Explore jobs

Find specific jobs

Explore careers

Explore professions

Best companies

Explore companies

What is an investment advisor and how to become one

An investment advisor is any person or group that makes investment recommendations or conducts securities analysis in return for a fee, whether through direct management of the client's assets or by way of written publications. They often have discretionary authority over their client's assets and are required to uphold fiduciary responsibility standards.

You should possess essential skills to qualify for the position, including excellent communication and listening, as well as strong financial, analytical, organizational, and time management skills. As an investment advisor, your responsibilities will include educating clients on various ways of accomplishing their financial goals. You'll also determine the risk tolerance of your clients and analyze various investment options. Some of your day-to-day will include choosing investment options that suit your client best, providing investment recommendations, and record keeping.

Brokerage firms prefer investment advisors to be qualified and have at least a bachelor's degree with a major in finance, marketing, or business. Certain licenses are also available to cement your qualifications further. The average yearly salary for the position is $87,000; however, you can make more depending upon commissions and other bonuses. The average hourly salary for a traditional workweek is $41.85.

What general advice would you give to an investment advisor?

APS Professor of Economics at the University of Arizona, The University of Arizona

Avg. Salary $105,377

Avg. Salary $59,228

Growth rate 15%

Growth rate 0.3%

American Indian and Alaska Native 0.11%

Asian 8.22%

Black or African American 5.58%

Hispanic or Latino 9.38%

Unknown 4.37%

White 72.34%

Genderfemale 27.73%

male 72.27%

Age - 44American Indian and Alaska Native 3.00%

Asian 7.00%

Black or African American 14.00%

Hispanic or Latino 19.00%

White 57.00%

Genderfemale 47.00%

male 53.00%

Age - 44Stress level is high

7.1 - high

Complexity level is advanced

7 - challenging

Work life balance is fair

6.4 - fair

Investment advisor career paths

Key steps to become an investment advisor

Explore investment advisor education requirements

Start to develop specific investment advisor skills

Skills Percentages Exceptional Client 11.58% Risk Management 9.79% Client Relationships 8.83% Health Insurance 8.22% Business Development 6.62% Complete relevant investment advisor training and internships

Accountants spend an average of 1-2 years on post-employment, on-the-job training. New investment advisors learn the skills and techniques required for their job and employer during this time. The chart below shows how long it takes to gain competency as an investment advisor based on U.S. Bureau of Labor Statistics data and data from real investment advisor resumes.Gain additional investment advisor certifications

More About CertificationsInvestment advisor certifications can show employers you have a baseline of knowledge expected for the position. Certifications can also make you a more competitive candidate. Even if employers don't require a specific investment advisor certification, having one may help you stand out relative to other applicants.

The most common certifications for investment advisors include Certified Professional, Life and Health Insurance Program (CPLHI) and Chartered Financial Analyst (CFA).

Research investment advisor duties and responsibilities

- Manage and strengthen customer relationships through cross-selling and up-selling to maximize retention and income generation by contacting existing and prospective customers.

- Obtain skills with different financial programs and tools such as Morningstar and NetX360.

- Advise and recommend insurance products including, fix and variable annuities, and term life.

- Focus on macroeconomic fundamentals, high yield, distress debt, volatility and macro base cross-asset statistical strategies.

