Automatically apply for jobs with Zippia

Upload your resume to get started.

Settlement clerk skills for your resume and career

15 settlement clerk skills for your resume and career

1. Data Entry

Data entry means entering data into a company's system with the help of a keyboard. A person responsible for entering data may also be asked to verify the authenticity of the data being entered. A person doing data entry must pay great attention to tiny details.

- Performed general Data Entry clerk and operated Main Voice Line.

- Utilized Data Entry skills and Microsoft Word for nightly data input

2. Settlement Statements

A settlement statement is a document that holds summaries of all the terms and conditions regarding a settlement. In the cases of a loan settlement statement, it fully discloses the terms of a loan and all details of the charges that a borrower needs to pay from a loan's interest.

- Prepared HUD-1 Settlement Statements in accordance with Bank loan instructions for refinance and purchase transactions.

- Prepared HUD-1 Settlement Statements in accordance with Bank loan instructions.

3. Administrative Tasks

- Demonstrated effective aptitude in a position that required the ability to handle a variety of customer service and administrative tasks.

- Prepared administrative tasks using automated systems involving assigning, maintaining, monitoring and updating work status and inventory records.

4. Bank Deposits

Any money that a customer chooses to leave with their bank account is a deposit. Deposits can vary in amounts and different banks have limits on the deposits their customers can have as a minimum. Banks charge customers for deposits especially when a teller is used by the customer to deposit money into their account.

- Post and pay invoices, reconcile accounts, EFT, and make bank deposits.

- Enter into spreadsheets and ready for bank deposits.

5. Computer System

- Participated in the conversion and quickly acquired a skilled and efficient knowledge of a more complex invoicing and settlement computer system.

- Balanced ATM deposits; processed through NCR and into Computer System.

6. Multi-Line Phone System

- Relieved receptionist operating a multi-line phone system.

Choose from 10+ customizable settlement clerk resume templates

Build a professional settlement clerk resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your settlement clerk resume.7. Customer Accounts

- Developed new processes for management of customer accounts Trained new employees in settlement process and facilitated interdepartmental transition

- Settled drivers' sales commissions and customer accounts for specific territories.

8. DTC

- Answered general telephone inquiries from other areas as well as other firms with questions regarding DTC settlement area.

- Balanced the firm's daily NSCC balance order account verses the DTC NSCC participant account statement.

9. AS400

- Processed Independent Contractors and Logistic Carriers settlements by using AS400 software.

- Process and release settlements through AS400 Verify invoice and accessorial amounts for accuracy, perform carrier verification.

10. Wire Transfers

A wire transfer is an electronic bank transaction where funds are transferred from one person to another. The transfer can be within the same bank or from one bank to another. Wire transfer makes it possible to transfer money to anyone anywhere in the world and to also transfer money to multiple accounts seamlessly regardless of location.

- Prepared wire transfer forms for payments of pair offs, repos, and trade instructions for partial pair offs.

- Submitted wire transfer from bank to pay our international growers Prepared weekly grower settlement reports.

11. Load Sheet

- Settled milk routes daily by balancing accounts, making proper adjustments against load sheets, and inputted corrections into accounting software.

- Handled all monies and company paperwork to ensure balance between money, outgoing product, invoices, and load sheets.

12. ACH

Automated Clearing House, ACH is a computerized electronic network to process, coordinate and manage transactions (credit and debit) and automated money transfers between banks and other financial institutions without the use of paper checks, electronic transfers, credit cards, or cash networks. The ACH network is regulated by the federal government and managed by the National Automated Clearing House Association (NACHA).

- Answered ACH related questions for external customers and bank personnel.

- Prepared and resolved customer disputes on ACH transactions.

13. Foreign Exchange

- Process all Foreign Exchange, Money Market, and Financial Futures.

- Input transactions and verified all Foreign Exchange and Money Market processing.

14. Process Payroll

- Trained new employees and supervised their performance while learning how to process payroll and settlements.

- Obtain labor information and process payroll accurately and efficiently delivering document with all proper procedures for various accounts.

