What does a finance planning analyst do?

Financial planning analysts are professionals in charge of the company's budgeting, forecasting, and analysis. The role of the analysts is crucial to the major decisions of corporations. They employ quantitative techniques and formulas to make things happen the easy way. They offer financial consulting and strategic support to the enterprise's senior management. Also, it is their job to monitor relevant laws, economic trends, and other factors affecting the financial state of the company.

Finance planning analyst responsibilities

Here are examples of responsibilities from real finance planning analyst resumes:

- Lead an initiative to improve high and low level user communication regarding company forecasting and reporting software, IBM Cognos TM1.

- Manage complex securities and investment portfolio reporting.

- Develop, maintain financial models/applications (VBA Excel/Access) to automate and streamline business processes and perform financial analysis.

- Facilitate month-end close process by delegating the preparation of journal entries and reconciliations.

- Used SQL and QMF query languages to audit data.

- Work with the accounting department to ensure proper GAAP compliance and reporting methods.

- Provide GAAP and revenue recognition guidance and training to program and functional teams.

- Compile and prepare key performance indicators (KPIs) on a weekly and monthly basis.

- Develop analysis by country, deductible, agent and product to identify trends and KPIs.

- Participate on a cross-divisional finance team to design and implement an Essbase cube to forecast product margins.

- Direct treasury function in new retail store roll-out, cash sweep and interface with advance POS system.

- Work with business controllers and the treasury department in reviewing weekly collection forecast for debt covenant compliance.

- Create a two-part process to identify erroneous revenue to analyst detecting large discrepancies for fraud discovery using Essbase.

- Work with the Thomson financial planning team to understand and complete plan upload processes to SAS FM (ERP system).

- Control of operating expenses accruals & vendors reconciliation.

Finance planning analyst skills and personality traits

We calculated that 9% of Finance Planning Analysts are proficient in Financial Analysis, PowerPoint, and Financial Planning Analysis. They’re also known for soft skills such as Computer skills, Analytical skills, and Communication skills.

We break down the percentage of Finance Planning Analysts that have these skills listed on their resume here:

- Financial Analysis, 9%

Perform financial analysis, as directed by management, and recommend alternative courses of action by utilizing appropriate financial tools.

- PowerPoint, 8%

Created year-end annual report with PowerPoint presentation for eight directors and General Manager.

- Financial Planning Analysis, 7%

Provided competitive/strategic financial planning analysis vs. industry competitors from a cost perspective in revenue forecasting.

- Financial Performance, 6%

Prepared monthly and quarterly reporting packages for senior management focusing on Key Performance Indicators and detailing financial performance relative to plan.

- Financial Models, 6%

Involved in preparation of financial models for acquisition prospects including preparation material for Senior Vice President on corporate acquisition presentations.

- Hyperion, 5%

Researched and investigated data discrepancies and provided data validation reports, such as preparing a monthly SAP to Hyperion reconciliation.

Most finance planning analysts use their skills in "financial analysis," "powerpoint," and "financial planning analysis" to do their jobs. You can find more detail on essential finance planning analyst responsibilities here:

Computer skills. One of the key soft skills for a finance planning analyst to have is computer skills. You can see how this relates to what finance planning analysts do because "financial analysts must be adept at using software to analyze financial data and trends, create portfolios, and make forecasts." Additionally, a finance planning analyst resume shows how finance planning analysts use computer skills: "provided the corporate financial analysis needed for a new start-up computer service line of business operating as a profitable subsidiary. "

Analytical skills. Many finance planning analyst duties rely on analytical skills. "financial analysts must evaluate a range of information in finding profitable investments.," so a finance planning analyst will need this skill often in their role. This resume example is just one of many ways finance planning analyst responsibilities rely on analytical skills: "assisted in preparation, analysis and distribution of final performance grids of targets and results to business units and hr. "

Communication skills. finance planning analysts are also known for communication skills, which are critical to their duties. You can see how this skill relates to finance planning analyst responsibilities, because "financial analysts must be able to clearly explain their recommendations to clients." A finance planning analyst resume example shows how communication skills is used in the workplace: "led an initiative to improve high and low level user communication regarding company forecasting and reporting software, ibm cognos tm1. "

Detail oriented. finance planning analyst responsibilities often require "detail oriented." The duties that rely on this skill are shown by the fact that "financial analysts must pay attention when reviewing a possible investment, as even small issues may have large implications for its health." This resume example shows what finance planning analysts do with detail oriented on a typical day: "maintained financial data for real estate planning and created detailed analysis of 765 locations nationwide. "

Math skills. Another common skill required for finance planning analyst responsibilities is "math skills." This skill comes up in the duties of finance planning analysts all the time, as "financial analysts use mathematics to estimate the value of financial securities." An excerpt from a real finance planning analyst resume shows how this skill is central to what a finance planning analyst does: "provide financial support and analysis to management regarding claims data, mail statistics, financial data. "

The three companies that hire the most finance planning analysts are:

