What does a title processor do?

A title processor is a legal professional who works with clients applying for real estate title to ensure that all documents are submitted correctly. Title processors are required to compile all the necessary legal documents and information so that they can obtain the legal deed to the property. They must work closely with both buyer and the realtor to ensure that their filing is following all local regulations. Title processors can also work with companies to ensure that all the necessary company title documents are complete when they apply for insurance.

Title processor responsibilities

Here are examples of responsibilities from real title processor resumes:

- Manage the ordering of homeowner's association estoppel letters for payoffs; as well as surveys and clear lien searches.

- Audit loan documentation to ensure all require RESPA documents and procedures are completed.

- Order payoffs on mortgages, judgments, HOA status letters and liens attach to the subject property.

- Provide updates to REO listing agents and selling agents, as well as communicating with asset managers.

- Correspond with banks, lenders, underwriters, attorneys, HOA's, tax offices, clerk of court, etc.

- Probate filing for formal and summary administrations including use of Lexus-Nexus software.

- Process collect specimens complete all requisition forms accurately, to maintain and monitor medication levels of all pain management patients.

- Respond to all inquiries from customer regarding TSG file and post-sale insurance.

Title processor skills and personality traits

We calculated that 12% of Title Processors are proficient in Data Entry, Title Commitments, and Customer Service. They’re also known for soft skills such as Business skills, Interpersonal skills, and Problem-solving skills.

We break down the percentage of Title Processors that have these skills listed on their resume here:

- Data Entry, 12%

Assisted with data entry of New Orders in various states outside of Florida, utilizing Sure Close and Aim+ software.

- Title Commitments, 11%

Generated title insurance documents including HUD-1 Settlements Statements and title commitments.

- Customer Service, 8%

Managed Accounts (UPS/Office Depot/Office Rent) Skills Used Multitasking Customer Service Managerial Closer Secretary

- Escrow, 8%

Established escrow accounts and maintained all documentation of accounts.

- Estoppel, 6%

Order payoffs, lien letters, surveys and estoppel letters.

- Mortgage Payoffs, 6%

Gathered and organized relevant paperwork from various sources to prepare loan settlement statements Ordered mortgage payoffs Scheduled and performed loan closings

Most title processors use their skills in "data entry," "title commitments," and "customer service" to do their jobs. You can find more detail on essential title processor responsibilities here:

Business skills. One of the key soft skills for a title processor to have is business skills. You can see how this relates to what title processors do because "because most real estate brokers and sales agents are self-employed, they must be able to manage every aspect of their business, including billing and advertising." Additionally, a title processor resume shows how title processors use business skills: "provide excellent customer service to forge relationships with lenders and their team members or repeat business. "

Interpersonal skills. Another soft skill that's essential for fulfilling title processor duties is interpersonal skills. The role rewards competence in this skill because "real estate brokers and sales agents spend much of their time interacting with others, such as clients and contractors." According to a title processor resume, here's how title processors can utilize interpersonal skills in their job responsibilities: "utilized interpersonal communication skills to develop strong and effective relationships among realtors and mortgage lenders. "

Problem-solving skills. title processors are also known for problem-solving skills, which are critical to their duties. You can see how this skill relates to title processor responsibilities, because "real estate brokers and sales agents must be able to address concerns relating to a property." A title processor resume example shows how problem-solving skills is used in the workplace: "reviewed private, assets, fnma, fha, va, fhlmc & usda title resolution for mortgage properties. "

Organizational skills. For certain title processor responsibilities to be completed, the job requires competence in "organizational skills." The day-to-day duties of a title processor rely on this skill, as "real estate brokers and sales agents must be able to manage their own time for planning and prioritizing their work." For example, this snippet was taken directly from a resume about how this skill applies to what title processors do: "executed flu medical claims processes and provided organizational support responsible for timely data entry and processing of claims. "

The three companies that hire the most title processors are:

