Automatically apply for jobs with Zippia

Upload your resume to get started.

Banking services clerk skills for your resume and career

15 banking services clerk skills for your resume and career

1. Outbound Calls

An outbound call is made by the call center representative to the customers on behalf of the company. Such calls help increase sales and generate revenue for the organization.

- Performed more than 20 outbound calls for service/sales follow ups in support of team goals per week.

- Make inbound and Outbound calls to boost sales and promptly reply to phone inquiries and e-mails.

2. Bank Policies

- Executed customer transactions quickly and efficiently for an average of 30 customers per day in accordance with bank policies.

- Ensured compliance with bank policies and protocols, including security, customer service, and reporting standards.

3. Bank Products

Those products which a bank offers to its customers are called bank products. There a variety of services that a bank offers to attract customers. Some of the banking products/ services are: giving loans, overdrafts, check payments, exchange of foreign currency, consultancy services credit, debit and ATM cards, home and online banking.

- Offered standard bank products: saving, checking, business, certificates of deposit (CD) and IRA accounts.

- Provide friendly customer service while preparing, calculating, and processing paying/receiving transactions; also cross selling bank products.

4. Cross-Sell

Cross-selling is the activity of selling various products or services to a consumer to add the sale value.

- Refer and cross-sell Personal Banking customer to Personal Bankers as appropriate to meet their banking and investment needs.

- Increased cross-sell in the branch through consistent needs assessment conversations that identified additional opportunities and referrals.

5. Cross-Selling

- Maximized revenue opportunities by cross-selling products and services, including training operations personnel on how to identify potential add on situations.

- Facilitated timely customer service by opening new accounts and cross-selling products enabling co-workers to maintain focus on their primary job duties.

6. Quality Customer Service

- Interact, and provide quality customer service to new, existing, and potential client.

- Provided prompt quality customer service and performed wide range of services and problem resolution.

Choose from 10+ customizable banking services clerk resume templates

Build a professional banking services clerk resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your banking services clerk resume.7. Operational Quality

- Perform routine office and administrative duties as well as maintains operational quality and standards.

8. Service Transactions

- Performed service transactions for the financial center by conducting research and following up with customers.

- Perform or delegate service transactions to include wiring of funds both international and domestic.

9. Account Maintenance

Account maintenance is a practice in accounting that ensures that all transactions and accounting records are per the general principles of accounting and applicable laws. The accounts should be maintained enough to permit the annual audit and clear the inspection of financial statements.

- Assist Personal Bankers and customers on a daily basis with account maintenance.

- Posted transactions to customers accounts Corrected processing errors Answered phone-calls and assisted Bankers General Bank Account Maintenance

10. Bank Secrecy Act

- Adhere to all Federal and State laws and regulations governing applicable to the Credit Union, including the Bank Secrecy Act.

- Complied with regulatory requirements, including the Bank Secrecy Act, Anti Money Laundering, and USA Patriot Act.

11. Financial Services

Financial services are economic services that are offered by the finance sector, which includes banks, financial institutes credit-card agencies, insurance companies, accountancy firms, and others that handles assets. Organizations in the financial services sector are concerned with money and risk management.

- Developed a comprehensive operational understanding of the financial services industry, in addition to keeping up-to-date with new products and services.

- Maintained excellent customer relationships, serving trust and confidence, by providing accurate and efficient financial services.

12. Phone Calls

Phone calls are a wireless or wired connection made over a telephone or a mobile phone between two people. Two parties are involved in a phone call, the caller and the receiver. A caller dials the number of the one he wants to call, and the recipient hears a bell or a tune to which he picks up the call. The call establishes a connection between them through which they can communicate. The voice is converted into signals and is transmitted through wired or wireless technology.

- Answer phone calls and proceed with helping the customer as needed.

- Answer phone calls with proper phone etiquette Accurately process and verify deposits

13. Debit Cards

- Order checks and debit cards as requested.

- Receive a high volume of calls, provide customers with their Acct balance, order/ replace debit cards and, checks.

14. ATM

ATM (Automated Teller Machine) refers to an electronic banking system that enables the customers to initiate and complete transactions without queuing for aid from the teller within the branch.

- Proved Internet banking entries daily, dealt with all aspects of the ATM and electronic banking departments.

- Demonstrate ability to balance the bank vault and ATM system to ensure correct cash balances.

