What does a liability claims representative do?

A liability claims representative works at insurance companies where they are in charge of processing and settling insurance claims, ensuring accurate and efficient client service. They are responsible for conducting assessments, reviewing reports from examiners, and tracking any discrepancies such as underpayment or overpayment, reporting them right away. There are also times when they must meet with clients and inspect damages, conduct interviews and evaluations, estimate and negotiate settlements with external parties, and coordinate with other professionals to gain insights. Moreover, a liability claims representative maintains an active communication line with staff, resolving issues in a timely manner.

Liability claims representative responsibilities

Here are examples of responsibilities from real liability claims representative resumes:

- Investigate, evaluate, and manage call to complete coverage analysis confirming or denying coverage using Xactimate estimating software.

- Investigate and conclude property and casualty liability claims including those in litigation with the highest overall production of the claims representatives.

- Participate in arbitration hearings through writing contentions, compiling evidence and personally representing files.

- Control expenses by developing and following resolutions and/or litigation plans to drive claim to resolution.

- Facilitate training seminars for new employees to familiarize them with various corporate procedures including exposure recognition, fraud detection and arbitration.

- Complete field inspection of losses including accurate scope of damages, photographic evidence collection, written estimates utilizing Xactimate estimating software.

- Set up payment arrangements with the at-fault party that cause harmed to the GEICO insure.

Liability claims representative skills and personality traits

We calculated that 9% of Liability Claims Representatives are proficient in Litigation, Claims Handling, and Customer Service. They’re also known for soft skills such as Analytical skills, Detail oriented, and Interpersonal skills.

We break down the percentage of Liability Claims Representatives that have these skills listed on their resume here:

- Litigation, 9%

Investigated and concluded property and casualty liability claims including those in litigation with the highest overall production of the claims representatives.

- Claims Handling, 8%

Resolved coverage questions in accordance with policy language, applicable laws and generally accepted claims handling procedures.

- Customer Service, 7%

Performed various customer service transactions such as reviewing bills, crediting accounts, disconnecting/reconnecting service, upgrading equipment and handling escalations.

- Law Enforcement Agencies, 6%

Served as a liaison to the public, governmental entities and law enforcement agencies on insurance fraud issues.

- Insurance Claims, 6%

Performed telephone interviews, took recorded statements; gathered facts from policyholders and claimants to determine liability for automobile insurance claims.

- Reservations, 6%

Composed professional communications including reservations of rights, status, settlement and declination letters.

"litigation," "claims handling," and "customer service" are among the most common skills that liability claims representatives use at work. You can find even more liability claims representative responsibilities below, including:

Analytical skills. The most essential soft skill for a liability claims representative to carry out their responsibilities is analytical skills. This skill is important for the role because "adjusters and examiners must each evaluate whether the insurance company is obligated to pay a claim and determine the amount to pay." Additionally, a liability claims representative resume shows how their duties depend on analytical skills: "analyzed and applied coverage, contact insureds, claimants, witnesses, attorneys, and body shops. "

Detail oriented. Many liability claims representative duties rely on detail oriented. "adjusters, appraisers, examiners, and investigators must carefully review documents and damaged property, because small details can have large financial consequences.," so a liability claims representative will need this skill often in their role. This resume example is just one of many ways liability claims representative responsibilities rely on detail oriented: "conducted necessary investigations to determine policy coverage and details of the automobile accident. "

Interpersonal skills. This is an important skill for liability claims representatives to perform their duties. For an example of how liability claims representative responsibilities depend on this skill, consider that "adjusters, examiners, and investigators often meet with claimants and others who may be upset by the situation that requires a claim or by the settlement the company is offering." This excerpt from a resume also shows how vital it is to everyday roles and responsibilities of a liability claims representative: "demonstrate interpersonal and customer service skills by interacting with customers on a daily basis. ".