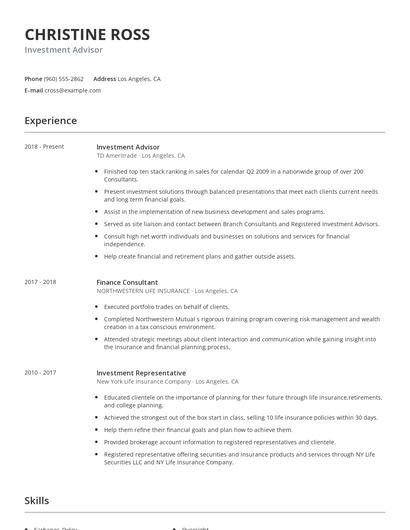

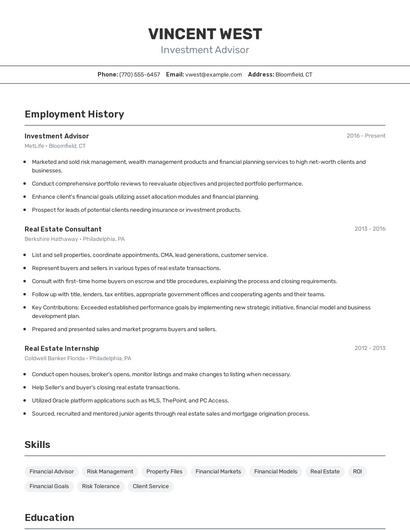

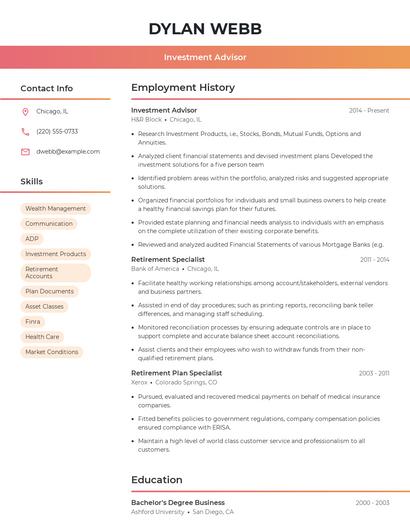

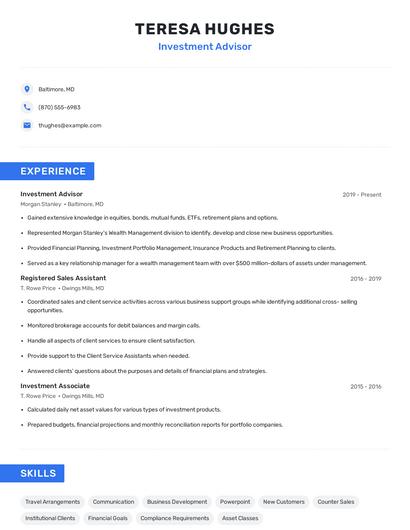

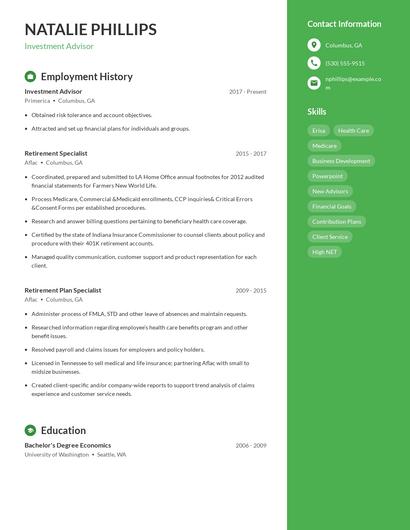

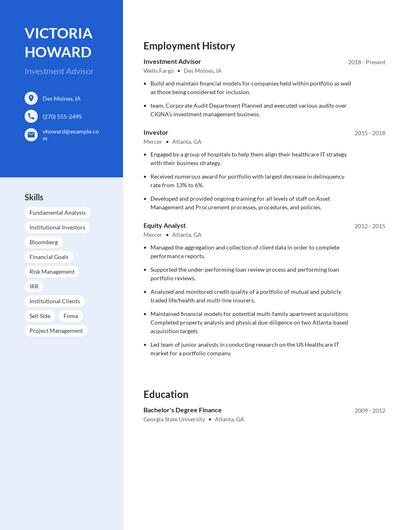

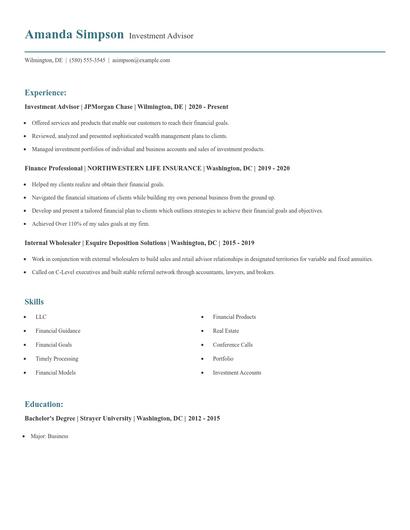

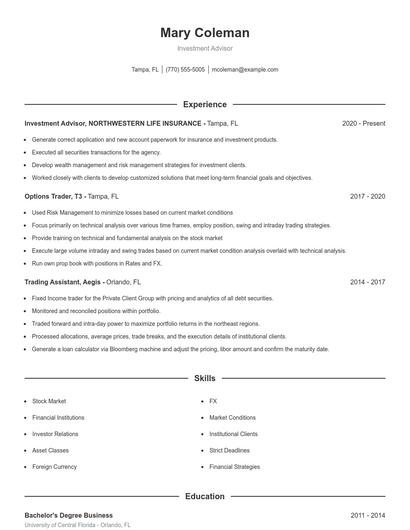

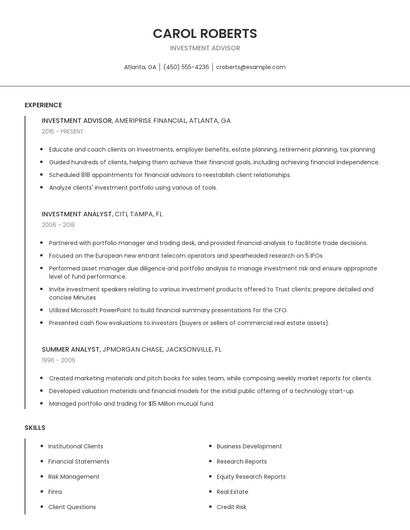

Prepare your investment advisor resume

When your background is strong enough, you can start writing your investment advisor resume.

You can use Zippia's AI resume builder to make the resume writing process easier while also making sure that you include key information that hiring managers expect to see on an investment advisor resume. You'll find resume tips and examples of skills, responsibilities, and summaries, all provided by Zippi, your career sidekick.

Choose from 10+ customizable investment advisor resume templates

Build a professional investment advisor resume in minutes. Browse through our resume examples to identify the best way to word your resume. Then choose from 10+ resume templates to create your investment advisor resume.Apply for investment advisor jobs

Now it's time to start searching for an investment advisor job. Consider the tips below for a successful job search:

- Browse job boards for relevant postings

- Consult your professional network

- Reach out to companies you're interested in working for directly

- Watch out for job scams

How did you land your first investment advisor job

Are you an investment advisor?

Share your story for a free salary report.

Average investment advisor salary

The average investment advisor salary in the United States is $105,377 per year or $51 per hour. Investment advisor salaries range between $60,000 and $184,000 per year.

What am I worth?

How do investment advisors rate their job?

Investment advisor reviews

Hi pay low pay never know how much you’re gonna get paid

Never knowing how much you’re gonna get paid