Find a Job You Really Want In

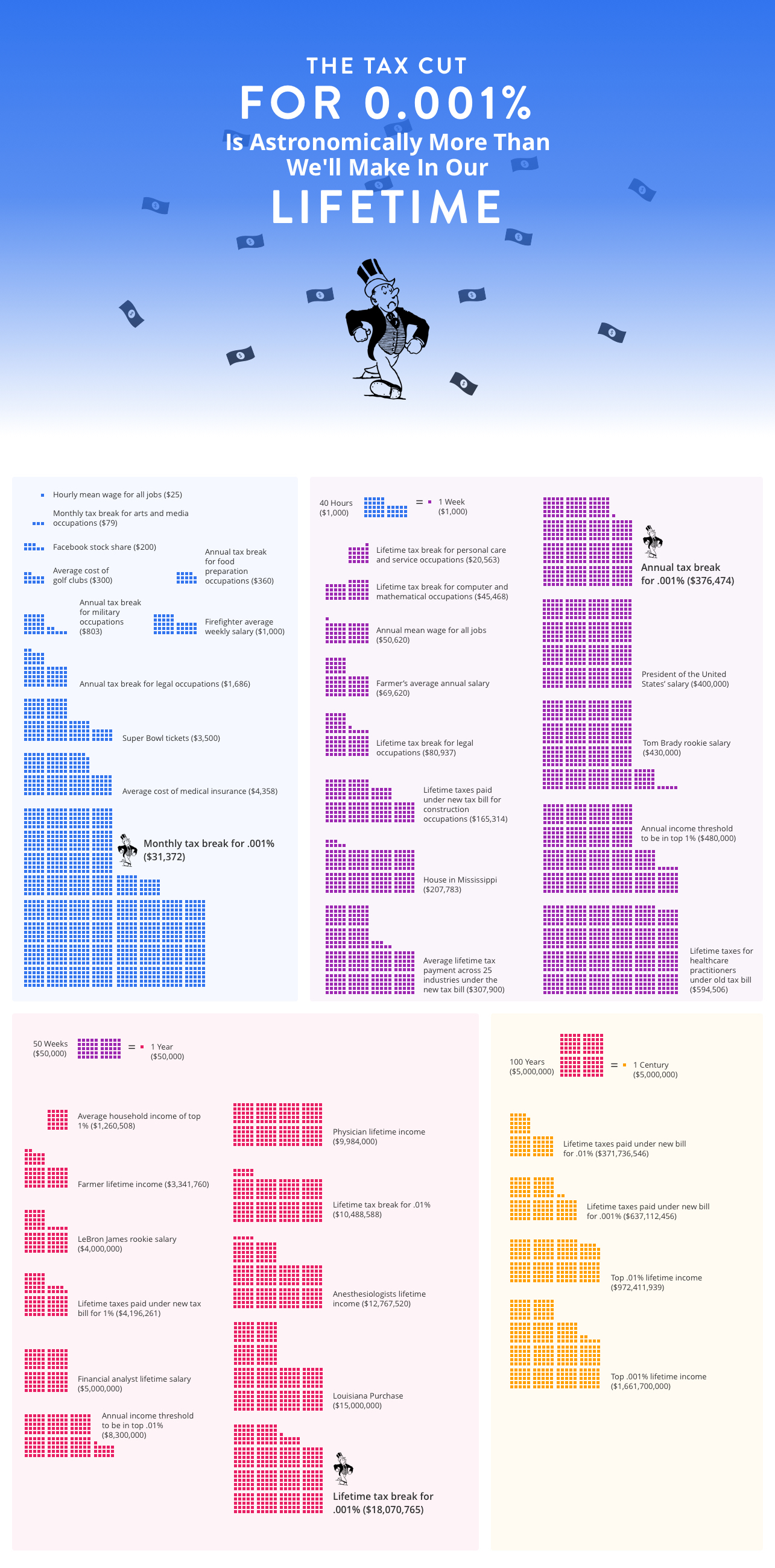

As we move into 2026, millennials continue to face significant challenges. With increasing student debt, stagnant wages, and rising living costs, many find it difficult to thrive in today’s economy.

The financial struggles of millennials are evident, as individuals aged 24-39 earn less and possess fewer assets compared to their parents’ generation. Additionally, the job market, cost of living, and location play critical roles in financial stability. We analyzed all 50 states and the District of Columbia to identify where millennials are finding it most difficult to succeed.

