Tax processor best companies

10 best companies for Tax processors

Zippia score 4.7

Average tax processor salary: $59,970

#1 top company for tax processorsCompany highlights:A leader in the banking industry, Bank of America provides financial products and services for their customers and clients throughout the United States. This reputable bank is guided by a common purpose which is to help make financial lives better by connecting clients and communities to the resource they need to be successful.

- Learn more about Bank of America:

- Bank of America overview

- Bank of America salaries

- Bank of America jobs

Zippia score 3.8

Average tax processor salary: $39,697

#2 top company for tax processorsCompany description:Liberty Tax Service is a United States-based company specializing in the preparation of tax returns for individuals and small businesses, it is the third largest tax preparation franchise in the United States.

- Learn more about Liberty Tax:

- Liberty Tax overview

- Liberty Tax salaries

- Liberty Tax jobs

Zippia score 4.9

Average tax processor salary: $43,640

#3 top company for tax processorsCompany highlights:CoreLogic, Inc. is an Irvine, California based corporation providing financial, property and consumer information, analytics and business intelligence. This reliable company analyzes information assets and data to provide clients with analytics and customized data services. CoreLogic, Inc. develops technology applications and platforms that streamline workflow for mortgage lenders and servicers, capital market investors, and real estate sales professionals. Their cloud-based loan origination and asset management platforms offer the flexibility and convenience of secure, on-demand, access-anywhere computing.

- Learn more about CoreLogic:

- CoreLogic overview

- CoreLogic salaries

- CoreLogic jobs

Zippia score 4.7

Average tax processor salary: $65,373

#4 top company for tax processorsCompany description:EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services EY delivers helps build trust and confidence in the capital markets and in economies the world over. EY develops outstanding leaders who team to deliver on their promises to all of their stakeholders. In so doing, EY play a critical role in building a better working world for their people, for their clients and for their communities. EY refers to the global organization and may refer to one or more of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. EY's 190,000 people are the foundation of EY's success. EY assembles the right multi-disciplinary team for your business, drawing on their global network of professionals. Working with you in a collaborative style, EY gains a clear understanding of your organisation and strive to identify issues before they become problems. You get the people you need, wherever in the world you need them, backed up by leading practices, methodologies and tools.

- Learn more about Ernst & Young:

- Ernst & Young overview

- Ernst & Young salaries

- Ernst & Young jobs

Zippia score 4.8

Average tax processor salary: $47,969

#5 top company for tax processorsCompany highlights:KPMG is one of the world’s leading professional services firms, providing innovative business solutions and audit, tax, and advisory services to many of the world’s largest and most prestigious organizations. KPMG is widely recognized for being a great place to work and build a career, and is consistently named one of the nation’s “100 Best Companies to Work For” by Fortune magazine. Our people share a sense of purpose in the work we do, and a strong commitment to community service, diversity and inclusion, and eradicating childhood illiteracy. A purpose-driven culture and a strong foundation for career success is what you will find at KPMG LLP. We start by enabling you to take personal responsibility for your own career development. Then we support you with the people, processes and experiences to help turn your goals and aspirations into a powerful plan of action. Join the firm that has won numerous prestigious workplace awards and is as invested in your career as you are.

- Learn more about KPMG LLP:

- KPMG LLP overview

- KPMG LLP salaries

- KPMG LLP jobs

Zippia score 4.7

Average tax processor salary: $39,193

#6 top company for tax processorsCompany highlights:First American, founded in 1889 in Santa Ana, CA, provides financial services through its Title Insurance and Services segment and its Specialty Insurance segment. Core business lines include title insurance and closing/settlement services; title plant management services; title and other real property records and images; valuation products and services; home warranty products, etc. First American Trust offers banking and trust services to the escrow and real estate industries.

- Learn more about First American Financial:

- First American Financial overview

- First American Financial salaries

- First American Financial jobs

Zippia score 4.8

Average tax processor salary: $56,006

#7 top company for tax processorsCompany description:PricewaterhouseCoopers is a multinational professional services network with headquarters in London, United Kingdom. PwC ranks as the second largest professional services firm in the world and is one of the Big Four auditors, along with Deloitte, EY and KPMG.