15. Cash Handling

- Process customer transactions, cross sell, sales, deposits, cash handling

- Cash Handling Large Deposits Customer service Sales goals

5 Banking Services Clerk resume examples

Build a professional banking services clerk resume in minutes. Browse through our resume examples to identify the best way to word your resume. Then choose from 5+ resume templates to create your banking services clerk resume.

What skills help Banking Services Clerks find jobs?

Tell us what job you are looking for, we’ll show you what skills employers want.

List of banking services clerk skills to add to your resume

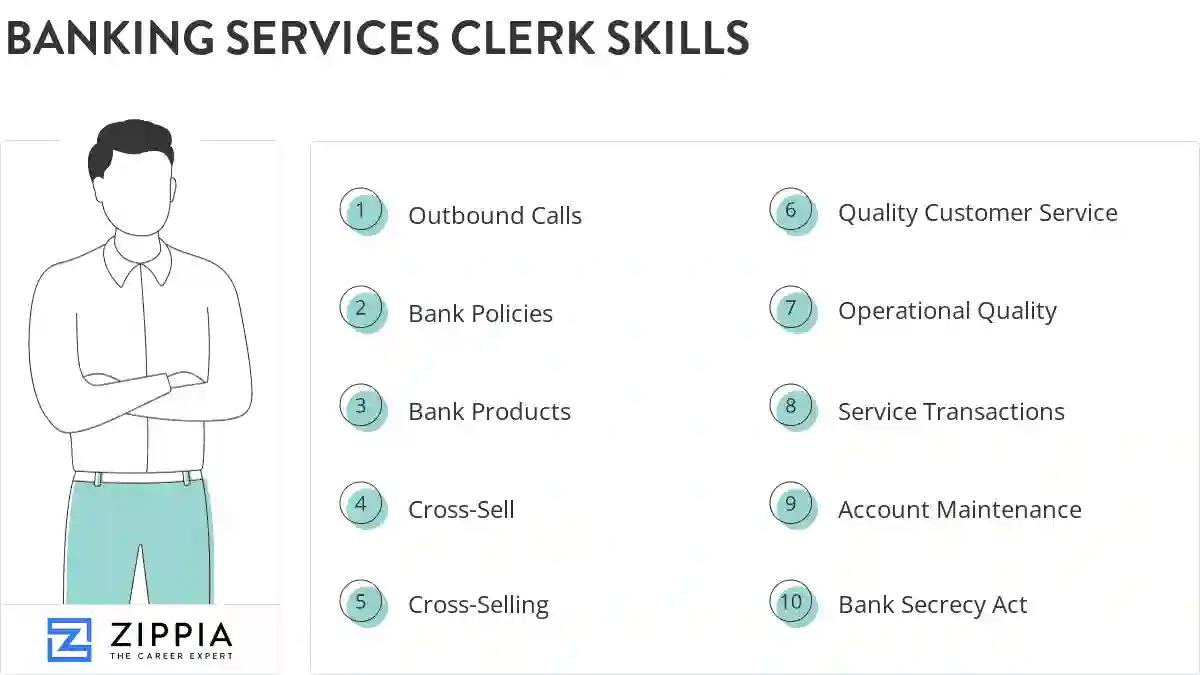

The most important skills for a banking services clerk resume and required skills for a banking services clerk to have include:

- Outbound Calls

- Bank Policies

- Bank Products

- Cross-Sell

- Cross-Selling

- Quality Customer Service

- Operational Quality

- Service Transactions

- Account Maintenance

- Bank Secrecy Act

- Financial Services

- Phone Calls

- Debit Cards

- ATM

- Cash Handling

- Customer Complaints

- Problem Resolution

- Wire Transfers

- Customer Satisfaction

- Security Guidelines

- Service Charges

- Processing Deposits

- Loan Payments

- Mobile Banking

- Profiling

- ACH

- Retail Products

- Customer Accounts

- Financial Products

- Credit Card

- Cash Drawers

- Cash Flow Analysis

- Bank Services

- Customer Relations

- Customer Issues

- Customer Inquiries

- Savings Accounts

- Loan Applications

- Product Knowledge

- Inbound Calls

- Account Services

- Bank Accounts

- Customer Problems

- Customer Transactions

- Telephone Inquiries

- Cold Calls

- Business Accounts

- Address Changes

Updated January 8, 2025