What does a finance and reporting analyst do?

A finance and reporting analyst is an individual who prepares financial documentation that reflects the financial standing of an organization. To ensure accurate financial reports, finance and reporting analyst must work closely with various departments and use the Generally Accepted Accounting Principles (GAAP) to create financial statements. They are required to analyze the organization's income and expenses and reconcile accounts. Finance and reporting analysts also provide financial information to auditors and issue data used in Securities and Exchange Commission (SEC) filings.

Finance and reporting analyst responsibilities

Here are examples of responsibilities from real finance and reporting analyst resumes:

- Manage derivative accounting at global level and ensure accounting and economic hedging objectives are align.

- Maintain integrity of subsidiary financial data via account reconciliations, supervise accounting activities, and implement control measures where necessary.

- Review and analyze financial data and reconciliations to ensure accuracy and compliance with the departmental guidelines and company policy.

- Perform quality control on data and formulas by utilizing multiple ERP's.

- Extract and assess ERP system data for use by senior financial management in decision-making.

- Resolve disparities and protract discrepancies for a diverse blend of securities hold in structure portfolios.

- Prepare security hedging grids and reports of highest-risk securities for senior management and trading desks.

- Prepare graphs for A/R days sales outstanding, A/P days outstanding, and hard goods inventory days supply.

- Develop flowcharts and narratives require for SOX reporting on behalf of an industry leading banking and financial services firm.

- Develop and maintain Sarbanes-Oxley documentation procedures.

- Perform financial reporting controls in accordance with SOX requirements.

- Participate in audit meetings to discuss issues relate to Sarbanes-Oxley compliance.

- Prepare quarterly and annual reports including financial statements and footnotes on GAAP analysis.

- Prepare daily treasury reports, including analysis of account movements and investigation of variances.

- Insure compliance with all legal documentation requirements and applicable company policies including current GAAP.

Finance and reporting analyst skills and personality traits

We calculated that 6% of Finance And Reporting Analysts are proficient in PowerPoint, Reconciliations, and Financial Analysis. They’re also known for soft skills such as Computer skills, Analytical skills, and Communication skills.

We break down the percentage of Finance And Reporting Analysts that have these skills listed on their resume here:

- PowerPoint, 6%

Create PowerPoint Presentations for VP Management Meetings which requires collecting and analyzing financial data and creating specialized reports.

- Reconciliations, 5%

General Ledger Maintenance - Processed journal entries and completed general ledger reconciliations; researched issues and made necessary journal adjustments.

- Financial Analysis, 5%

Provided timely financial decision support to plant management in the form of historical and projected financial analysis and projected rolling estimates.

- External Auditors, 5%

Worked closely with Corporate Accounting, Corporate Treasury, and external auditors with regards to elements of financial and regulatory reporting.

- Internal Controls, 4%

Produced, analyzed and ensured accuracy for monthly financial statements, production reporting, forecast and internal controls.

- Financial Data, 4%

Analyzed each business unit's monthly financial data and maintained accurate records for the consolidation of accounting activity.

Common skills that a finance and reporting analyst uses to do their job include "powerpoint," "reconciliations," and "financial analysis." You can find details on the most important finance and reporting analyst responsibilities below.

Computer skills. One of the key soft skills for a finance and reporting analyst to have is computer skills. You can see how this relates to what finance and reporting analysts do because "financial analysts must be adept at using software to analyze financial data and trends, create portfolios, and make forecasts." Additionally, a finance and reporting analyst resume shows how finance and reporting analysts use computer skills: "advanced knowledge in various computer systems, including precision (fiserv), excel, access and hyperion s essbase. "

Analytical skills. Another essential skill to perform finance and reporting analyst duties is analytical skills. Finance and reporting analysts responsibilities require that "financial analysts must evaluate a range of information in finding profitable investments." Finance and reporting analysts also use analytical skills in their role according to a real resume snippet: "experience in excel vba (updating and running macros) and ms access database to pull out data as needed. "

