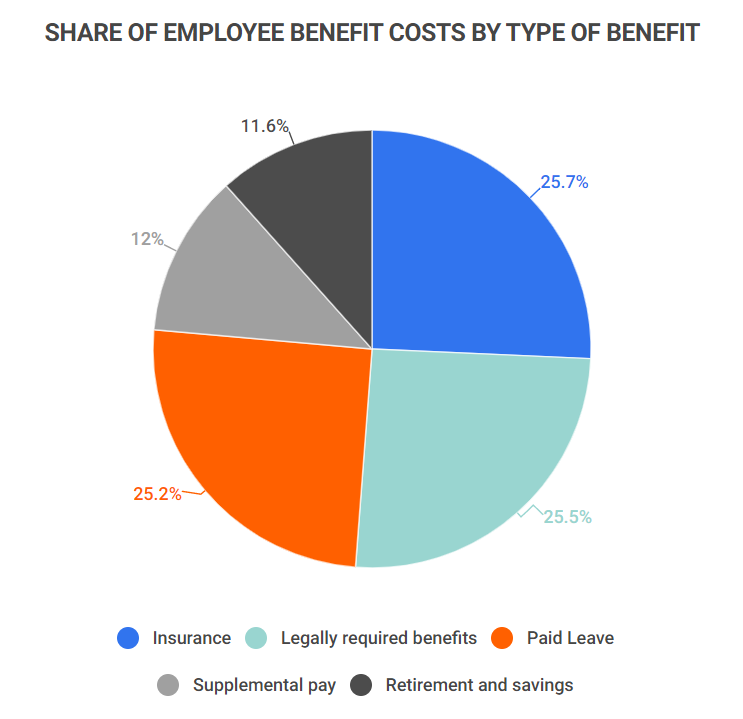

Insurance, Legally required benefits, and Paid leave each account for just over 25% of total benefits, collectively making up more than 76% of total benefits costs.

-

Retirement and savings contribute the smallest portion of benefits costs, at approximately $1.50, or 12% of the total.

-

Healthcare expenses typically account for an overwhelming 94% of total insurance costs ($3.00 out of $3.20).

For deeper insights, we have categorized the data as follows:

Private Vs. Public | Private Sector Occupation | Public Sector Occupation | Cost of Employee Benefits | Cost of Insurance Benefits | Over Time

Private Vs. Public Cost of Employee Benefits

| Sector | Average cost of employee benefits | Share of total compensation costs |

|---|---|---|

| Private | $21.91 | 38.0% |

| Public | $12.50 | 30.0% |

Average Cost of Employee Benefits By Private Sector Occupation

| Occupational group | Average cost of benefits | Share of total compensation costs |

|---|---|---|

| Management, professional, & related | $22.00 | 31.0% |

| Sales & Office | $9.00 | 28.0% |

| Service | $4.75 | 23.0% |

| Natural resources, construction, & maintenance | $14.00 | 33.0% |

| Production, transportation, & material moving | $11.00 | 31.5% |

Average Cost of Employee Benefits By Public Sector Occupation

| Occupational group | Average cost of benefits | Share of total compensation costs |

|---|---|---|

| Management, professional, & related | $26.00 | 37.0% |

| Sales & Office | $18.00 | 43.0% |

| Service | $19.00 | 43.5% |

Cost of Employee Benefits by Type of Benefit

| Type of benefit | Average cost | Share of the total cost of benefits |

|---|---|---|

| Insurance | $3.20 | 26.0% |

| Legally required benefits | $3.05 | 25.5% |

| Paid Leave | $3.00 | 25.0% |

| Supplemental pay | $1.50 | 12.0% |

| Retirement and savings | $1.50 | 12.0% |

Cost of Insurance Benefits by Type of Benefit

| Type of Insurance | Average cost | Share of the total cost of insurance benefits |

|---|---|---|

| Health | $3.00 | 93.8% |

| Short-term disability | $0.10 | 3.0% |

| Long-term disability | $0.05 | 1.5% |

| Life | $0.05 | 1.7% |

Cost of Employee Benefits Over Time

| Year | Average cost of employee benefits |

|---|---|

| 2022 | $12.50 |

| 2021 | $11.86 |

| 2020 | $11.82 |

| 2019 | $11.60 |

Employee Benefit Costs FAQ

-

What costs are normally associated with an employee benefits package?

