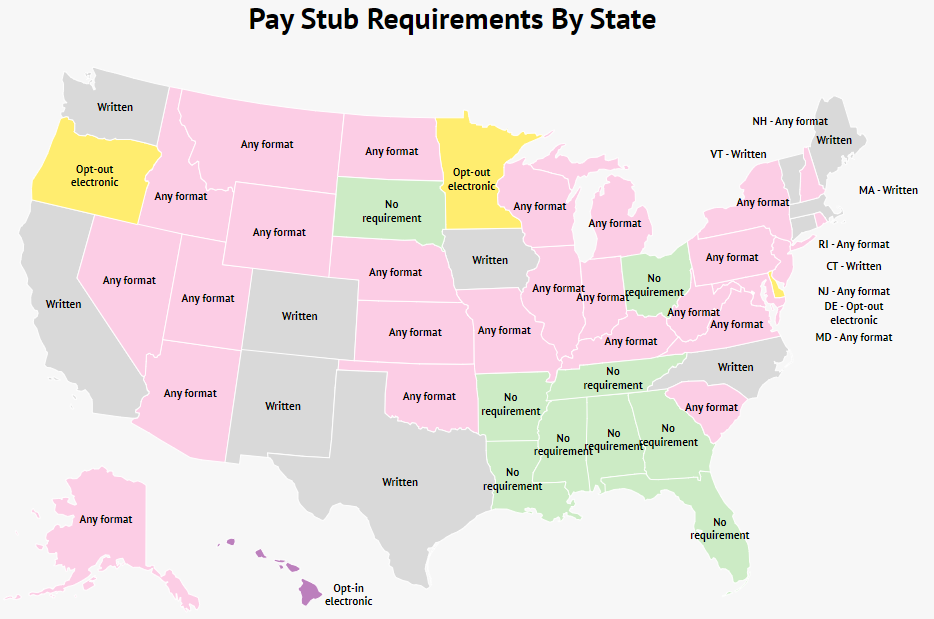

Understanding Pay Stub Requirements by State in 2026: Pay stubs play an essential role in ensuring transparency in employee compensation. As remote and hybrid work continue to reshape the labor market, understanding the requirements for pay stubs across the states is crucial for both employees and employers. Our comprehensive analysis of pay stub regulations across all 50 states highlights notable variances, revealing which states mandate written documentation and which allow electronic formats. Here’s what you need to know:

Pay Stub Requirements by State

| State | Pay Stub Requirements |

|---|---|

| Alabama | No requirement |

| Alaska | Employers must provide pay stubs in any format |

| Arizona | Employers must provide pay stubs in any format |

| Arkansas | No requirement |

| California | Employers must provide written or printed pay stubs |

| Colorado | Employers must provide written or printed pay stubs |

| Connecticut | Employers must provide written or printed pay stubs |

| Delaware | Employers may provide electronic pay stubs, but employees can request paper stubs |

| Florida | No requirement |

| Georgia | No requirement |

| Hawaii | Employers can only provide electronic pay stubs when requested |

| Idaho | Employers must provide pay stubs in any format |

| Illinois | Employers must provide pay stubs in any format |

| Indiana | Employers must provide pay stubs in any format |

| Iowa | Employers must provide written or printed pay stubs |

| Kansas | Employers must provide pay stubs in any format |

| Kentucky | Employers must provide pay stubs in any format |

| Louisiana | No requirements |

| Maine | Employers must provide written or printed pay stubs |

| Maryland | Employers must provide pay stubs in any format |

| Massachusetts | Employers must provide written or printed pay stubs |

| Michigan | Employers must provide pay stubs in any format |

| Minnesota | Employers may provide electronic pay stubs, but employees can request paper stubs |

| Mississippi | No requirements |

| Missouri | Employers must provide pay stubs in any format |

| Montana | Employers must provide pay stubs in any format |

| Nebraska | Employers must provide pay stubs in any format |

| Nevada | Employers must provide pay stubs in any format |

| New Hampshire | Employers must provide pay stubs in any format |

| New Jersey | Employers must provide pay stubs in any format |

| New Mexico | Employers must provide written or printed pay stubs |

| New York | Employers must provide pay stubs in any format |

| North Carolina | Employers must provide written or printed pay stubs |

| North Dakota | Employers must provide pay stubs in any format |

| Ohio | No requirements |

| Oklahoma | Employers must provide pay stubs in any format |

| Oregon | Employers may provide electronic pay stubs, but employees can request paper stubs |

