Find a Job You Really Want In

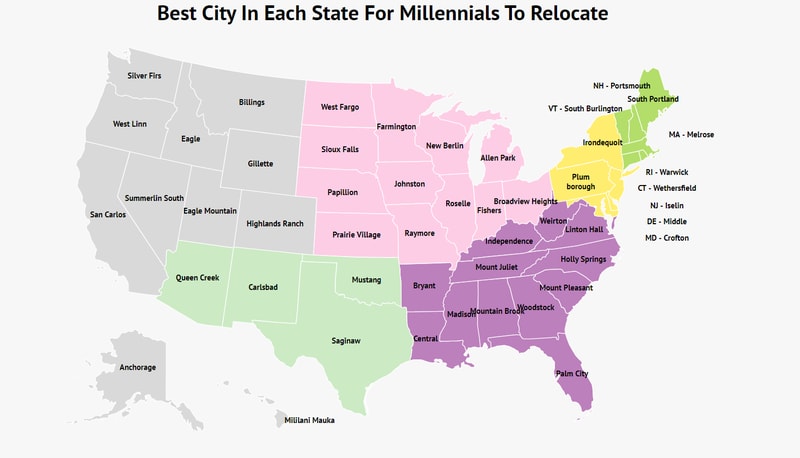

Top Cities for Millennials to Relocate in 2026

As the workforce evolves and the job market adapts to new technologies and remote working practices, millennials are navigating a unique landscape when it comes to relocation. This generation, characterized by innovation and adaptability, is redefining traditional life milestones such as homeownership and career progression.

Despite facing stereotypes, millennials are not only reshaping workplaces but also contributing significantly to local economies. With the right information, you can make a smart move that aligns with your career aspirations and lifestyle. We’ve compiled a list of the best cities across the U.S. that offer millennials a blend of affordability, job opportunities, and quality of life.

To identify the most millennial-friendly cities, we analyzed key factors including median incomes, home prices, unemployment rates, and poverty levels among millennials. Let’s dive into the top cities that should be on your relocation radar.

Top 10 Best Cities for Millennials

- Broadview Heights, Ohio

- Mountain Brook, Alabama

- Roselle, Illinois

- Bryant, Arkansas

- Saginaw, Texas

- Palm City, Florida

- Irondequoit, New York

- Farmington, Minnesota

- Prairie Village, Kansas

- Fishers, Indiana

With these cities in mind, it’s time to start planning your next chapter. Many millennials are entering homeownership later than previous generations, often in their 30s, due to financial challenges. The cities listed here offer competitive salaries and affordable housing, making it easier to save for a home and invest in your future.

Keep reading to discover our full analysis of the cities that are most suitable for millennials.

How We Determined the Best Cities for Millennials to Relocate

We analyzed 2,249 cities based on the following criteria:

- Median Income

- Percentage of millennials living in poverty

- Unemployment rates among millennials

- Median home prices

Our goal was to identify cities where salaries provide a comfortable living, poverty rates are low, and job opportunities abound. We also considered home prices to ensure affordability, as homeownership remains a priority for many millennials.

Data for our analysis was sourced from the latest Census ACS.

1. Broadview Heights, Ohio

Average Income: $45,808

Millennials in Poverty: 0.9%

Average Home Price: $243,100

Broadview Heights, Ohio, stands out as a top destination for millennials, with only 0.9% of the millennial population living in poverty. The average income is a healthy $45,808, and with homes averaging $243,100, it’s a great place to settle down early.

2. Mountain Brook, Alabama

Average Income: $75,105

Millennials in Poverty: 2.3%

Average Home Price: $605,300

Mountain Brook, Alabama, boasts a high average income of $75,105, although home prices are steeper at $605,300. However, the city’s solid economy offers a pathway to financial stability.