The costs typically associated with employee benefits include Insurance, Paid Leave, Supplemental pay, Retirement, and savings. While some states may mandate additional benefits, these are the core components.

To understand how these elements contribute to the average total cost of benefits ($12.50), here are further details:

-

Insurance: 26.0% of total benefits

-

Legally required benefits: 25.5%

-

Paid Leave: 25.0%

-

Supplemental pay: 12.0%

-

Retirement and savings: 12.0%

These categories can also be analyzed further; for example, health insurance alone accounts for over 93% of total insurance costs.

-

-

How do you reduce employee benefit costs?

Reducing employee benefit costs involves analyzing trends and implementing strategic adjustments. Here are several effective strategies:

-

Analyze employee program usage. Understanding which benefits employees utilize can help identify programs that may be underused or unnecessary, allowing for potential cuts.

-

Explore plan design options. Tailoring benefits plans to fit the unique needs of your workforce can help lower overall premiums.

-

Investigate pharmacy offerings. As medication costs fluctuate, it’s essential to evaluate lower-cost, clinically effective alternatives to maintain affordability for both the employer and employees.

-

Reduce administrative costs. Utilizing tools such as online portals and automated messaging can streamline administration, ensuring efficiency and cost-effectiveness.

-

Educate employees. Keeping employees informed about their benefits enhances utilization and reduces misuse, which can be achieved through proper training and consultations with benefits brokers.

-

Promote telehealth services. Encouraging the use of virtual healthcare can offer employees easy access to providers while potentially lowering costs for the employer.

-

Implement wellness programs. Initiatives such as gym memberships and stress management resources contribute positively to employee health and can improve overall workplace morale.

-

-

Are employee benefits overhead costs?

Yes, employee benefits are classified as overhead costs. Overhead encompasses expenses like rent, utilities, administrative costs, insurance, and employee perks, while operating costs relate only to direct expenses necessary for producing goods and services.

This categorization means that expenditures on employee benefits, including perks like office snacks and gym discounts, fall under overhead costs.

Conclusion

In 2026, the average cost of employee benefits is $12.50, accounting for 30% of the total employee compensation. The breakdown includes Insurance (26.0% of total benefits), Legally required benefits (25.5%), Paid Leave (25.0%), Supplemental pay (12.0%), and Retirement and savings (12.0%).

Public sector employees incur higher average benefits costs of $23.50, comprising 40% of their total compensation. Costs also vary significantly by industry, with Management positions seeing higher benefits costs compared to Service roles, which tend to have lower costs.

Ultimately, understanding and managing your employee benefits costs as a business owner is crucial for aligning organizational goals with employee needs. It is essential to evaluate which benefits resonate most with your workforce and to engage in cost-effective strategies that promote employee well-being.

References

-

BLS – Employer Costs for Employee Compensation

- Business Statistics

- Startup Statistics

- Cloud Adoption Statistics

- Customer Loyalty Statistics

- Nonprofit Statistics

- Affiliate Marketing Statistics

- Cart Abandonment Rate Statistics

- Ridesharing Statistics

- Call Center Statistics

- eLearning statistics

- Customer Service Statistics

- Customer Experience statistics

- Entrepreneur Statistics

- Outsourcing Statistics

- Gross Revenue for Marketing and Advertising

- Sales Statistics

- MBA Statistics

- Average Small Business Revenue + Profit Margin

- How Much Do Employee Benefits Cost?