Before delving into the detailed rankings and criteria, let’s highlight the 10 states where millennials are facing the most adversity.

The Southern states dominate this list, with five out of ten being located in this region. The remaining states are either known for high living costs or economic challenges.

Continue reading to understand the factors contributing to these rankings and to explore the complete list of states.

How We Determined The Worst States For Millennials

- Millennial Unemployment Rate

- Average Student Loan Debt

- Millennial Home Ownership Rate

- Percentage of Millennials Living In Poverty

Each category was averaged together with equal weight. A lower score in any category resulted in a higher rank. For instance, D.C. had the highest average student loan debt at $55,400, placing it at #1 for that metric.

We utilized the most recent American Community Survey data from the U.S. Census Bureau to assess unemployment rates and poverty levels for individuals aged 25-34 across the states.

To gauge millennial home ownership, we again referenced ACS data focused on homeowners under 35 in each state.

Average student loan debt figures were derived from a recent report by Educationdata.org.

If your state isn’t in the top 10, scroll to the bottom of the post to find its rank on the full list. If it is, read on to explore why these states present the most challenges for millennials.

1. Mississippi

Unemployment: 10%

Poverty Rate: 29%

Homeownership: 10%

It’s unsurprising that Mississippi ranks as the most challenging state for millennials. The state consistently falls short on education and quality of life metrics. Why do millennials struggle in this state?

Over one in four millennials in Mississippi lives in poverty, facing the highest unemployment rate in the country. While housing is relatively affordable, it doesn’t alleviate the financial strain for millennials merely trying to survive.

2. Florida

Unemployment: 7%

Poverty Rate: 22%

Homeownership: 7%

Florida is a popular destination for tourists, but millennials residing there often encounter significant hardships. With a 22% poverty rate, Florida ranks third worst in millennial homeownership nationwide.

Despite its attractive surroundings, the economic reality can be daunting for young adults striving for stability.

3. Alabama

Unemployment: 8%

Poverty Rate: 27%

Homeownership: 10%

Alabama ranks third on the list of the worst states for millennials. Although the unemployment rate is 2% lower than Mississippi, a staggering 27% of millennials live below the federal poverty line.

4. South Carolina

Unemployment: 7%

Poverty Rate: 22%

Homeownership: 10%

Graduating college in South Carolina leads to an average student loan debt of $38,300. With 7% of millennials unemployed, repaying those loans becomes a significant challenge.

5. Georgia

Unemployment: 7%

Poverty Rate: 21%

Homeownership: 10%

Georgia mirrors the struggles of its southern neighbors, with high poverty rates and low unemployment figures. Coupled with significant student debt, the situation for millennials in the Peach State is challenging.

6. North Carolina

Unemployment: 7%

Poverty Rate: 22%

Homeownership: 10%

North Carolina exhibits statistics similar to those of South Carolina, but with slightly lower student debt burdens.

7. West Virginia

Unemployment: 9%

Poverty Rate: 32%

Homeownership: 9%

West Virginia faces a declining population as many residents leave in search of better opportunities. Millennials here have the highest poverty rate in the nation, with nearly one in three living below the poverty line.

Combined with high unemployment, the prospects for improvement are slim.

8. New Mexico

Unemployment: 8%

Poverty Rate: 27%

Homeownership: 10%

Millennials in New Mexico face a challenging environment marked by an 8% unemployment rate. With job opportunities scarce, affording basics like food and housing becomes increasingly difficult.

9. Oregon

Unemployment: 6%

Poverty Rate: 23%

Homeownership: 9%

While Oregon has a relatively high employment rate, the state struggles with a low homeownership rate and a concerning poverty rate, indicating that many millennials are working just to make ends meet.

10. California

Unemployment: 7%

Poverty Rate: 20%

Homeownership: 8%

California, often dubbed the Golden State, presents a stark contrast for millennials. With exorbitant housing costs, many find homeownership unattainable. High unemployment and poverty rates further complicate their situation, securing California’s place at #10 on this list.

Some States Offer Millennials Fewer Opportunities

This concludes our overview of the ten states where millennials face the most hurdles.

Overall, millennials are encountering widespread challenges across the country. However, certain states present greater barriers due to limited job opportunities, elevated living costs, and other obstacles to achieving financial stability—let alone the American Dream.