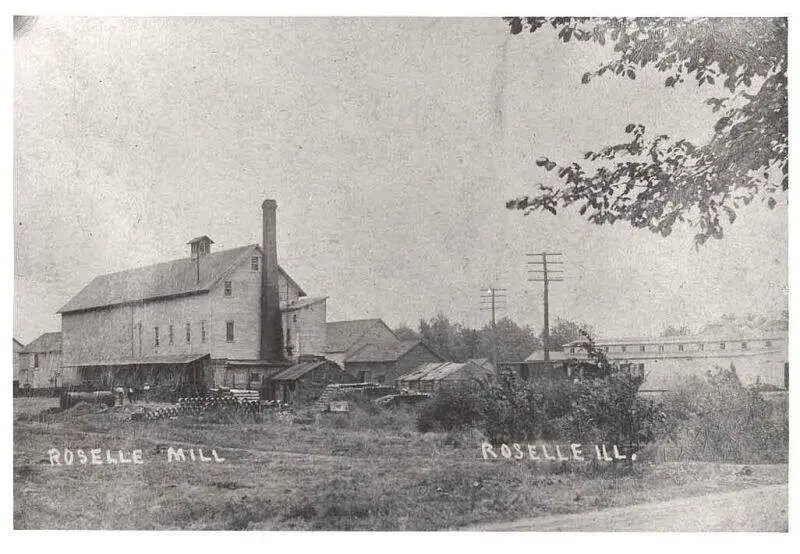

3. Roselle, Illinois

Average Income: $41,207

Millennials in Poverty: 4.1%

Average Home Price: $256,600

Located just outside of Chicago, Roselle, Illinois, offers an average income of $41,207 against a home price of $256,600, making it an attractive option for young professionals.

4. Bryant, Arkansas

Average Income: $37,614

Millennials in Poverty: 8.3%

Average Home Price: $163,900

In Bryant, Arkansas, despite a higher poverty rate of 8.3%, the city’s 0% unemployment rate offers hope. With an average home price of $163,900, it presents a compelling case for affordability.

5. Saginaw, Texas

Average Income: $43,342

Millennials in Poverty: 3.4%

Average Home Price: $151,200

In Saginaw, Texas, the average home price is just $151,200, making it one of the most affordable cities on this list, complemented by an average income of $43,342.

6. Palm City, Florida

Average Income: $42,340

Millennials in Poverty: 7.2%

Average Home Price: $341,400

Palm City, Florida, features a strong job market with a 0% unemployment rate, an average income of $42,340, and a vibrant community perfect for millennials.

7. Irondequoit, New York

Average Income: $39,239

Millennials in Poverty: 7.2%

Average Home Price: $120,900

Irondequoit is a hidden gem in New York for millennials, featuring affordable homes averaging just $120,900 and a supportive community for young professionals.

8. Farmington, Minnesota

Average Income: $46,291

Millennials in Poverty: 2.6%

Average Home Price: $244,100

Farmington, Minnesota, is another excellent choice for millennials, offering a low poverty rate of 2.6% and an average income of $46,291, alongside reasonable housing costs.

9. Prairie Village, Kansas

Average Income: $51,862

Millennials in Poverty: 3.4%

Average Home Price: $261,300

Prairie Village, Kansas, scores high with an average income of $51,862 and a low unemployment rate of 0.45%, making it an attractive place for millennials to thrive.

10. Fishers, Indiana

Average Income: $55,311

Millennials in Poverty: 4.5%

Average Home Price: $249,900

Fishers, Indiana, rounds out our list with an average income of $55,311 and an unemployment rate of just 1.5%. It’s an ideal spot to enjoy a higher standard of living.

Summary of the Best Cities for Millennials to Relocate

Millennials continue to face unique challenges in today’s economic landscape. Finding cities that offer both affordable living and promising job opportunities shouldn’t add to that stress. The cities highlighted in this article provide not only lower home prices but also higher average incomes, making them ideal for millennials looking to thrive.

Explore the best city in each state where millennials can carve out a fulfilling life, balancing career ambitions with quality living conditions.