- Kaiser Permanente27 finance planning analysts jobs

- Morgan Stanley23 finance planning analysts jobs

- Centene21 finance planning analysts jobs

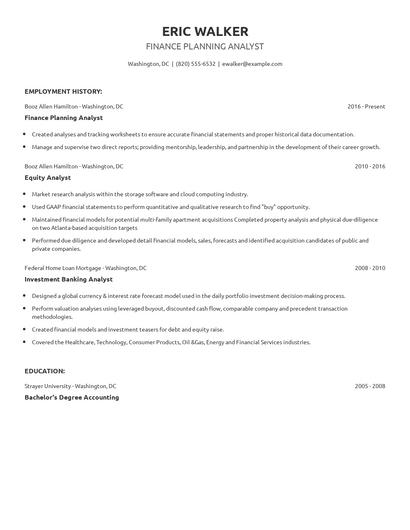

Choose from 10+ customizable finance planning analyst resume templates

Build a professional finance planning analyst resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your finance planning analyst resume.Compare different finance planning analysts

Finance planning analyst vs. Cost analyst

Cost Analysts are employees with a strong background in finance or accounting. They are in charge of collecting financial data and analyzing the entries. They study the company's expenses and prepare pertinent reports. Cost Analysts look for inconsistencies in the financial data. This way, they can assist in auditing the company's spending. Cost Analysts also look for inefficiencies. They do so by tracking item costs and department budgets and monitoring department expenses. They are also involved in budget-setting activities.

These skill sets are where the common ground ends though. The responsibilities of a finance planning analyst are more likely to require skills like "powerpoint," "financial models," "hyperion," and "ad-hoc analysis." On the other hand, a job as a cost analyst requires skills like "cost analysis," "cost estimates," "data analysis," and "dod." As you can see, what employees do in each career varies considerably.

Cost analysts really shine in the automotive industry with an average salary of $76,426. Comparatively, finance planning analysts tend to make the most money in the finance industry with an average salary of $88,258.cost analysts tend to reach lower levels of education than finance planning analysts. In fact, cost analysts are 8.3% less likely to graduate with a Master's Degree and 0.3% less likely to have a Doctoral Degree.Finance planning analyst vs. Treasury analyst

A treasury analyst is an individual who manages and analyses the financial activities of an organization that can include cash flows, liability obligations, and assets. Treasury analysts are required to execute the daily cash management of the organization such as cash forecasting, investing of excess cash, and running a hedging program in interest rates. They must present monthly reports and daily briefings on cash flows to senior management and provide advice on the financial operations of the movement of cash. Treasury analysts also update treasury policies and procedures for the organization to comply.

While some skills are similar in these professions, other skills aren't so similar. For example, resumes show us that finance planning analyst responsibilities requires skills like "powerpoint," "financial performance," "financial data," and "ad-hoc analysis." But a treasury analyst might use other skills in their typical duties, such as, "cash management," "ach," "treasury operations," and "credit card."

Treasury analysts earn a lower average salary than finance planning analysts. But treasury analysts earn the highest pay in the automotive industry, with an average salary of $87,077. Additionally, finance planning analysts earn the highest salaries in the finance with average pay of $88,258 annually.treasury analysts earn lower levels of education than finance planning analysts in general. They're 5.5% less likely to graduate with a Master's Degree and 0.3% less likely to earn a Doctoral Degree.What technology do you think will become more important and prevalent for finance planning analysts in the next 3-5 years?

Nate Peach Ph.D.

Associate Professor of Economics, George Fox University

Finance planning analyst vs. Analyst

Analysts are employees or individual contributors with a vast experience in a particular field that help the organization address challenges. They help the organization improve processes, policies, and other operations protocol by studying the current processes in place and determining the effectiveness of those processes. They also research industry trends and data to make sound inferences and recommendations on what the company should do to improve their numbers. Analysts recommend business solutions and often help the organization roll out these solutions. They ensure that the proposed action plans are effective and produce the desired results.

The required skills of the two careers differ considerably. For example, finance planning analysts are more likely to have skills like "powerpoint," "financial performance," "hyperion," and "variance analysis." But a analyst is more likely to have skills like "customer service," "troubleshoot," "data analysis," and "management system."

Analysts earn the highest salary when working in the technology industry, where they receive an average salary of $79,330. Comparatively, finance planning analysts have the highest earning potential in the finance industry, with an average salary of $88,258.analysts typically earn lower educational levels compared to finance planning analysts. Specifically, they're 7.8% less likely to graduate with a Master's Degree, and 0.8% less likely to earn a Doctoral Degree.Finance planning analyst vs. Equity analyst

An equity analyst's role is to help clients navigate through stocks and bonds using their expertise. In a company setting, their responsibilities revolve around performing extensive research and analysis on areas such as the stock market, coordinating with different departments to gather necessary data, identifying new opportunities, preparing and analyzing the company's financial records, and creating forecast models. Furthermore, as an equity analyst, it is essential to make recommendations in adherence to the company's policies and regulations, including its vision and mission.

Even though a few skill sets overlap between finance planning analysts and equity analysts, there are some differences that are important to note. For one, a finance planning analyst might have more use for skills like "financial analysis," "financial planning analysis," "hyperion," and "variance analysis." Meanwhile, some responsibilities of equity analysts require skills like "equities," "portfolio companies," "fundamental analysis," and "dcf. "

Equity analysts enjoy the best pay in the finance industry, with an average salary of $125,442. For comparison, finance planning analysts earn the highest salary in the finance industry.In general, equity analysts hold similar degree levels compared to finance planning analysts. Equity analysts are 1.9% more likely to earn their Master's Degree and 0.2% more likely to graduate with a Doctoral Degree.Types of finance planning analyst

Updated January 8, 2025