Explore jobs

Find specific jobs

Explore careers

Explore professions

Best companies

Explore companies

What is a public accountant and how to become one

The primary responsibility of a public accountant is to handle a wide range of the general public's day-to-day monetary issues, from tax services to financial consulting. Public accountants typically work for public accounting firms that serve a broader client base, as opposed to private accountants who work within specific organizations. A public accountant usually holds a wide understanding of various accounting systems, whereas private accountants are generally more specialized.

The duties of a public accountant include preparing financial documents, verifying document information, assisting in financial planning, and analyzing business and personal budgets. They may also consult for a wide variety of clients, perform bookkeeping, and serve as auditors.

The minimum education requirements to become a public accountant are usually a bachelor's or master's degree in accounting or a related field. After starting at an entry-level position earning an average of $59,000 per year, it's possible to move up through the ranks to become a senior accountant, audit partner, or tax manager. Job growth in the U.S. for accountants and auditors is expected to rise by 4% by 2029.

What general advice would you give to a public accountant?

Most of the above remains true so the only open question is job availability. It would be unrealistic to say things are great. However, it seems that job prospects for accounting majors will be better than for those of virtually every other entry-level profession during difficult times. I have been speaking with firm leaders across the spectrum of firms and most do intend to be on campus in the fall recruiting season. Of course, they have a lot of time to learn more about the economy over the next few months, but we are cautiously optimistic. Again, I am confident that whatever the state of job availability for young CPAs-to-be, prospects will be better for accounting graduates than virtually any other profession.

They will be entering the profession at a fascinating moment in time. Of course, the technological advances assure this regardless of economic conditions. However, there are business disruption-related issues that will provide rich opportunities for making a difference. For example, audit staff will be working with clients to see them through these troubling times. Lamentably, I fear that these young professionals will learn more about the going concern determination than they desire to know. Tax staff will help clients to optimally use the tax loss carrybacks and carryforwards that are arising by the day. Entry level professionals in corporate accounting will get a day-to-day front row seat in business management through crisis. While lamentable times, these are times when young professionals can make a difference that saves jobs.

Avg. Salary $58,843

Avg. Salary $59,228

Growth rate 6%

Growth rate 0.3%

American Indian and Alaska Native 0.46%

Asian 12.44%

Black or African American 8.82%

Hispanic or Latino 11.16%

Unknown 3.97%

White 63.14%

Genderfemale 47.96%

male 52.04%

Age - 43American Indian and Alaska Native 3.00%

Asian 7.00%

Black or African American 14.00%

Hispanic or Latino 19.00%

White 57.00%

Genderfemale 47.00%

male 53.00%

Age - 43Stress level is manageable

7.1 - high

Complexity level is challenging

7 - challenging

Work life balance is good

6.4 - fair

Public accountant career paths

Key steps to become a public accountant

Explore public accountant education requirements

Start to develop specific public accountant skills

Skills Percentages CPA 17.00% Real Estate 9.01% Audit Procedures 8.58% Financial Statement Preparation 6.81% Payroll Tax 6.18% Complete relevant public accountant training and internships

Accountants spend an average of 1-3 months on post-employment, on-the-job training. New public accountants learn the skills and techniques required for their job and employer during this time. The chart below shows how long it takes to gain competency as a public accountant based on U.S. Bureau of Labor Statistics data and data from real public accountant resumes.Research public accountant duties and responsibilities

- Manage and monitor accounting procedures for compliance with Sarbanes-Oxley and coordinate and facilitate external audit requirements.

- Perform write-ups, analysis of general ledger, adjusting journal entries and reconciliations.

- Ensure accuracy and completeness of write-ups and monthly bank reconciliations.

- Handle tax matters with the IRS for clients and business owners.

