Find a Job You Really Want In

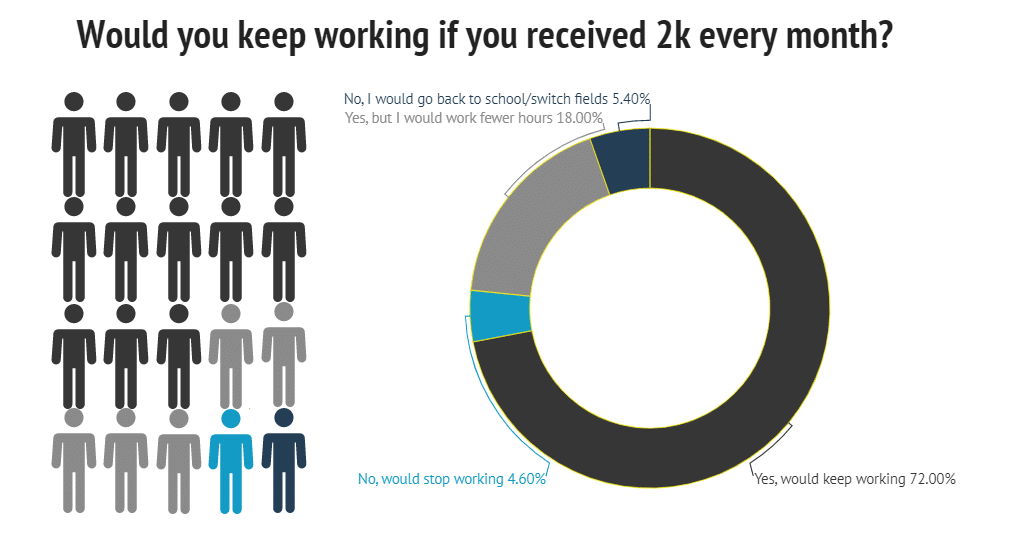

- Only 72% of workers would continue working as normal.

- 1-in-20 would quit their jobs altogether.

- 18% would cut their hours; Another 5% would use the extra cash to go back to school or switch fields

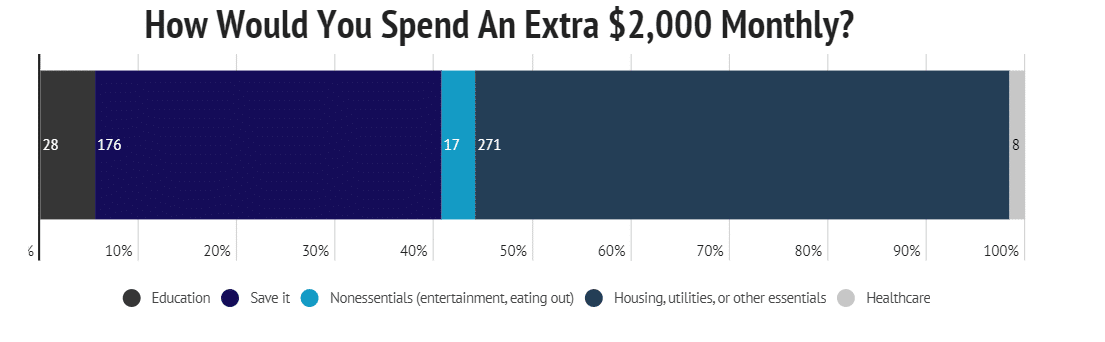

- People would spend spend most of the money on housing, utilities, or other essentials.

Universal Basic Income is a term that came into prominence through the campaign of Andrew Yang. The economic slump from COVID-19 has brought it to the forefront of political discussions once again, with some suggesting issuing monthly $2,000 dollar checks to every American worker until the situation abates.

It begs the question, what would the American workforce look like if everyone received an extra $2,000 a month? What is that benefit became ongoing? Considering the median household income in the US is only $63,688, there is no doubt it would shake things up.

Would people continue going to their 9-to-5 with guaranteed money coming in? Or would they use this opportunity to cut their hours and smell the flowers? What would this surplus cash be used on?

Zippia surveyed 500 American workers of diverse incomes and ages to investigate how a monthly $2,000 check would change the way Americans work.

Below are additional findings from Zippia’s survey.