Communication skills. Another crucial skill for a liability claims representative to carry out their responsibilities is "communication skills." A big part of what liability claims representatives relies on this skill, since "claims adjusters and investigators must get information from a range of people, including claimants, witnesses, and medical experts." How this skill relates to liability claims representative duties can be seen in an example from a liability claims representative resume snippet: "manage payment and communication with third party vendors to provide top-tier customer service to policyholders during the during the repair process. "

The three companies that hire the most liability claims representatives are:

- Sedgwick LLP108 liability claims representatives jobs

- Clearcover23 liability claims representatives jobs

- The Independent Traveler15 liability claims representatives jobs

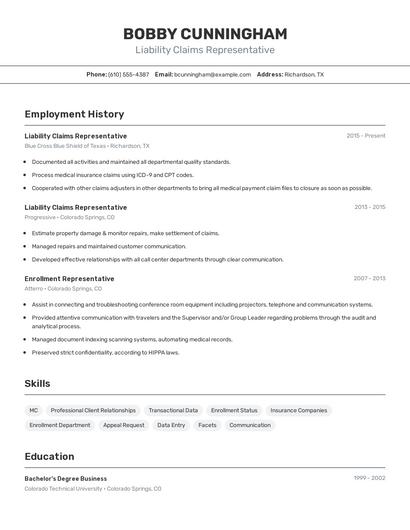

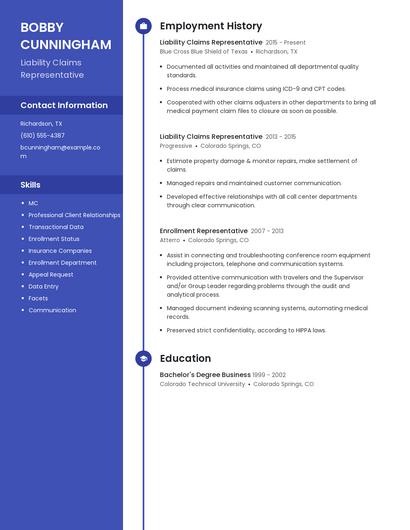

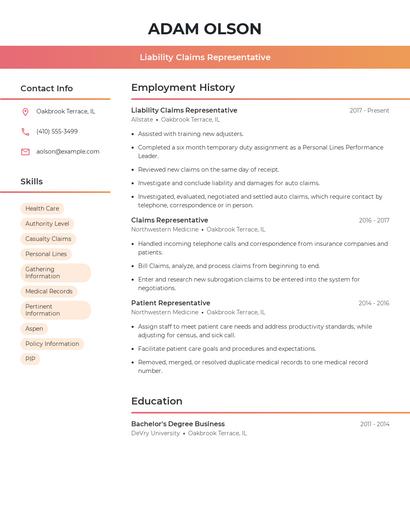

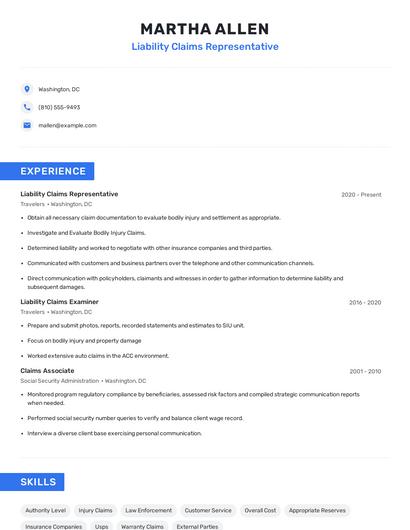

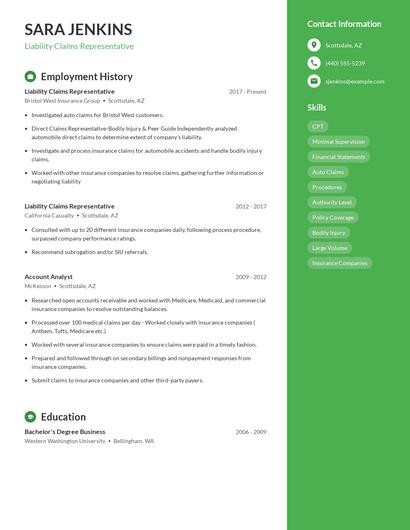

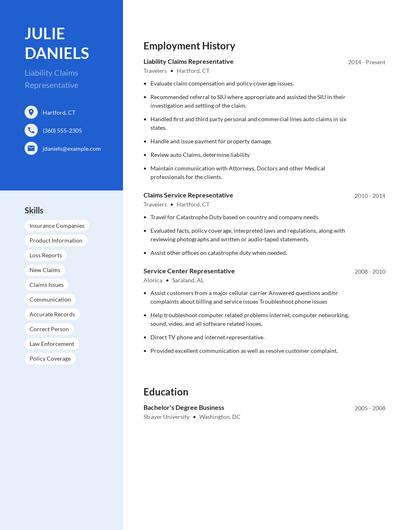