- Learn more about Pwc:

- Pwc overview

- Pwc salaries

- Pwc jobs

Zippia score 4.2

Average tax processor salary: $39,218

#8 top company for tax processorsCompany description:LERETA provides the mortgage and insurance industries the fastest, most accurate and complete access to property tax data and flood hazard status information across the U.S. LERETA is committed to giving customers extraordinary service and cost-effective property tax and flood solutions. LERETA's services are designed to increase efficiency, reduce penalties and liabilities and improve processes for mortgage originators and servicers. LERETA's dedicated teams of real estate tax and flood professionals along with LERETA's experienced management team allow the company to lead the industry in service and technology.

- Learn more about Lereta:

- Lereta overview

- Lereta jobs

Zippia score 4.1

Average tax processor salary: $39,702

#9 top company for tax processorsCompany description:Jackson Hewitt Tax Service is primarily engaged in providing tax return preparation services without also providing accounting, auditing, or bookkeeping services.

- Learn more about Jackson Hewitt:

- Jackson Hewitt overview

- Jackson Hewitt salaries

- Jackson Hewitt jobs

Zippia score 3.8

Average tax processor salary: $32,279

#10 top company for tax processorsCompany description:ms.gov is the official website for the State of Mississippi. Visit us at http://www.ms.gov/

- Learn more about ms.gov - Mississippi's Official State Website:

