What does a structurer do?

Structurer responsibilities

Here are examples of responsibilities from real structurer resumes:

- Manage financial operations such as account management, book keeping, wire transfers, and transaction, position reconciliations.

- Develop bespeak equity derivative solutions for high net worth private banking clients.

- Ensure, clients without an execute ISDA, adhere to all internal requirements within first month of trading.

- Develop executive PowerPoint presentations detailing investment performance.

- Design, price, trade and hedge FX derivatives products on a live basis for corporate and institutional clients.

- Develop executive PowerPoint presentations detailing investment performance.

Structurer skills and personality traits

We calculated that 43% of Structurers are proficient in Derivative, Origination, and Fixed Income. They’re also known for soft skills such as Analytical skills, Communication skills, and Computer skills.

We break down the percentage of Structurers that have these skills listed on their resume here:

- Derivative, 43%

Worked closely with marketing department to promote and sell complex investment products to individual clients, including derivatives and fixed-income products.

- Origination, 16%

Assisted the Structured Equity Products Desk in the origination, offering, unwinding, and transfer of numerous equity structured products.

- Fixed Income, 7%

Create Tableau dashboards to help Wellington fixed income portfolio managers and traders spot attractive investment opportunities across Structured Products.

- Approval Process, 6%

Initiate and drive internal product review and approval process.

- Financial Institutions, 5%

Rotated through IG Credit Trading covering Financial Institutions, and Prime Finance: Cash & Collateral Management.

- Asset Classes, 5%

Conduct top-down macro-economic research, investment manager due diligence, and product research/analysis for all traditional asset classes.

Common skills that a structurer uses to do their job include "derivative," "origination," and "fixed income." You can find details on the most important structurer responsibilities below.

Analytical skills. To carry out their duties, the most important skill for a structurer to have is analytical skills. Their role and responsibilities require that "financial analysts must evaluate a range of information in finding profitable investments." Structurers often use analytical skills in their day-to-day job, as shown by this real resume: "managed the analysis and approval process of worldwide special bid rv transaction requests. "

Communication skills. Another essential skill to perform structurer duties is communication skills. Structurers responsibilities require that "financial analysts must be able to clearly explain their recommendations to clients." Structurers also use communication skills in their role according to a real resume snippet: "handled communications with various key stakeholders for ad hoc financial analysis and requests used for internal planning and fundraising. "

Computer skills. This is an important skill for structurers to perform their duties. For an example of how structurer responsibilities depend on this skill, consider that "financial analysts must be adept at using software to analyze financial data and trends, create portfolios, and make forecasts." This excerpt from a resume also shows how vital it is to everyday roles and responsibilities of a structurer: "used computer programs such as excel and company-wide database programs necho and abs that managed customer's financial data and policies. ".

Detail oriented. structurer responsibilities often require "detail oriented." The duties that rely on this skill are shown by the fact that "financial analysts must pay attention when reviewing a possible investment, as even small issues may have large implications for its health." This resume example shows what structurers do with detail oriented on a typical day: "completed renewals of expiring credit facilities through detailed financial analysis. "

Math skills. Another crucial skill for a structurer to carry out their responsibilities is "math skills." A big part of what structurers relies on this skill, since "financial analysts use mathematics to estimate the value of financial securities." How this skill relates to structurer duties can be seen in an example from a structurer resume snippet: "performed pe due diligence and quantitative and qualitative analysis used to support the underwriting of investment opportunities. "

The three companies that hire the most structurers are:

- Citi10 structurers jobs

- The Medicus Firm

9 structurers jobs

- Martin/Martin

8 structurers jobs

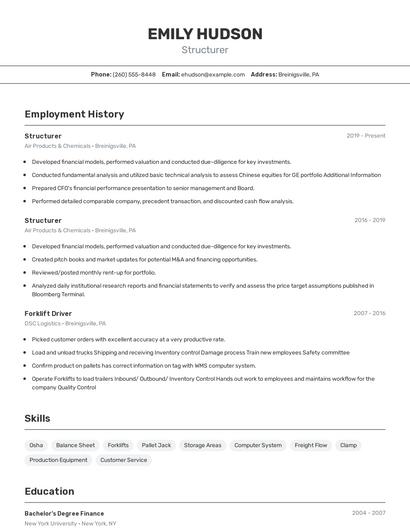

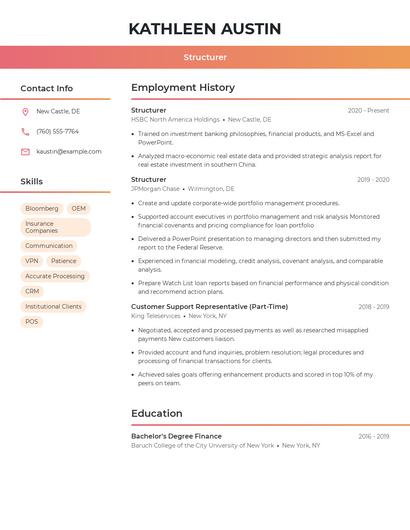

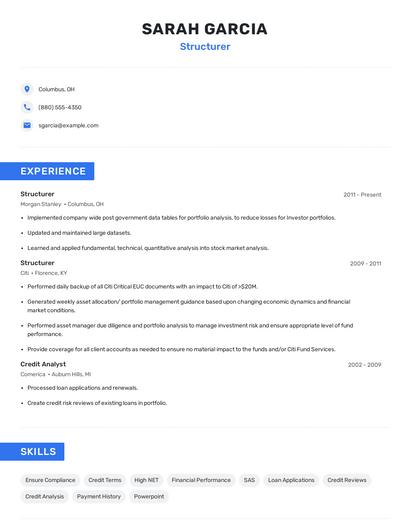

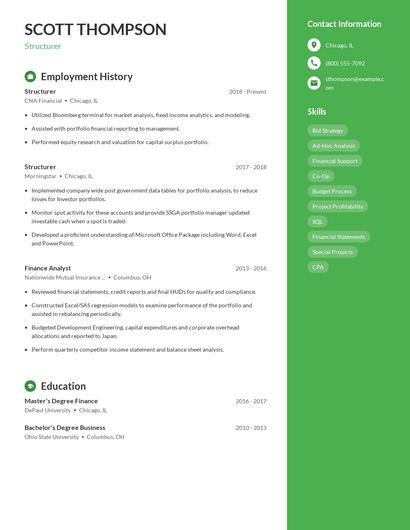

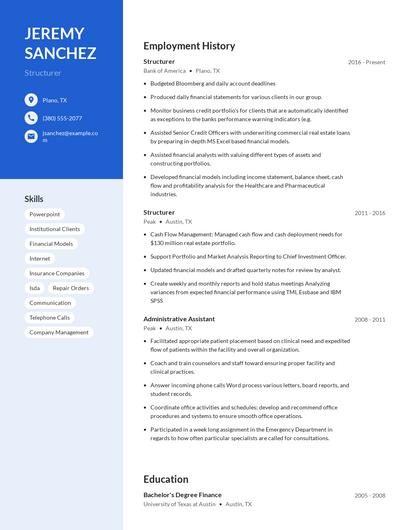

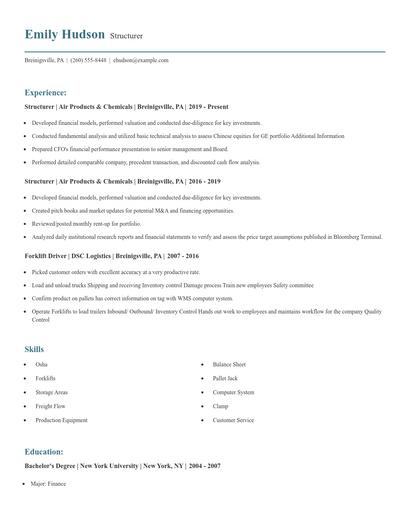

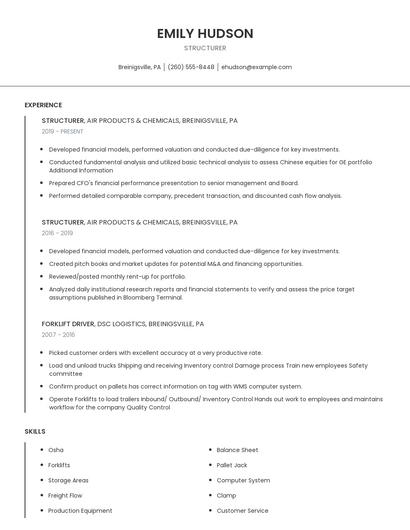

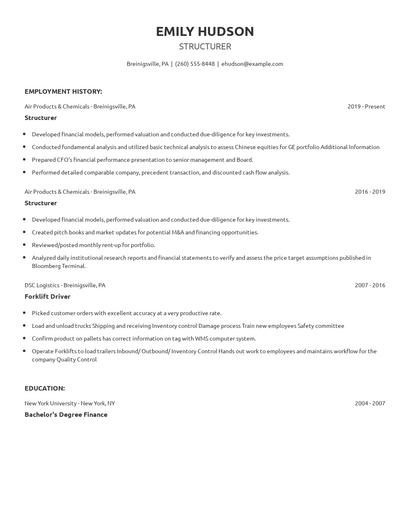

Choose from 10+ customizable structurer resume templates

Build a professional structurer resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your structurer resume.Compare different structurers

Structurer vs. Finance engineer

Basically, a finance or financial engineer tests and issues investment analysis methods and tools in an organization. Finance engineers collaborate with asset management firms, insurance companies, banks, and hedge funds. They predict the performance of stocks and other financial tools to help improve the financial operation and management. Computer science and math are the subject matters they utilize in building stock market trends. They play a key role in risk management and investment strategizing.

There are some key differences in the responsibilities of each position. For example, structurer responsibilities require skills like "origination," "approval process," "global markets," and "corporates." Meanwhile a typical finance engineer has skills in areas such as "python," "java," "risk management," and "c #." This difference in skills reveals the differences in what each career does.

Finance engineers earn the highest salaries when working in the finance industry, with an average yearly salary of $106,812. On the other hand, structurers are paid more in the finance industry with an average salary of $127,286.On average, finance engineers reach similar levels of education than structurers. Finance engineers are 1.8% less likely to earn a Master's Degree and 4.4% more likely to graduate with a Doctoral Degree.Structurer vs. Equity structurer

Each career also uses different skills, according to real structurer resumes. While structurer responsibilities can utilize skills like "origination," "fixed income," "approval process," and "global markets," equity structurers use skills like "institutional clients," "wealth management," "equity products," and "isda."

Average education levels between the two professions vary. Equity structurers tend to reach lower levels of education than structurers. In fact, they're 21.8% less likely to graduate with a Master's Degree and 4.4% less likely to earn a Doctoral Degree.Types of structurer

Updated January 8, 2025