The 10 States With The Highest and Lowest Tax Burden in 2026

The state with the highest tax burden is California, with a personal income tax rate of 9.3% and a sales tax of 7.3%.

The state with the lowest tax burden is Wyoming, which has no income tax and a sales tax of 4%.

There are 9 states with no income tax, including: Wyoming, Alaska, South Dakota, Florida, Tennessee, Nevada, New Hampshire, Washington, and Texas.

Only 5 states have no sales tax, including: Oregon, Montana, Delaware, New Hampshire, and Alaska.

No one enjoys paying taxes, but they are an unavoidable part of life.

The tax code remains complex, filled with numerous rates and nuanced rules based on income and family circumstances. While federal tax regulations apply uniformly across the nation, individual states impose their own tax rates. This discrepancy means that residents in some states bear a lighter tax burden, while those in others face significant financial obligations.

In our analysis of state tax codes across all 50 states, we identified the areas where taxpayers experience the heaviest tax burdens.

Instead of simply looking at tax rates, we examined the overall “tax burden” that residents can expect, factoring in personal income tax, property tax, and sales tax. Tax burden is assessed as a percentage of income, providing a clearer picture of the financial impact on residents. After all, the term “most” can be subjective; for instance, $1,000 may represent a lot or a little, depending on one’s income.

We focused on tax burden to determine which states extract a larger share of residents’ earnings compared to others.

A comprehensive list of all 50 states is available at the end of this article, ranked from the highest to lowest tax burdens, alongside details about states with the highest personal income tax, property tax, and sales tax. Let’s take a closer look at the states where tax obligations are most pronounced.

States Where People Pay The Most In Taxes

California tops the list as the state with the highest tax burden in the U.S. While states like New Jersey and New York are infamous for their high taxes, others such as Iowa may surprise residents. You can find our methodology below, along with the rankings of the remaining 40 states.

Methodology – How We Determined The States With The Most (And Least) Tax Burden

To identify the states that impose the most and least aggressive tax burdens, we ranked all 50 states based on three criteria:

-

Property Tax

-

Individual Income Tax

-

Total Sales Tax

Each criterion was evaluated based on the percentage of income. Property tax and individual income tax were combined to account for 70% of each state’s score. We utilized median state income to assign a “dollar amount” to income, while state-specific property tax rates were applied to median home prices to compute the overall tax burden from property and income taxes. Sales tax contributed the remaining 30% of the overall ranking. Local taxes or excise taxes were not included in our rankings, as they can vary significantly from city to city.

Data was sourced from a combination of the Tax Foundation and state tax documents. Median state income and home prices were obtained from the Census Bureau’s most recent American Community Survey.

The complete ranked list of states, from highest to lowest tax burden, can be found at the end of the article.

1. California

Personal Income Tax: 9.30%

Property Tax: 0.74%

Sales Tax: 7.3%

Californians bear the highest tax burden in the U.S. with the highest personal income tax at 9.3% and the top sales tax rate of 7.3%. While property tax rates are relatively low, the high median home price of $475,900 exacerbates the overall tax burden for residents.

2. New Jersey

Personal Income Tax: 5.53%

Property Tax: 1.89%

Sales Tax: 6.6%

New Jersey is known for its high taxes, contributing to one of the fastest population declines in the nation. The median home price is $327,900, coupled with the highest state property tax rate, which is nearly 2%.

3. Vermont

Personal Income Tax: 6.60%

Property Tax: 1.59%

Sales Tax: 6.0%

Vermont residents face a personal income tax rate of 6.6% and a sales tax of 6%. This means that every purchase, from local cheese to maple syrup, incurs an additional tax charge.

4. Connecticut

Personal Income Tax: 5.50%

Property Tax: 1.63%

Sales Tax: 6.4%

Connecticut residents contend with a property tax rate of 1.6%, which contributes significantly to their overall tax burden.

5. Oregon

Personal Income Tax: 9.00%

Property Tax: 0.87%

Sales Tax: 0%

Oregon does not levy a sales tax but compensates with a high personal income tax rate of 9%, making it one of the costliest states for taxpayers.

6. New York

Personal Income Tax: 6.21%

Property Tax: 1.23%

Sales Tax: 4.0%

New Yorkers are well aware of the state’s expenses, and they have the sixth-highest tax burden in the nation. The data does not account for excise or “sin” taxes, which also contribute to the financial strain on residents.