- Bank of the West

8 title processors jobs

- BNP Paribas6 title processors jobs

- GPAC5 title processors jobs

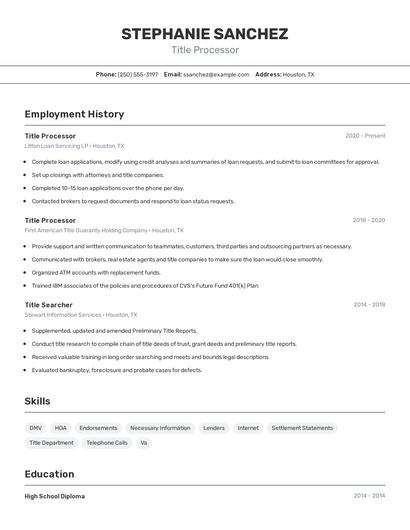

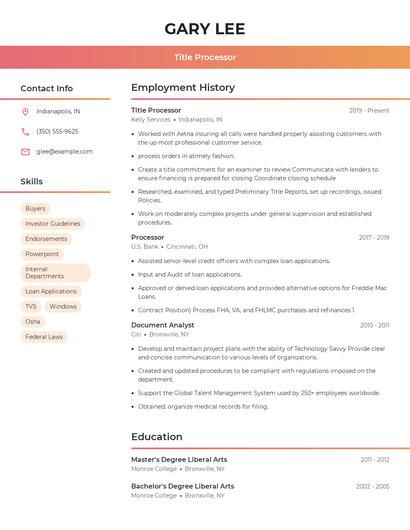

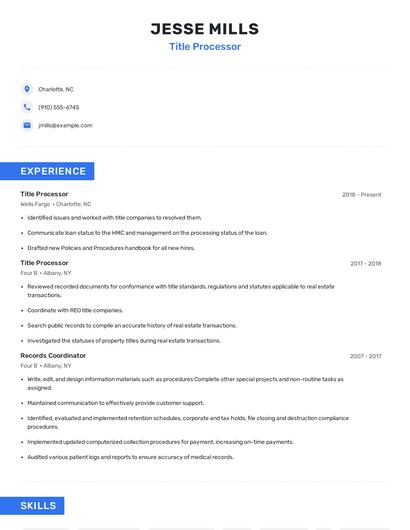

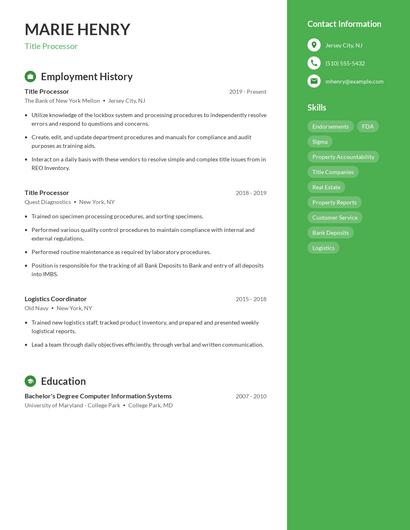

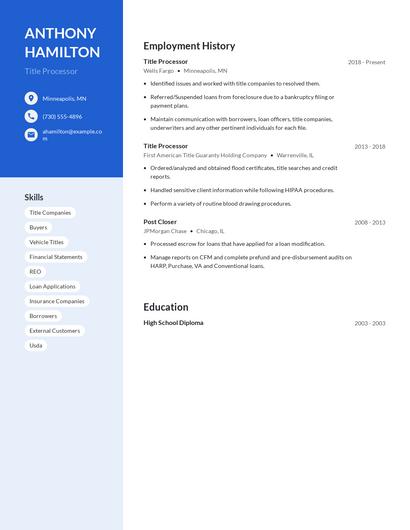

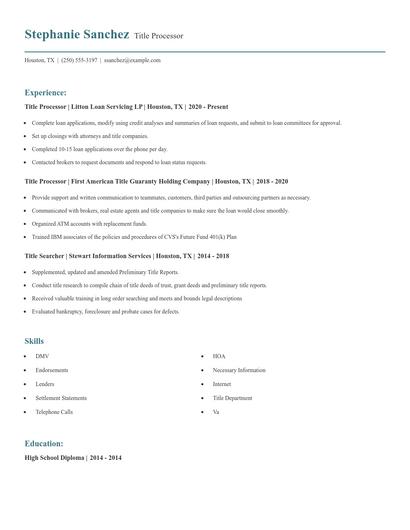

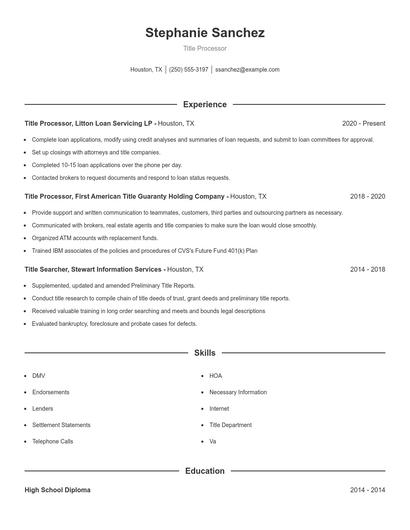

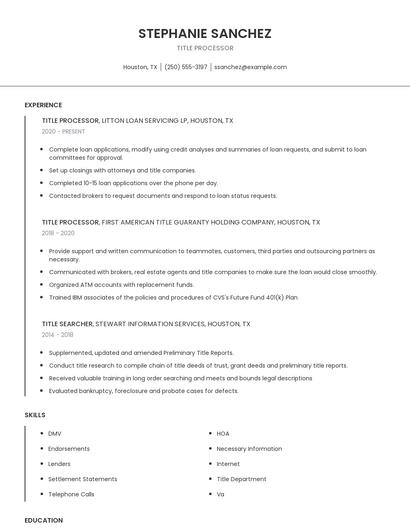

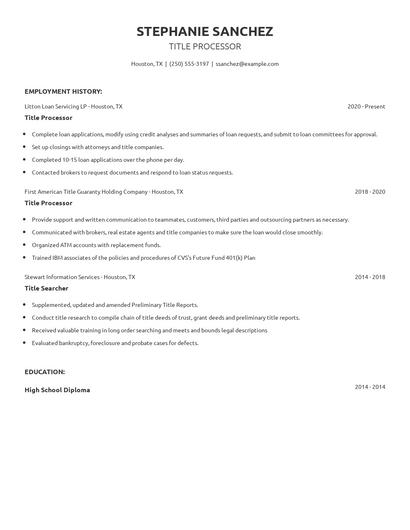

Choose from 10+ customizable title processor resume templates

Build a professional title processor resume in minutes. Our AI resume writing assistant will guide you through every step of the process, and you can choose from 10+ resume templates to create your title processor resume.Compare different title processors

Title processor vs. Abstracter

While similarities exist, there are also some differences between title processors and abstracter. For instance, title processor responsibilities require skills such as "title commitments," "customer service," "escrow," and "estoppel." Whereas a abstracter is skilled in "classification system," "medical terminology," "epic," and "hedis." This is part of what separates the two careers.

On average, abstracters reach similar levels of education than title processors. Abstracters are 0.8% more likely to earn a Master's Degree and 1.0% more likely to graduate with a Doctoral Degree.Title processor vs. Document examiner

Each career also uses different skills, according to real title processor resumes. While title processor responsibilities can utilize skills like "title commitments," "customer service," "escrow," and "estoppel," document examiners use skills like "computer system," "technical assistance," "medicaid," and "tax returns."

Average education levels between the two professions vary. Document examiners tend to reach similar levels of education than title processors. In fact, they're 4.7% more likely to graduate with a Master's Degree and 1.0% more likely to earn a Doctoral Degree.Title processor vs. Abstract clerk

There are many key differences between these two careers, including some of the skills required to perform responsibilities within each role. For example, a title processor is likely to be skilled in "title commitments," "customer service," "escrow," and "estoppel," while a typical abstract clerk is skilled in "epic system," "paper chart," "hippa," and "electronic chart."

When it comes to education, abstract clerks tend to earn similar degree levels compared to title processors. In fact, they're 0.8% less likely to earn a Master's Degree, and 1.4% less likely to graduate with a Doctoral Degree.Title processor vs. Commercial title examiner

Types of title processor

Updated January 8, 2025