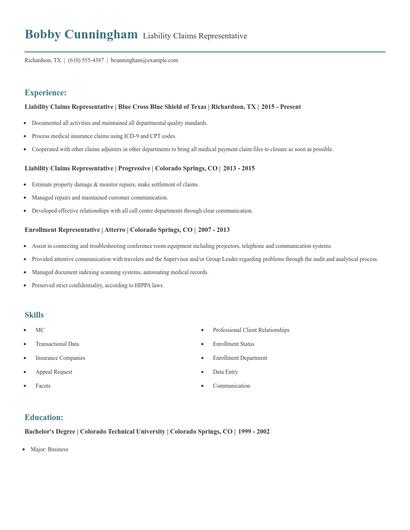

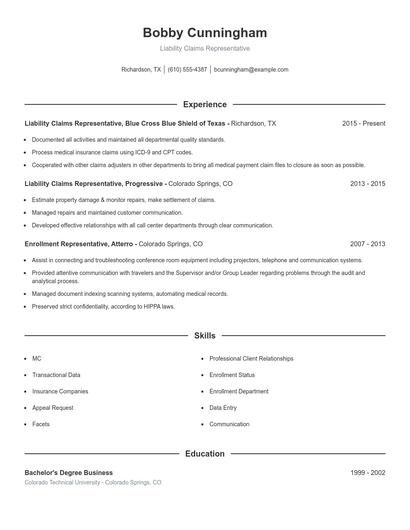

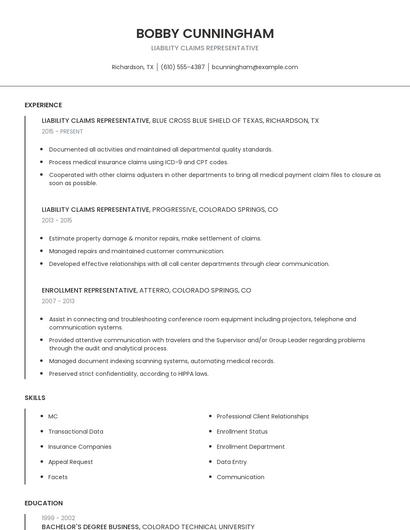

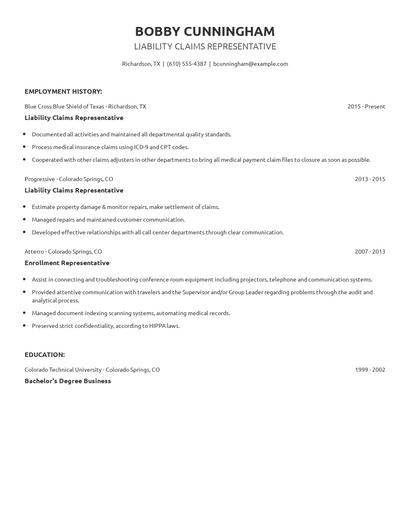

Choose from 10+ customizable liability claims representative resume templates

Build a professional liability claims representative resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your liability claims representative resume.Compare different liability claims representatives

Liability claims representative vs. Claim specialist

A claims specialist is responsible for processing insurance claims, reviewing insurance coverage, and analyzing claims cases. Claims specialists' duties include negotiating claims settlements, validating claims to prevent fraud, creating court testimonies as needed, developing claim review plans, and checking necessary documents and related resolve claims. A claims specialist must have strong analytical and critical-thinking skills to authorize claim payment and investigate complex and unusual claims. Claims specialists should also have extensive knowledge of the insurance processes to handle various cases, following legal policies and regulatory procedures.