7. Wisconsin

Personal Income Tax: 6.27%

Property Tax: 1.76%

Sales Tax: 5.0%

Wisconsin has a significant tax burden, with residents paying high property taxes relative to their home values, impacting their overall income significantly.

8. Nebraska

Personal Income Tax: 6.84%

Property Tax: 1.76%

Sales Tax: 5.5%

In Nebraska, residents face a considerable tax burden, with property tax being the most significant contributor, compounded by their average income level.

9. Iowa

Personal Income Tax: 7.44%

Property Tax: 1.29%

Sales Tax: 6.0%

Despite its reputation for affordability, Iowa residents bear a substantial tax burden, particularly through the state’s income tax, which ranks among the highest in the nation.

10. Maine

Personal Income Tax: 7.15%

Property Tax: 1.09%

Sales Tax: 5.5%

Maine’s tax burden is significant, placing it closely behind Iowa, with a relatively low sales tax rate providing a minor relief.

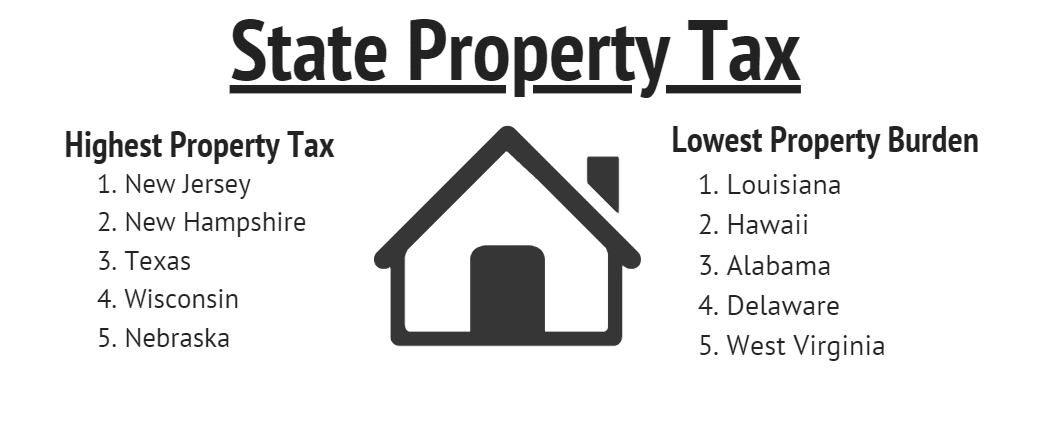

States With The Highest Property Tax And The Lowest

Louisiana has the lowest state property tax at 0.18%, while New Jersey has the highest at 1.89%.

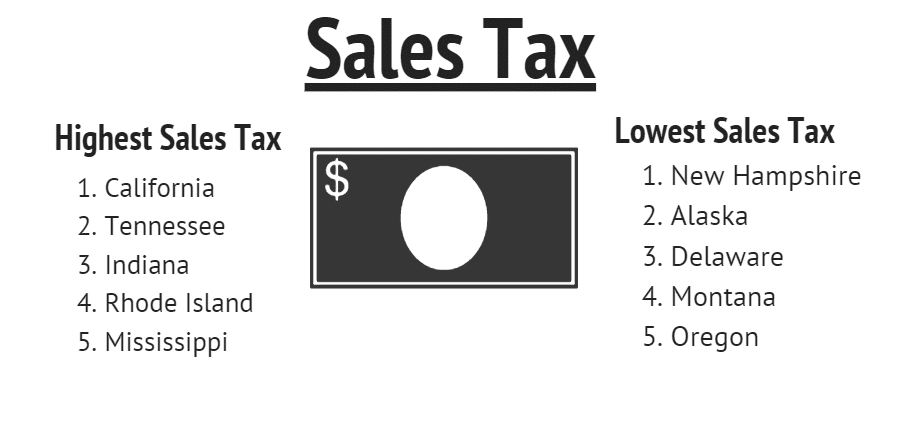

States With The Highest Sales Tax And The Lowest

All of the states with the lowest sales tax have no state sales tax. However, local or city sales taxes may still apply, leading to higher costs in certain areas. California retains the highest state sales tax at 7.3%.

States With The Highest Personal Income Tax And The Lowest

California leads with the highest income tax at 9.30%. States such as Tennessee, Nevada, Washington, Texas, Florida, South Dakota, Wyoming, New Hampshire, and Alaska have no personal income tax, although they often compensate with higher sales and/or property taxes.