| Pennsylvania | Employers must provide pay stubs in any format |

| Rhode Island | Employers must provide pay stubs in any format |

| South Carolina | Employers must provide pay stubs in any format |

| South Dakota | No requirements |

| Tennessee | No requirements |

| Texas | Employers must provide written or printed pay stubs |

| Utah | Employers must provide pay stubs in any format |

| Vermont | Employers must provide written or printed pay stubs |

| Virginia | Employers must provide pay stubs in any format |

| Washington | Employers must provide written or printed pay stubs |

| West Virginia | Employers must provide pay stubs in any format |

| Wisconsin | Employers must provide pay stubs in any format |

| Wyoming | Employers must provide pay stubs in any format |

Which States Require Pay Stubs?

In 2026, 41 states mandate the provision of pay stubs in some capacity, with 26 states allowing pay stubs to be delivered in various formats. These pay stubs serve an essential function in ensuring compliance with labor laws and protecting employee rights.

Typically, pay stubs must detail pay frequency, gross wages, net pay, taxes, deductions, and employer contributions, including any overtime. This comprehensive documentation is vital for both employees and employers.

States that Require Pay Stubs in Any Format

- Alaska

- Arizona

- Idaho

- Illinois

- Indiana

- Kansas

- Kentucky

- Maryland

- Michigan

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New York

- North Dakota

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- Utah

- Virginia

- West Virginia

- Wisconsin

- Wyoming

In these states, employers are required to provide pay stubs in any format, allowing flexibility in meeting this obligation.

States that Require Written Pay Stubs

- California

- Colorado

- Connecticut

- Iowa

- Maine

- Massachusetts

- New Mexico

- North Carolina

- Texas

- Vermont

- Washington

In these 11 states, employers must provide written pay stubs, ensuring careful record-keeping and transparency in wage documentation.

Opt-In and Opt-Out States

| Opt-Out of Electronic Pay Stubs | Opt-In to Electronic Pay Stubs |

|---|---|

| Delaware | Hawaii |

| Minnesota | |

| Oregon |

States that Don’t Require Pay Stubs

Only nine states do not mandate pay stubs. Without a federal law enforcing pay stub requirements, these states are legally permitted to forgo them.

The states without requirements are:

- Alabama

- Arkansas

- Florida

- Georgia

- Louisiana

- Mississippi

- Ohio

- South Dakota

- Tennessee

Pay Stubs FAQ

-

Is Not Providing Pay Stubs Illegal?

Not providing pay stubs can be illegal at the state level, even if there are no federal mandates. For instance, in California, employers who fail to provide pay stubs may face penalties up to $4,000 for each affected employee. Conversely, in states without pay stub requirements, employers are not subject to such legal consequences.

-

How Can I Prove My Income Without Pay Stubs?

There are several effective methods to prove your income without a pay stub:

- W-2s, 1099s, and tax returns

- Employment verification letters

- Signed offer letters

- Official statements from a CPA or financial manager

- Bank statements

- College financial aid documents

- Guarantors

-

What If My Employer Refuses to Give Me a Pay Stub?

If your employer refuses to provide a pay stub, the available actions depend on your state. In states that do not require pay stubs, there may be no recourse. However, in the 41 states that do mandate them, you may pursue legal action to obtain your pay records, and non-compliance could result in fines for your employer.

Conclusion

In 2026, a majority of U.S. states—41 out of 50—require employers to provide pay stubs to ensure compliance with labor laws and maintain accurate employee records. While 26 states allow pay stubs in any format, 11 states insist on written documentation.

Conversely, nine states do not impose such requirements, reflecting the absence of federal regulations. It remains essential for employees to be aware of their rights, ensuring fair compensation and accurate record-keeping in the workplace.