Explore jobs

Find specific jobs

Explore careers

Explore professions

Best companies

Explore companies

What is a branch lending officer and how to become one

Branch lending officers evaluate and authorize approval of business, real estate, or credit loans. They are specialists at evaluating the financial status of a loan applicant. Duties include updating account records and reviewing loan files. They work for commercial banks, mortgage companies, or credit unions.

Some of the functions that they perform include meeting with loan applicants to identify their needs and collect information for loan applications, analyzing active loan files on a regular basis and recommending solutions to speed up the loan process, preparing detailed lending proposals, and operating in compliance with laws and regulations. Qualifications include a bachelor's degree in finance or similar field along with at least three years of experience as a loan officer or a related capacity. Moreover, a solid understanding of local, state, and federal loan regulations is also required. Essential skills include interpersonal, computer, communication, and customer service.

The average hourly salary for the position is $29.19, which amounts to $60,723 annually. The career is expected to grow in the near future and create new opportunities across the United States.

Avg. Salary $46,615

Avg. Salary $59,228

Growth rate 4%

Growth rate 0.3%

American Indian and Alaska Native 0.48%

Asian 6.40%

Black or African American 9.22%

Hispanic or Latino 16.01%

Unknown 4.64%

White 63.27%

Genderfemale 39.97%

male 60.03%

Age - 44American Indian and Alaska Native 3.00%

Asian 7.00%

Black or African American 14.00%

Hispanic or Latino 19.00%

White 57.00%

Genderfemale 47.00%

male 53.00%

Age - 44Stress level is high

7.1 - high

Complexity level is advanced

7 - challenging

Work life balance is fair

6.4 - fair

Branch lending officer career paths

Key steps to become a branch lending officer

Explore branch lending officer education requirements

Start to develop specific branch lending officer skills

Skills Percentages Business Relationships 19.38% Origination 15.29% FHA 12.33% Mortgage Loans 8.48% Loan Products 8.39% Complete relevant branch lending officer training and internships

Accountants spend an average of 6-12 months on post-employment, on-the-job training. New branch lending officers learn the skills and techniques required for their job and employer during this time. The chart below shows how long it takes to gain competency as a branch lending officer based on U.S. Bureau of Labor Statistics data and data from real branch lending officer resumes.Research branch lending officer duties and responsibilities

- Manage financial resources from budget, treasury, expenditure commitments, accounting and finance, report from different departments to donors/stakeholders.

- Obtain unique identifier with the NMLS.

- Train in FNMA and FHLMC retention, including producing and production staff.

- Originate and process conventional/VA loans in compliance with FNMA, FHLMC, and non-conforming investor guidelines.

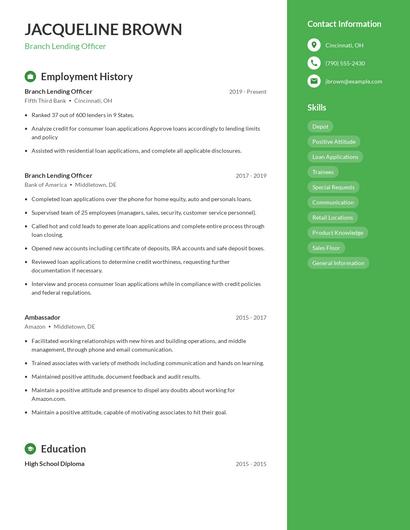

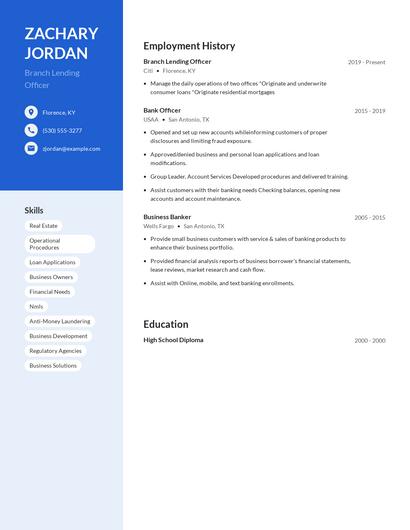

Prepare your branch lending officer resume

When your background is strong enough, you can start writing your branch lending officer resume.

You can use Zippia's AI resume builder to make the resume writing process easier while also making sure that you include key information that hiring managers expect to see on a branch lending officer resume. You'll find resume tips and examples of skills, responsibilities, and summaries, all provided by Zippi, your career sidekick.

Choose from 10+ customizable branch lending officer resume templates

Build a professional branch lending officer resume in minutes. Browse through our resume examples to identify the best way to word your resume. Then choose from 10+ resume templates to create your branch lending officer resume.Apply for branch lending officer jobs

Now it's time to start searching for a branch lending officer job. Consider the tips below for a successful job search:

- Browse job boards for relevant postings

- Consult your professional network

- Reach out to companies you're interested in working for directly

- Watch out for job scams

How did you land your first branch lending officer job

Are you a branch lending officer?

Share your story for a free salary report.

Average branch lending officer salary

The average branch lending officer salary in the United States is $46,615 per year or $22 per hour. Branch lending officer salaries range between $29,000 and $73,000 per year.

What am I worth?

How do branch lending officers rate their job?

Branch lending officer reviews

Helping People, secure a better financial future

Having to Decline applicants

when a person being assisted to obtain a loan to uplift their lives

when more loans are deliquent