Automatically apply for jobs with Zippia

Upload your resume to get started.

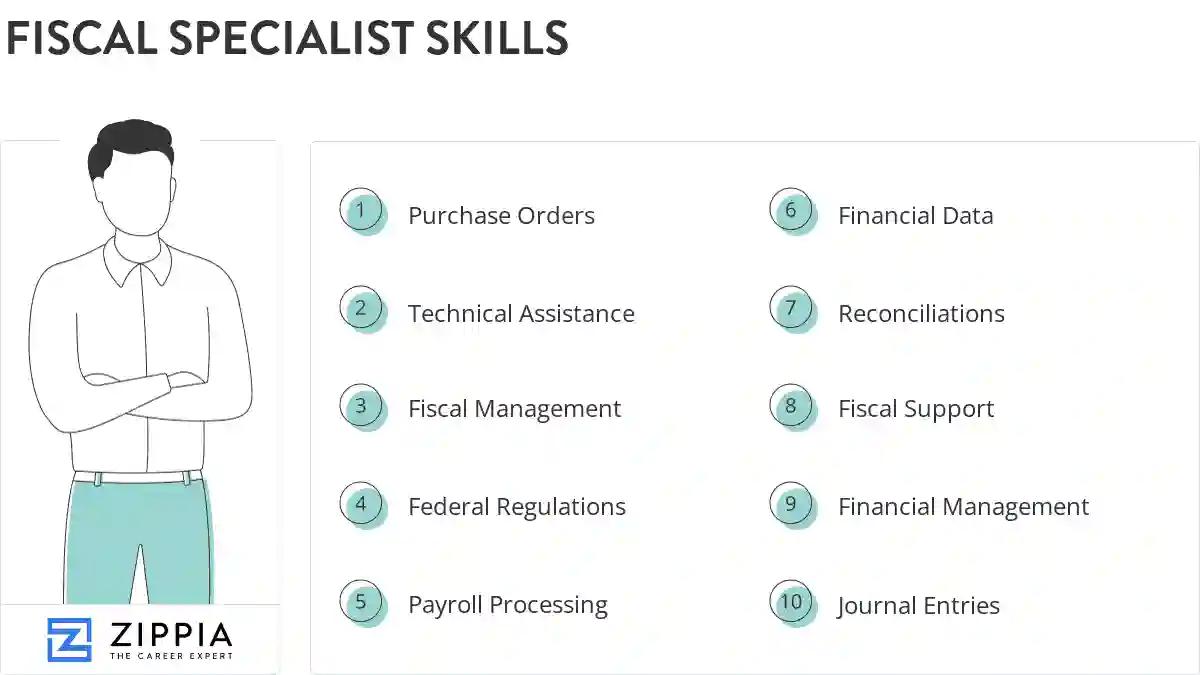

Fiscal specialist skills for your resume and career

15 fiscal specialist skills for your resume and career

1. Purchase Orders

- Processed reimbursements, payment applications, purchase orders and purchase requisitions according to procurement rules and regulations.

- Monitor and evaluate encumbrances/purchase orders and track expenditures including procurement card purchases.

2. Technical Assistance

Technical assistance is the non-financial assistance provided by local or international specialists. The purpose of technical assistance is to maximize the project's implementation and quality of the final product. Technical assistance consists of sharing information, the transmission of working knowledge, and other transfer of technical data which would aid the administration, management team and help build the project. The technical assistance focuses on particular needs identified by the beneficiary country and is delivered in the form of missions.

- Provide fiscal technical assistance to EARN Maryland program grantees, partners and stakeholders and EARN program staff.

- Provided technical assistance and training for year-round and seasonal staff.

3. Fiscal Management

- Received UW Professional & Organizational Development Fiscal Management Certification.

- Served in the following roles: Promoted to Patient Financial Services in 2004; promoted to Fiscal Management Officer in 2007.

4. Federal Regulations

Federal regulations refer to the set of rules, both general and permanent that are published in the Federal Register by the agencies of the federal government and the executive departments. Federal regulations are the large body of rules that govern federal practice. Examples of these laws include taxes and financial regulation, discrimination law, wages law, and so on.

- Maintain an understanding of the Federal Regulations that govern Wire Transfer transactions to minimize/eliminate potential loss to the credit union.

- Reviewed and analyzed initial budgets and subsequent changes in order to ensure compliance with federal regulations or grant regulations.

5. Payroll Processing

- Assist in various payroll processing functions; receive and verify time sheets, honorariums and consultant invoices for processing.