- ms.gov - Mississippi's Official State Website overview

- ms.gov - Mississippi's Official State Website salaries

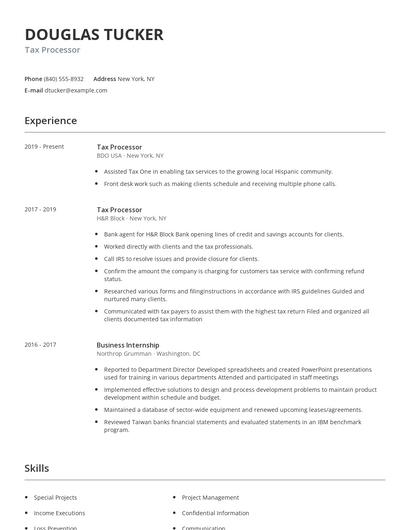

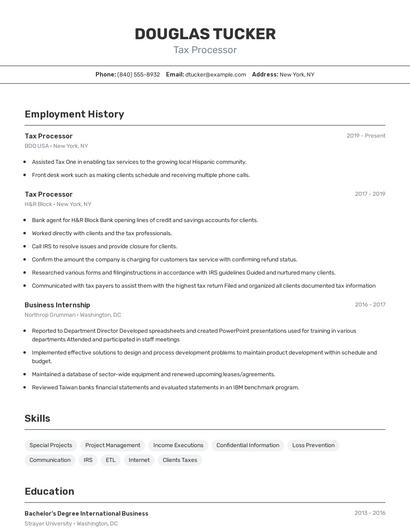

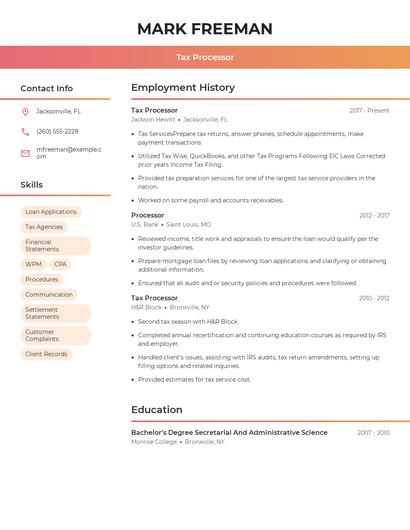

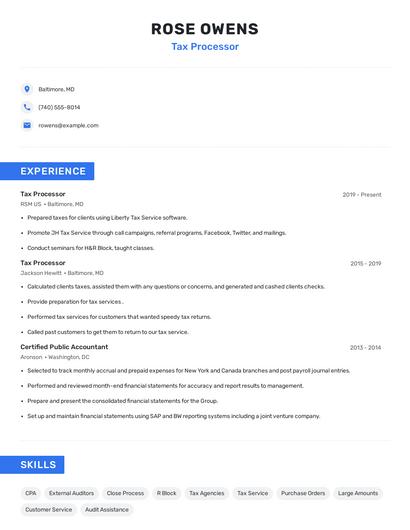

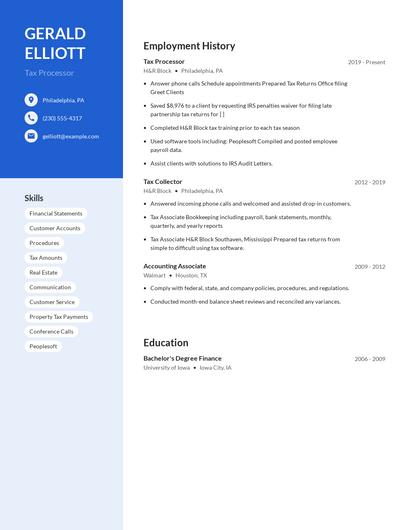

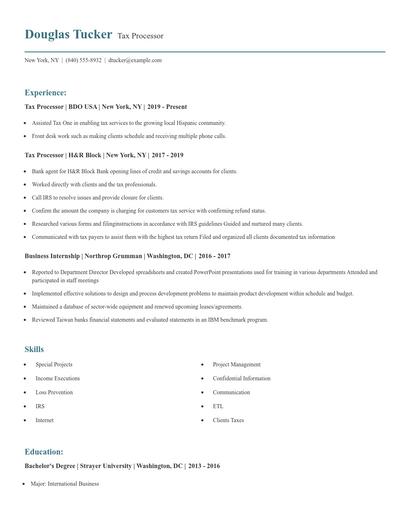

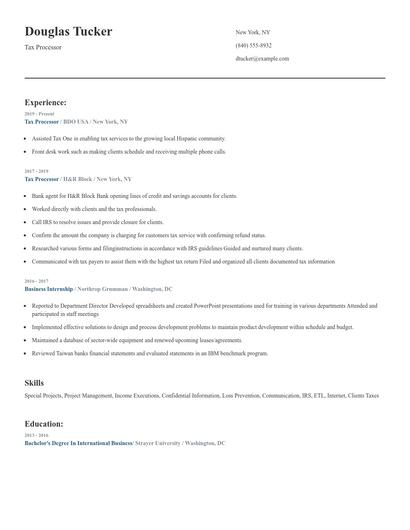

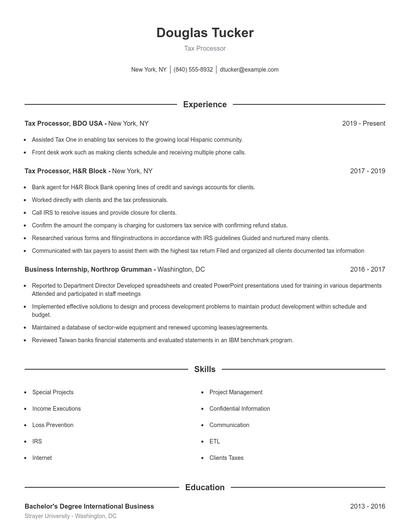

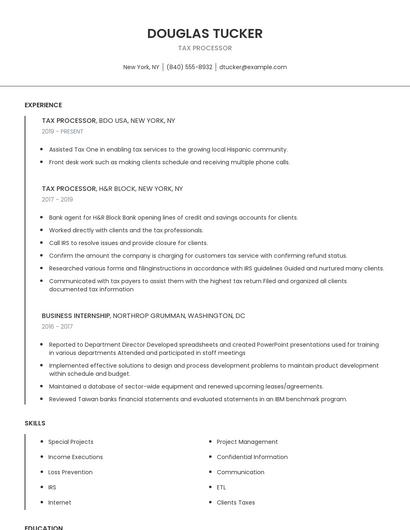

Choose from 10+ customizable tax processor resume templates

Choose from a variety of easy-to-use tax processor resume templates and get expert advice from Zippia’s AI resume writer along the way. Using pre-approved templates, you can rest assured that the structure and format of your tax processor resume is top notch. Choose a template with the colors, fonts & text sizes that are appropriate for your industry.

Top companies for tax processors in US

| Rank | Company | Avg. Salary | Jobs |

|---|---|---|---|

| 1 | Bank of America | $59,970 | 8 |

| 2 | Liberty Tax | $39,697 | 96 |

| 3 | CoreLogic | $43,640 | 1 |

| 4 | Ernst & Young | $65,373 | 2,022 |

| 5 | KPMG LLP | $47,969 | 355 |

| 6 | First American Financial | $39,193 | 8 |

| 7 | Pwc | $56,006 | 1,699 |

| 8 | Lereta | $39,218 | 3 |

| 9 | Jackson Hewitt | $39,702 | 1,567 |

| 10 | ms.gov - Mississippi's Official State Website | $32,279 | - |