Explore jobs

Find specific jobs

Explore careers

Explore professions

Best companies

Explore companies

What is an insurance processor and how to become one

Insurance processors are clerks who specialize in the insurance industry. Their main job revolves around maintaining, updating, and processing records for policyholders and claimants.

There are two types of insurance processors: policy processors and claims processors. Both are clerical jobs centered on accurate data entry and quality customer service, differing only in their area of expertise.

Insurance policy processors consult with clients to determine plan eligibility, issue new policies, and maintain, update, or cancel existing policies. From day to day, a policy processor can expect to fill and file forms, answer calls and emails, and coordinate with insurance agents to complete the policyholders' application process.

On the other hand, claims processors are tasked with determining the validity of insurance claims rather than processing policies. They review claimant insurance policies to decide whether or not a payout will be issued on a claim. For valid claims, insurance processors will calculate the amount to be paid, prepare the necessary paperwork, and ultimately issue a check to the client.

Both types of insurance processors share the same clerical duties and require similar skills -- namely, organizational, communication, and computer skills. Though a college degree isn't usually needed to begin this career, previous experience in an office position makes for a strong insurance processor candidate.

Avg. Salary $33,041

Avg. Salary $59,228

Growth rate -3%

Growth rate 0.3%

American Indian and Alaska Native 0.48%

Asian 3.89%

Black or African American 13.78%

Hispanic or Latino 14.38%

Unknown 4.28%

White 63.20%

Genderfemale 83.71%

male 16.29%

Age - 44American Indian and Alaska Native 3.00%

Asian 7.00%

Black or African American 14.00%

Hispanic or Latino 19.00%

White 57.00%

Genderfemale 47.00%

male 53.00%

Age - 44Stress level is manageable

7.1 - high

Complexity level is intermediate

7 - challenging

Work life balance is excellent

6.4 - fair

Insurance processor career paths

Key steps to become an insurance processor

Explore insurance processor education requirements

Start to develop specific insurance processor skills

Skills Percentages Data Entry 18.23% Customer Service 11.74% Phone Calls 9.36% Outbound Calls 9.09% Insurance Claims 5.96% Complete relevant insurance processor training and internships

Accountants spend an average of 1-3 months on post-employment, on-the-job training. New insurance processors learn the skills and techniques required for their job and employer during this time. The chart below shows how long it takes to gain competency as an insurance processor based on U.S. Bureau of Labor Statistics data and data from real insurance processor resumes.Research insurance processor duties and responsibilities

- Manage database by processing renewals and endorsements.

- Input and process all dental claims, through electronic and paper submission, to private insurance companies and Medicaid.

- Maintain patient privacy and confidentiality complaint with HIPPA regulations.

- Work directly with mortgage lenders and foreclosure attorneys to negotiate timely and cost effective repayment plans or modifications for delinquent loans.

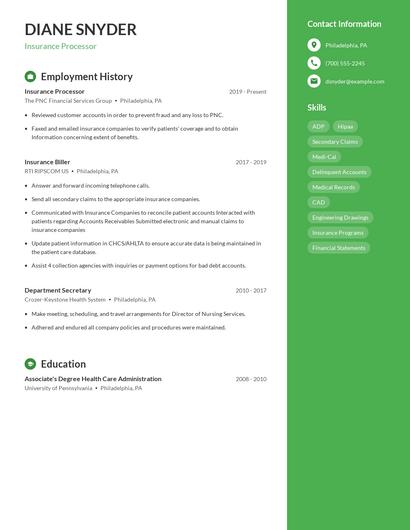

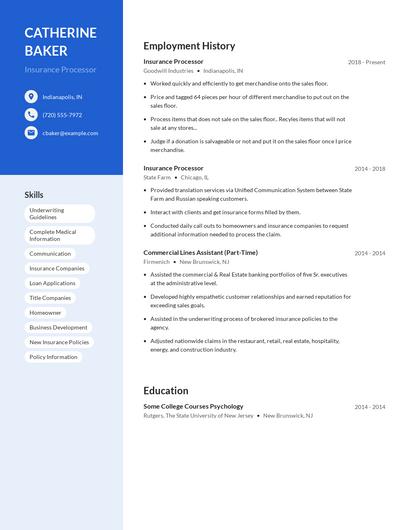

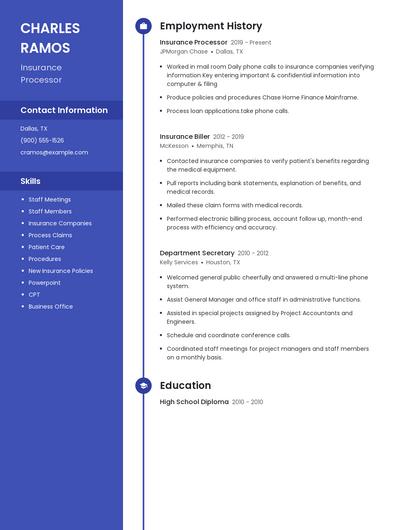

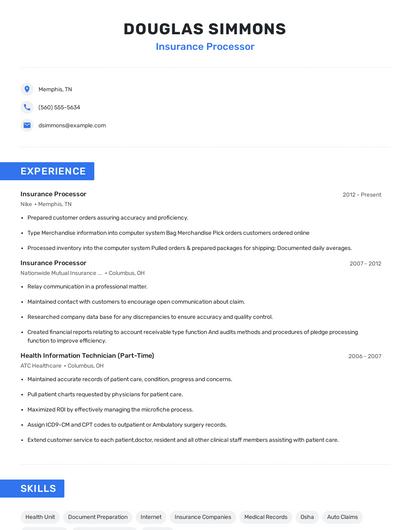

Prepare your insurance processor resume

When your background is strong enough, you can start writing your insurance processor resume.

You can use Zippia's AI resume builder to make the resume writing process easier while also making sure that you include key information that hiring managers expect to see on an insurance processor resume. You'll find resume tips and examples of skills, responsibilities, and summaries, all provided by Zippi, your career sidekick.

Choose from 10+ customizable insurance processor resume templates

Build a professional insurance processor resume in minutes. Browse through our resume examples to identify the best way to word your resume. Then choose from 10+ resume templates to create your insurance processor resume.Apply for insurance processor jobs

Now it's time to start searching for an insurance processor job. Consider the tips below for a successful job search:

- Browse job boards for relevant postings

- Consult your professional network

- Reach out to companies you're interested in working for directly

- Watch out for job scams

How did you land your first insurance processor job

Are you an insurance processor?

Share your story for a free salary report.

Average insurance processor salary

The average insurance processor salary in the United States is $33,041 per year or $16 per hour. Insurance processor salaries range between $28,000 and $38,000 per year.

What am I worth?

How do insurance processors rate their job?

Insurance processor reviews

There is no need to work in shift, especially evening or midnight shifts, disclaimer: i transitioned from the hospitality industry to insurance industry. Now i work 8-5 mostly and day off on weekends. And it has been great so far! I can finally sleep at nights now definitely!

Pay is too low especially in my country. And as we are a small firm, so career progression is super narrow. And regardless of how long i work there, pay will still be low.

There's nothing to dislike.