So where should millennials look for better opportunities? The western states consistently rank among the top ten best states for millennials.

Best States For Millennials

If your state wasn’t listed in the top ten, you can find its rank below.

See Where Your State Fell On The List:

| Rank | Geographic Area Name | Unemployment(%) | Poverty Rate(%) | Homeownership(%) | Student Debt |

|---|---|---|---|---|---|

| 1 | Mississippi | 9 | 28 | 10 | $36,700 |

| 1 | Florida | 6 | 21 | 7 | $39,700 |

| 3 | Alabama | 8 | 26 | 10 | $37,100 |

| 4 | South Carolina | 7 | 21 | 9 | $38,300 |

| 5 | Georgia | 7 | 20 | 9 | $41,500 |

| 6 | North Carolina | 6 | 21 | 9 | $37,500 |

| 7 | West Virginia | 8 | 32 | 9 | $31,800 |

| 8 | New Mexico | 8 | 27 | 10 | $33,600 |

| 9 | Oregon | 6 | 22 | 9 | $36,900 |

| 10 | California | 6 | 20 | 8 | $36,400 |

| 11 | New York | 6 | 18 | 7 | $37,800 |

| 12 | Michigan | 7 | 22 | 10 | $35,900 |

| 13 | Louisiana | 7 | 26 | 11 | $34,400 |

| 13 | Tennessee | 6 | 22 | 10 | $36,200 |

| 15 | Delaware | 6 | 17 | 9 | $37,000 |

| 15 | Connecticut | 7 | 17 | 7 | $34,900 |

| 15 | Hawaii | 4 | 20 | 6 | $36,500 |

| 18 | Arizona | 6 | 22 | 9 | $34,100 |

| 19 | New Jersey | 6 | 17 | 7 | $35,100 |

| 20 | Illinois | 6 | 18 | 10 | $37,600 |

| 21 | Maryland | 6 | 15 | 9 | $42,700 |

| 22 | Pennsylvania | 6 | 19 | 9 | $35,400 |

| 23 | Kentucky | 6 | 24 | 11 | $32,500 |

| 23 | Ohio | 6 | 21 | 10 | $34,600 |

| 25 | Nevada | 6 | 20 | 10 | $33,600 |

| 26 | Maine | 5 | 22 | 9 | $32,500 |

| 26 | Arkansas | 6 | 24 | 11 | $33,300 |

| 26 | Virginia | 5 | 16 | 9 | $39,000 |

| 29 | Rhode Island | 6 | 18 | 8 | $31,800 |

| 30 | Vermont | 4 | 15 | 8 | $36,700 |

| 31 | Missouri | 5 | 20 | 11 | $35,400 |

| 32 | Massachusetts | 5 | 16 | 8 | $34,100 |

| 33 | New Hampshire | 3 | 15 | 8 | $36,700 |

| 34 | Washington | 5 | 17 | 10 | $35,000 |

| 35 | Indiana | 5 | 21 | 11 | $32,800 |

| 36 | Alaska | 7 | 15 | 12 | $33,600 |

| 37 | Idaho | 4 | 23 | 12 | $32,600 |

| 37 | District of Columbia | 5 | 10 | 12 | $55,400 |

| 39 | Montana | 4 | 21 | 10 | $33,300 |

| 40 | Oklahoma | 5 | 23 | 12 | $31,500 |

| 41 | Texas | 5 | 18 | 11 | $32,800 |

| 42 | Colorado | 4 | 15 | 11 | $35,800 |

| 43 | Kansas | 4 | 20 | 12 | $32,500 |

| 44 | Wisconsin | 4 | 16 | 10 | $31,800 |

| 45 | Utah | 3 | 20 | 15 | $32,200 |

| 46 | Minnesota | 3 | 14 | 12 | $33,400 |

| 47 | Wyoming | 5 | 17 | 13 | $31,000 |

| 48 | Iowa | 3 | 19 | 13 | $30,500 |

| 48 | South Dakota | 3 | 19 | 14 | $31,100 |

| 50 | Nebraska | 3 | 17 | 13 | $32,100 |

| 51 | North Dakota | 2 | 13 | 16 | $29,200 |

Want the latest research and most engaging stories first? Email Kathy Morris at kmorris@zippia.com to be added to our weekly newsletter.