Summary On States With The Highest Tax Burdens

Understanding tax obligations can be complex, with varying breaks and brackets depending on income and household size. However, it is clear that some states impose significantly higher taxes than others. Through property taxes, sales taxes, and personal income taxes, states generate revenue; often, a low tax in one area translates to a higher burden in another.

For job seekers considering relocation, it’s crucial to account for more than just salary; higher taxes can significantly diminish expected income. Which states present the most favorable tax environment for job seekers?

States With The Lowest Tax Burdens

- Wyoming

- Alaska

- South Dakota

- Florida

- Tennessee

- Nevada

- Alabama

- New Hampshire

- Washington

- Texas

- North Dakota

States With The Most (And Least) Tax Burdens

| Most To Least | State | Individual Income Tax | Property Tax | Sales Tax |

|---|---|---|---|---|

| 1 | California | 9.30% | 0.74% | 7% |

| 2 | New Jersey | 5.53% | 1.89% | 6% |

| 3 | Vermont | 6.60% | 1.59% | 6% |

| 4 | Connecticut | 5.50% | 1.63% | 6% |

| 5 | Oregon | 9.00% | 0.87% | 0% |

| 6 | New York | 6.21% | 1.23% | 4% |

| 7 | Wisconsin | 6.27% | 1.76% | 5% |

| 8 | Nebraska | 6.84% | 1.76% | 5% |

| 9 | Iowa | 7.44% | 1.29% | 6% |

| 10 | Maine | 7.15% | 1.09% | 5% |

| 11 | Minnesota | 6.80% | 1.05% | 6% |

| 12 | Illinois | 4.95% | 1.73% | 6% |

| 13 | Massachusetts | 5.05% | 1.04% | 6% |

| 14 | Rhode Island | 3.75% | 1.35% | 7% |

| 15 | Montana | 6.90% | 0.83% | 0% |

| 16 | Hawaii | 8.25% | 0.26% | 4% |

| 17 | Idaho | 6.93% | 0.69% | 6% |

| 18 | Kansas | 5.70% | 1.29% | 6% |

| 19 | South Carolina | 7.00% | 0.50% | 6% |

| 20 | Michigan | 4.25% | 1.62% | 6% |

| 21 | Virginia | 5.75% | 0.74% | 4% |

| 22 | Maryland | 4.75% | 0.87% | 6% |

| 23 | West Virginia | 6.50% | 0.49% | 6% |

| 24 | Delaware | 6.60% | 0.43% | 0% |

| 25 | Georgia | 5.75% | 0.83% | 4% |

| 26 | Arkansas | 5.90% | 0.52% | 6% |

| 27 | Missouri | 5.40% | 0.91% | 4% |

| 28 | North Carolina | 5.25% | 0.78% | 4% |

| 29 | Kentucky | 5.00% | 0.72% | 6% |

| 30 | Pennsylvania | 3.07% | 1.35% | 6% |

| 31 | Utah | 4.95% | 0.60% | 4% |

| 32 | Colorado | 4.63% | 0.60% | 2% |

| 33 | Oklahoma | 5.00% | 0.74% | 4% |

| 34 | Mississippi | 5.00% | 0.52% | 7% |

| 34 | New Mexico | 4.90% | 0.55% | 5% |

| 36 | Ohio | 3.33% | 1.36% | 5% |

| 37 | Arizona | 4.17% | 0.72% | 5% |

| 38 | Louisiana | 6.00% | 0.18% | 4% |

| 38 | Indiana | 3.23% | 0.85% | 7% |

| 40 | North Dakota | 2.04% | 1.42% | 5% |

| 41 | Texas | 0.00% | 1.81% | 6% |

| 42 | Washington | 0.00% | 0.92% | 6% |

| 43 | New Hampshire | 0.00% | 1.86% | 0% |

| 44 | Alabama | 5.00% | 0.33% | 4% |

| 45 | Nevada | 0.00% | 0.84% | 6% |

| 46 | Tennessee | 0.00% | 0.68% | 7% |

| 47 | Florida | 0.00% | 0.97% | 6% |

| 48 | South Dakota | 0.00% | 1.28% | 4% |

| 49 | Alaska | 0.00% | 1.04% | 0% |

| 50 | Wyoming | 0.00% | 0.58% | 4% |