Summary Of Findings

- 18-to-24 year olds were the most likely to say they’d use the money for education

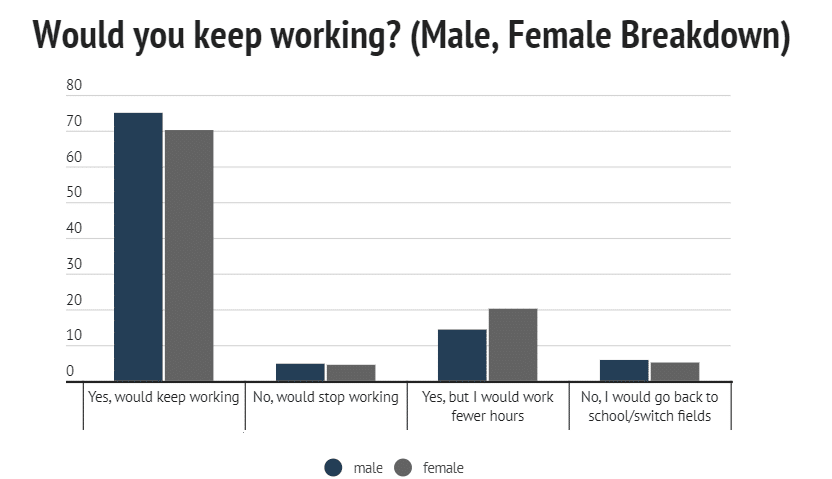

- Women were 5% less likely than men to keep working as normal– instead opting to work fewer hours

- After essentials, people were most likely to save the money for a rainy day

- 60% of 35-44 years old(the highest of any age group) say they would the cash to make ends meet

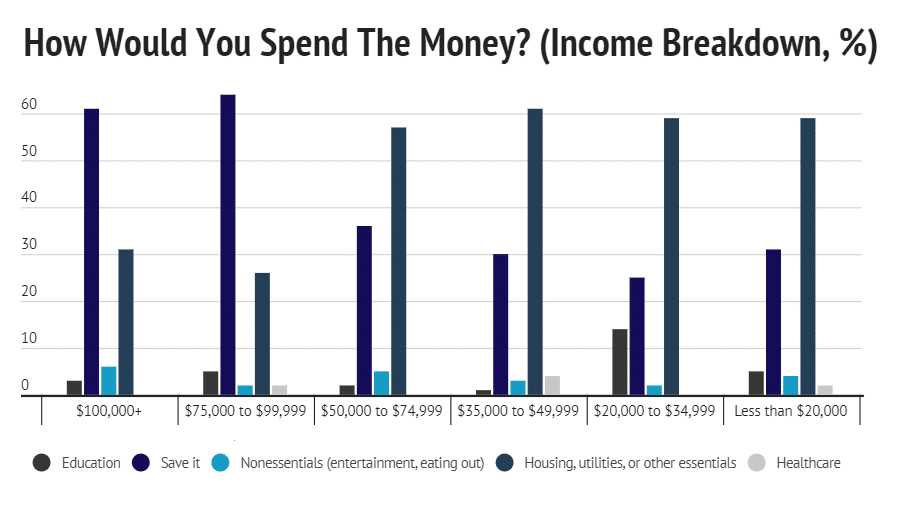

- Higher earners were more likely to save than use the funds on essentials; Similarly, low earners were more likely to use the money on bills and less likely to save.

When you break our survey results down, it has 1-of-20 workers quitting the workforce. A staggering 25% may be staying in the workforce, but would use their funds to work less and live more.

Essentials such as housing costs, utilities, and food were what the majority would spend an extra $2,000 a month on. Right behind that was savings. Healthcare was the least common response.

Not All Groups Of People Make The Same Choices

While overall choice to remain or leave the workforce was flat, workers of different age groups would spend money differently.

The youngest age group, 18-24 year olds, were 10% more likely to spend money on education expenses. Baby boomers were most likely to save the money. 35-44 year olds were the most likely to spend additional money on housing and other necessities.

Higher earners were more likely to save money, than spend it on necessities. Those with less income were more likely to use any cash they got to pay the bills.

Women were 5% less likely than men to keep working as normal. However, they were 5% more likely to continue working but instead working fewer hours. Since women work more “unpaid labor”, including childcare, this might be a motivating factor.

Closing Thoughts On How American Workers Would Handle An Extra $2,000 A Month

Not everyone enjoys their job. Many go to work just to pay the bills. Remove bills from the equation, and they’d find something else to do with their time.

However, $2,0000 a month isn’t enough to sway the 72% of workers who would stay in the workforce, unchanged.

Ultimately, while 5% of our respondents would quit their jobs– just as many would use this as an opportunity to receive more education and change fields to one they would enjoy more. If universal income becomes policy, it likely would shrink the labor force. However, it would also lead to a changing American perspective on work.

With so many desiring shorter work hours, perhaps it would lead to more productivity- rather hours- focused work environments.

While we cannot predict all the consequences of American workers receiving a monthly stipend, we can say it would change the workforce and job culture.