Communication skills. finance and reporting analysts are also known for communication skills, which are critical to their duties. You can see how this skill relates to finance and reporting analyst responsibilities, because "financial analysts must be able to clearly explain their recommendations to clients." A finance and reporting analyst resume example shows how communication skills is used in the workplace: "assisted in the quarterly earnings release process, including communication with senior management. "

Detail oriented. A big part of what finance and reporting analysts do relies on "detail oriented." You can see how essential it is to finance and reporting analyst responsibilities because "financial analysts must pay attention when reviewing a possible investment, as even small issues may have large implications for its health." Here's an example of how this skill is used from a resume that represents typical finance and reporting analyst tasks: "assessed the risk of financial transactions by performing detailed financial analysis as well as ad hoc reporting. "

Math skills. A commonly-found skill in finance and reporting analyst job descriptions, "math skills" is essential to what finance and reporting analysts do. Finance and reporting analyst responsibilities rely on this skill because "financial analysts use mathematics to estimate the value of financial securities." You can also see how finance and reporting analyst duties rely on math skills in this resume example: "conduct quantitative analysis of financial data to forecast revenue and asses risks associated with capital expenditures. "

The three companies that hire the most finance and reporting analysts are:

- USAA157 finance and reporting analysts jobs

- Lincoln Financial Group99 finance and reporting analysts jobs

- Guidehouse48 finance and reporting analysts jobs

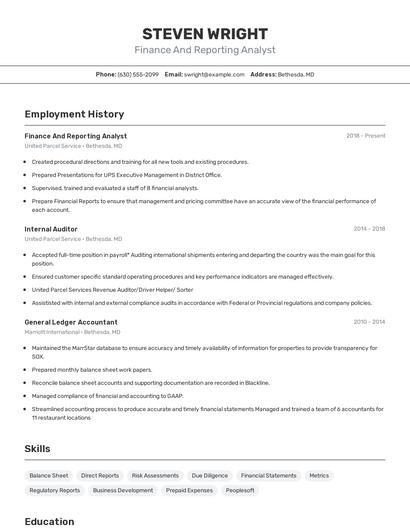

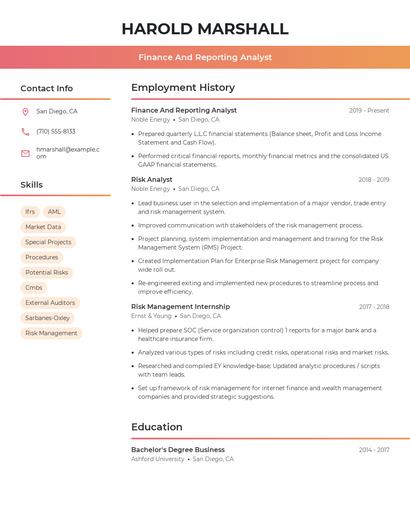

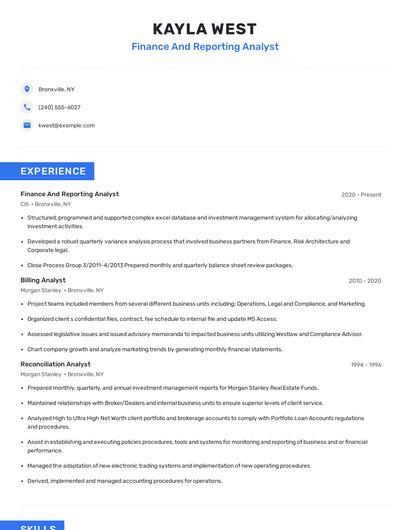

Choose from 10+ customizable finance and reporting analyst resume templates

Build a professional finance and reporting analyst resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your finance and reporting analyst resume.Compare different finance and reporting analysts

Finance and reporting analyst vs. Risk analyst

As a risk analyst, you will oversee the identification, assessment, and monitoring of risks that your company has been exposed to. You will evaluate financial documents, potential clients, and economic conditions to determine the level of risk in business decisions. You will be responsible for aggregating data from several sources to develop a comprehensive assessment and create reports, processes, and presentations to better present results. You are also expected to work closely with other team members to analyze and show data effectively.

