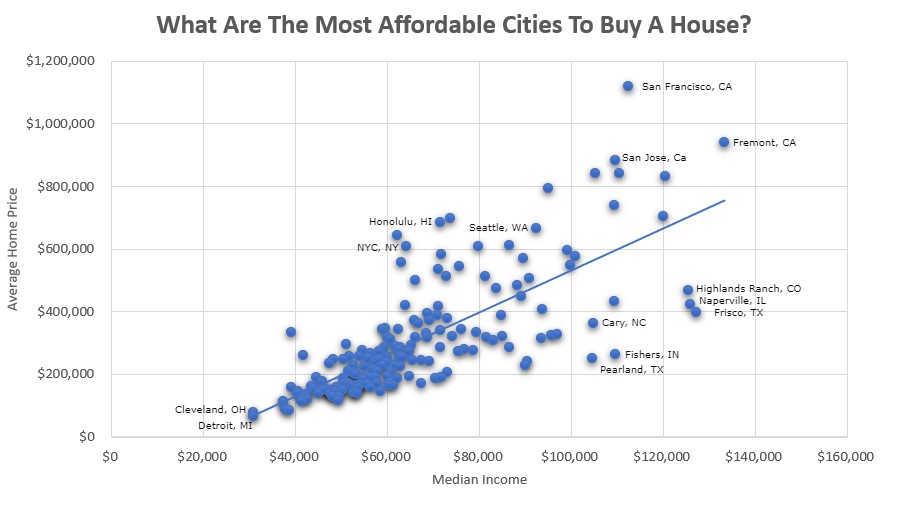

This is How Much You Need To Earn To Buy a House In Each City (And What’s Unattainable For The Average Worker)

The least affordable city in the US is Los Angeles, California, where the average home costs $642,400, while the median income is only $62,142.

The most affordable city in the US is Detroit, Michigan, where the average home costs just $66,300!

The city with the highest home prices in the US is San Francisco, California, where the average home costs $1,118,200.

Iowa is the most affordable state for homebuyers, with an average home price of $147,800 and a median household income of $79,500.

Purchasing a home is one of the most significant investments the average worker will ever make. However, the earnings required to buy a house can differ drastically from one city to another.

We set out to identify where the American dream of homeownership remains achievable for the average worker and where it is simply out of reach. To do this, we analyzed the average home costs, calculated the corresponding monthly mortgage payments, and determined the minimum salary necessary to afford these homes.

The greater the gap between the required salary for homeownership and the average income, the less attainable homeownership becomes.

The findings reveal that homeownership is out of reach for many workers in several cities. In fact, of the 175 cities we analyzed, 51 have median incomes below the threshold needed for homeownership to be feasible. Additionally, recent data indicates that only 66% of Americans own their homes.

Below, you’ll find a detailed breakdown of what it takes to afford a home in major cities, but first, we highlight the cities that are the most and least affordable for homebuyers.

10 Least Affordable Cities To Buy A Home

- Los Angeles, California

- San Francisco, California

- Honolulu, Hawaii

- New York City, New York

- Oakland, California

- Long Beach, California

- Miami, Florida

- Huntington Beach, California

- Anaheim, California

- San Jose, California

As expected, purchasing a home in California can be an expensive endeavor. California cities, along with notoriously costly locations such as Honolulu and NYC, dominate the least affordable list. While San Francisco boasts the highest home prices, Los Angeles residents earn an average of $62,142, which is significantly lower than the $130,157 needed to comfortably afford a home there.

Where can you find more affordable home prices? Or at least where it requires less of your income to become a homeowner?

10 Most Affordable Cities To Buy A Home

- Detroit, Michigan

- Akron, Ohio

- Toledo, Ohio

- Fort Wayne, Indiana

- Fishers, Indiana

- Pearland, Texas

- Cedar Rapids, Iowa

- Lee’s Summit, Missouri

- Cleveland, Ohio

- Grand Prairie, Texas

Midwestern cities continue to offer some of the most affordable options for homeownership. Low housing prices combined with reasonable salaries create a favorable economic environment for prospective homeowners.

HOW WE DETERMINED THIS

Our methodology was straightforward. We began by gathering data on the average home values in each major city from the US Census.

We defined major cities as the 175 locations with the highest number of owner-occupied housing units with a mortgage.

Home prices can vary widely within a city. Similarly, some buyers opt for more or less expensive homes based on their income and personal preferences. However, to provide a comprehensive overview of housing and income, we relied on average values.

Subsequently, we applied the standard 30-year mortgage model with a 3.9% interest rate to calculate monthly payments. We did not factor in PMI, taxes, down payment size, or home insurance, as these vary significantly based on individual circumstances and loan types.

To ensure that median income does not exceed 28% of gross income for housing costs, we calculated the minimum income required for the monthly mortgage to remain below this threshold. This provided us with the necessary income figures for home purchases.

To evaluate the reasonableness of these figures, we compared them to the median income. Some cities with high housing costs also have high incomes that keep pace. However, in many places, even substantial salaries fall short of covering housing expenses.

The greater the negative difference between median income and the minimum income required to afford the average home, the less affordable homeownership is. Conversely, a positive difference indicates greater affordability.

Continue scrolling to see the complete data breakdown.

BREAKING THE BANK TO LIVE THE AMERICAN DREAM

While some cities still present affordable homeownership options, in others, the American dream remains elusive.

Ultimately, buying a home is a deeply personal decision. Factors like size, location, and style will vary based on individual preferences. For instance, an affordable home in your city may not be situated in your desired school district, while one that is may be beyond your budget.

Moreover, burdens such as student debt or other financial obligations may necessitate spending well below the recommended 28% of income on housing. As any homeowner knows, the mortgage is just one of many expenses associated with homeownership.

In conclusion, these numbers offer a broad perspective on a complex situation that can differ greatly on a personal basis.

Below, you’ll find the full ranking from the least to the most affordable cities for homeownership: