Explore jobs

Find specific jobs

Explore careers

Explore professions

Best companies

Explore companies

What is a payment processor and how to become one

People do not really look forward to receiving bills. We would even delay looking at bills until the deadline is right around the corner. Once we see the bill, we can now choose the mode of payment to take care of the outstanding balance. We may choose to do it over-the-counter, through online banking, or through payment hubs. Whichever payment method we choose, there is one role that receives the payment and ensures your payment is reflected in the system. This is the payment processor.

Payment processors are assigned to handle receiving customer payments. They also check whether the payment is already logged into the system and if the customer's account is already updated. In addition to this, they may also be assigned to handle the preparation of new billing statements and to set up payment accounts.

Payment processors should be trustworthy and must work with integrity at all times. They should also have the technical skills involved in the job. If you have all of these, you might want to consider the role.

Avg. Salary $34,030

Avg. Salary $59,228

Growth rate -5%

Growth rate 0.3%

American Indian and Alaska Native 0.63%

Asian 6.59%

Black or African American 6.85%

Hispanic or Latino 14.55%

Unknown 3.97%

White 67.42%

Genderfemale 78.45%

male 21.55%

Age - 53American Indian and Alaska Native 3.00%

Asian 7.00%

Black or African American 14.00%

Hispanic or Latino 19.00%

White 57.00%

Genderfemale 47.00%

male 53.00%

Age - 53Stress level is manageable

7.1 - high

Complexity level is intermediate

7 - challenging

Work life balance is good

6.4 - fair

Payment processor career paths

Key steps to become a payment processor

Explore payment processor education requirements

Start to develop specific payment processor skills

Skills Percentages Customer Service 14.75% Patients 10.16% Data Entry 9.74% ACH 7.77% Phone Calls 4.60% Complete relevant payment processor training and internships

Accountants spend an average of 1-3 months on post-employment, on-the-job training. New payment processors learn the skills and techniques required for their job and employer during this time. The chart below shows how long it takes to gain competency as a payment processor based on U.S. Bureau of Labor Statistics data and data from real payment processor resumes.Gain additional payment processor certifications

More About CertificationsPayment processor certifications can show employers you have a baseline of knowledge expected for the position. Certifications can also make you a more competitive candidate. Even if employers don't require a specific payment processor certification, having one may help you stand out relative to other applicants.

The most common certifications for payment processors include Certified Medical Office Manager (CMOM) and Certified Management Accountant (CMA).

Research payment processor duties and responsibilities

- Manage and review all incoming discounts and electronic contractual adjustments for accuracy per the negotiated Medicaid and Medicare contracts ;.

- Maintain daily transactions for customer payments and various bank accounts using Quickbooks to track transactions.

- Prepare and print all reports for EDI processing.

- Maintain client customer confidentiality and HIPAA regulations with all data handling and transfers.

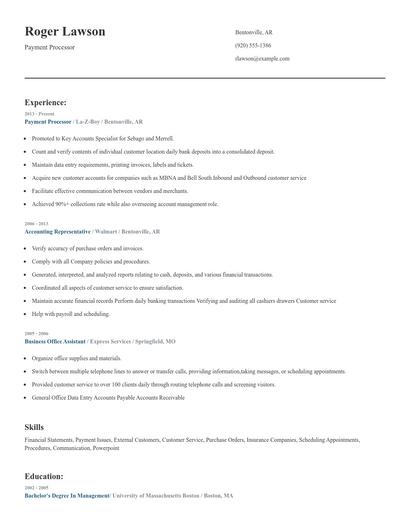

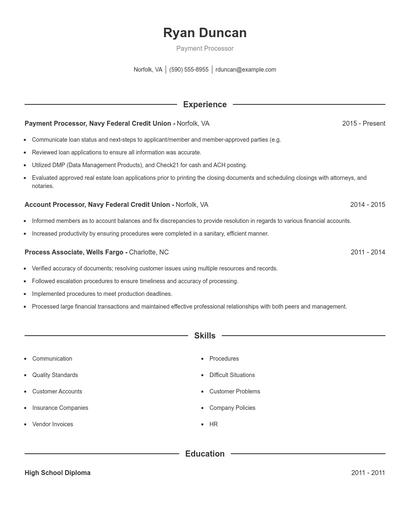

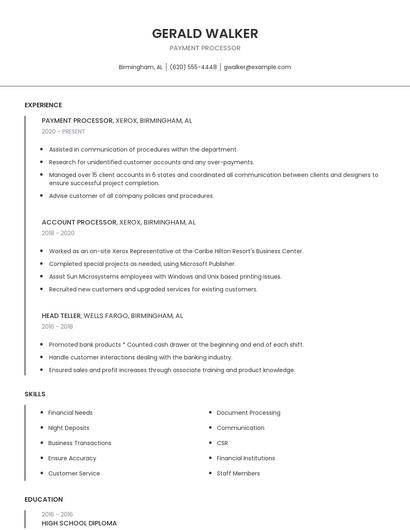

Prepare your payment processor resume

When your background is strong enough, you can start writing your payment processor resume.

You can use Zippia's AI resume builder to make the resume writing process easier while also making sure that you include key information that hiring managers expect to see on a payment processor resume. You'll find resume tips and examples of skills, responsibilities, and summaries, all provided by Zippi, your career sidekick.

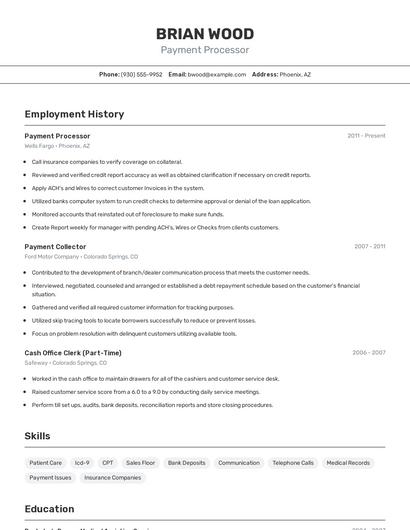

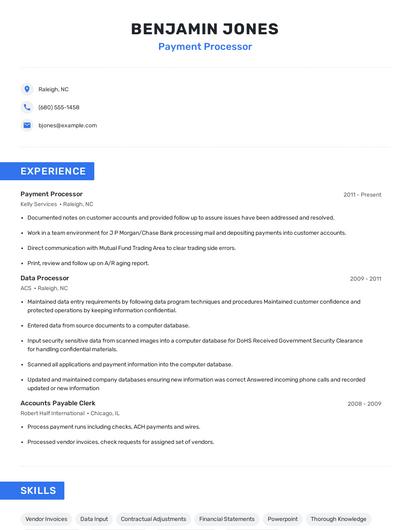

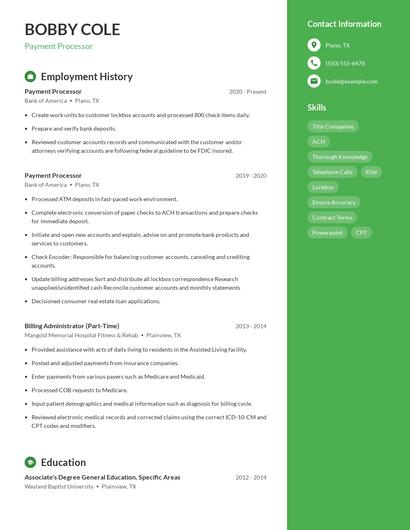

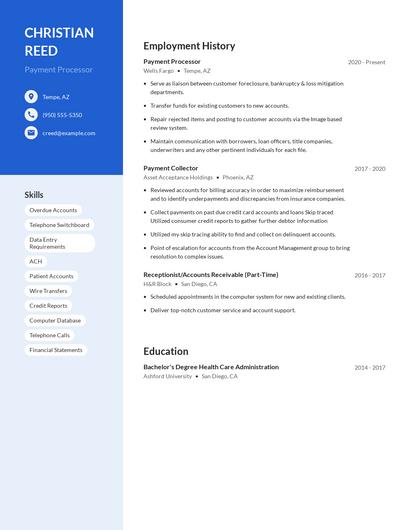

Choose from 10+ customizable payment processor resume templates

Build a professional payment processor resume in minutes. Browse through our resume examples to identify the best way to word your resume. Then choose from 10+ resume templates to create your payment processor resume.Apply for payment processor jobs

Now it's time to start searching for a payment processor job. Consider the tips below for a successful job search:

- Browse job boards for relevant postings

- Consult your professional network

- Reach out to companies you're interested in working for directly

- Watch out for job scams

How did you land your first payment processor job

Are you a payment processor?

Share your story for a free salary report.

Average payment processor salary

The average payment processor salary in the United States is $34,030 per year or $16 per hour. Payment processor salaries range between $27,000 and $42,000 per year.

What am I worth?

How do payment processors rate their job?

Payment processor reviews

Being able to work with a variety of people of different aptitudes with different focuses. Learning the ins and outs of the financial world, as well as networking for the future. Able to stay on top of technological advances and stay competitive for future advancement.

Inefficient flow of information from top to bottom.