Get public accountant experience

Generally, it takes 2-4 years to become a public accountant. The most common roles before becoming a public accountant include accountant, staff accountant team lead and controller.Prepare your public accountant resume

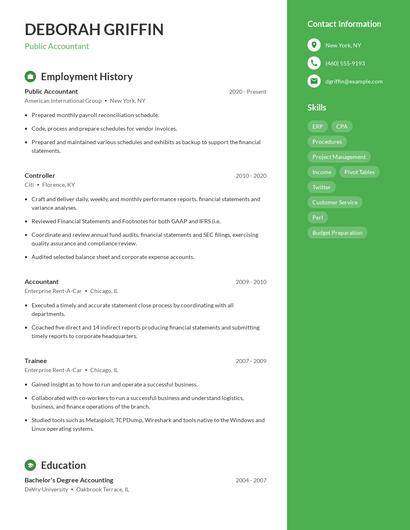

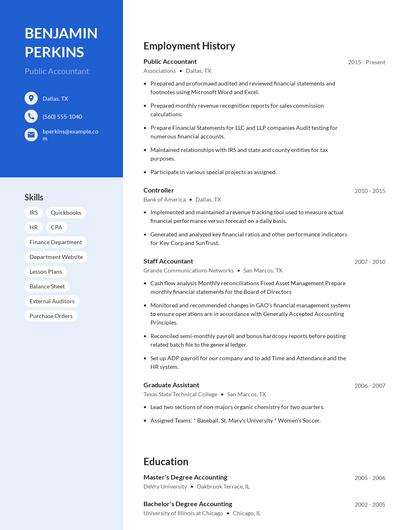

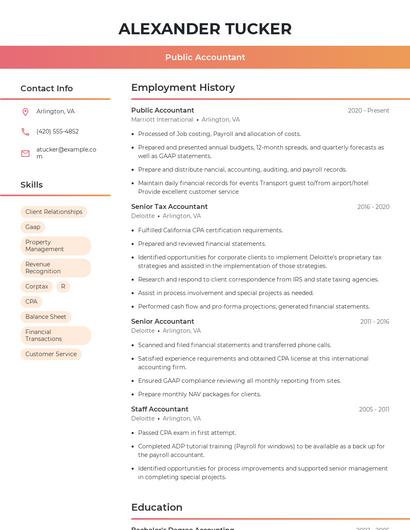

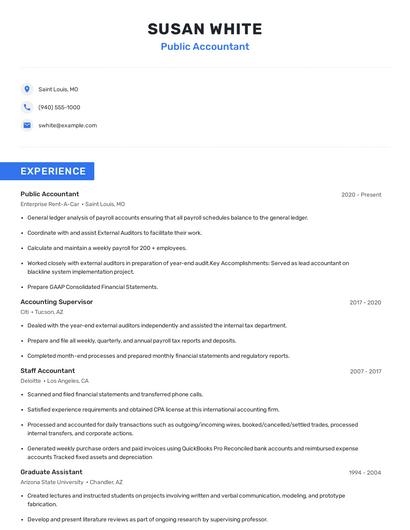

When your background is strong enough, you can start writing your public accountant resume.

You can use Zippia's AI resume builder to make the resume writing process easier while also making sure that you include key information that hiring managers expect to see on a public accountant resume. You'll find resume tips and examples of skills, responsibilities, and summaries, all provided by Zippi, your career sidekick.

Choose from 10+ customizable public accountant resume templates

Build a professional public accountant resume in minutes. Browse through our resume examples to identify the best way to word your resume. Then choose from 10+ resume templates to create your public accountant resume.Apply for public accountant jobs

Now it's time to start searching for a public accountant job. Consider the tips below for a successful job search:

- Browse job boards for relevant postings

- Consult your professional network

- Reach out to companies you're interested in working for directly

- Watch out for job scams

How did you land your first public accountant job

Are you a public accountant?

Share your story for a free salary report.

Average public accountant salary

The average public accountant salary in the United States is $58,843 per year or $28 per hour. Public accountant salaries range between $43,000 and $80,000 per year.

What am I worth?

How do public accountants rate their job?

Public accountant reviews

Reporting to a CPA Controller or CFO, always learning and not micromanaged. Treated as a professional always.

Business owners that do not know or understand compliance and GAAP, or the patience to follow the rules... generally common in small companies.

It's an office job.

Everything else. Too much anxiety, debts, low sallary (€700/month).

Low pay, considering the knowledge required to do the work and the volume of work that has to be done in a limited amount of time.