15. Financial Institutions

Financial Institutions come in all sizes, forms, and are meant for all sorts of purposes. Some only keep money, some only trade it, some focus on extending loans, some work with only other financial corporations or regular business and companies, and some are built to be useful and multi-purpose. A central bank, for example, is a banking institution meant to keep an eye on other banks and ensure that no laws or rules are broken or bent.

- Processed debit and credit adjustments necessary to settle accounts with depositing financial institutions.

- Perform operational duties associated with check processing and investigating inquiries received from financial institutions and other Federal Reserve offices.

5 Settlement Clerk resume examples

Build a professional settlement clerk resume in minutes. Browse through our resume examples to identify the best way to word your resume. Then choose from 5+ resume templates to create your settlement clerk resume.

What skills help Settlement Clerks find jobs?

Tell us what job you are looking for, we’ll show you what skills employers want.

List of settlement clerk skills to add to your resume

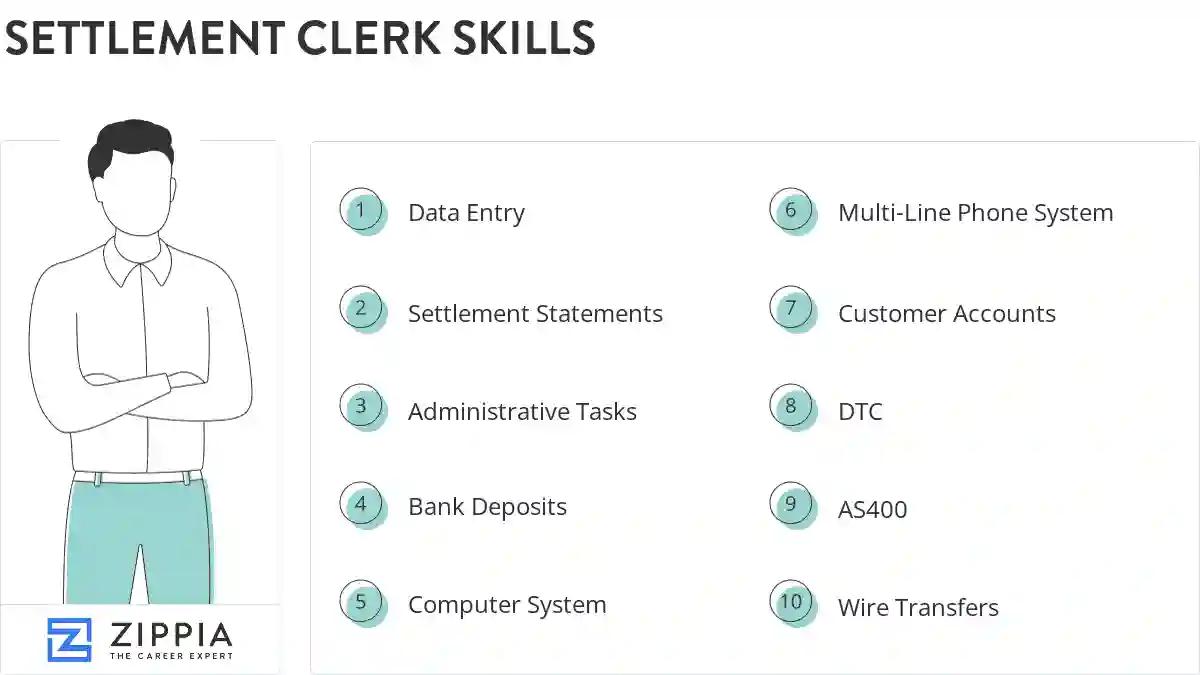

The most important skills for a settlement clerk resume and required skills for a settlement clerk to have include:

- Data Entry

- Settlement Statements

- Administrative Tasks

- Bank Deposits

- Computer System

- Multi-Line Phone System

- Customer Accounts

- DTC

- AS400

- Wire Transfers

- Load Sheet

- ACH

- Foreign Exchange

- Process Payroll

- Financial Institutions

- DOT

- Service Calls

- Owner Operators

- Office Equipment

- A/R

- ATM

- Route Settlement

- PPG

- Customer Orders

- Sales Reports

- Customer Inquiries

Updated January 8, 2025