| State | City | Average Income | Unemployment | Poverty | Average Home Cost |

|---|---|---|---|---|---|

| Alabama | Mountain Brook | $75,105 | 0% | 2.30% | $605,300 |

| Alaska | Anchorage | $41,250 | 4.45% | 10% | $316,500 |

| Arizona | Queen Creek | $50,451 | 3.25% | 6.60% | $340,400 |

| Arkansas | Bryant | $37,614 | 0% | 8.30% | $163,900 |

| California | San Carlos | $91,084 | 1.45% | 3.70% | $1,541,900 |

| Colorado | Highlands Ranch | $59,004 | 2.85% | 4.60% | $443,000 |

| Connecticut | Wethersfield | $48,421 | 2.95% | 3.40% | $253,400 |

| Delaware | Middle | $47,657 | 9.95% | 6% | $280,900 |

| Florida | Palm City | $42,340 | 0% | 7.20% | $341,400 |

| Georgia | Woodstock | $42,258 | 1.55% | 7.50% | $224,100 |

| Hawaii | Mililani Mauka | $55,926 | 1.45% | 3.20% | $685,600 |

| Idaho | Eagle | $41,703 | 2% | 6.20% | $380,500 |

| Illinois | Roselle | $41,207 | 0% | 4.10% | $256,600 |

| Indiana | Fishers | $55,311 | 1.50% | 4.50% | $249,900 |

| Iowa | Johnston | $58,016 | 1.95% | 6.80% | $266,900 |

| Kansas | Prairie Village | $51,862 | 0.45% | 3.40% | $261,300 |

| Kentucky | Independence | $40,420 | 1.30% | 7.40% | $172,200 |

| Louisiana | Central | $41,424 | 3.65% | 5.70% | $209,600 |

| Maine | South Portland | $32,779 | 1.90% | 9.10% | $249,300 |

| Maryland | Crofton | $63,582 | 2.65% | 1% | $381,100 |

| Massachusetts | Melrose | $59,682 | 2.85% | 3.50% | $533,200 |

| Michigan | Allen Park | $39,596 | 2.70% | 11.10% | $121,500 |

| Minnesota | Farmington | $46,291 | 0.20% | 2.60% | $244,100 |

| Mississippi | Madison | $51,329 | 3.10% | 4.10% | $267,400 |

| Missouri | Raymore | $47,095 | 2.85% | 5.60% | $197,100 |

| Montana | Billings | $31,954 | 3.60% | 13.30% | $215,800 |

| Nebraska | Papillion | $37,664 | 1.80% | 2.80% | $181,400 |

| Nevada | Summerlin South | $57,614 | 4.05% | 6.70% | $388,200 |

| New Hampshire | Portsmouth | $44,391 | 2.40% | 5.90% | $408,500 |

| New Jersey | Iselin | $58,181 | 1.15% | 4.60% | $307,300 |

| New Mexico | Carlsbad | $57,290 | 4.60% | 8.70% | $796,900 |

| New York | Irondequoit | $39,239 | 2.60% | 7.20% | $120,900 |

| North Carolina | Holly Springs | $50,977 | 1.70% | 3.40% | $282,100 |

| North Dakota | West Fargo | $41,858 | 1.65% | 7.30% | $242,900 |

| Ohio | Broadview Heights | $45,808 | 0% | 0.90% | $243,100 |

| Oklahoma | Mustang | $38,381 | 2.35% | 6.40% | $157,900 |

| Oregon | West Linn | $52,485 | 1.45% | 7.50% | $471,100 |

| Pennsylvania | Plum | $41,265 | 5.05% | 3.20% | $154,600 |

| Rhode Island | Warwick | $41,583 | 5.35% | 7.40% | $214,200 |

| South Carolina | Mount Pleasant | $52,452 | 2.05% | 6.20% | $442,200 |

| South Dakota | Sioux Falls | $33,391 | 2.60% | 12.90% | $178,200 |

| Tennessee | Mount Juliet | $42,472 | 1.15% | 5.80% | $254,900 |

| Texas | Saginaw | $43,342 | 0.80% | 3.40% | $151,200 |

| Utah | Eagle Mountain | $39,597 | 0.65% | 4.30% | $251,600 |

| Vermont | South Burlington | $40,466 | 2.95% | 5.80% | $293,500 |

| Virginia | Linton Hall | $61,861 | 1.45% | 2.90% | $435,800 |

| Washington | Silver Firs | $59,830 | 1.10% | 3.60% | $453,000 |

| West Virginia | Weirton | $29,025 | 8.90% | 16.20% | $97,700 |

| Wisconsin | New Berlin | $47,046 | 1.10% | 3.30% | $252,500 |

| Wyoming | Gillette | $40,330 | 2% | 12.90% | $218,700 |