These skill sets are where the common ground ends though. The responsibilities of a liability claims representative are more likely to require skills like "law enforcement agencies," "reservations," "supervised learning," and "claims process." On the other hand, a job as a claim specialist requires skills like "patients," "quality standards," "excellent organizational," and "medical terminology." As you can see, what employees do in each career varies considerably.

Claim specialists earn the highest salaries when working in the insurance industry, with an average yearly salary of $56,779. On the other hand, liability claims representatives are paid more in the insurance industry with an average salary of $49,286.On average, claim specialists reach similar levels of education than liability claims representatives. Claim specialists are 1.0% less likely to earn a Master's Degree and 0.5% less likely to graduate with a Doctoral Degree.Liability claims representative vs. Worker's compensation claims examiner

Worker's Compensation Claims Examiners are responsible for managing the overall process of compensation claims for workers. They review accurate submission of claim documents, determine the appropriateness of compensation, and finalize the amount before authorizing payment to the respective worker. Other duties include ensuring claims adhere to workers' compensation law and follow proper guidelines. A Worker Compensation Claims Examiner normally work for life insurance or health companies.

Each career also uses different skills, according to real liability claims representative resumes. While liability claims representative responsibilities can utilize skills like "customer service," "law enforcement agencies," "insurance claims," and "reservations," workers's compensation claims examiner use skills like "rehabilitation," "calculates," "social security," and "medical management."

Workers's compensation claims examiner may earn a higher salary than liability claims representatives, but workers's compensation claims examiner earn the most pay in the finance industry with an average salary of $87,601. On the other hand, liability claims representatives receive higher pay in the insurance industry, where they earn an average salary of $49,286.Average education levels between the two professions vary. Workers's compensation claims examiner tend to reach similar levels of education than liability claims representatives. In fact, they're 0.7% more likely to graduate with a Master's Degree and 0.5% less likely to earn a Doctoral Degree.Liability claims representative vs. Claims adjudicator

Claims adjudicators determine the amount of money an insurance policy owner is entitled to receive. Other names they are known for are claims adjusters and medical bill advocates. They investigate the claims filed and decide to deny, pay, or negotiate a settlement with the policyholder themselves or their representatives. The insurance companies that hire them provide insurances for property, casualty, and liability. To do their job well, they should be organized and understand how the insurance industry works.

There are many key differences between these two careers, including some of the skills required to perform responsibilities within each role. For example, a liability claims representative is likely to be skilled in "litigation," "claims handling," "customer service," and "law enforcement agencies," while a typical claims adjudicator is skilled in "medical terminology," "cpt," "disability claims," and "adjudicate claims."

Claims adjudicators make a very good living in the insurance industry with an average annual salary of $47,077. On the other hand, liability claims representatives are paid the highest salary in the insurance industry, with average annual pay of $49,286.claims adjudicators typically earn similar educational levels compared to liability claims representatives. Specifically, they're 0.6% more likely to graduate with a Master's Degree, and 1.0% more likely to earn a Doctoral Degree.Liability claims representative vs. Claims adjuster

A claim's adjuster is responsible for the handling of the insurance claims and investigating the extent of property damage and processing the business or a person's liability. Claims adjusters have a broad range of duties such as damage inspection to evaluate incident reports, communicating with property owners and spectators as well as referring to legal documents. They must also have excellent analytical and critical-thinking skills to calculate payments and analyze the complexities of multiple sources. Claims adjusters should also provide timely reports for reference and possible disputes.

Types of liability claims representative

Updated January 8, 2025