While similarities exist, there are also some differences between finance and reporting analysts and risk analyst. For instance, finance and reporting analyst responsibilities require skills such as "reconciliations," "external auditors," "hyperion," and "us gaap." Whereas a risk analyst is skilled in "risk management," "risk assessments," "sas," and "risk analysis." This is part of what separates the two careers.

Risk analysts tend to make the most money working in the manufacturing industry, where they earn an average salary of $77,608. In contrast, finance and reporting analysts make the biggest average salary, $88,192, in the finance industry.On average, risk analysts reach similar levels of education than finance and reporting analysts. Risk analysts are 1.7% less likely to earn a Master's Degree and 0.9% more likely to graduate with a Doctoral Degree.Finance and reporting analyst vs. Treasury analyst

A treasury analyst is an individual who manages and analyses the financial activities of an organization that can include cash flows, liability obligations, and assets. Treasury analysts are required to execute the daily cash management of the organization such as cash forecasting, investing of excess cash, and running a hedging program in interest rates. They must present monthly reports and daily briefings on cash flows to senior management and provide advice on the financial operations of the movement of cash. Treasury analysts also update treasury policies and procedures for the organization to comply.

In addition to the difference in salary, there are some other key differences worth noting. For example, finance and reporting analyst responsibilities are more likely to require skills like "powerpoint," "financial data," "us gaap," and "pivot tables." Meanwhile, a treasury analyst has duties that require skills in areas such as "cash management," "ach," "treasury operations," and "journal entries." These differences highlight just how different the day-to-day in each role looks.

Treasury analysts earn a lower average salary than finance and reporting analysts. But treasury analysts earn the highest pay in the automotive industry, with an average salary of $87,077. Additionally, finance and reporting analysts earn the highest salaries in the finance with average pay of $88,192 annually.Average education levels between the two professions vary. Treasury analysts tend to reach similar levels of education than finance and reporting analysts. In fact, they're 3.2% less likely to graduate with a Master's Degree and 0.9% less likely to earn a Doctoral Degree.What technology do you think will become more important and prevalent for finance and reporting analysts in the next 3-5 years?

Nate Peach Ph.D.

Associate Professor of Economics, George Fox University

Finance and reporting analyst vs. Senior finance consultant

A senior finance consultant is responsible for helping clients manage their account portfolios, recommending investment options, and monitoring their finances. Senior finance consultants should have extensive knowledge of the financial industry, especially on working with clients and inform them of current financial services and strategize financial plans according to the clients' needs and best interests. They also respond to clients' inquiries and concerns regarding their account performance and financial discrepancies, resolving issues to achieve the clients' long-term financial goals and objectives.

There are many key differences between these two careers, including some of the skills required to perform responsibilities within each role. For example, a finance and reporting analyst is likely to be skilled in "powerpoint," "us gaap," "pivot tables," and "regulatory reports," while a typical senior finance consultant is skilled in "project management," "financial services," "strong analytical," and "risk management."

Senior finance consultants earn the best pay in the technology industry, where they command an average salary of $100,438. Finance and reporting analysts earn the highest pay from the finance industry, with an average salary of $88,192.When it comes to education, senior finance consultants tend to earn similar degree levels compared to finance and reporting analysts. In fact, they're 3.7% more likely to earn a Master's Degree, and 0.2% more likely to graduate with a Doctoral Degree.Finance and reporting analyst vs. Finance manager

A finance manager is responsible for monitoring the financial system of a company. Their tasks include handling their organization's financial status, generating cost estimates and budget goals, identifying business opportunities to increase revenues and profitability, improving financial strategies, reducing costs, analyzing account statements, processing invoice as needed, analyzing market trends, searching potential partnerships, and presenting reports. A finance manager must have excellent analytical skills and knowledge of the accounting and financial industry. They are responsible for providing the best recommendations for the organization's growth.

Types of finance and reporting analyst

Updated January 8, 2025