Find a Job You Really Want In

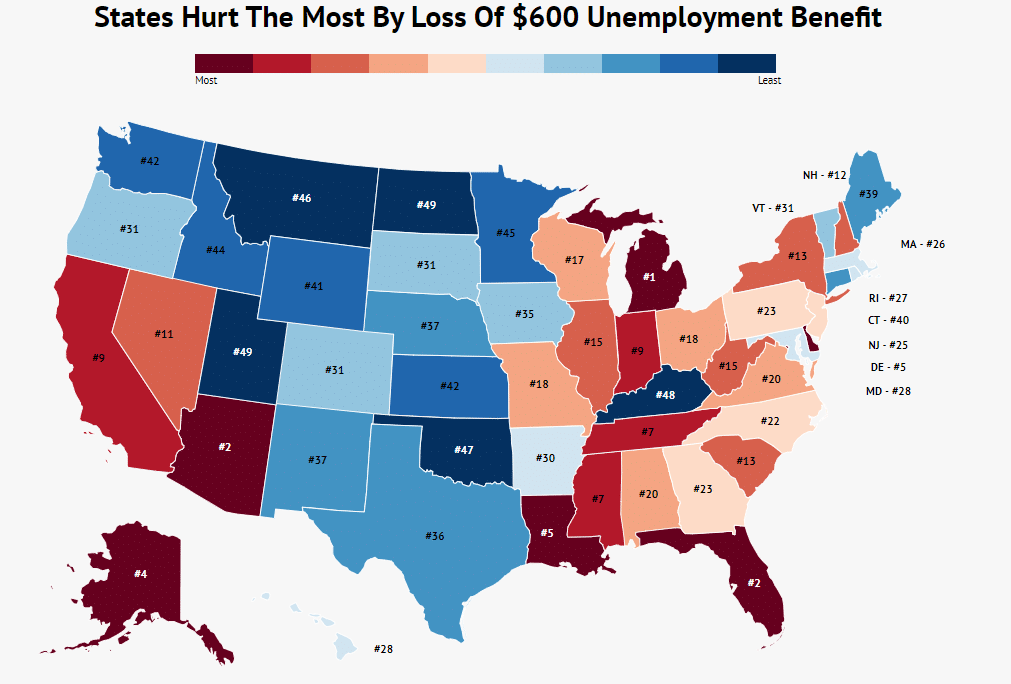

In the wake of changing economic conditions, many Americans are still navigating the complexities of unemployment benefits. With the discontinuation of additional federal support, workers are left to depend on their state’s unemployment benefits, which vary widely.

The end of the supplemental benefits means that many individuals will revert to state-provided weekly maximums, which can range from as high as $823 to as low as $235. Typically, unemployed workers receive around 50% of their previous wages, leaving many at risk of financial instability.

As unemployment rates remain elevated in various regions, concerns about job security and the ability to cover essential expenses are more pressing than ever. This article examines the states likely to experience the most significant challenges as they adjust to the absence of enhanced unemployment support.

States Most Impacted

Workers in these ten states face significant challenges due to low maximum state benefits coupled with high unemployment rates, making it particularly difficult to secure new employment.

How We Analyzed This Data

Our ranking criteria included:

- Maximum Weekly Unemployment Benefits

- Current Unemployment Rate

The maximum weekly unemployment benefits data was sourced from each state’s unemployment website, while the unemployment rate reflects June 2023 statistics from the Bureau of Labor Statistics (BLS).

While the duration of unemployment benefits varies significantly by state, we chose not to include this variable in our ranking due to its complexity and the nuance surrounding the end of federal support.

1. Michigan

Max Weekly Benefits: $362

June Unemployment: 14.8%

Max Weeks: 33

Michigan ranks as the state most at risk as the additional federal benefits cease. With a high unemployment rate of 14.8%, many workers will face a significant drop in support, with maximum weekly benefits at only $362.

2. Florida

Max Weekly Benefits: $275

June Unemployment: 10.4%

Max Weeks: 25

Florida’s unemployment system is among the least supportive nationwide, with maximum benefits capped at $275. This poses a challenge for the nearly 10% of unemployed Floridians, especially given the short duration of benefits.

3. Arizona

Max Weekly Benefits: $240

June Unemployment: 10%

Max Weeks: 39

Arizona faces a challenging employment landscape with a 10% unemployment rate. The maximum weekly benefit is just $240, which is insufficient for many, particularly with rent costs averaging over $1,036 per month.

4. Alaska

Max Weekly Benefits: $370

June Unemployment: 12.4%

Max Weeks: 39

Alaska’s combination of low benefits and high unemployment presents a difficult situation for workers facing a sudden drop in financial support.

5. Delaware

Max Weekly Benefits: $400

June Unemployment: 12.5%

Max Weeks: 39

With an unemployment rate of 12.5%, Delaware’s maximum weekly benefit of $400 poses a financial strain on residents, especially given the state’s cost of living.

6. Louisiana

Max Weekly Benefits: $247

June Unemployment: 9.7%

Max Weeks: 39

Louisiana’s low maximum benefits and relatively high unemployment rate mean that many workers are struggling to make ends meet without additional federal aid.

7. Tennessee

Max Weekly Benefits: $275

June Unemployment: 9.7%

Max Weeks: 39

Tennessee’s unemployment rate and low benefits leave many residents in a precarious situation as they attempt to find new work.

8. Mississippi

Max Weekly Benefits: $235

June Unemployment: 8.7%

Max Weeks: 39

Mississippi’s maximum weekly benefit is the lowest in the nation at just $235, creating significant financial strain for many unemployed workers.

9. California

Max Weekly Benefits: $450

June Unemployment: 14.9%

Max Weeks: 39

Despite having higher benefits, California’s unemployment rate remains high at nearly 15%, complicating the financial situation for many displaced workers.

10. Indiana

Max Weekly Benefits: $390

June Unemployment: 11.2%

Max Weeks: 39

Indiana’s workers are facing a difficult situation with a high unemployment rate and reduced benefits, making it harder for them to navigate financial challenges.

The Vulnerability of Workers

While unemployment is a national concern, workers in these ten states face particularly daunting challenges. With minimal benefits that often fail to meet basic living expenses and high unemployment rates making job acquisition difficult, many are understandably anxious about their financial futures.

As states continue to navigate post-pandemic recovery, workers are left watching the legislative process, uncertain if further relief will materialize. The end of additional benefits exacerbates the economic pressure on countless families.

Ranked States Facing the Most Hardship Post-Stimulus

| Rank | State | Max Weekly Benefits | June Unemployment |

|---|---|---|---|

| 1 | Michigan | 362 | 14.8 |

| 2 | Arizona | 240 | 10 |

| 3 | Florida | 275 | 10.4 |

| 4 | Alaska | 370 | 12.4 |

| 5 | Louisiana | 247 | 9.7 |

| 6 | Delaware | 400 | 12.5 |

| 7 | Mississippi | 235 | 8.7 |

| 8 | Tennessee | 275 | 9.7 |

| 9 | California | 450 | 14.9 |

| 10 | Indiana | 390 | 11.2 |