- Assist the Administrative Director in payroll processing, budget liquidation, and source document approval.

6. Financial Data

- Determine eligibility for federal and state reimbursement programs including gathering and reviewing child and family financial data.

- Provided and organized financial data to external auditor for fiscal year-end audit procedures.

Choose from 10+ customizable fiscal specialist resume templates

Build a professional fiscal specialist resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your fiscal specialist resume.7. Reconciliations

- Administered complex reconciliations and financial analysis based upon needs of the Finance Department.

- Performed monthly account reconciliations, journal entries and monitored general ledger transactions.

8. Fiscal Support

- Maintain detailed records related to fiscal support responsibilities.

- Conduct fiscal support workshops to business management of private providers site location.

9. Financial Management

- Maintain accounting, budgeting and all other financial management relevant duties for appropriated funds supporting the operating forces and supporting establishments.

- Worked collaboratively with co-workers both internal to the Eastern Region and throughout the bureau to achieve financial management excellence.

10. Journal Entries

Journal entries can be defined as an act of keeping or making records of any transactions either economic or non-economic. The journal entries are made in the accounting systems of an organization. The entries are filled with two main fields; debit and credit. The debit and credit must be equal at the end of a journal entry else it is not considered correct. The journal entries also keep the date of transactions and the names of the accounts that were affected by the transactions.

- Reconciled month end accounting reports for closing journal entries for a variety of accounts and calculated the allowance for doubtful accounts.

- Prepare journal entries; distribute cash, accounts receivable, income and other financial transactions to appropriate budget accounts.

11. Credit Card

A type of card issued by banks and other financial institutions, that enable users to manage and borrow their finances is called a credit card. The funds borrowed from a financial institution through a credit card are meant to be paid back along with certain amounts of interest imposed by the bank.

- Managed credit card log for Social Workers receiving monies for Patient Trust Funds, Welfare, Costco & Petty Cash.

- Approved the use of the Government Purchase Credit Card Program and any Temporary Additional Duty expenses within the aircraft group.

12. Fixed Assets

- Prepare annual fixed assets schedules for CAFR, including notes to the financial statements.

- Maintained organization all departments fixed assets and financial records.

13. Fiscal Operations

- Manage all regulatory Fiscal Operations Report and Application to Participate (FISAP) reporting to the Department of Education bi annually.

- Monitored fiscal operations, contracted community providers, and state-operated psychiatric hospitals.

14. General Ledger

- General ledger maintenance and responsible for adjusting entries by utilizing Microsoft Excel.

- Maintained the General Ledger accounts by ensuring that all accounts were substantiated and accurately reflected the status of CSREES program funds.

15. Grants Management

- Focused primarily on Grants Management and Funds Management dealing with Budget/Funds availability.

- Trained staff in new methods of accountability with regard to A/R, A/P and grants management.

5 Fiscal Specialist resume examples

Build a professional fiscal specialist resume in minutes. Browse through our resume examples to identify the best way to word your resume. Then choose from 5+ resume templates to create your fiscal specialist resume.

What skills help Fiscal Specialists find jobs?

Tell us what job you are looking for, we’ll show you what skills employers want.

What hard/technical skills are most important for fiscal specialists?

Frank Longo

Assistant Professor of Business, Centenary University

Keep in mind that successful firms performed audits, prepared tax returns, advised clients on data security, and much more during the pandemic, and they often did so remotely. This can be expected to continue into the future.

List of fiscal specialist skills to add to your resume

The most important skills for a fiscal specialist resume and required skills for a fiscal specialist to have include:

- Purchase Orders

- Technical Assistance

- Fiscal Management

- Federal Regulations

- Payroll Processing

- Financial Data

- Reconciliations

- Fiscal Support

- Financial Management

- Journal Entries

- Credit Card

- Fixed Assets

- Fiscal Operations

- General Ledger

- Grants Management

- Internal Controls

- Fiscal Policies

- UW

- Fiscal Reports

- Financial Transactions

- Bank Deposits

- PI

- Ledgers

- GAAP

- Bank Accounts

- Budget Reports

- Travel Expenses

- Medicaid

- PeopleSoft

- Expenditure Reports

- Travel Arrangements

- Payroll System

- Financial Systems

- Budget Activity

- Payment Processing

- A/P

- ACH

- Oracle Ebs

- Vendor Contracts

- Expense Reports

- Review Payroll

- PowerPoint

- Petty Cash

- Management System

- Child Support

- HR

- Reconcile Cash

Updated January 8, 2025